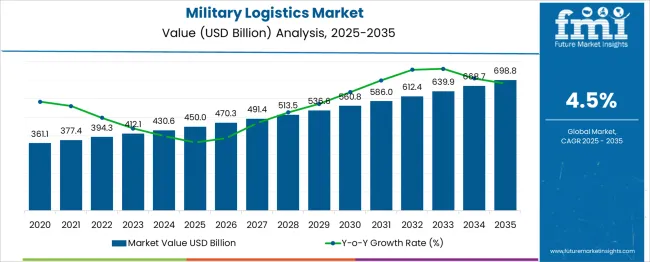

The Military Logistics Market is estimated to be valued at USD 450.0 billion in 2025 and is projected to reach USD 698.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. A rolling CAGR analysis reveals a steady yet slightly moderating growth trajectory over successive five-year intervals. From 2025 to 2030, the market expands from USD 450.0 billion to 536.6 billion, reflecting a five-year CAGR of approximately 3.6%, driven by the modernization of supply chains, increased demand for strategic mobility, and digitalization of military operations.

The subsequent period (2026-2031) continues this upward trend, moving from 470.3 billion in 2026 to 560.8 billion in 2031, maintaining a similar CAGR near 3.6%, supported by expanded deployment of real-time tracking systems and automation in inventory management. Later rolling intervals, such as 2028-2033 and 2030–2035, show slight acceleration toward 4.0%-4.2%, with values reaching 698.8 billion by 2035, driven by rising investments in AI-based predictive logistics, autonomous transport, and resilient supply networks for multi-domain operations.

This analysis indicates stable, predictable growth without volatility, creating long-term opportunities for defense contractors and logistics providers focused on digital platforms, advanced warehousing solutions, and integration of robotics to meet evolving operational requirements.

| Metric | Value |

|---|---|

| Military Logistics Market Estimated Value in (2025 E) | USD 450.0 billion |

| Military Logistics Market Forecast Value in (2035 F) | USD 698.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The military logistics market is positioned along a maturity curve that demonstrates a structured adoption lifecycle driven by technological advancements, defense modernization, and strategic readiness priorities. The introduction phase was characterized by traditional logistics systems relying on manual planning and basic inventory control, which offered limited flexibility for rapid deployment. Growth accelerated as integrated supply chain platforms, advanced fleet tracking, and predictive maintenance solutions were implemented to improve operational efficiency and mission reliability.

This stage was further strengthened by investments in automation, digital networks, and interoperability frameworks supporting joint military operations.The market is progressing through an extended growth phase, supported by digital transformation initiatives and the integration of AI-powered analytics for real-time logistics visibility. Advanced defense forces are adopting unmanned ground and aerial systems to optimize resupply operations in complex environments, signaling a transition toward next-generation logistics strategies.

In developing regions, adoption is gaining momentum through modernization programs and procurement of network-centric logistics solutions. The future landscape is expected to evolve toward autonomous supply chain systems, additive manufacturing for on-demand spare parts, and blockchain-enabled security for sensitive logistics data, ensuring continued expansion before the market moves toward maturity in core military operations.

The military logistics market is witnessing steady advancement as defense forces globally prioritize operational readiness, rapid deployment capabilities, and resilient supply chains. The evolving threat landscape and geopolitical tensions have heightened the focus on efficient logistics to support multi-domain operations.

Increasing investments in modernization programs, inventory management systems, and mobility infrastructure are reshaping the market dynamics. Growth is being supported by the integration of digital platforms, automation, and modular solutions aimed at reducing costs and improving responsiveness.

Future opportunities are expected to emerge from the adoption of predictive analytics, unmanned delivery systems, and strengthened civil-military collaboration, all of which are creating a robust pathway for sustained development and enhanced mission effectiveness.

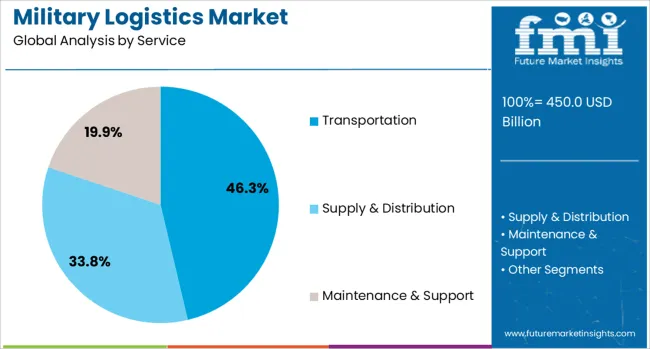

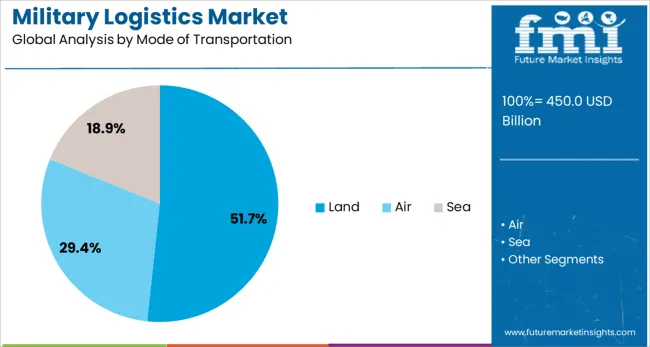

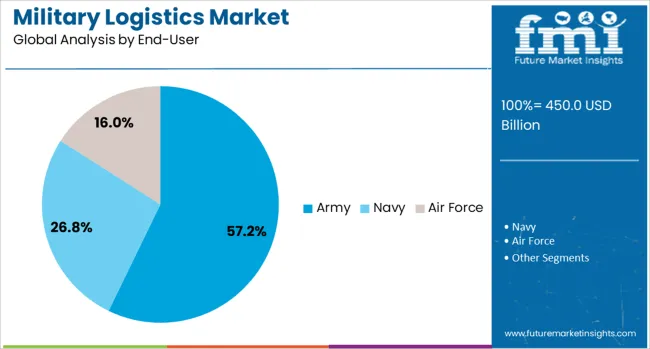

The military logistics market is segmented by service, mode of transportation, and end-user and geographic regions. The military logistics market is divided into Transportation, Supply & Distribution, and Maintenance & Support. In terms of mode of transportation, the military logistics market is classified into Land, Air, and Sea. The end-users of the military logistics market are segmented into the Army, Navy, and Air Force. Regionally, the military logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by service, the transportation subsegment is anticipated to command 46.30% of the total market revenue in 2025, positioning itself as the leading service category. This dominance is attributed to the indispensable role of transportation in ensuring the timely movement of personnel, equipment, and supplies across diverse terrains and theaters of operation.

The segment has benefited from investments in multi-modal capabilities, enhanced fleet readiness, and interoperability standards that enable seamless cross-border movements. Advancements in vehicle technology, route optimization, and integrated logistics planning have supported emphasis on rapid response and flexibility.

The increasing complexity of missions and the necessity of supporting dispersed forces have further reinforced the criticality of transportation, cementing its leadership position within military logistics services.

Segmented by mode of transportation, the land subsegment is projected to secure 51.7% of the total market revenue in 2025, making it the most prominent mode in the market. This leadership is driven by the strategic and tactical advantages of land-based logistics in supporting both conventional and asymmetric operations.

The ability to navigate varied and challenging terrains, deliver supplies directly to forward positions, and maintain continuous supply lines has been pivotal in maintaining land’s dominance. Enhancements in armored and all-terrain vehicles, logistics convoys, and route security measures have improved efficiency and survivability.

The resilience of land transportation against disruptions and its alignment with the majority of military operational doctrines have strengthened its position as the primary choice for sustaining missions.

When segmented by end-user, the army subsegment is expected to hold 57.2% of the total market revenue in 2025, affirming its leadership among military branches. This prominence arises from the army’s extensive logistical demands, which encompass large-scale personnel movement, sustained supply of ammunition, food, medical support, and infrastructure maintenance.

The scale and scope of ground operations necessitate comprehensive logistics planning and execution, which has been supported by modernization initiatives and increased budgets allocated to army logistics. Strategic priorities focused on enhancing mobility, readiness, and endurance for prolonged operations have further contributed to the segment’s growth.

The army’s role as the backbone of most national defense strategies has ensured its continued investment in robust logistics capabilities, securing its dominant share within the market.

Military logistics includes planning and execution of provisioning, transportation, maintenance, and distribution of equipment and supplies across defence operations. The domain spans land, sea, air, and joint mission logistics for armed forces, peacekeeping, humanitarian relief, and expeditionary operations. Demand is driven by global defence readiness, operational tempo, and logistics modernization efforts. Providers offering robust supply chain platforms, intelligent tracking solutions, and rapid deployment capabilities have been positioned to support force projection. Equipment resilience under harsh environments and interoperability across domains have been prioritized by defence organisations seeking dependable logistics support.

Increased global security concerns and expanded peacekeeping missions have driven demand for military logistics infrastructure. High operational tempo in active theatres requires timely delivery of supplies, munitions, fuel, and spare parts. Heightened preparedness requirements have led to investments in forward staging areas, mobile warehousing, and transport fleets. Logistics interoperability recently became critical as joint operations involving multinational forces have increased. Expectations for predictable supply performance across austere environments have supported adoption of advanced logistics platforms. Focused military training and readiness exercises have created demand for logistics services capable of rapid mobilization, resupply, and sustainment across diverse geographic zones.

Growth has been restricted by high cost of establishing logistics chains with transport fleets, warehousing, and traceability systems. Upfront investment required for mobile ports, field distribution hubs, and secure tracking introduces financial burden. Skilled personnel and training investments are needed to manage complex logistics networks and technologies. Disruptions due to terrain, climate extremes, or limited infrastructure in remote deployment zones have posed reliability risks. Supply chain resilience has been affected by variability in procurement and vendor management processes. Regulatory and customs protocols across host nations have added delays and compliance complexity. Operational security concerns regarding sensitive cargo or mission-critical assets have required stringent protocols that slow logistics flows.

Opportunities exist in integrating automated inventory systems, RFID, or satellite‑based tracking for real‑time asset visibility. Expansion of base infrastructure in strategic locations and creation of forward supply nodes offer logistics scalability. Retrofit and upgrade of legacy transport fleets with digital communications can improve throughput and mission punctuality. Partnerships with defence contractors and systems integrators may enable bundled logistics contracts in support of multi-domain operations. Use of modular container systems and rapid field assembly warehouses supports mission agility. Long-term service agreements for predictive maintenance and spare provisioning offer recurring revenue models. Emerging unmanned logistics platforms, such as cargo drones or autonomous vehicles, present innovation potential for future supply missions.

Adoption of real‑time visibility technologies for logistics has increased, enabling precise tracking of parts, fuel, and equipment across supply routes. Agile platform deployment such as modular field hubs or mobile distribution centres has reduced staging time and improved resupply cycles. Emphasis on connectivity between field units and central logistics command systems has strengthened coordination. Focus on secure data links and encrypted tracking has risen due to operational security imperatives. Integration of robotic handling systems and rapid unpacking tools has improved turnaround times at field docks. Standardized pallet systems and interoperable transport modules have grown in use to facilitate cross‑regional redeployment and multi‑force collaboration in alliance operations.

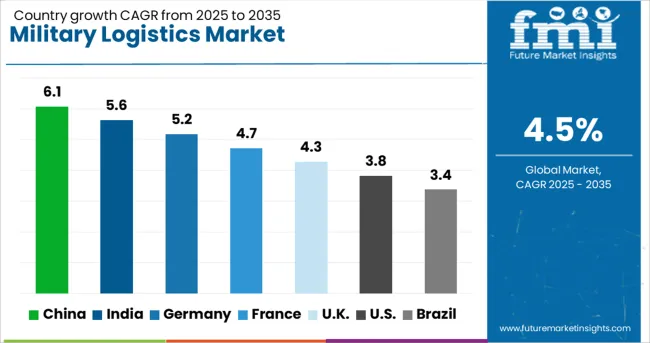

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The military logistics market is projected to expand at a CAGR of 4.5% from 2025 to 2035, driven by the modernization of defense supply chains, increased cross-border military operations, and rising demand for advanced transportation and warehousing systems. China leads at 6.1% CAGR, supported by large-scale investment in integrated supply and distribution networks. India follows at 5.6%, driven by enhanced defense procurement and strategic mobility programs. Among OECD countries, Germany records 5.2%, emphasizing digitalized logistics management and advanced fleet solutions. France grows at 4.7%, focusing on multi-modal transport systems for troop and equipment movement. The United Kingdom posts 4.3%, driven by increasing adoption of AI-enabled tracking and optimized material handling systems.The report covers over 40 countries, with detailed insights for five profiled below.

China is projected to grow at 6.1% CAGR, the highest among key countries, due to its strong focus on building integrated logistics hubs and improving rapid deployment capabilities. Expansion of airlift and maritime transport capacity is a core priority, enabling faster troop and equipment mobilization. The adoption of advanced warehouse automation and AI-driven inventory systems is strengthening operational efficiency. Military exercises conducted across varied terrains are creating demand for modular storage units and portable maintenance solutions. Partnerships with domestic defense contractors are accelerating development of armored transport fleets designed for long-range support missions. Rising use of autonomous ground vehicles for tactical resupply enhances responsiveness in conflict zones.

India is expected to grow at a 5.6% CAGR, supported by the expansion of multi-domain logistics frameworks and enhanced strategic mobility. Large-scale procurement of heavy-lift aircraft and modular transport platforms is improving force readiness across remote areas. Investments in digitized supply chains are enabling better route planning and fuel optimization for military convoys. Emphasis on containerized logistics for rapid deployment during high-altitude operations has strengthened infrastructure reliability. The focus on indigenous manufacturing of advanced logistics vehicles reduces dependency on external suppliers while improving adaptability for rugged terrains. Adoption of predictive maintenance tools for fleet and material handling systems ensures efficiency and cost control in critical operations.

Germany is forecast to grow at a 5.2% CAGR, driven by the modernization of transport fleets and the adoption of high-capacity fuel distribution systems. Logistics automation within armored divisions and rapid-response units is enhancing operational efficiency. The country’s defense strategy focuses on modular logistics bases to support joint missions across Europe. Integration of real-time data analytics into command systems enables dynamic allocation of transport resources, reducing lead times for equipment delivery. German manufacturers are deploying advanced load-handling systems for heavy-duty vehicles, ensuring rapid cargo reconfiguration during missions. Rising demand for energy-efficient transport vehicles contributes to improved operational performance across multi-theater operations.

France is projected to achieve a 4.7% CAGR, supported by a strategic focus on enhancing interoperability for multinational operations. Military logistics upgrades prioritize long-range transport solutions with emphasis on air cargo efficiency and maritime deployment capabilities. The use of modular logistics containers and mobile maintenance units enhances support for dispersed forces. Investment in AI-based route optimization tools strengthens fleet management by reducing delays in supply convoys. Tactical resupply systems integrated with precision navigation platforms improve reliability in complex terrains. Partnerships between leading defense contractors and technology providers are fostering the development of advanced logistics software solutions for mission planning.

The United Kingdom is forecast to grow at a 4.3% CAGR, supported by the digitization of logistics networks and the expansion of strategic mobility platforms. Air mobility systems, including next-generation cargo aircraft, form a critical component for rapid deployment during overseas operations. Fleet upgrades with hybrid propulsion systems are improving endurance and reducing operational delays in logistics convoys. Advanced tracking platforms integrated with centralized command systems are being deployed to monitor cargo flow in real time. Emphasis on expeditionary logistics infrastructure for naval task forces is shaping procurement strategies. Predictive analytics and AI-enabled decision-making tools are becoming integral to optimizing distribution timelines during high-intensity missions.

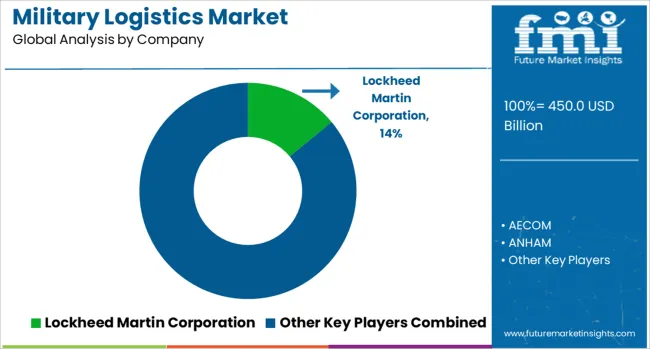

The military logistics market is highly competitive, featuring global defense contractors and specialized logistics service providers such as Lockheed Martin Corporation, AECOM, ANHAM, KBR Inc., DynCorp International, BAE Systems PLC, Thales Group, Honeywell International Inc., ASELSAN A.S., Fluor Corporation, and Genco. Lockheed Martin and BAE Systems dominate with integrated logistics solutions that include fleet management, maintenance, and advanced supply chain automation for military equipment.

AECOM and Fluor Corporation lead in infrastructure development and base operations support, while KBR Inc. and DynCorp specialize in life cycle support and deployment logistics for forward operating bases. ANHAM and Genco provide contract-based procurement, warehousing, and transportation services for global military missions. Honeywell focuses on precision logistics systems with IoT-enabled asset tracking, while Thales Group and ASELSAN integrate secure communication and digital platforms to streamline operational readiness.

Industry structure is shaped by high entry barriers due to strict defense compliance, cybersecurity standards, and capital-intensive infrastructure. Porter’s analysis highlights low substitution risk, limited supplier power due to long-term defense contracts, and high rivalry among incumbents for multi-year government tenders. Strategic differentiation is driven by advanced tracking systems, AI-based demand forecasting, modular logistics solutions, and in-theater supply chain resilience.

Future competitiveness will hinge on digital transformation, autonomous vehicle integration, and predictive analytics for inventory and fleet management. Key performance benchmarks include mission readiness, cost optimization, real-time visibility, and cybersecurity in logistics networks. Companies investing in automation, energy-efficient transport solutions, and resilient supply chains are positioned to secure large-scale contracts in evolving defense environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 450.0 Billion |

| Service | Transportation, Supply & Distribution, and Maintenance & Support |

| Mode of Transportation | Land, Air, and Sea |

| End-User | Army, Navy, and Air Force |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, AECOM, ANHAM, KBR Inc., DynCorp International, BAE Systems PLC, Thales Group, Honeywell International Inc., ASELSAN A.S., Fluor Corporation, and Genco |

| Additional Attributes | Dollar sales by service type (transportation, supply chain management, maintenance & repair operations, infrastructure development) and end-user application (army, navy, air force), with demand driven by increasing defense budgets and modernization programs. Regional dynamics indicate strong growth in North America and Europe due to military readiness programs, while Asia-Pacific expands logistics capabilities for joint operations and border security. Innovation trends include blockchain-based secure transactions, AI-powered predictive supply models, and autonomous systems for last-mile delivery in contested environments. |

The global military logistics market is estimated to be valued at USD 450.0 billion in 2025.

The market size for the military logistics market is projected to reach USD 698.8 billion by 2035.

The military logistics market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in military logistics market are transportation, supply & distribution and maintenance & support.

In terms of mode of transportation, land segment to command 51.7% share in the military logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA