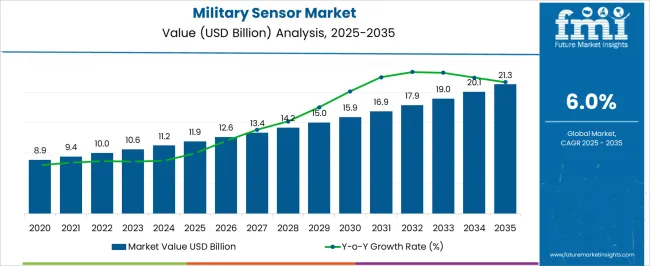

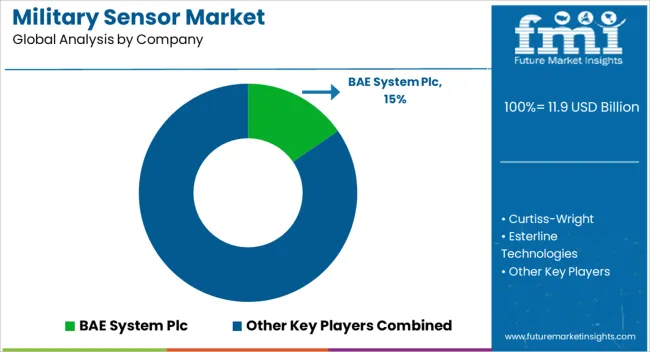

The military sensor market is projected to reach 11.9 billion dollars in 2025 and 21.3 billion dollars in 2035, growing at a CAGR of 6.0% between 2025 and 2035. During the early adoption phase from 2020 to 2024, demand was driven by select defense programs and pilot deployments of advanced sensing systems for surveillance, reconnaissance, and threat detection.

Defense contractors expand production and supply networks, while repeat procurement contracts drive steady revenue growth and wider operational deployment. From 2030 to 2035, the market enters the consolidation phase as adoption stabilizes and leading suppliers strengthen positions through long-term government contracts, strategic alliances, and global distribution capabilities. Smaller vendors either specialize in niche systems or exit. Military forces integrate mature sensor technologies across all platforms, prompting companies to focus on system reliability, cost efficiency, and lifecycle support. By 2035, the market exhibits predictable growth, mature competition, and standardized operational protocols, creating a structured and well-established defense industry landscape.

| Metric | Value |

|---|---|

| Military Sensor Market Estimated Value in (2025 E) | USD 11.9 billion |

| Military Sensor Market Forecast Value in (2035 F) | USD 21.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The military sensor market is segmented across various defense applications, each contributing to overall growth. Land Systems lead with approximately 30% of the market, including armored vehicles, tanks, and tactical ground platforms equipped with radar, infrared, and electronic sensors for battlefield awareness. Airborne Platforms contribute 25%, covering fighter jets, helicopters, and unmanned aerial vehicles (UAVs) that rely on advanced targeting, surveillance, and reconnaissance sensors. Naval Systems account for 15%, where ships and submarines integrate sonar, radar, and electronic warfare sensors for navigation and threat detection. Missile and Defense Systems represent 10%, focusing on guided munitions and defense intercept systems.

Border Security and Surveillance holds 8%, employing fixed and mobile sensor networks for monitoring and early warning. Cyber and Electronic Warfare Platforms contribute 5%, integrating sensors for signal interception and electronic defense. Training and Simulation Systems represent 4%, using sensor-enabled simulators to replicate operational scenarios. Smaller segments, including Research and Development Projects and Special Forces Applications, make up 3%, focusing on experimental or highly specialized sensor deployments.

Revenue contributions follow deployment intensity and platform value, growing from 8.9 billion dollars in 2020 to 11.9 billion in 2025 and projected to reach 21.3 billion by 2035, reflecting a CAGR of 6.0%. Land, air, and naval platforms remain primary drivers, while border security and cyber systems show steady incremental growth, shaping the market’s long-term trajectory.

The military sensor market is experiencing steady advancement driven by the increasing need for enhanced situational awareness, precision targeting, and real time threat detection in modern defense operations. Technological progress in sensor miniaturization, data fusion, and AI-powered analytics is enabling deployment across diverse platforms, including airborne, naval, and land systems.

Rising defense budgets and modernization programs in both developed and emerging economies are accelerating the integration of advanced sensor solutions to address evolving security threats. The growing importance of network-centric warfare and interoperability among allied forces is further supporting investment in multi-domain sensor capabilities.

The outlook remains positive as militaries prioritize surveillance accuracy, mission efficiency, and rapid decision-making through robust, adaptable sensor technologies.

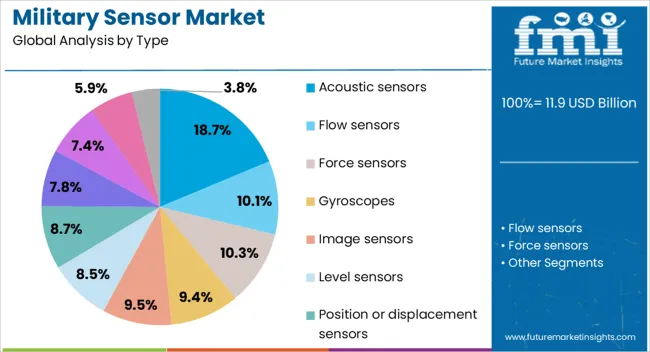

The military sensor market is segmented by type, application, end use, and geographic regions. By type, military sensor market is divided into Acoustic sensors, Flow sensors, Force sensors, Gyroscopes, Image sensors, Level sensors, Position or displacement sensors, Pressure sensors, Proximity sensors, Temperature sensors, and Other.

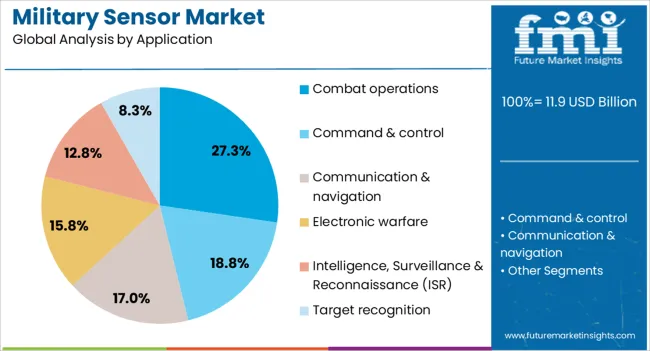

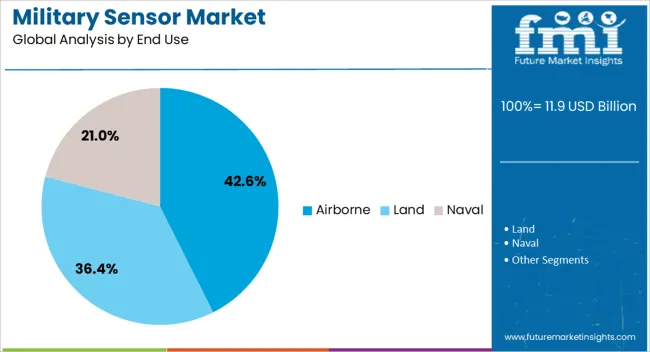

In terms of application, military sensor market is classified into Combat operations, Command & control, Communication & navigation, Electronic warfare, Intelligence, Surveillance & Reconnaissance (ISR), and Target recognition. Based on end use, military sensor market is segmented into Airborne, Land, and Naval. Regionally, the military sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acoustic sensors segment is projected to hold 18.70% of total revenue by 2025 within the type category, making it a significant contributor to the market. Growth in this segment is driven by its ability to detect and classify sound signatures for applications such as submarine tracking, sniper detection, and perimeter security.

Acoustic sensors are valued for their passive detection capability, operational stealth, and wide area coverage. The adoption is further supported by advancements in digital signal processing that enhance accuracy and reduce false positives.

Their integration into both fixed and mobile platforms across defense operations has solidified their role as a critical component in multi sensor defense systems.

The combat operations segment is expected to account for 27.30% of total market revenue by 2025 under the application category, positioning it as a leading operational use case. This dominance is linked to the rising demand for precision engagement, situational awareness, and real time intelligence in high intensity conflict scenarios.

Sensors deployed in combat operations enable detection of enemy movement, targeting assistance, and threat identification across diverse environments. The increasing complexity of modern warfare and the requirement for faster decision cycles have intensified the integration of advanced sensor arrays in field operations.

Continuous upgrades in sensor resilience and adaptability have further reinforced their essential role in combat missions.

The airborne segment is projected to capture 42.60% of total market revenue by 2025, making it the largest end use category. This share is supported by the expanding role of airborne platforms in surveillance, reconnaissance, and precision strike missions.

Airborne sensors deliver wide area coverage, rapid deployment capability, and high resolution data, essential for both strategic and tactical operations. Modernization of military aircraft and the proliferation of unmanned aerial systems are driving further adoption of advanced airborne sensor suites.

As aerial superiority remains a key defense priority, investment in high performance airborne sensor technologies continues to strengthen this segment’s market leadership.

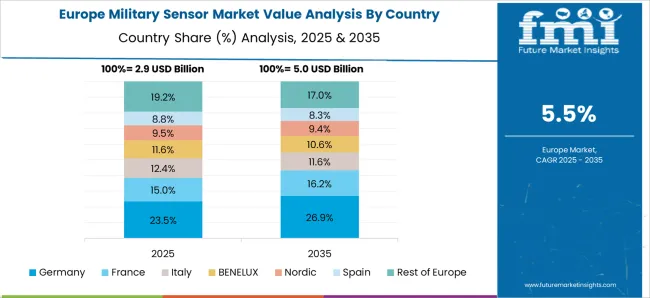

The military sensor market is expanding due to increasing defense modernization, situational awareness requirements, and technological integration in surveillance, reconnaissance, and targeting systems. North America and Europe lead with high-performance infrared, radar, and electro-optical sensors for advanced combat platforms. Asia-Pacific shows rapid growth driven by military modernization, border security, and naval expansion.

Manufacturers differentiate through sensor accuracy, multi-domain capability, and ruggedized designs. Regional variations in defense budgets, procurement cycles, and operational environments strongly influence adoption, system integration, and competitive positioning globally.

Adoption of military sensors is fueled by the need for multi-domain surveillance across land, air, and maritime theaters. North America and Europe prioritize high-resolution radar, electro-optical, and infrared sensors for real-time target detection, tracking, and intelligence gathering. Asia-Pacific markets emphasize cost-effective yet reliable sensors to monitor borders, maritime zones, and conflict-prone regions. Differences in detection range, integration capability, and environmental adaptability influence system deployment and operational effectiveness. Leading suppliers offer multi-spectral, modular sensors with networked connectivity and real-time data processing, while regional players focus on practical, ruggedized solutions. Multi-domain surveillance contrasts shape adoption, situational awareness, and market competitiveness globally.

Sensor performance, accuracy, and environmental robustness are critical for military applications. North America and Europe deploy sensors designed for extreme temperatures, humidity, and battlefield conditions, ensuring precise detection and minimal false alarms. Asia-Pacific markets adopt durable sensors suitable for diverse terrains and operational requirements while balancing cost constraints. Differences in precision, calibration, and environmental resilience affect mission success, equipment reliability, and adoption rates. Leading suppliers invest in advanced optics, high-sensitivity detectors, and automated calibration systems, while regional manufacturers provide dependable, cost-efficient alternatives. Accuracy and robustness contrasts shape adoption, operational reliability, and competitiveness in the global military sensor market.

Seamless integration of sensors with command, control, communications, and intelligence (C3I) systems drives adoption. North America and Europe focus on sensors compatible with real-time networks, battlefield management systems, and automated threat response platforms. Asia-Pacific markets prioritize sensors that can integrate with existing military infrastructure while maintaining affordability. Differences in connectivity, interoperability, and data processing capabilities affect deployment speed, operational effectiveness, and user adoption. Leading suppliers offer network-ready, modular sensors with secure communication links, while regional players provide adaptable systems for localized operations. Integration contrasts shape adoption, operational efficiency, and competitive positioning globally.

Compliance with defense standards, certifications, and procurement regulations significantly influences market adoption. North America and Europe enforce stringent MIL-STD, ISO, and NATO-compliant requirements for performance, reliability, and interoperability. Asia-Pacific regulations vary, with advanced markets adopting international standards and emerging markets using localized guidelines to balance cost and capability. Differences in procurement cycles, certification processes, and regulatory rigor affect adoption, project timelines, and system integration. Suppliers offering fully certified, compliant sensors gain higher adoption, while regional manufacturers deliver cost-effective, regulation-aligned alternatives. Regulatory and procurement contrasts shape adoption, credibility, and market competitiveness globally.

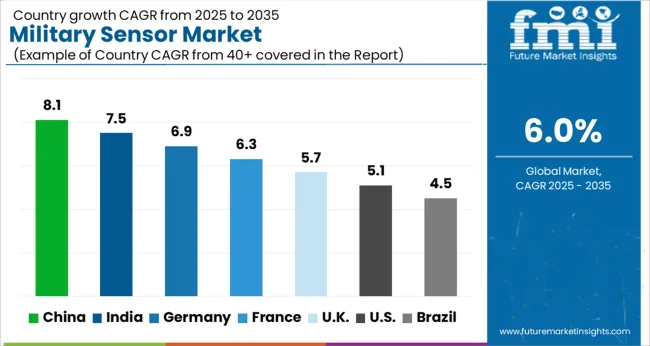

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global military sensor market is projected to grow at a 6.0% CAGR through 2035, driven by demand in defense systems, surveillance, and tactical operations. Among BRICS nations, China led with 8.1% growth as research, production, and deployment facilities were established and adherence to defense standards was ensured, while India at 7.5% growth expanded manufacturing and integration capacities to support regional defense initiatives. In the OECD region, Germany at 6.9% maintained consistent output under strict regulatory frameworks, while the United Kingdom at 5.7% operated mid-scale facilities supplying advanced sensor systems. The USA, growing at 5.1%, supported steady demand across defense and surveillance applications, ensuring compliance with federal and state-level safety and quality protocols. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The military sensor market in China is projected to grow at a CAGR of 8.1% due to increasing defense modernization programs and advanced surveillance requirements. Adoption is being driven by sensors that provide improved target detection, threat monitoring, and battlefield situational awareness. Manufacturers are being encouraged to supply high performance, reliable, and technologically advanced sensors. Distribution through defense contractors, government agencies, and research institutions is being strengthened. Research in sensor accuracy, miniaturization, and integration with defense systems is being conducted. Expansion of military capabilities, strategic defense initiatives, and rising demand for smart surveillance solutions are considered key factors supporting the military sensor market in China.

The military sensor market in India is expected to grow at a CAGR of 7.5%, driven by expansion of defense infrastructure and investment in surveillance technologies. Adoption is being strengthened by sensors that enhance threat detection, reconnaissance, and battlefield monitoring. Manufacturers are being encouraged to deliver cost-effective, durable, and high-performance solutions. Distribution through defense procurement channels, government agencies, and authorized suppliers is being expanded. Technical training programs and workshops are being conducted to ensure proper deployment and maintenance. Increasing defense budgets, modernization of armed forces, and demand for advanced monitoring systems are recognized as primary drivers of the military sensor market in India.

Germany is experiencing growth in the military sensor market at a CAGR of 6.9%, supported by adoption in defense applications requiring high precision and reliable detection. Adoption is being strengthened by sensors that enhance situational awareness, threat monitoring, and intelligence gathering. Manufacturers are being encouraged to supply technologically advanced, accurate, and reliable sensors. Distribution through defense contractors, government agencies, and research institutions is being maintained. Research in miniaturization, system integration, and real-time monitoring is being conducted. Growing focus on homeland security, defense modernization, and advanced surveillance systems is considered a key contributor to the military sensor market in Germany.

The military sensor market in the United Kingdom is expected to grow at a CAGR of 5.7% due to increasing demand for surveillance and intelligence solutions in defense operations. Adoption is being emphasized for sensors that provide high accuracy, reliable detection, and enhanced situational awareness. Manufacturers are being encouraged to deliver high quality, reliable, and technologically advanced solutions. Distribution through defense agencies, government contractors, and authorized suppliers is being strengthened. Awareness programs and technical workshops are being conducted to ensure effective sensor deployment. Expansion of defense initiatives, modernization of armed forces, and increasing intelligence requirements are recognized as key factors supporting the military sensor market in the United Kingdom.

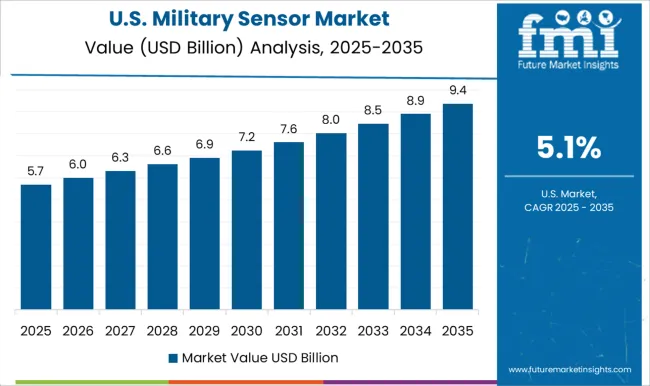

The military sensor market in the United States is projected to grow at a CAGR of 5.1%, driven by increasing investment in surveillance, intelligence, and battlefield monitoring systems. Adoption is being supported by sensors that enhance detection accuracy, operational efficiency, and real-time threat assessment. Manufacturers are being encouraged to supply technologically advanced, reliable, and high-performance sensors. Distribution through defense contractors, military agencies, and research institutions is being maintained. Research in sensor technology, system integration, and miniaturization is being conducted. Expansion of defense modernization programs, homeland security initiatives, and smart monitoring systems is considered a key driver of the military sensor market in the United States.

The military sensor market is shaped by global defense contractors, specialized sensor manufacturers, and technology solution providers focusing on advanced surveillance, targeting, and situational awareness systems. Leading players such as Lockheed Martin, Raytheon Technologies, BAE Systems, and Northrop Grumman hold strong positions by offering diversified portfolios of radar, infrared, acoustic, and electronic sensors for land, air, sea, and space applications. Sensor accuracy, durability, real-time data processing capabilities, and integration with defense platforms such as unmanned vehicles, fighter aircraft, and naval vessels drive competitive differentiation.

Regional players, particularly in Asia-Pacific and Europe, compete by providing cost-effective, mission-specific sensors and localized support for government defense programs. Strategic partnerships with defense ministries, military integrators, and research institutions enhance market reach and accelerate technology adoption. Innovation in multi-sensor fusion, AI-enabled threat detection, and miniaturized high-performance sensors further strengthens competitive positioning. Companies emphasizing technological excellence, regulatory compliance, and robust after-sales support are poised to capture significant shares in the military sensor market, fueled by rising defense budgets and increasing focus on advanced battlefield monitoring and security systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 Billion |

| Type | Acoustic sensors, Flow sensors, Force sensors, Gyroscopes, Image sensors, Level sensors, Position or displacement sensors, Pressure sensors, Proximity sensors, Temperature sensors, and Other |

| Application | Combat operations, Command & control, Communication & navigation, Electronic warfare, Intelligence, Surveillance & Reconnaissance (ISR), and Target recognition |

| End Use | Airborne, Land, and Naval |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE System Plc, Curtiss-Wright, Esterline Technologies, General Electric, Honeywell International, Lockheed Martin, and Raytheon |

| Additional Attributes | Dollar sales vary by sensor type, including radar, infrared, acoustic, electro-optical, and chemical sensors; by application, such as surveillance, target acquisition, navigation, and threat detection; by end-use, spanning defense forces, homeland security, and defense contractors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising defense modernization, battlefield situational awareness needs, and technological advancements in sensor systems. |

The global military sensor market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the military sensor market is projected to reach USD 21.3 billion by 2035.

The military sensor market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in military sensor market are acoustic sensors, flow sensors, force sensors, gyroscopes, image sensors, level sensors, position or displacement sensors, pressure sensors, proximity sensors, temperature sensors and other.

In terms of application, combat operations segment to command 27.3% share in the military sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA