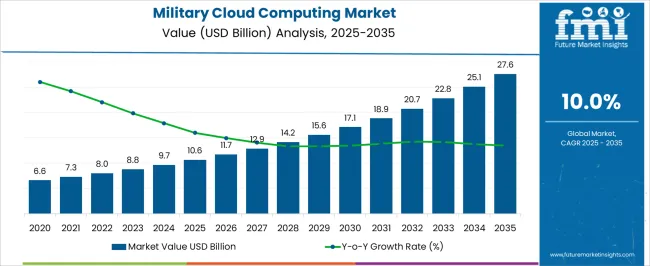

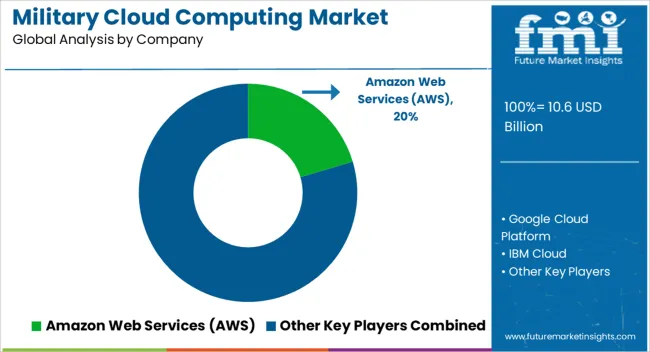

The Military Cloud Computing Market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 27.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The military cloud computing market, estimated at USD 10.6 billion in 2025 and projected to reach USD 27.6 billion by 2035, is expanding at a CAGR of 10.0%. Between 2020 and 2024, the market grows steadily from USD 6.6 billion to USD 9.7 billion, with annual increments such as USD 7.3 billion in 2021, USD 8.0 billion in 2022, and USD 8.8 billion in 2023 highlighting the progressive adoption of secure, scalable, and mission-critical cloud solutions. This phase reflects the growing integration of cloud systems into defense communications, intelligence analysis, and data-driven decision-making. In the period from 2025 to 2030, the market progresses strongly from USD 10.6 billion to USD 17.1 billion, accounting for a significant share of the overall expansion. Rising investments in cybersecurity frameworks, AI-driven cloud analytics, and the deployment of hybrid and edge cloud systems for real-time battlefield awareness drive this phase. Cloud-enabled collaboration across multinational forces and modernization of defense IT infrastructure further accelerate growth. From 2031 to 2035, the market advances from USD 18.9 billion to USD 27.6 billion, generating about 38% of the total projected growth. This stage is marked by the dominance of advanced multi-domain command platforms, IoT integration, and greater reliance on AI-enabled secure cloud ecosystems for predictive maintenance and operational efficiency. Overall, the military cloud computing market demonstrates a robust trajectory through 2035, underpinned by digital transformation, cybersecurity imperatives, and the global defense sector’s shift toward cloud-based operational agility.

| Metric | Value |

|---|---|

| Military Cloud Computing Market Estimated Value in (2025 E) | USD 10.6 billion |

| Military Cloud Computing Market Forecast Value in (2035 F) | USD 27.6 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The military cloud computing market occupies a crucial position within the global defense and information technology sector, representing approximately 18–22% share of the broader defense IT infrastructure and digital transformation industry. Within defense operations and command systems, military cloud solutions account for nearly 25–28% share, driven by adoption of secure, scalable, and real-time data processing platforms to support mission-critical decision-making, situational awareness, and interoperability across branches of armed forces. In intelligence, surveillance, and reconnaissance applications, cloud computing contributes around 20–22% share, as advanced analytics, AI integration, and high-speed connectivity improve threat detection and operational efficiency. For logistics, maintenance, and fleet management, military cloud systems hold roughly 12–14% share, enabling predictive maintenance, resource allocation, and supply chain optimization. Cybersecurity and secure communication sectors represent close to 10–12% share, with emphasis on encrypted data storage, access controls, and compliance with defense-grade standards. Growth is supported by rising global defense spending, modernization of legacy IT infrastructure, increasing demand for real-time battlefield intelligence, and government initiatives to integrate cloud-enabled platforms in military networks. Vendors are focusing on hybrid cloud deployments, edge computing integration, and defense-grade security protocols to ensure resilient and mission-ready systems. As digital warfare, data-driven decision-making, and cross-domain operations expand, military cloud computing is becoming a pivotal element of defense strategy, operational readiness, and technological superiority.

The military cloud computing market is advancing rapidly as defense agencies prioritize digital transformation to modernize command, control, and intelligence systems. Cloud integration enables faster data processing, secure communications, and real-time operational responsiveness, which are critical for modern warfare and disaster response.

Rising cyber threats and the need for agile, scalable IT infrastructure are pushing defense forces to invest in cloud-native technologies. Governments are also increasing defense IT budgets to accommodate hybrid environments that allow secure access to mission-critical applications.

The adoption of advanced encryption, multi-factor authentication, and compliance-driven architecture is enabling the secure migration of sensitive data to the cloud.

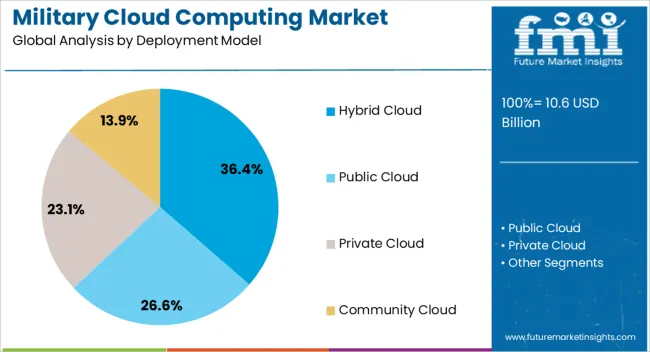

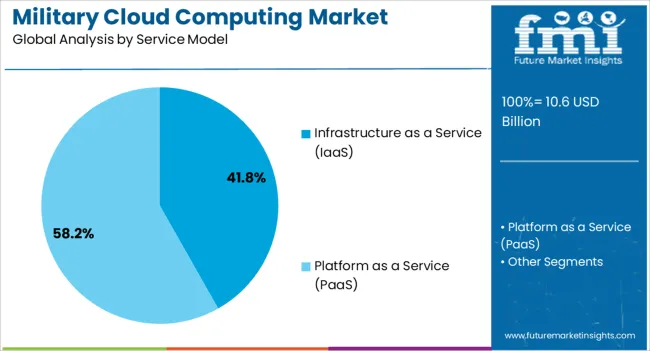

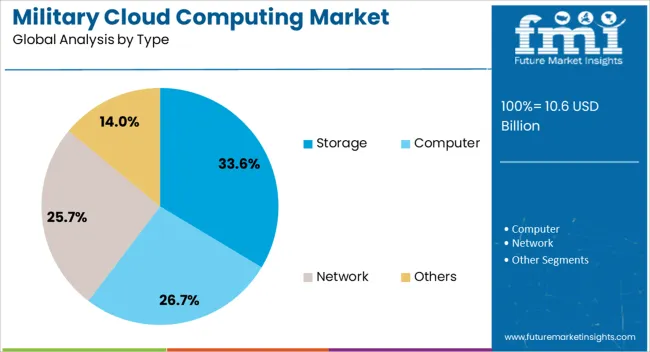

The military cloud computing market is segmented by deployment model, service model, type, application, end-use, security type, and geographic regions. By deployment model, military cloud computing market is divided into Hybrid Cloud, Public Cloud, Private Cloud, and Community Cloud. In terms of service model, military cloud computing market is classified into Infrastructure as a Service (IaaS) and Platform as a Service (PaaS). Based on type, military cloud computing market is segmented into Storage, Computer, Network, and Others. By application, military cloud computing market is segmented into Cybersecurity, Command and Control, Intelligence and Surveillance, Disaster Management, Logistics and Transportation, and Others. By end-use, military cloud computing market is segmented into Army, Navy, Air Force, Space Force, and Defense Agencies. By security type, military cloud computing market is segmented into Enterprise Cloud, Tactical Cloud, and Edge Computing. Regionally, the military cloud computing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hybrid cloud is expected to dominate the deployment landscape with 36.4% share in 2025, driven by its ability to balance operational agility with stringent security requirements. Military agencies favor hybrid models for their flexibility in allocating workloads across on-premise and cloud-based environments.

This deployment model allows classified and sensitive data to remain on secure servers while utilizing public cloud scalability for less critical tasks. Hybrid cloud infrastructure also supports interoperability across allied forces, enhancing multinational mission coordination.

The increasing deployment of AI, IoT, and battlefield analytics further reinforces the need for adaptable and resilient cloud solutions like hybrid cloud.

Infrastructure as a Service (IaaS) is projected to lead the service model segment with a 41.8% market share in 2025, due to its cost-efficiency and on-demand scalability. IaaS provides military users with virtualized computing resources such as storage, servers, and networking, essential for mission-readiness in diverse operational environments.

It enables rapid provisioning and decommissioning of resources during active deployments or simulations. The growth in cyber training programs, digital twins, and cloud-native combat simulations is accelerating IaaS adoption.

Defense departments also leverage IaaS to ensure continuity of operations and disaster recovery through globally distributed data centers.

Storage solutions are anticipated to hold 33.6% of the market in 2025, making it the leading cloud computing type within the military domain. Military organizations require massive, secure, and redundant storage capabilities to manage geospatial data, intelligence imagery, drone footage, and encrypted communications.

The shift toward real-time data access and long-term archival of sensitive mission logs is bolstering cloud-based storage demand. Advances in secure storage architecture, such as air-gapped systems and homomorphic encryption, are supporting compliance with national defense cybersecurity mandates.

As operational complexity grows, scalable and tamper-proof cloud storage remains a foundational layer for military digital ecosystems.

Military cloud computing is driven by defense digitization, secure data management, and operational efficiency needs. Growth is influenced by adoption trends, secure platform demand, and challenges in integration and compliance.

Military cloud computing demand is primarily fueled by defense modernization programs and digital transformation of armed forces. Cloud-based platforms are increasingly integrated into command and control systems, enabling real-time data sharing, mission planning, and situational awareness. Adoption is particularly high for joint operations requiring seamless interoperability between army, navy, and air force units. Procurement decisions are influenced by governments seeking secure, scalable, and resilient IT infrastructure capable of processing large volumes of operational and intelligence data. Military agencies also prioritize platforms that support simulation, training, and war-gaming exercises, enhancing operational readiness. Growth in drone, satellite, and autonomous vehicle operations further drives demand for cloud-based data management systems, ensuring operational efficiency and decision superiority across various defense theaters.

The military cloud computing sector benefits from increasing requirements for secure storage, data classification, and access management. Defense organizations are shifting from legacy on-premises servers to hybrid and private cloud environments to protect sensitive information from cyber threats. Cloud systems facilitate encrypted communication channels, access control protocols, and audit-ready storage of classified documents. Governments are introducing stricter regulations for data sovereignty, prompting adoption of compliant cloud solutions. Expansion of battlefield intelligence collection and sensor networks necessitates secure repositories for high-resolution imagery, telemetry, and operational logs. Vendors focusing on high-assurance security, redundancy, and defense-grade certifications gain a competitive advantage. Opportunities also exist in remote base operations and allied military exercises where secure cloud infrastructure enables real-time data sharing while maintaining classified integrity.

Military cloud computing adoption is shaped by integration of AI-enabled analytics, big data processing, and edge computing at operational fronts. Cloud platforms enable centralized management of distributed defense networks, supporting rapid deployment, predictive maintenance, and automated threat assessment. Collaboration with allied forces for joint missions is facilitated by interoperable cloud architectures that ensure secure cross-domain communication. Logistics, fleet management, and operational planning increasingly rely on cloud-hosted applications to optimize resource allocation. Defense contractors and system integrators are customizing offerings to meet mission-specific requirements, including bandwidth, latency, and operational redundancy. As modernization programs expand, agencies are emphasizing modular, flexible platforms that allow integration with existing IT and command systems without compromising operational continuity or security standards.

Despite rapid adoption, military cloud computing faces hurdles related to network latency, interoperability, and defense-grade security compliance. Integrating new cloud solutions with legacy command systems and communication networks often requires significant customization and testing. Data encryption, multi-level access, and compliance with defense regulations add to implementation complexity. Limited bandwidth in remote or tactical environments can hinder real-time data transmission. Vendor lock-in concerns and high capital investment for defense-grade infrastructure also impact procurement decisions. Training military personnel to manage, monitor, and secure cloud platforms requires continuous investment. Overcoming these challenges involves robust testing, incremental deployment, and collaboration between defense IT teams and cloud solution providers to maintain operational efficiency and mission readiness.

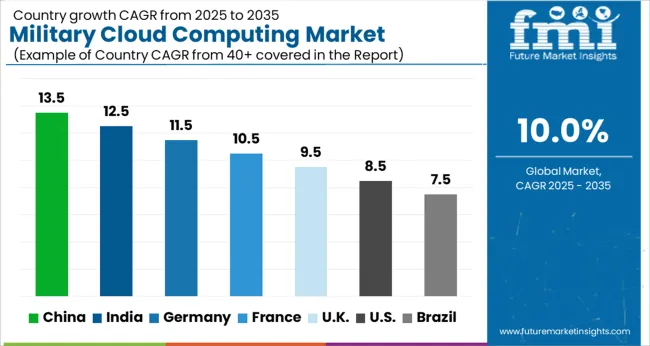

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The military cloud computing market is estimated to grow globally at a CAGR of 10.0% from 2025 to 2035, supported by rising defense digitalization, expanding intelligence operations, and growing reliance on secure data platforms. China leads with a CAGR of 13.5%, fueled by modernization of armed forces, deployment of advanced cloud infrastructure, and integration with command and control systems. India follows at 12.5%, driven by adoption of secure cloud storage, joint military exercises, and investment in AI-enabled analytics for operational efficiency. France records a CAGR of 10.5%, with growth shaped by defense IT upgrades, secure battlefield data management, and collaborative intelligence programs. The United Kingdom grows at 9.5%, influenced by secure cloud adoption in naval, air, and army operations, and expansion of hybrid cloud solutions. The United States posts 8.5%, driven by cloud-enabled command systems, intelligence-sharing platforms, and defense modernization initiatives. The analysis spans over 40 regions, with these five countries serving as key references for defense cloud adoption strategies, procurement patterns, and deployment trends globally.

China is expected to grow at a CAGR of 13.5% during 2025–2035, significantly surpassing the global benchmark of 10.0%, driven by modernization of armed forces, deployment of secure cloud networks, and expansion of AI-enabled command and control systems. During the 2020–2024 period, the growth rate was 11.8%, supported by initial digitalization of military operations, adoption of cloud-based intelligence platforms, and government initiatives to strengthen cybersecurity across defense networks. The increase in CAGR moving forward is driven by integration of cloud computing into battlefield operations, investment in domestic data centers, and collaboration with domestic and international defense technology providers. China’s strategic investments in military cloud technologies underpin this rise.

India is projected to achieve a CAGR of 12.5% between 2025 and 2035, exceeding the global average of 10.0%, supported by modernization of defense IT systems, adoption of cloud-enabled intelligence sharing, and expansion of digital military infrastructure. During 2020–2024, India recorded a CAGR of 10.9%, driven by initial investments in hybrid cloud solutions, joint military exercises utilizing cloud analytics, and establishment of secure cloud data repositories. The rise in growth is attributed to increasing integration of cloud platforms in intelligence operations, expansion of domestic IT defense capabilities, and rising government focus on defense cybersecurity. India’s focus on strengthening military cloud initiatives underpins continued market expansion.

France is expected to grow at a CAGR of 10.5% during 2025–2035, slightly above the global CAGR of 10.0%, driven by modernization of defense IT systems, secure battlefield data management, and collaboration with European defense technology networks. During 2020–2024, the growth rate was 9.1%, supported by early adoption of secure cloud platforms for air, naval, and ground forces, defense IT upgrades, and expansion of intelligence-sharing networks. The increase in CAGR moving forward is driven by enhanced adoption of multi-cloud and hybrid solutions, investment in domestic cloud infrastructure, and integration of AI-driven analytics into military operations. France’s defense digital modernization underpins this rise.

The United Kingdom is projected to achieve a CAGR of 9.5% between 2025 and 2035, above the global average of 10.0%, propelled by modernization of defense IT systems, cloud-enabled naval and army operations, and increased reliance on secure data platforms. During 2020–2024, the UK recorded a CAGR of 8.2%, driven by adoption of hybrid cloud solutions, integration of intelligence platforms across military branches, and investment in secure defense IT infrastructure. The rise in CAGR for 2025–2035 is supported by expanding adoption of cloud-based command and control systems, upgrades to cybersecurity frameworks, and government-backed initiatives for joint defense intelligence programs. Cloud computing is increasingly embedded in operational and strategic defense functions across the UK.

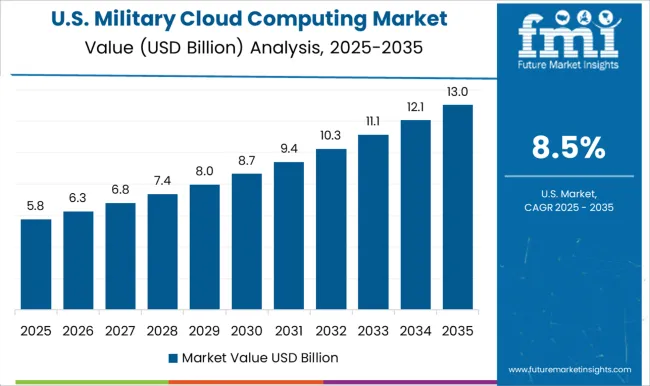

The United States is projected to grow at a CAGR of 8.5% during 2025–2035, slightly below the global benchmark of 10.0%, driven by large-scale defense cloud adoption, AI-enabled military intelligence systems, and integration into ongoing military operations. During 2020–2024, the growth rate was 7.3%, supported by early adoption of cloud infrastructure, modernization of intelligence networks, and expansion of secure battlefield platforms. The increase in CAGR moving forward is driven by deployment of advanced hybrid and multi-cloud platforms, large-scale investment in defense IT modernization, and strategic initiatives for cross-branch intelligence collaboration. US military cloud programs focus on secure, scalable, and mission-critical solutions.

The military cloud computing market is shaped by global technology leaders and defense contractors offering secure, scalable, and mission-critical cloud platforms. Amazon Web Services (AWS) holds a dominant position with extensive cloud infrastructure, high-security standards, and specialized defense cloud services supporting joint military operations. Microsoft Azure provides integrated cloud solutions with secure government and defense cloud offerings, enabling multi-branch intelligence and operational management. Google Cloud Platform delivers AI-powered analytics, hybrid cloud capabilities, and secure collaboration tools tailored for defense applications. IBM Cloud leverages hybrid and private cloud solutions, emphasizing cybersecurity, data sovereignty, and mission-critical workloads. Oracle Cloud specializes in enterprise-grade, secure cloud platforms supporting defense logistics, analytics, and intelligence functions. Lockheed Martin Corporation and Northrop Grumman Corporation integrate cloud computing into defense platforms, enhancing command, control, communications, and intelligence (C3I) operations. These companies compete on data security, system reliability, interoperability, and cloud scalability for defense applications. Strategies include developing dedicated government and defense cloud regions, offering AI-enabled analytics, integrating multi-cloud orchestration, and ensuring compliance with defense cybersecurity standards. Continuous investment in infrastructure, strategic collaborations with defense agencies, and innovation in cloud-based intelligence and operational management platforms remain central to maintaining competitive positioning in the global military cloud computing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.6 Billion |

| Deployment Model | Hybrid Cloud, Public Cloud, Private Cloud, and Community Cloud |

| Service Model | Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) |

| Type | Storage, Computer, Network, and Others |

| Application | Cybersecurity, Command and Control, Intelligence and Surveillance, Disaster Management, Logistics and Transportation, and Others |

| End-use | Army, Navy, Air Force, Space Force, and Defense Agencies |

| Security Type | Enterprise Cloud, Tactical Cloud, and Edge Computing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Web Services (AWS), Google Cloud Platform, IBM Cloud, Lockheed Martin Corporation, Microsoft Azure, Northrop Grumman Corporation, and Oracle Cloud |

| Additional Attributes | Dollar sales by deployment type, share by platform (private, hybrid, public), procurement trends in defense agencies, regional adoption rates, growth by mission type, integration with AI/analytics, vendor landscape, cybersecurity requirements, government budgets, multi-year contracts, cloud scalability, and interoperability standards. |

The global military cloud computing market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the military cloud computing market is projected to reach USD 27.6 billion by 2035.

The military cloud computing market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in military cloud computing market are hybrid cloud, public cloud, private cloud and community cloud.

In terms of service model, infrastructure as a service (iaas) segment to command 41.8% share in the military cloud computing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA