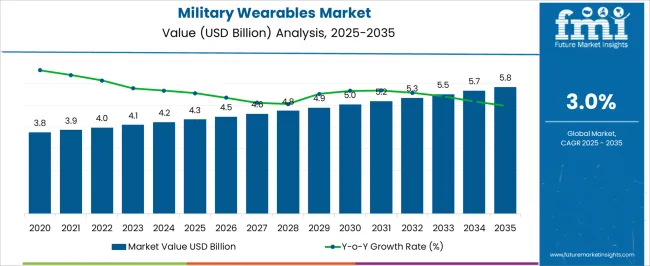

The military wearables market is projected to grow from USD 4.3 billion in 2025 to USD 5.8 billion by 2035, reflecting steady expansion over the forecast period. This period benefits from advancements in lightweight, durable materials and the integration of advanced sensors, smart fabrics, and communication systems into wearables designed for military applications.

Enhanced soldier performance and mental health monitoring also become major drivers. With a growing focus on improving the safety and operational effectiveness of military personnel, the market for military wearables is poised for significant growth, supported by innovations in technology, demand for real-time data, and the increasing complexity of modern military operations.

| Metric | Value |

|---|---|

| Military Wearables Market Estimated Value in (2025 E) | USD 4.3 billion |

| Military Wearables Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The military wearables market is advancing steadily, driven by rising defense modernization programs, increased focus on soldier survivability, and the integration of smart technologies into field-ready systems. Governments across key defense economies are prioritizing investments in network-centric operations, combat readiness, and situational awareness, prompting increased procurement of wearable devices.

Demand is being further supported by the need for real-time health diagnostics, navigation aids, secure communications, and threat detection. With the growing relevance of asymmetric warfare and urban combat scenarios, wearable systems are being adopted to enhance agility, communication, and tactical advantage.

Continued collaboration between defense agencies, electronics manufacturers, and textile innovators is driving the development of lightweight, durable, and AI-integrated solutions. Future growth will be underpinned by the expansion of soldier connectivity programs, miniaturization of sensors, and compatibility with broader battlefield management systems.

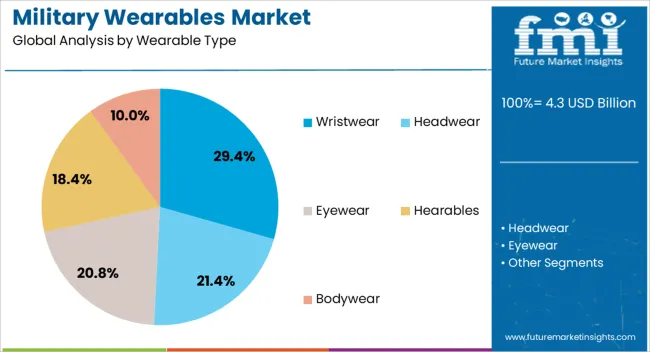

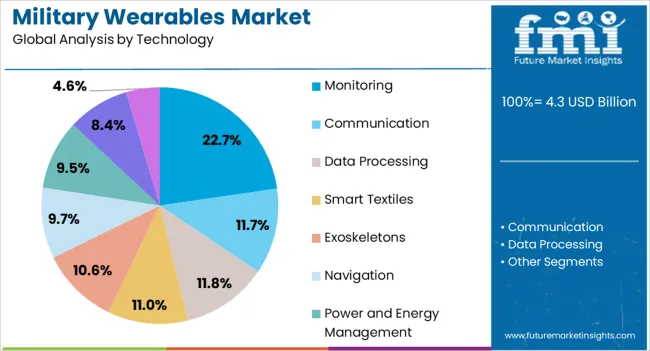

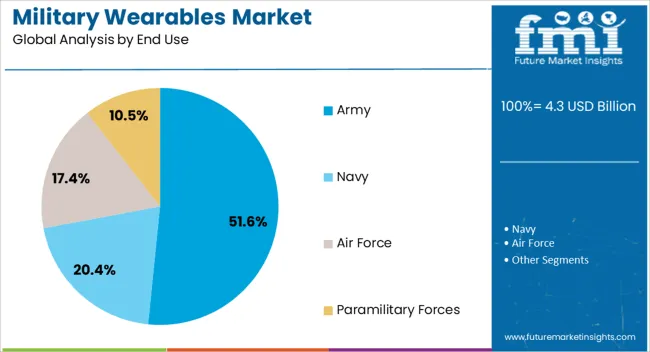

The military wearables market is segmented by wearable type, technology, end use, and region. By wearable type, the market is divided into wristwear, headwear, eyewear, hearables, and bodywear. In terms of technology, it is classified into monitoring, communication, data processing, smart textiles, exoskeletons, navigation, power and energy management, vision and surveillance, and network and connectivity management. Based on end use, the market is segmented into army, navy, air force, and paramilitary forces. Regionally, the military wearables industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Wristwear is projected to hold 29.40% of the total revenue in the military wearables market by 2025, establishing it as the leading wearable type segment. This position is being supported by its ease of integration with biometric sensors, GPS modules, and communication tools, offering real-time data to enhance operational awareness.

Compact design, rapid accessibility, and ergonomic comfort make wristwear ideal for continuous usage in active field conditions. Enhanced battery life, waterproofing, and encryption capabilities have further elevated its application across missions requiring durability and secure data transmission.

Its compatibility with various command-and-control platforms has solidified its adoption across technologically advanced military forces aiming for synchronized ground-level intelligence.

Monitoring technology is expected to account for 22.70% of the overall market share in 2025, making it the dominant technology segment. Its leadership is being driven by increasing deployment of wearable systems for real-time tracking of soldier vitals, fatigue levels, hydration status, and stress indicators.

Such capabilities are essential for preventing performance decline and enhancing mission endurance. The integration of AI and predictive analytics into monitoring platforms enables rapid risk assessment and decision-making.

Wearable monitoring devices have also become critical in training environments to simulate high-stress conditions and optimize physical conditioning. As defense forces move toward data-centric soldier performance evaluation, this segment is positioned for sustained growth.

The army segment is forecast to contribute 51.60% of the total market revenue in 2025, making it the top end-use category. This leadership stems from large-scale troop deployments, extensive terrain operations, and continuous engagement in peacekeeping, border security, and reconnaissance missions.

The demand for wearable technologies is being prioritized to enhance soldier health tracking, mobility, communication efficiency, and tactical responsiveness. Armies worldwide are increasingly investing in modular and ruggedized wearable ecosystems to integrate seamlessly with helmets, body armor, and uniforms.

Programmatic initiatives under soldier modernization agendas are accelerating adoption, particularly in regions with active defense R&D ecosystems. The segment is expected to maintain its lead due to ongoing digital battlefield transformations and the operational need for real-time connectivity and feedback.

The military wearables market is propelled by increased demand for operational efficiency, health monitoring, and new wearable technologies. Advancements in safety standards and defense investments continue to fuel growth.

The military wearables market is driven by rising demand within defense forces for advanced technology that enhances operational efficiency. Military budgets worldwide are increasingly allocated to improving soldier capabilities through wearable technologies such as exoskeletons and biometric sensors. These solutions are designed to improve situational awareness, communication, and health monitoring, allowing military personnel to function effectively in extreme environments. Enhanced soldier safety through body armor systems integrated with wearables also contributes to growing market demand. The increasing focus on soldier performance optimization and battlefield readiness ensures that the market is well-positioned for steady growth, especially in regions heavily investing in defense modernization.

New developments in wearable technologies such as augmented reality (AR) and artificial intelligence (AI) are transforming the military sector. Wearables with AR provide soldiers with real-time data and heads-up displays, enhancing tactical awareness. AI-powered wearables can assist in predictive maintenance, monitoring health metrics, and providing actionable insights during combat operations. These systems are highly integrated into military strategies to enhance coordination, decision-making, and reduce operational risks. The increasing integration of such technologies ensures that military wearables evolve alongside broader defense innovations, making them indispensable in modern military environments.

The growing emphasis on soldier health has led to the integration of advanced wearables that monitor vital signs and physical performance. Wearables designed to track biometrics, fatigue levels, and stress contribute to enhancing overall soldier well-being. By providing insights into physical conditions in real time, these devices enable military forces to deploy their personnel in the most effective manner. Furthermore, wearables can detect health issues, ensuring immediate medical attention when needed, which is essential in high-risk environments. This integration of health monitoring into wearables improves mission success and reduces casualties, making it a critical market driver.

Regulatory frameworks and safety standards play a significant role in shaping the adoption and development of military wearables. Governments across the globe are increasingly implementing standards for wearable technologies used in defense applications, emphasizing their reliability, performance, and compliance with safety protocols. This includes ensuring wearables can withstand harsh environmental conditions while providing accurate data under combat stress. Regulatory bodies influence the design and manufacturing processes, ensuring the devices meet the necessary durability and safety benchmarks. These regulations help build trust among defense organizations, further driving the adoption of wearables in military operations.

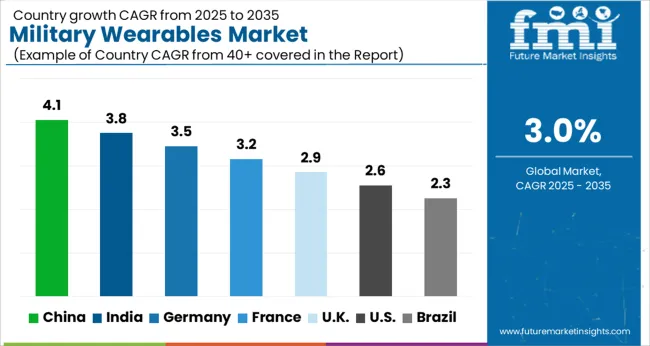

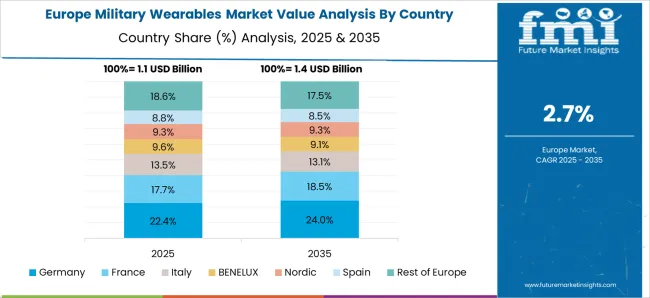

The military wearables market is projected to grow globally at a CAGR of 3.0% from 2025 to 2035, with China leading the growth at 4.1%, driven by significant defense modernization efforts and technological investments in military wearables. India follows closely at 3.8%, bolstered by growing defense budgets and a focus on soldier efficiency and safety. France shows a steady 3.2% growth, supported by military upgrades and the integration of wearable technologies in the French Armed Forces. The UK records a 2.9% CAGR, influenced by increasing demand for smart military gear and defense automation. The USA maintains a 2.6% growth rate, driven by innovations in soldier monitoring systems and AR/AI wearable solutions, emphasizing its technological leadership in defense technologies.

The CAGR for the military wearables market in the United Kingdom was estimated at 2.5% during 2020–2024 and improved to 2.9% for the 2025–2035 period. This increase in growth is driven by heightened defense investments aimed at enhancing soldier performance and safety through advanced wearable technologies. The adoption of biometric monitoring systems, augmented reality solutions, and exoskeletons by the UK military to optimize soldier health and operational efficiency significantly contributed to this growth. The focus on wearable technologies integrated into combat and training environments has led to consistent demand. The government's emphasis on enhancing military readiness through cutting-edge defense solutions also supported this market expansion.

The CAGR for the military wearables market in China was recorded at 3.6% between 2020–2024 and surged to nearly 4.1% during 2025–2035. This notable rise is driven by China’s extensive modernization efforts in defense, including the development and deployment of wearables such as exoskeletons, smart vests, and biometric sensors. These wearable technologies are designed to optimize soldier performance and improve real-time battlefield communication. China’s growing defense budget and strategic investments in high-tech military solutions are key factors propelling this growth. The continued emphasis on smart military equipment has positioned China as a major contributor to global market expansion in this sector.

The CAGR for the military wearables market in India was 3.2% during 2020–2024, and is projected to rise to 3.8% between 2025–2035. This increase is attributed to India’s focus on strengthening its military with wearable technologies that enhance soldier efficiency, health monitoring, and communication. The growing importance of real-time data analytics for soldiers during combat and training operations has contributed to the increased demand for wearable devices. The Indian government’s rising defense budget, paired with its emphasis on technological integration, has supported market growth. India’s military modernization efforts ensure continued adoption of wearable technologies for improved soldier effectiveness.

The CAGR for the military wearables market in France was estimated at 2.8% during 2020–2024 and is expected to increase to 3.2% during 2025–2035. This growth is largely driven by the French Armed Forces’ commitment to adopting wearable technologies that improve tactical awareness and soldier health. The French government’s focus on modernizing its military infrastructure has spurred investments in wearable communication systems and performance-monitoring devices. These technologies enhance soldier preparedness and provide real-time feedback in both combat and training environments. The integration of wearable solutions into defense strategies further supports growth in this market, positioning France as a significant player in military technology.

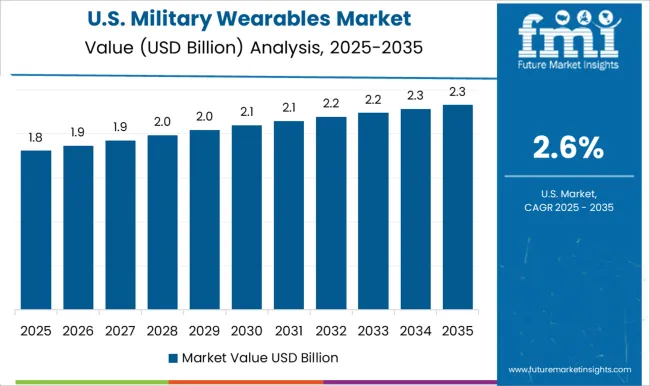

The CAGR for the USA military wearables market was 2.4% from 2020 to 2024 and is projected to rise to 2.6% during the 2025 to 2035 period. The increase is attributed to the USA military's ongoing investments in next-generation wearable technologies, including exoskeletons, augmented reality devices, and biometric sensors. These innovations are designed to improve soldier efficiency, health monitoring, and situational awareness. The USA remains a leader in military innovation, with a focus on smart devices that optimize battlefield performance and reduce operational risks. As a result, the USA military continues to drive demand for advanced wearable solutions.

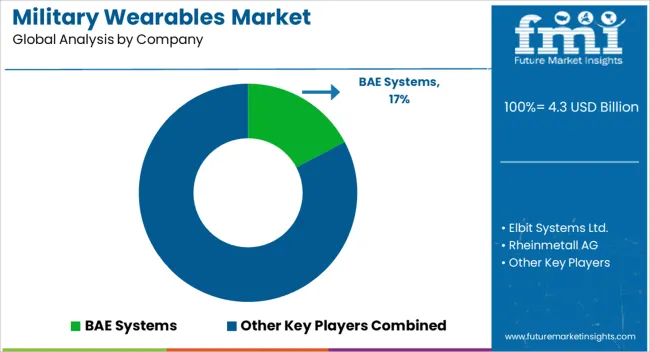

The military wearables market is marked by the presence of major global defense technology companies and specialized producers focused on advancing wearable technologies for soldier safety, performance, and operational efficiency. BAE Systems leads with its focus on providing high-tech solutions that enhance combat readiness and situational awareness. Elbit Systems Ltd. is a key player with its wearable systems designed for soldier health monitoring and communication.

Rheinmetall AG specializes in exoskeletons and wearables that support physical performance and reduce soldier fatigue. Saab AB continues to innovate with advanced wearable technologies for surveillance and communication applications. Thales Group plays a significant role by providing wearable solutions with integrated AR for enhanced battlefield experience. Aselsan A.S. focuses on integrating wearable technologies with military-grade electronics to improve soldier performance.

Teledyne Flir LLC offers wearable thermal imaging solutions that increase visibility in low-light conditions, driving the demand for wearable technologies in military operations. Competitive differentiation in this market revolves around advancements in health monitoring systems, wearable communication tools, and real-time tactical feedback, as these companies drive the development of next-generation wearable systems for military applications.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Wearable Type | Wristwear, Headwear, Eyewear, Hearables, and Bodywear |

| Technology | Monitoring, Communication, Data Processing, Smart Textiles, Exoskeletons, Navigation, Power and Energy Management, Vision & Surveillance, and Network & connectivity Management |

| End Use | Army, Navy, Air Force, and Paramilitary Forces |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems, Elbit Systems Ltd., Rheinmetall AG, Saab AB, Thales Group, Aselsan A.S., and Teledyne Flir LLC |

| Additional Attributes | Dollar sales projections, share of key segments, growth rate by region, competitive landscape, consumer adoption trends, government contracts, technological advancements, demand for wearable health monitoring, and regulatory influences. |

The global military wearables market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the military wearables market is projected to reach USD 5.8 billion by 2035.

The military wearables market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in military wearables market are wristwear, headwear, eyewear, hearables and bodywear.

In terms of technology, monitoring segment to command 22.7% share in the military wearables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA