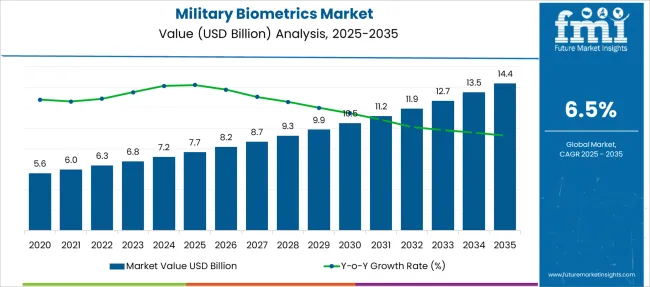

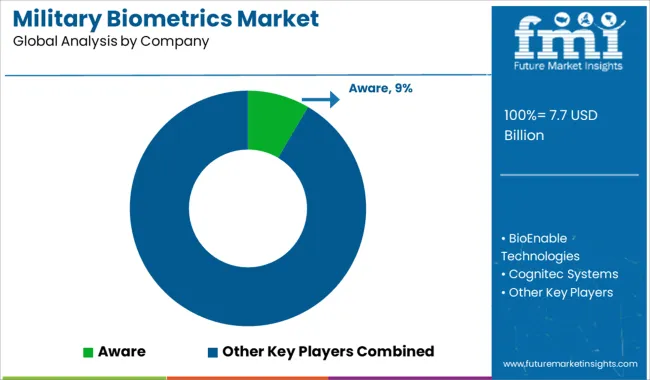

The Military Biometrics Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Military Biometrics Market Estimated Value in (2025 E) | USD 7.7 billion |

| Military Biometrics Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The military biometrics market is gaining momentum as defense organizations prioritize identity verification, secure access control, and surveillance efficiency in increasingly complex threat environments. The need for rapid, reliable, and tamper-proof identification of personnel, combatants, and civilians in conflict zones has heightened investment in biometric technologies.

Geopolitical instability, cross-border threats, and the rise of asymmetric warfare have further underscored the demand for robust biometric authentication systems across defense operations. Advancements in biometric hardware, integration with artificial intelligence, and interoperability across command systems are improving accuracy and deployment speed.

The sector is poised for continued expansion as modern militaries shift toward digital transformation, multi-modal biometrics, and mobile-based authentication tools that enhance field efficiency and operational readiness.

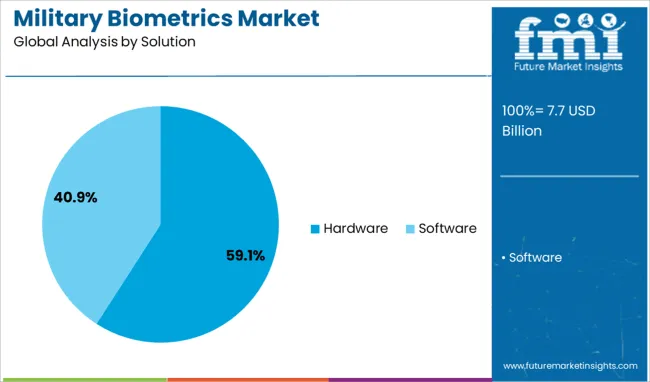

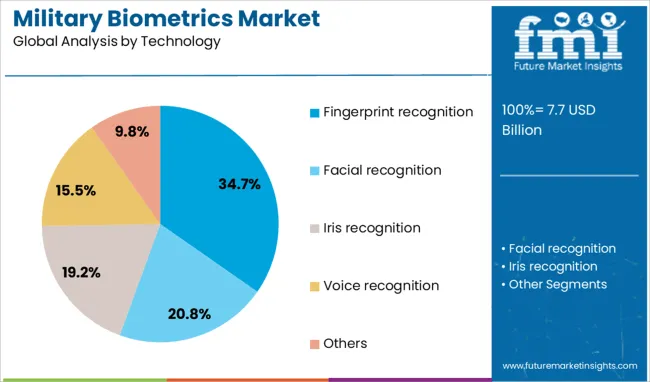

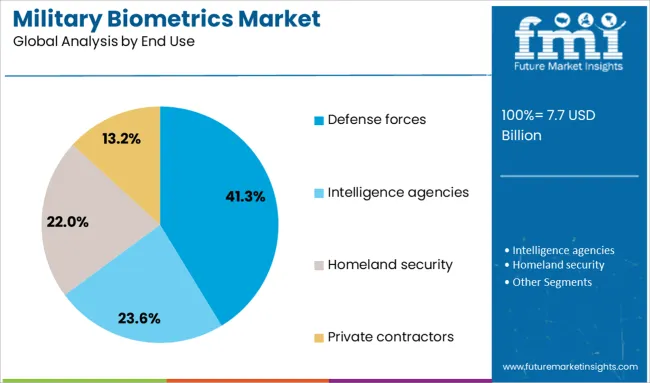

The military biometrics market is segmented by solution, technology, end use, and geographic regions. The military biometrics market is divided into Hardware and Software. In terms of technology of the military biometrics market is classified into Fingerprint recognition, Facial recognition, Iris recognition, Voice recognition, and Others. The military biometrics market is segmented based on end use into Defense forces, Intelligence agencies, Homeland security, and Private contractors. Regionally, the military biometrics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment dominates the military biometrics market with a commanding 59.1% share, supported by the ongoing demand for rugged, reliable, and field-deployable biometric devices. These systems include scanners, sensors, handheld terminals, and imaging equipment that are purpose-built for harsh operational conditions and frontline environments.

Hardware solutions are critical to enabling real-time identification and verification tasks, whether in fixed installations or mobile deployments. Military contracts increasingly prioritize hardware that supports multi-modal capabilities, low-latency processing, and seamless integration with existing defense IT infrastructure.

Advancements in miniaturization and energy efficiency are enhancing device portability and utility in combat settings. The hardware segment is expected to remain the backbone of military biometric deployments, driven by its essential role in on-ground operations and mission-critical decision-making.

Fingerprint recognition leads the technology category with a 34.7% market share, largely due to its maturity, accuracy, and ease of integration into both mobile and stationary defense systems. The technology has long been trusted for personnel tracking, border control, and detainee management, offering fast authentication without the need for extensive infrastructure.

Fingerprint scanners are widely deployed at military checkpoints, access control gates, and enrollment stations due to their low operational complexity and proven effectiveness. Despite the emergence of newer biometric modalities, fingerprint recognition continues to dominate military settings due to cost-efficiency, compact hardware form factors, and established interoperability with defense databases.

Ongoing improvements in sensor resolution, spoof detection, and ruggedization are expected to reinforce this segment’s leadership position in both legacy and modern military applications.

The defense forces end-use segment holds a leading 41.3% share in the military biometrics market, driven by the increasing integration of biometric tools into defense operations for identity verification, surveillance, and secure access. Military organizations worldwide are adopting biometrics to enhance operational security, manage personnel movement, and ensure compliance with mission protocols.

Use cases range from base access authentication to battlefield identity confirmation, where rapid and reliable recognition is essential. Investments in national defense modernization programs and counterterrorism measures are boosting biometric deployment within armed forces.

Defense forces also serve as early adopters of advanced technologies, influencing procurement trends across allied agencies and international missions. As threats become more complex and distributed, the strategic role of biometrics in safeguarding assets, data, and personnel will continue to expand, solidifying this segment’s dominance.

The military biometrics market is expanding with growing adoption of secure access control, border security systems, and battlefield integration, driven by modernization programs and counterterrorism needs. Strategic investments, AI-based solutions, and multimodal authentication are shaping a competitive, rapidly evolving landscape.

The military biometrics market is being driven by the need for secure authentication in defense facilities and high-risk operational environments. Fingerprint, iris, and facial recognition systems are increasingly used to control access to sensitive installations, ensuring that only authorized personnel gain entry. Rising threats of espionage and cyber-physical security breaches have accelerated the adoption of multi-layered biometric solutions. Defense agencies are prioritizing biometrics as part of their identity management systems to minimize insider threats and unauthorized movements. This demand is further reinforced by military modernization programs across NATO and allied nations, where advanced security protocols are mandated for base operations, weapons storage areas, and classified data centers.

The adoption of biometric solutions for border protection has surged as countries strengthen perimeter defense against illegal entry and smuggling activities. Military forces are integrating biometric checkpoints at land borders, naval bases, and forward-operating posts to validate identities in real time. Facial recognition systems combined with handheld biometric scanners have become essential for verifying individuals in conflict-prone zones and during counterterrorism missions. Governments in regions with porous borders, such as the Middle East and parts of Asia, are deploying multimodal biometric technologies for accurate profiling. These deployments enable military personnel to quickly identify threats while ensuring lawful movement across strategic defense corridors.

Military biometrics are no longer confined to static installations; their integration with battlefield systems is gaining traction. Portable biometric devices and wearable solutions allow soldiers to perform identity checks during missions, enhancing situational awareness. In remote or hostile environments, these systems enable real-time verification of detainees, reducing the risk of impersonation or insurgent infiltration. Defense programs are focusing on interoperable biometric systems that communicate with command centers for instant data sharing. This trend is particularly strong in asymmetric warfare and peacekeeping operations, where quick and accurate identification is mission-critical. Such integration demonstrates the shift toward dynamic, field-ready biometric applications.

The competitive environment in the military biometrics market is shaped by continuous investment in high-accuracy, low-latency systems. Key players are forming partnerships with defense ministries to deliver turnkey biometric platforms, including software-driven analytics for faster decision-making. Companies are developing solutions that function reliably in diverse conditions, such as extreme temperatures, dust, and low-light scenarios. Strategic initiatives include acquisition of niche firms specializing in AI-based biometrics to enhance multimodal authentication systems. Defense contractors are leveraging government contracts to expand their global footprint, particularly in emerging markets where border control and anti-insurgency measures are national priorities, driving sustained market expansion.

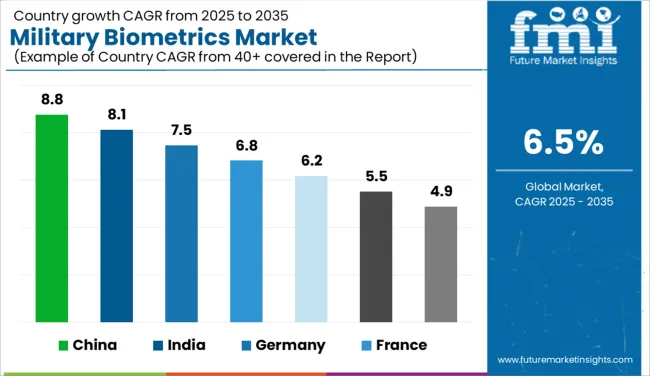

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

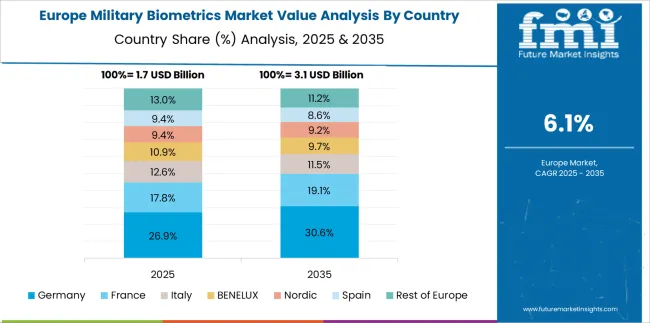

The military biometrics market, projected to grow at a global CAGR of 6.5% from 2025 to 2035, is showing strong performance across major countries. China is leading with an impressive CAGR of 8.8%, fueled by large-scale defense modernization and investments in AI-driven security solutions. India follows at 8.1%, reflecting its strategic focus on enhancing border security and modernizing military bases. France records a 6.8% CAGR, driven by increased adoption of multimodal biometrics across NATO operations. These trends highlight how both BRICS and European nations are prioritizing advanced security infrastructure for national defense initiatives. The United Kingdom and the United States are seeing slightly slower yet steady growth at 6.2% and 5.5%, respectively, driven by deployments in tactical systems and homeland security measures. The UK’s investments are centered on base security and identity verification for critical missions, while the USA is focusing on next-gen portable biometrics integrated with AI analytics for battlefield applications. These figures underscore a competitive market where high-growth opportunities exist in Asia, while North America and Europe continue to emphasize operational security through advanced biometric systems. The report includes an in-depth analysis of 40+ countries, with the top five nations detailed as key reference points for global market performance.

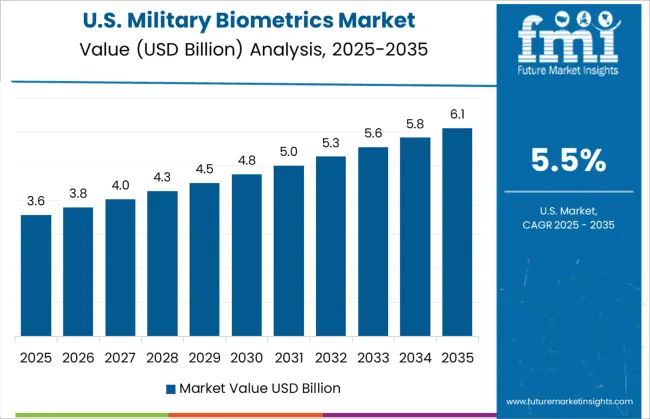

The CAGR in the United States increased from 4.6% in 2020-2024 to 5.5% during 2025-2035, driven by significant defense modernization and enhanced adoption of advanced authentication systems for secure installations. Early-phase growth was slower due to reliance on legacy systems and fragmented procurement policies. However, increased investments in portable biometric solutions for field deployment and AI-driven analytics in identity management strengthened market performance post-2025. U.S. defense agencies prioritized multimodal biometrics, combining facial, iris, and fingerprint recognition for border control and homeland security initiatives. Deployment in naval bases, air force command centers, and critical intelligence facilities has expanded significantly.

The CAGR in the United Kingdom rose from about 5.1% during 2020-2024 to 6.2% in the 2025-2035 period, supported by enhanced NATO security frameworks and a growing need for identity verification in critical defense infrastructure. The earlier phase of adoption was moderate due to delayed upgrades to older systems. Post-2025, U.K. defense operations saw wider deployment of biometric gates at military airbases and naval facilities, reducing insider threats and ensuring robust perimeter security. Policy frameworks aligned with EU directives for secure access control contributed to a surge in multimodal authentication solutions, improving interoperability with allied forces.

China recorded a sharp CAGR increase from 6.7% in 2020-2024 to 8.8% during 2025-2035, fueled by large-scale border surveillance projects and AI-enabled biometric programs under national security reforms. Defense investments in multimodal systems accelerated after 2025 to support high-threat region monitoring. Biometric deployments in coastal defense and strategic air command have gained momentum, coupled with domestic R&D breakthroughs in facial and gait recognition technologies. Integration of biometrics into digital command systems has positioned China as a global leader in high-performance defense security applications.

India saw CAGR growth from nearly 6.2% in 2020-2024 to 8.1% for 2025-2035, driven by increasing deployment of biometric identity systems at forward-operating bases and sensitive defense zones. Early adoption was limited due to infrastructure constraints, but strategic programs like the Digital Border Management initiative post-2025 spurred growth. Handheld biometric verification devices are now standard in high-risk regions, improving operational efficiency during counter-insurgency missions. Partnerships between defense agencies and technology firms have expanded the integration of AI-powered solutions for advanced threat profiling.

France witnessed CAGR improvement from 5.9% in 2020-2024 to 6.8% in the 2025-2035 timeframe, driven by its commitment to advanced perimeter security within NATO and EU defense alliances. Initial uptake was steady, supported by secure access systems in air command facilities. However, the post-2025 phase accelerated with the integration of portable biometrics into rapid deployment forces and naval missions. Government-backed investments in AI-driven facial and iris recognition systems ensured compliance with evolving security standards.

The military biometrics market is led by globally recognized companies offering advanced identity verification solutions for defense applications. Organizations such as Aware, BioEnable Technologies, and Cognitec Systems are focusing on robust software platforms for facial and iris recognition to enhance secure access control in sensitive environments. Dermalog Identification Systems and Fulcrum Biometrics specialize in multimodal biometric technologies designed for mission-critical deployments. HID Global, IDEMIA, and Leidos are key players providing end-to-end identity management solutions integrated with AI for real-time authentication in operational theaters. M2SYS Technology and Microsoft contribute by leveraging cloud-based biometric analytics and secure data platforms for scalability. NEC Corporation and Neurotechnology deliver high-accuracy biometric algorithms optimized for harsh environments, supporting interoperability across defense systems. Industry giants like Safran, Thales, and Smiths Group are enhancing hardware capabilities with mobile and portable biometric devices suitable for field operations. Securiport, known for its border control expertise, is expanding into defense-related biometric deployments, aligning with rising global security concerns.

These companies are adopting strategies such as AI integration, cybersecurity reinforcement, and partnerships with defense agencies to deliver innovative, reliable, and scalable solutions. Their combined focus on system accuracy, rapid deployment, and compliance with international security standards positions them as dominant forces in advancing biometric technologies for military modernization and operational readiness.

On September 2, 2024, Safran finalized an acquisition of Preligens, a French AI specialist focused on military surveillance and imagery analytics.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Solution | Hardware and Software |

| Technology | Fingerprint recognition, Facial recognition, Iris recognition, Voice recognition, and Others |

| End Use | Defense forces, Intelligence agencies, Homeland security, and Private contractors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aware, BioEnable Technologies, Cognitec Systems, Dermalog Identification Systems, Fulcrum Biometrics, HID Global, IDEMIA, Leidos, M2SYS Technology, Microsoft, NEC Corporation, Neurotechnology, Safran, Securiport, Smiths Group, and Thales |

| Additional Attributes | Dollar sales, share, growth projections, procurement trends, competitive landscape, regional demand hotspots, key defense contracts, government funding programs, technology adoption rates, and pricing benchmarks to align strategies effectively. |

The global military biometrics market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the military biometrics market is projected to reach USD 14.4 billion by 2035.

The military biometrics market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in military biometrics market are hardware and software.

In terms of technology, fingerprint recognition segment to command 34.7% share in the military biometrics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA