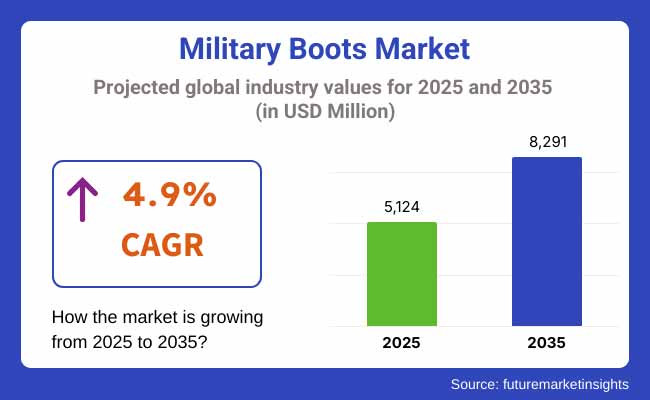

The military boots market is expected to witness record growth in 2025 to 2035 based on R&D in materials, defence spending, and growing police force demand. The market is expected to grow to around USD 5,124 million in 2025 and will be expected to grow to USD 8,291 million in the forecast period with a CAGR of 4.9% in the forecast period.

There are certain trends changing market dynamics. One of the main drivers is a growing need for light, resistant, and high-performance combat footwear for troops that are deployed into hostile environments. Combat footwear is changing with improvements in shock resistance, waterproofing, and air permeability.

For instance, the USA military recently introduced advanced combat footwear featuring fire-resistant components and self-grooming outsoles to make them more resilient as well as comfortable. Also, rising geo-political tensions necessitated the governments to go on a spree of weapon building. That also hurried the demand for high tech boots for the military.

There are various military boots based on material and use. Combat, tactical, desert, and jungle boots are different with respect to operational requirements. Desert boots for deserts in tropical region countries will have heat-resistant soles and humidity-wicking liners, and jungle boots have additional drainage channels for rain-based territories. Private military companies and police units are also contributing to the market growth through military-grade tactical boots used for perilous operations.

North America is an exemplary market for military boots purely because of the mega-procurement plans by the USA Department of Defence. The USA military keeps pouring money into new boot designs to enhance troops' mobility and ruggedness. For instance, current USA government procurement orders from suppliers favour ultralight puncture-resistant fabric and 3D-printed insoles to enhance comfort.

Additionally, more Canadian law enforcement officers utilize military boots for riot control and urban patrol operations.

Since sustainability is the buzzword of the day, North American manufacturers are making a move towards sustainable products such as recycled rubber soles and bio-based leathers. Manufacturers are manufacturing boots with antimicrobial coating to provide increased foot hygiene, increased wear duration, and thereby increasing demand even more.

Europe is the largest market for military boots, with the German, French, and UK militaries requiring the most. Italy and Spain are also witnessing growing applications of tactical boots by their military forces with a focus on lightweight, heat-resistant footwear. Continental land force modernization is driving the demand for new-generation boots with Kevlar insert to offer higher ballistic protection.

European Union environmental policies are compelling business houses to think out of the box in terms of eco-friendly material. Corporate business is developing biodegradable combat boots that are extremely high on functionality and extremely low on ecosystem devastation. European defence firms are collaborating with nanotechnology scientists to develop self-healing material combat boots and smart sensors integrated into them that monitor foot health in real-time.

Asia-Pacific will be the fastest-growing military boots market with defence expansion at an explosive rate and more spending on tactical equipment. India, Japan, China, and South Korea are competitively updating their military boots with state-of-the-art protection. The Indian Army, for instance, has unveiled new combat boots with better traction and heat dissipation for high-altitude regions such as the Himalayas.

China's military sector is also investing heavily in manufacturing heavy-duty light military shoes with graphene-based technologies for superior wear and tear protection. Expansion in the security services sector in the region is also generating demand, as private security companies and law enforcement authorities are buying high-performance tactical footwear for various operational purposes.

Challenge: Durability vs. Comfort Trade-off

One of the greatest challenges the military boot industry has is to balance protection with comfort. The boots need to be tough enough to withstand the harsh conditions but strain and tire the foot when caused by wear and tear. Troops forced to fight in rugged terrain like hills or bogs need boots that impose as little stress on their feet as possible without sacrificing protection. Companies are spending big bucks on ergonomics-based design and shock-absorbing technology to make up the difference.

Opportunity: Clever and Eco-Friendly Military Boots

Emerging technologies offer great opportunity to the military boots sector. Companies are creating intelligent boots with embedded GPS position sensing, pressure sensing, and energy harvesting capabilities to drive operations. The boots enable soldiers to navigate difficult terrain with feedback information in real time and eliminate the need for external power supply.

There is also growing momentum on the lines of sustainability trends in the market, and greater use of recyclable and biodegradable materials is being employed. Plant polymers, waterless tanning, and eco-friendly dyes are being used, reducing the environmental impact of boot production.

Between 2020 and 2024, the military boots market grew consistently with growing defence spending, material science technology innovation, and growing usage of lightweight boots. Military forces around the world were concerned with shock absorption functionality and anti-slip properties to enhance soldiers' mobility and avoid combat fatigue injury. Supply chain interference and geopolitical tension were risks, but local production capacity was capitalized.

In the coming years up to 2025 to 2035, market trends will be towards sustainability, smart shoe technology integration, and increased durability. Temperature control materials, self-repellent nanocoatings, and AI-powered custom boots will transform military boots. With militaries becoming increasingly mobilized, the need for high-tech responsive boots will also grow, propelling the next generation of tactical boots.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Military boot producers followed national defence procurement procedures, emphasizing durability and safety criteria. Environmental concerns started having an impact on material choice. |

| Technological Advancements | Incorporation of light composite materials enhanced performance and durability. Waterproofing technologies and fatigue-reducing soles became popular. |

| Tactical and Combat Performance | Boots incorporating better traction, ventilation, and weather resistance to contend with varied combat conditions. |

| Sustainability Trends | Synthetic leather and recycled rubber use in boot production became popular. Some producers experimented with bio-based alternatives. |

| Market Demand Trends | Driven by world defence spending and modernization initiatives, with emphasis on high-durability and ergonomic boots. |

| Production & Supply Chain Dynamics | Raw material supply and production schedules were impacted by pandemic lockdowns and geopolitical tensions. |

| Comfort and Injury Prevention | Orthopaedic insole and ankle-support technologies introduced have lowered injury rates among soldiers. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulators worldwide impose more stringent environmental protection measures, prompting the use of biodegradable and recyclable materials in military footwear. More visibility in the supply chain and more ethical procurement of raw materials. |

| Technological Advancements | Smart military footwear with inbuilt sensors to gather biometric data and track GPS locations is prevalent. Innovative materials with the ability to repair themselves and with advanced shock absorption enhance soldier mobility and sustainability. |

| Tactical and Combat Performance | Advanced materials science leads to adaptive camouflage boots and thermal management systems, improving soldier performance in extreme environments. |

| Sustainability Trends | Circular economy principles drive the industry, with fully recyclable military boots and energy-efficient production techniques becoming mainstream. The use of vegan-friendly, high-performance materials reduces dependence on animal-derived products. |

| Market Demand Trends | High stakes investments in robotic-assisted mobility solutions boost market demand for compatible military boots that can accommodate assistive robots. Growth in law enforcement and private security industries creates overall demand. |

| Production & Supply Chain Dynamics | Decentralized manufacturing and proximity production facilities limit dependence on individual suppliers. The use of on-demand 3D printing for custom-fitted military boot design is made possible. |

| Comfort and Injury Prevention | AI-based custom-fitting technology ensures absolute ergonomics, significantly reducing foot and joint stress under battle conditions. |

The USA military boot market word has been developing with high speed based on the rising defence budgets and technological upgrading of combat boots. Demand for lightweight, high-performance boots remains robust, with a focus on moisture-wicking and shock-absorbing features. In the coming years, smart incorporation into combat footwear will transform soldier tracking and protection.

The USA Department of Defence is underwriting biometric tracking boots that offer real-time monitoring of health and connectivity to field command centres. As sustainability concerns become more and more critical, companies are being forced to look at biodegradable composites and closed-loop systems of production in an attempt to minimize environmental impacts.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The UK military footwear market is evolving with a compliance and environmentally friendly production focus. The Ministry of Defence (MoD) has been investing in light tactical boots to ensure mobility and yet meet high durability standards. Its future is determined by technologies of the next generation, including boots with weather-sensitive materials incorporated into them to control the temperature of the foot in extreme conditions.

And new anti-slip technologies are in development for enhanced grip in all conditions, from deserts to Arctic conditions. With greater emphasis on green defence procurement, manufacturers are moving toward low-carbon and water-saving production methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The European Union military footwear market is propelled by high defence expenditure alongside stringent environmental requirements. Germany, France, and Italy are pioneers, using energy-saving production technologies and recyclable materials when producing military footwear.

One of the trends that are highlighted is the trend of modular military boots, whereby the inserts and soles are replaceable by the soldier according to the demands of the mission. Ballistic-resistant high-performance boots are also in great demand as a measure against enhanced security threats. The European Commission's low CO2 emissions defence manufacturing initiative is driving companies to utilize eco-friendly practices of tanning leather goods and green adhesives.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

The country's advancement in nanotechnology and ergonomic boot technology is transforming Japan's military boot market. Concentrating on light-weight, high-strength materials, the Japanese Self-Defence Forces (JSDF) have been shifting toward high-technology tactical boots featuring pressure-sensitive cushioning to deliver increased support to the foot.

In the future, customization through AI will be the standard, and 3D-scanning technology will provide accurate fits to soldiers. Japan's zero-waste initiative is also filtering into the industry, with corporations depend on biodegradable polymers and streamlined designs to minimize resource consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The South Korean military boot market is expanding tremendously with evolving defence technology and protective equipment. The shift toward functional, durable boots with anti-bacterial liner and advanced grip technology is accelerating with efforts toward military modernization. Most mentioned is the deployment of electrostatic-proof boots to protect soldiers operating in sophisticated electronic warfare environments.

Second is intelligent temperature-regulating insoles to achieve maximum comfort in South Korea's diverse climatic conditions. Government incentives on green manufacturing see domestic firms emerging as leaders of low-emission, high-performance composites to power future boots in the military.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

Combat boots are the stars due to their higher durability, tough build, and resistance to extreme conditions. Designed specifically to offer superior ankle support, slip resistance, and shock absorption, combat military boots are a vital gear for combat soldiers. Types like the Garmont T8 Bifida Tactical Boot are widely utilized due to their tough build and light weight, enabling soldiers to tread comfortably over uncharted ground.

Their dominance is also attributed to better material composition, including full-grain leather and ventilated nylon composition that is abrasion-resistant and durable. Furthermore, with more military modernization efforts being carried out around the world, purchasing high-performance boots with puncture-resistant soles incorporated and moisture-wicking properties has also contributed to demand, particularly in the United States, China, and Russia.

Desert boots are also fashionable, particularly in extremely warm and arid climates such as North Africa and the Middle East. Desert boots are suede or light leather constructions with adequate ventilation and thermal resistance. The Altama Foxhound SR 8" Desert Boot, for instance, is popular among military personnel due to its oil-resistant sole and cushioned midsole for support during prolonged patrol duty.

In spite of the retention of their popularity, problems of sand penetration and excessive wear during extreme conditions have led to the introduction of high-end variants with toe caps for support and improved moisture-wicking linings. Defense procurement in countries such as Saudi Arabia and the UAE is driving steady sales of desert boots, as companies experiment with new materials to make them work better and last longer.

Jungle boots remain a military requirement in swamps and wet terrain where drying and drainage capacity is essential. Jungle boots, normally drainage eyelets and rubber-soled, Panama-type, maintain dryness of feet and provide traction on muddiness. Rocky S2V Jungle Boot is one of favourites with aggressive tread pattern and antimicrobial moisture management.

South America and Southeast Asia have the highest demand for jungle boots where rainforests are mobility barriers. The Brazilian, Indian, and Vietnamese militaries restock jungle boot inventory regularly to address evolving combat and training requirements. Furthermore, advances in synthetics have led to lighter boots with faster drying times without compromising durability.

Since the military operations in the Arctic and high-altitude areas are intensified, cold-weather boots are in great demand. The boots utilize insulation, waterproof membranes, and treaded outsoles for maximum functionality under sub-freezing temperatures. A few of them are the Baffin Tundra Military Boot with thermal insulation of -40°C, which is being supplied to the troops deployed in Alaska, Canada, and Northern Europe.

Russia and Norway are also spending heavily on winter-specific military gear, in addition to the need for high-performance military winter boots. NATO soldiers carrying out exercises in sub-freezing temperatures also fuelled the acquisition of GORE-TEX-insulated boots and high-grip Vibram soles to prevent frostbite and enhance mobility.

Global defence troops are the biggest consumers of military boots due to their requirement for defence operations, training, and special operations. The constant search for soldier equipment upgrade programs, particularly by countries like the U.S., India, and Germany, has led to bulk orders of upgraded combat boots.

Military boot producers are using light but tough composites, puncture-resistant films, and flame-resistant materials to offer tough battlefield needs. Multilateral warfare and multilateral defence pacts also have been driving procurement needs, as the armies need homogenized but location-based shoe designs.

Apart from use in the army, military boots are also largely used by backpackers and tourists because of its tough build and off-road functionality. Military boots are the top choice of adventure sport enthusiasts, mountain climbers, and marathon walkers because of its improved ankle support and water-resistant properties. Danner Tachyon Boot is a favourite among hikers since it is lightweight in weight but high in performance.

Growth of outdoor recreational travel in the USA, Canada, and Australia created consumer demand for military boots. Travelers wear them while hiking Patagonia's rugged mountains, the Grand Canyon, or the Himalayas to protect themselves and endure poor conditions. In response, manufacturers created hybrid military-hiking boots that are militarily tough yet comfortable.

The military boot industry is a large and dynamic market, where the industry is dominated by huge global producers and local suppliers to defence agencies, police forces, and tactical specialist markets. There are a few major players with huge market shares, and the emphasis is on high-performance materials, ergonomic comfort, and toughness.

The companies are focusing on light weight design, improved protection, and toughness capability to address military and tactical requirements. The industry has a combination of established players and new entrants, and both players innovate products and the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Belleville Boot Company | 12-17% |

| Bates Footwear | 10-14% |

| Rocky Brands, Inc. | 8-12% |

| Altama (Original Footwear) | 5-9% |

| Danner (LaCrosse Footwear) | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Belleville Boot Company | Produces military and tactical boots with flame-resistant materials and composite toe protection. Pioneering lightweight designs for enhanced mobility. |

| Bates Footwear | Specializes in waterproof and slip-resistant combat boots. Incorporates energy-returning midsole technology for long-wear comfort. |

| Rocky Brands, Inc. | Develops rugged military footwear with reinforced outsoles and puncture-resistant midsoles. Emphasizes cold-weather protection for harsh environments. |

| Altama (Original Footwear) | Supplies jungle boots, maritime assault footwear, and quick-drying military boots. Focuses on hybrid models for multi-terrain adaptability. |

| Danner (LaCrosse Footwear) | Manufactures handcrafted tactical boots with GORE-TEX lining and Vibram outsoles. Recognized for premium leather and stitch-down construction. |

Key Company Insights

Belleville Boot Company (12-17%)

Belleville Boot Company is the leading manufacturer in the military boot sector, producing high-performance combat and tactical military boots for the USA Military and global military forces. It employs flame-resistant material and composite toe protection to enable defense needs. Belleville is especially committed to light-weighting and shock-absorbing midsoles designs for soldier mobility enhancement in combat. For more than a century, it is a trusted supply partner of the military and police forces worldwide.

Bates Footwear (10-14%)

Bates Footwear stands very high among combat-ready boot providers, which is famous for slip-resistant and waterproof technology. Bates also uses high-technology midsole cushioning to minimize foot fatigue for long missions. Bates also substitutes side-zip tactical boots with comfort wearability. Since it has penetrated so much into police markets and military contracts, the company still improves durability and comfort through high-technology production.

Rocky Brands, Inc. (8-12%)

Rocky Brands, Inc. is a leading company in the military boot industry, producing tough boots meant for extreme usage. The boots of the company are made up of reinforced outsoles, puncture-resistant midsoles, and cold-working insulated linings. The company diversified its product offerings to include special operations forces, providing high-durability boots that are solely meant for extreme usage.

Altama (5-7%)

Altama is a Original Footwear firm that produces crossover function military boots such as jungle boots and naval assault shoes. Altama produces crossover styles suited for use on-water as well as on-land, therefore suitable for amphibious and special operations. Quick-drying material, wicking lining, and heavy tread soles are aspects in Altama boots. Altama is the military consumer's first line of choice in the adaptive and light-footwear segment.

Danner (3-7%)

Danner, which is a LaCrosse Footwear company, is famous for its premium hand-stitched military boots. The company has GORE-TEX waterproofing and Vibram outsoles that ensure incredible traction and abrasion-resistance. Danner boots are famous with stitch-down construction that ensures maximum life and resolvability. Appreciated for its excellent quality leather and ergonomic comfort, Danner is suitable for military, tactical, and law enforcement officers who require hard, high-capacity boots.

Other Leading Players (45-55% Total)

Aside from the above market leaders, there are numerous other leading players with an enormous combined market share, and they encourage material enhancements, price rivalry, and innovation. These include:

The overall market size for military boots market was USD 5,124 million in 2025.

The military boots market is expected to reach USD 8,291 million in 2035.

The increasing defence budgets, rising demand for durable and high-performance footwear for military personnel, and advancements in boot materials and technology fuel the military boots market during the forecast period.

The top 5 countries which drive the development of military boots market are USA, China, Russia, India, and Germany.

On the basis of material, leather military boots are expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Pairs) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 4: Global Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 10: North America Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 16: Latin America Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 22: Western Europe Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 40: East Asia Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Pairs) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Pairs) Forecast by Machine Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Pairs) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Pairs) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 9: Global Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 27: North America Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 45: Latin America Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Machine Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 117: East Asia Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Machine Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Pairs) Analysis by Machine Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Pairs) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Machine Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA