The military cyber security market is estimated to be valued at USD 17.0 billion in 2025 and is projected to reach USD 31.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. Demand is projected to grow from USD 17 billion in 2025 to USD 23.3 billion by 2030, generating an incremental gain of USD 6.3 billion over the first five years, which accounts for 39.5% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by the increasing complexity of cyber threats and the rising need for robust cybersecurity solutions to protect military infrastructure.

The demand for advanced security systems is further fueled by the rapid expansion of digital technologies and increased adoption of defense technologies across global military operations. The second half (2030–2035) will contribute USD 9.3 billion, representing 60.5% of the total growth, reflecting stronger momentum as nations continue to increase their defense budgets and digital infrastructure to combat evolving cyber threats. Annual increments rise from USD 0.8 billion in early years to USD 1.6 billion by 2035, signaling significant growth driven by geopolitical tensions, the integration of artificial intelligence in defense systems, and the rising need for secure communication and data protection in military operations. Manufacturers focusing on AI-driven, scalable cybersecurity solutions will capture the largest share of this USD 15.6 billion opportunity.

| Metric | Value |

|---|---|

| Military Cyber Security Market Estimated Value in (2025 E) | USD 17.0 billion |

| Military Cyber Security Market Forecast Value in (2035 F) | USD 31.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The military cyber security market is advancing steadily as global defense sectors prioritize digital resilience amid rising threats of cyber warfare and data breaches. Sophisticated state sponsored attacks, critical infrastructure vulnerabilities, and the increasing use of connected systems in military operations have driven demand for robust cyber defense frameworks.

Governments are investing in multi layered security infrastructure that integrates artificial intelligence, threat intelligence, and secure communications. The transition from conventional warfare to cyber enabled conflict scenarios has heightened the urgency to protect sensitive data, command systems, and real time intelligence.

As defense organizations modernize IT environments, the adoption of advanced cyber security protocols remains integral to national security strategies. The outlook is expected to remain strong as military agencies focus on zero trust architecture, supply chain security, and the implementation of mission critical cyber resilience programs across defense ecosystems.

The military cyber security market is segmented by offering, security, deployment modelapplication, and geographic regions. By offering, the military cyber security market is divided into Solution and Services. In terms of security, the military cybersecurity market is classified into Network security, Cloud security, Wireless security, Application security, and Others. Based on deployment model, the military cyber security market is segmented into On-premises and Cloud.

By application, the military cyber security market is segmented into Command and control systems, Communication network, Intelligence and surveillance, and Weapon systems and platforms. Regionally, the military cyber security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment is projected to represent 56.20% of total market revenue by 2025 within the offering category, making it the leading contributor. This dominance is driven by increased reliance on integrated security platforms that combine threat detection, prevention, and response.

Military operations require continuous protection against a broad range of cyber threats, prompting demand for customized security solutions that secure endpoints, networks, and applications. The solution segment has also benefited from investments in real time monitoring, intrusion prevention systems, and vulnerability management tailored specifically for defense environments.

With the need for scalable, mission ready cyber infrastructure, the solution segment continues to be favored for its adaptability, efficiency, and ability to meet evolving military security requirements.

Network security is anticipated to hold 48.90% of market revenue within the security segment by 2025, placing it at the forefront of military cyber defense priorities. This is due to the growing volume of interconnected defense systems and data exchanges across command centers, weapons platforms, and communication networks.

Protecting these communication lines from unauthorized access, data tampering, and espionage is critical. Investments in encrypted communication protocols, secure firewalls, and threat detection technologies have supported the segment’s growth.

Network security frameworks are also being enhanced with automation and machine learning to proactively detect anomalies. The essential role of secure, uninterrupted data flow across military assets positions network security as the most vital segment within the overall defense cyber security strategy.

The on premises deployment model is projected to capture 54.10% of total market share by 2025, leading the deployment model category. This preference is driven by the heightened need for absolute data control, security assurance, and compliance with military confidentiality standards.

Defense organizations prioritize internal hosting environments to mitigate third party risks and to maintain physical oversight of sensitive data systems. On premises deployment also supports customization, allowing defense agencies to tailor configurations to specific operational requirements without relying on external vendors.

With data sovereignty and breach prevention being key defense concerns, the on-premises model is expected to remain dominant for mission-critical deployments where maximum control, visibility, and system integrity are non-negotiable.

The military cyber security market is driven by increasing cyber threats to military systems and opportunities arising from expanding defense budgets and procurement. Emerging trends like AI and automation are shaping the market’s future. However, challenges such as high costs and complex system integration remain. By 2025, overcoming these obstacles through cost-effective solutions and efficient integration strategies will be essential for sustaining growth and ensuring that military organizations can protect their critical systems from evolving cyber threats.

The military cyber security market is experiencing growth due to the increasing frequency and complexity of cyberattacks targeting military systems globally. With the rise of cyber warfare and advanced persistent threats, defense organizations are prioritizing robust cybersecurity measures to protect sensitive military infrastructure. The increasing reliance on digital systems for command and control operations has further amplified the need for secure networks and systems. By 2025, the demand for military cyber security solutions will grow as nations enhance their defense capabilities against evolving cyber threats.

Opportunities in the military cyber security market are increasing due to the expansion of defense budgets in several nations. Governments are investing heavily in upgrading their defense infrastructure to safeguard national security against cyberattacks. The rising need for more secure communication networks, data protection, and surveillance systems has accelerated military procurement of advanced cyber defense technologies. By 2025, increased defense spending will drive demand for cutting-edge cybersecurity solutions to protect military operations, making the market ripe for growth in both developed and emerging markets.

Emerging trends in the military cyber security market include the integration of artificial intelligence (AI) and automation for enhanced cyber defense. AI-powered systems can identify and respond to cyber threats in real time, significantly improving the speed and effectiveness of security protocols. Automation also helps streamline threat detection and response processes, minimizing human intervention and reducing the risk of errors. By 2025, AI and automated cyber defense systems will continue to revolutionize military cybersecurity, providing greater resilience against advanced cyber threats.

Despite growth, challenges such as high costs and complex system integration persist in the military cyber security market. Advanced cybersecurity systems require significant upfront investment in both hardware and software, which can strain defense budgets, particularly in smaller or developing nations. Additionally, integrating new cybersecurity solutions with legacy systems can be technically challenging and time-consuming. By 2025, overcoming these challenges will require cost-effective solutions, efficient system integration strategies, and financial incentives to make advanced cybersecurity technologies more accessible to defense organizations worldwide.

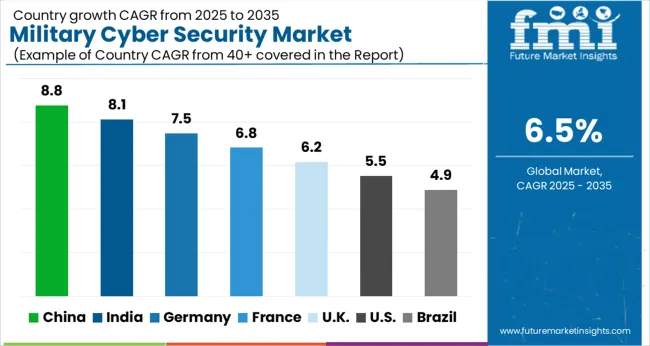

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global military cyber security market is projected to grow at a 6.5% CAGR from 2025 to 2035. China leads with a growth rate of 8.8%, followed by India at 8.1%, and France at 6.8%. The United Kingdom records a growth rate of 6.2%, while the United States shows the slowest growth at 5.5%. These varying growth rates are driven by increasing cyber threats, advancements in military technology, and rising investments in defense cyber security infrastructure. Emerging markets like China and India are experiencing higher growth due to rapid technological advancements, growing defense budgets, and the rising focus on strengthening cyber defenses. More mature markets like the USA and the UK see steady growth driven by regulatory policies, ongoing defense innovations, and the need for robust cyber security solutions to protect critical national infrastructure and military assets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The military cyber security market in China is growing rapidly, with a projected CAGR of 8.8%. China’s increasing military investments, coupled with its focus on modernizing defense systems and cyber warfare capabilities, are driving significant demand for cyber security solutions in the military sector. The country’s strong push towards technological advancements and its growing emphasis on securing critical infrastructure and national defense networks is contributing to market growth. China’s government policies supporting cyber defense initiatives and the integration of artificial intelligence and machine learning into military systems further accelerate the demand for military cyber security solutions.

The military cyber security market in India is projected to grow at a CAGR of 8.1%. India’s growing defense budget and focus on modernizing military capabilities are driving the demand for advanced cyber security solutions. The country’s increasing emphasis on cyber warfare, national security, and securing defense communications networks is accelerating the adoption of military cyber security technologies. Additionally, India’s government support for cyber defense policies, rising investment in military technology infrastructure, and the growing need for military organizations to defend against cyber threats contribute to the market’s growth. India’s rising geopolitical concerns and focus on cybersecurity in defense-related infrastructure further boost the market demand.

The military cyber security market in France is projected to grow at a CAGR of 6.8%. France’s growing emphasis on protecting military systems, national security infrastructure, and critical defense communications networks continues to drive steady market growth. The country’s strong regulatory frameworks supporting cybersecurity, along with ongoing investments in defense technologies and infrastructure, are contributing to the demand for advanced cyber security solutions. France’s increasing focus on enhancing cyber defense capabilities in military operations, combined with its commitment to strengthening the European Union’s defense sector, further accelerates the market adoption of military cyber security technologies.

The military cyber security market in the United Kingdom is projected to grow at a CAGR of 6.2%. The UK’s emphasis on national security, particularly in the context of cyber threats targeting critical infrastructure and defense systems, is driving steady market growth. The country’s ongoing investments in defense innovation and cyber defense capabilities, as well as its commitment to cyber resilience, continue to support the market’s expansion. Additionally, the UK’s regulatory environment, which emphasizes cyber security in defense and military sectors, alongside its collaboration with NATO on defense cyber initiatives, further accelerates the demand for advanced military cyber security solutions.

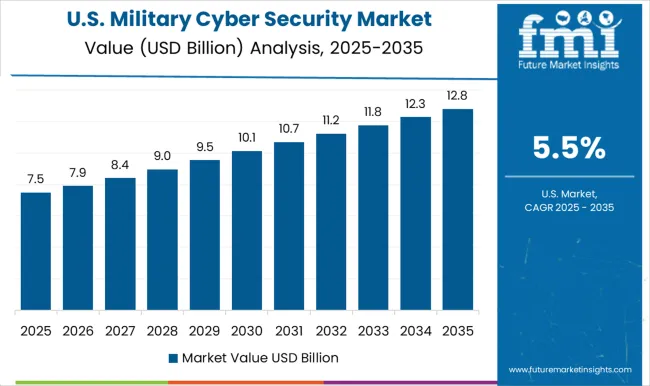

The military cyber security market in the United States is expected to grow at a CAGR of 5.5%. The USA market remains steady, driven by the growing need for cyber security solutions to protect critical defense systems and national security infrastructure. The country’s increasing focus on cybersecurity in military applications, particularly with the rise of cyber warfare and emerging threats, continues to support market growth. The USA government’s robust cyber defense policies, coupled with ongoing investments in defense technologies, intelligence, and military cyber infrastructure, contribute to the adoption of advanced cyber security solutions. The demand for securing military communications and networks in the USA military remains a key driver for growth.

The military cyber security market is dominated by BAE Systems, which leads with its advanced cyber defense solutions designed to protect defense networks, critical infrastructures, and military systems from cyber threats. BAE’s dominance is supported by its deep expertise in defense technology, robust cybersecurity frameworks, and commitment to delivering highly secure and reliable systems for military operations. Key players such as Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation maintain significant market shares by providing comprehensive cyber security services and solutions tailored for military applications, including threat detection, risk assessment, and system protection.

These companies focus on strengthening military cyber capabilities through advanced artificial intelligence, machine learning, and real-time cyber threat intelligence. Emerging players like Palo Alto Networks, Inc., McAfee, LLC, and Thales Group are expanding their market presence by offering specialized cyber security solutions for niche military applications, such as communications security, intelligence operations, and mission-critical defense systems. Their strategies include enhancing data encryption, integrating AI-powered threat detection, and improving the resilience of military infrastructure. Market growth is driven by the increasing sophistication of cyber threats, the rise of digital warfare, and the growing need for national security. Innovations in cyber defense strategies, autonomous security systems, and secure cloud services are expected to continue shaping competitive dynamics and fuel further growth in the global military cyber security market.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.0 Billion |

| Offering | Solution and Services |

| Security | Network security, Cloud security, Wireless security, Application security, and Others |

| Deployment Model | On-premises and Cloud |

| Application | Command and control systems, Communication network, Intelligence and surveillance, and Weapon systems and platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems, Cisco Systems, Inc., L3Harris Technologies, Lockheed Martin Corporation, McAfee, LLC, Northrop Grumman Corporation, Palo Alto Networks, Inc., Raytheon Technologies Corporation, Symantec Corporation, and Thales Group |

| Additional Attributes | Dollar sales by security type and application, demand dynamics across defense, government, and industrial sectors, regional trends in military cybersecurity adoption, innovation in AI-driven threat detection and real-time monitoring, impact of regulatory standards on data privacy and compliance, and emerging use cases in autonomous systems and defense network protection. |

The global military cyber security market is estimated to be valued at USD 17.0 billion in 2025.

The market size for the military cyber security market is projected to reach USD 31.9 billion by 2035.

The military cyber security market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in military cyber security market are solution, _risk and compliance management, _encryption, _data loss prevention, _distributed denial of service (ddos) mitigation, _identity & access management, _antivirus/antimalware, _others, services, _professional and _managed.

In terms of security, network security segment to command 48.9% share in the military cyber security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA