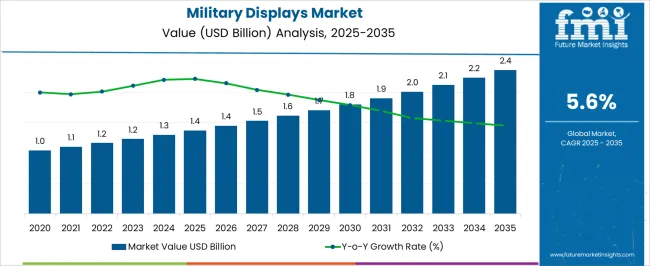

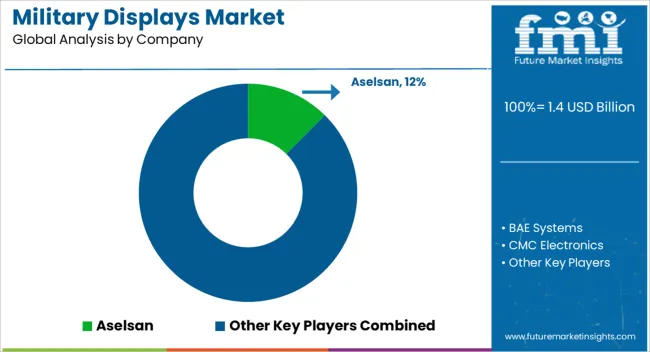

The military displays market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The military displays market, estimated at USD 1.4 billion in 2025 and projected to reach USD 2.4 billion by 2035 at a CAGR of 5.6%, operates within a highly regulated environment where defense standards, export controls, and compliance mandates significantly shape market growth. Regulatory frameworks governing military-grade electronics, including MIL-STD certifications, electromagnetic compatibility standards, and ruggedization requirements, dictate design, testing, and manufacturing processes. These standards ensure operational reliability, safety, and interoperability under extreme conditions, directly impacting production costs, technology selection, and product lifecycle management.

Export controls and defense procurement regulations further influence market dynamics, as governments impose licensing requirements, technology transfer restrictions, and regional compliance mandates that affect both domestic and international sales. Suppliers must adhere to strict quality assurance protocols, documentation procedures, and traceability requirements to maintain regulatory compliance, which can extend lead times and increase operational complexity.

From 2025 to 2035, the gradual increase from USD 1.4 billion to USD 2.4 billion reflects cautious adoption influenced by these regulatory considerations. Incremental growth is observed as manufacturers innovate within compliance frameworks, leveraging certified materials, modular designs, and standardized testing procedures to minimize regulatory risk while expanding market reach. The regulatory oversight remains a critical driver, shaping both the cost structure and strategic planning of stakeholders across the market.

| Metric | Value |

|---|---|

| Military Displays Market Estimated Value in (2025 E) | USD 1.4 billion |

| Military Displays Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The military displays market represents a specialized segment within the global defense electronics and battlefield systems industry, emphasizing enhanced situational awareness, ruggedness, and real-time information delivery. Within the broader defense electronics sector, it accounts for about 5.4%, driven by demand for command and control systems, armored vehicles, and combat aircraft. In the rugged display and human-machine interface segment, it secures 4.8%, reflecting the need for high-performance screens capable of withstanding harsh operational conditions. Across the avionics and vehicle instrumentation market, the share is 4.1%, supporting adoption in fighter jets, helicopters, and ground vehicles.

Within the simulation and training equipment category, it represents 3.7%, highlighting the role of displays in mission rehearsal and tactical training. In the next-generation battlefield technology sector, it contributes about 3.3%, emphasizing integration with sensor networks, augmented reality, and mission-critical information systems. Recent developments in this market have focused on high-resolution imaging, ruggedization, and advanced integration capabilities. Innovations include OLED and microLED displays, touch-sensitive interfaces, and low-latency visualization systems for real-time decision-making.

Key players are collaborating with defense contractors and government agencies to enhance display performance under extreme temperature, vibration, and shock conditions. Adoption of night-vision compatible, sunlight-readable, and multi-functional displays is gaining traction to improve operational effectiveness. The augmented reality overlays, helmet-mounted displays, and modular display solutions are being deployed to enhance battlefield situational awareness. These advancements demonstrate how durability, clarity, and technology integration are shaping the market.

The military displays market is experiencing steady growth driven by the increasing demand for advanced visualization systems in defense operations, rising adoption of ruggedized and high resolution display technologies, and the integration of real time data visualization in mission critical applications. Enhanced battlefield awareness, improved communication systems, and the need for quick decision making in dynamic environments are pushing military forces toward technologically advanced display solutions.

Investments in lightweight, durable, and energy efficient display units are also increasing, particularly in handheld and portable formats. Advancements in augmented reality and night vision compatibility, combined with strong government defense budgets, are fostering wider deployment.

The market outlook remains strong as modern militaries prioritize operational efficiency, situational awareness, and enhanced soldier capability through display technology innovations.

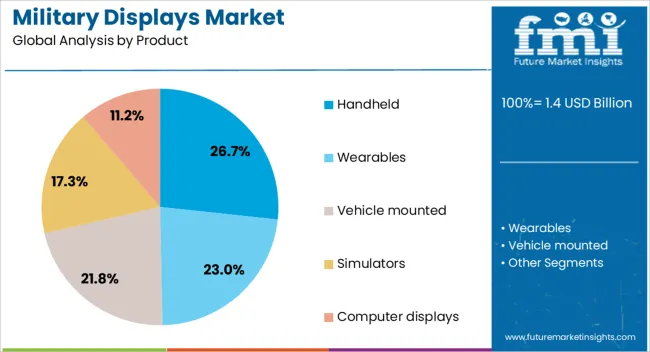

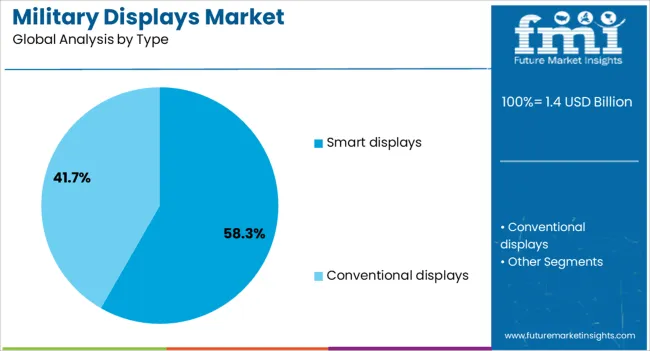

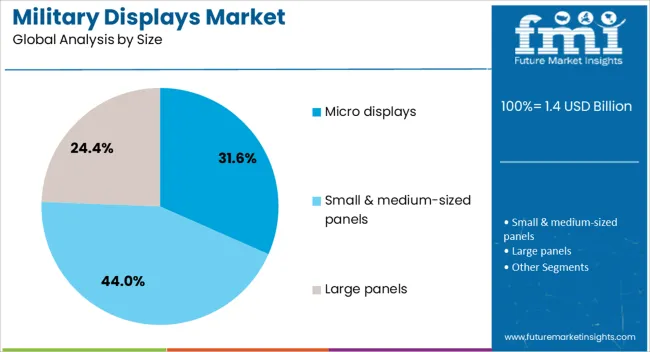

The military displays market is segmented by product, type, size, technology, end-user, and geographic regions. By product, military displays market is divided into handheld, wearables, vehicle mounted, simulators, and computer displays. In terms of type, military displays market is classified into smart displays and conventional displays. Based on size, military displays market is segmented into micro displays, small & medium-sized panels, and large panels. By technology, military displays market is segmented into Light emitting diode (LED), Liquid crystal display (LCD), active matrix organic light emitting diode (AMOLED), and organic light emitting diode (OLED). By end-user, military displays market is segmented into naval, airborne, and land. Regionally, the military displays industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld product segment is expected to account for 26.7% of the total market revenue by 2025, making it a significant contributor within the product category. Growth is supported by the portability, ruggedness, and operational flexibility of handheld displays, which are essential for field communications, navigation, and mission planning.

Their capability to function in harsh environments with minimal maintenance has increased their adoption.

The integration of high resolution screens and touch interface functionalities further enhances operational efficiency, making handheld displays an indispensable tool for ground personnel.

The smart displays segment is projected to hold 58.3% of the total market revenue by 2025, positioning it as the leading type. This dominance is driven by their multifunctional capabilities, integration of AI assisted data processing, and compatibility with multiple defense systems.

Smart displays enable real time data visualization, improved target recognition, and enhanced decision making support, which are critical in modern combat operations.

Their adaptability for various platforms including land vehicles, aircraft, and naval systems contributes to their widespread use.

The small & medium-sized panels segment is anticipated to capture 44% of the total market revenue by 2025, marking it as the leading size category. The segment’s growth is fueled by its versatility, rugged design, and ability to deliver high-brightness and sunlight-readable imagery across multiple defense platforms.

These panels are increasingly integrated into vehicle dashboards, cockpit systems, and portable command devices used for navigation, targeting, and tactical situational awareness.

Their efficiency in providing touch-interactive capabilities, durability under harsh conditions, and balanced portability makes them highly suitable for both platform-mounted and handheld military equipment.

The market has witnessed robust growth due to increasing demand for advanced visualization solutions in defense and aerospace applications. Military-grade displays are essential for command and control centers, cockpit instrumentation, unmanned vehicles, and battlefield management systems. Adoption is driven by the need for high-resolution imaging, durability under extreme environmental conditions, and integration with sensors and communication networks. Ruggedized displays with touchscreen, heads-up, and night-vision capabilities are gaining traction. Investments in modernization programs, increased defense budgets, and global military technology upgrades are further boosting demand.

Military operations increasingly rely on displays to provide situational awareness, real-time intelligence, and decision support. High-resolution multi-functional displays are deployed in command centers, fighter aircraft, armored vehicles, and naval systems to monitor battlefield data, satellite imagery, and sensor inputs. The ability to process and present information in real-time enables rapid and informed decision-making. Displays with night-vision, thermal imaging, and augmented reality features enhance operational effectiveness in diverse and challenging terrains. Rising emphasis on network-centric warfare and precision targeting has further driven demand for integrated display solutions. These technological requirements make military-grade displays indispensable for modern defense operations globally.

Technological improvements have expanded the capabilities of military displays, emphasizing ruggedization, high brightness, wide viewing angles, and resistance to vibration, shock, and extreme temperatures. OLED, LCD, and microLED technologies are increasingly adopted to improve clarity, energy efficiency, and reliability. Touchscreen interfaces, heads-up displays, and helmet-mounted systems allow better human-machine interaction, reducing cognitive load for personnel. Customizable and modular designs are being developed to integrate with a variety of platforms, from ground vehicles to unmanned aerial systems. Continuous innovation ensures that displays can withstand battlefield stressors while providing accurate, actionable data to enhance operational performance and situational awareness.

The military displays market is diversified across air, land, and naval platforms. In aviation, cockpit displays for fighter jets, transport aircraft, and UAVs facilitate navigation, targeting, and mission management. On the ground, armored vehicles, artillery systems, and mobile command units rely on displays for monitoring sensor networks, communications, and mapping. Naval applications include bridge control, radar, sonar monitoring, and fleet coordination systems. Integration with other defense electronics such as sensors, communication modules, and navigation systems has increased reliance on high-performance displays. Expanding use across multiple platforms highlights the versatility and strategic importance of military-grade displays in modern defense operations.

The market faces challenges due to high production costs, stringent quality standards, and rigorous compliance requirements. Military-grade displays must meet strict MIL-STD certifications, electromagnetic interference regulations, and environmental testing protocols, which increase design complexity and manufacturing costs. Supply chain limitations, reliance on specialized components, and geopolitical constraints on advanced technologies further affect availability. The defense procurement cycles and budget fluctuations can influence adoption rates. Manufacturers are investing in R&D, advanced materials, and modular designs to mitigate these challenges while delivering reliable, durable, and compliant display solutions. Despite these barriers, increasing defense modernization initiatives continue to support market growth.

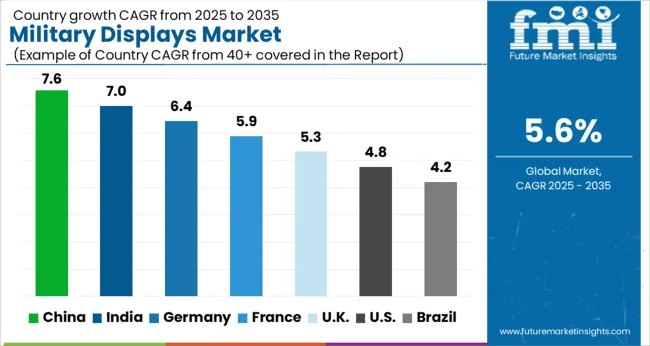

| Countries | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

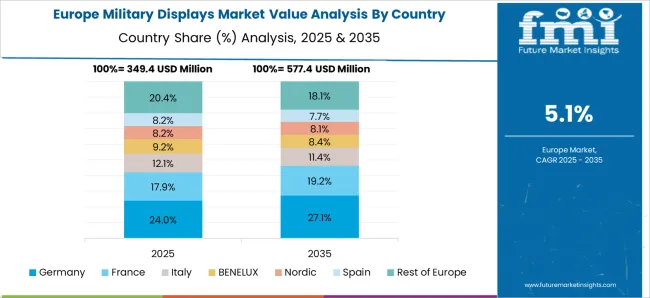

The market is projected to grow at a CAGR of 5.6% from 2025 to 2035, supported by rising defense modernization and advanced visualization technologies. India recorded 7.0%, driven by procurement of advanced cockpit and command displays. Germany reached 6.4%, where defense electronics innovation and integration in armored and naval platforms contributed to growth. China led with 7.6%, benefiting from large-scale defense manufacturing and adoption of next-generation display systems. The United Kingdom reported 5.3%, supported by upgrades in tactical and training displays. The United States accounted for 4.8%, with consistent investment in military avionics and situational awareness technologies. Together, these countries represent key centers for production, deployment, and technological advancement in military display solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.6%, driven by modernization of defense equipment, increasing procurement of advanced fighter jets, naval vessels, and armored vehicles. Adoption has been reinforced by domestic production of ruggedized LCD, OLED, and multifunctional displays for command, control, and situational awareness applications. Strategic investments in indigenous defense technologies and R&D centers enhance capabilities for high resolution and low latency displays. Integration of AI and sensor fusion into cockpit and battlefield systems further accelerates demand.

India is expected to grow at a CAGR of 7.0%, supported by procurement programs for fighter jets, naval ships, and armored vehicles. Adoption has been reinforced by modernization of legacy platforms with multifunctional displays and ruggedized systems. Domestic defense firms collaborate with global suppliers to integrate advanced displays into avionics, command and control, and surveillance applications. Increasing defense budgets and indigenous manufacturing initiatives, such as Make in India for defense electronics, further strengthen the market.

Germany is forecast to grow at a CAGR of 6.4%, driven by modernization of armored vehicles, naval vessels, and UAV platforms. Adoption has been reinforced by integration of high resolution, night vision compatible, and ruggedized displays. German manufacturers focus on innovation, reliability, and compliance with NATO standards. Applications extend to command centers, simulators, and training systems. Exports of advanced military display systems to allied countries support market expansion.

The United Kingdom is projected to grow at a CAGR of 5.3%, supported by adoption in fighter jets, naval platforms, armored vehicles, and training simulators. Domestic manufacturers focus on ruggedized, multifunctional, and night vision compatible displays. Imports of specialized high performance displays complement domestic capabilities. Increasing defense budgets and modernization of legacy platforms, including aircraft cockpit upgrades, further drive market growth.

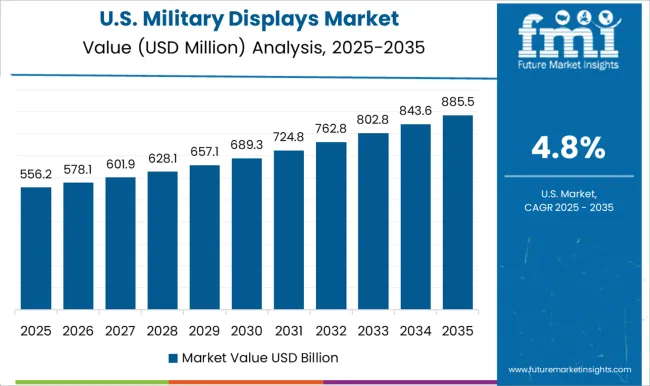

The United States is anticipated to grow at a CAGR of 4.8%, supported by modernization of aircraft, naval, and ground platforms with high resolution, multifunctional, and rugged displays. Adoption has been reinforced by the integration of AI, sensor fusion, and advanced situational awareness systems. Defense contractors focus on lightweight, energy efficient, and mission adaptable displays. Strong military budgets, UAV proliferation, and advanced simulation and training systems contribute to sustained market growth.

The market is shaped by global defense contractors, specialized electronics manufacturers, and system integrators that provide ruggedized and mission-critical display solutions. Aselsan, a leading Turkish defense electronics provider, delivers advanced displays for armored vehicles, naval vessels, and airborne systems, emphasizing durability and battlefield adaptability. BAE Systems and General Dynamics, two prominent multinational defense contractors, integrate military-grade displays into a broader suite of defense platforms, leveraging strong government contracts and technological innovation.

Elbit Systems and Leonardo focus on high-resolution, night vision compatible, and multi-functional displays for air, land, and naval applications, providing tailored solutions that meet stringent military standards. Curtiss-Wright, CMC Electronics, and Crystal Group specialize in rugged computing and display solutions capable of operating under extreme temperatures, shock, and vibration. Hatteland Technology and Milcots are recognized for innovative cockpit and control room displays, delivering reliability and enhanced situational awareness.

L3Harris, Saab, and Thales offer integrated display systems combined with sensors, communication modules, and command-control interfaces, reinforcing operational efficiency across defense platforms. Competition in the market is driven by technological innovation, compliance with defense specifications, and the ability to deliver customizable, resilient solutions for harsh environments. Partnerships with defense agencies, long-term contracts, and advancements in touchscreen, holographic, and augmented reality displays act as critical differentiators for market players.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Product | Handheld, Wearables, Vehicle mounted, Simulators, and Computer displays |

| Type | Smart displays and Conventional displays |

| Size | Micro displays, Small & medium-sized panels, and Large panels |

| Technology | Light emitting diode (LED), Liquid crystal display (LCD), Active matrix organic light emitting diode (AMOLED), and Organic light emitting diode (OLED) |

| End-user | Naval, Airborne, and Land |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aselsan, BAE Systems, CMC Electronics, Crystal Group, Curtiss-Wright, Elbit Systems, General Digital, General Dynamics, Hatteland Technology, L3Harris, Leonardo, Milcots, Saab, and Thales |

| Additional Attributes | Dollar sales by display type and application, demand dynamics across land, naval, and aerial defense platforms, regional trends in military technology adoption, innovation in ruggedization, high-resolution imaging, and multi-functional interfaces, environmental impact of electronic component production and disposal, and emerging use cases in situational awareness, simulation training, and command-and-control systems. |

The global military displays market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the military displays market is projected to reach USD 2.4 billion by 2035.

The military displays market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in military displays market are handheld, smartphones & tablets, tactical radios, global positioning system (gps), wearables, head-mounted, smartwatches, multifunction displays (mfds), and others.

In terms of type, smart displays segment to command 58.3% share in the military displays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA