The military vehicles and aircraft simulations market is experiencing robust growth due to rising investments in defense modernization and training programs. Governments worldwide are prioritizing advanced simulation technologies to enhance the operational preparedness and safety of military personnel. These simulations provide cost-effective, risk-free environments for practicing complex combat scenarios, vehicle operations, and aircraft maneuvers.

The increased adoption of virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) in simulation systems is elevating training realism and effectiveness. With growing geopolitical tensions and the emphasis on military readiness, the demand for cutting-edge simulation solutions is steadily increasing.

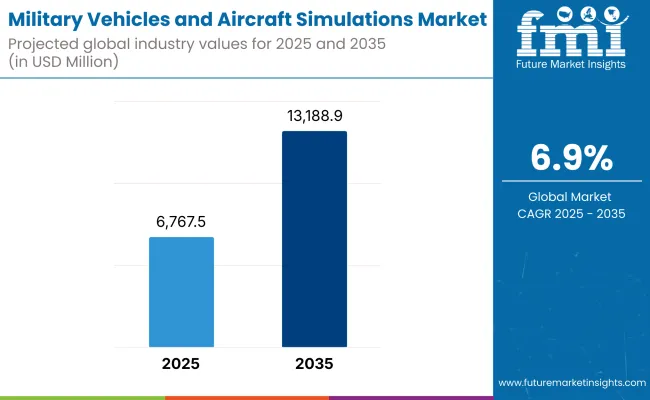

In 2025, the market size for military vehicles and aircraft simulations is estimated at approximately USD 6,767.5 million. By 2035, it is projected to reach USD 13,188.9 million, expanding at a compound annual growth rate (CAGR) of 6.9%. This growth is fueled by technological advancements, such as AI-driven scenario generation, enhanced graphics engines, and integration of IoT sensors into simulation platforms.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6,767.5 Million |

| Projected Market Size in 2035 | USD 13,188.9 Million |

| CAGR (2025 to 2035) | 6.9% |

Defense agencies are focusing on upgrading their simulation infrastructures to mirror real-world complexities, thereby boosting demand. Additionally, collaborative training exercises between allied nations are increasing the need for interoperable and scalable simulation systems that can adapt to multi-domain operations.

| Type | Market Share (2025) |

|---|---|

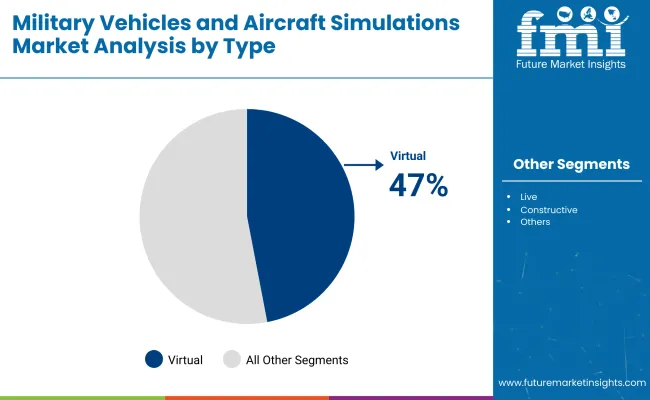

| Virtual | 47% |

Demand for virtual simulation dominates the market, with nearly half of the demand for across the globe. Virtual simulations provide high-fidelity, immersive training environments that closely reproduce a variety of combat, tactical, and operational scenarios.

They allow defense forces to train for complex missions in secure, controlled environments, without the high logistical costs, safety risks or environmental footprints of conventional, live field exercises. With the support of advanced technologies like artificial intelligence (AI), machine learning (ML), augmented reality (AR), and virtual reality (VR), modern virtual simulations offer highly immersive and responsive environments.

Such technologies enable the tailoring of training programs, delivery of real-time feedback and the simulation of unpredictable combat situations that can assist soldiers in developing critical thinking, adaptability and strategic planning skills.

In addition, virtual simulations are scalable and facilitate multi-domain training that enables the training of participants from different branches land, air and naval as well as cyber which can team up to engage in synchronized missions. Such interconnectivity enhances joint operation readiness preparations while also making faultless communication, as well as collaboration between teams under pressure, that much easier.

Another advantage is the potential to quickly update scenarios for contemporary threats or geopolitical changes, keeping forces ready for modern challenges like cyber warfare, urban combat, and counterinsurgency operations. Cost-effectiveness is a key motivation for the move to virtual simulation, with significant savings on both fuel, ammunition, maintenance, and fielding to have a real effect on training outcomes.

It also contributes to the zero environmental impact in training, responding to the broader sustainability goals of multiple defense organizations around the globe. As global defense concepts of operations evolve and move towards preparing for technology-enabled military readiness, adaptive training responses, and net-centric warfare, the requirement for advanced virtual simulation solutions continue to accelerate. AI-driven adaptive learning paths, wearable simulation suits, full-body motion tracking, all incorporated to further the realism and effectiveness of such systems, have become a bedrock in military training infrastructure today.

| Application | Market Share (2025) |

|---|---|

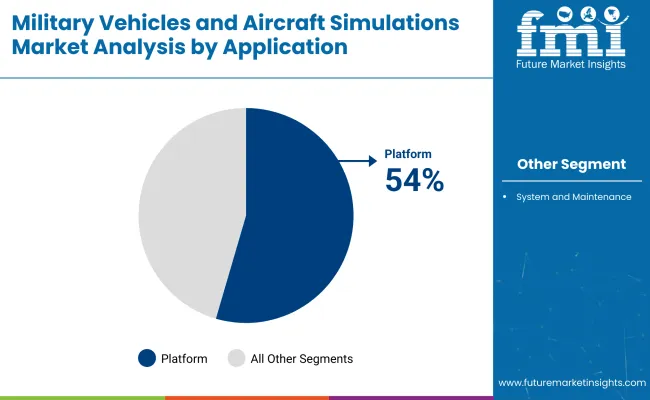

| Platform | 54% |

Due to the importance of vehicle, aircraft, naval, and weapon platform-specific trainings to modern military forces, platform application segment accounts for the larger market share in this segment. In the complex operational environment of today, learning the particulars of a given platform from a next-generation fighter to an armored vehicle to a missile system translates directly to mission effectiveness and operational safety. An advanced simulation-based training platform delivers some of the most realistic, scenario-based experiences available, closely approximating how systems will operate, malfunction, and perform in combat scenarios.

Such fidelity empowers personnel to attain technical proficiency, rapidly acclimate to equipment upgrades and improve their tactical decision-making in a controlled pressurized environment. Platform-specific training, in addition, can help maintenance crews and technical personnel get practice with problem-solving and managing systems without risking a live system.

The increasing need for multi-domain operations and network-centric warfare only adds to the necessity of having platform simulations for air, land, sea, space and cyber that can be interoperable. Simulation platforms leverage real-time data analytics, artificial intelligence-driven threat generation and virtualized environments to prepare forces for rapidly changing battlefield scenarios.

Additionally, the objective of the cost-efficient and sustainable implementation of defense solutions has also pushed the militaries to invest more in platform simulators, since they significantly minimize wear and tear on costly equipment and lower fuel and munitions expenditure during training.

With global defense modernization initiatives gaining momentum - in particular, in North America, Europe and Asia-Pacific - the platform application segment is expected to grow considerably, further solidifying its position as the largest segment in the military simulation & virtual training market.

High Initial Investment and Technology Complexity

Advanced simulation systems for military vehicles and aircraft require investments of significant financial and elite expertise. Simulators that employ technologies such as AI, the VR, and the haptics are among the most advanced in the world, requiring high levels of complexity to ensure their design, production, and upkeep.

Defense agencies in developing countries may face budgetary constraints thus limiting the growth of the market. Also, developments of ultra-realistic training environments have technical challenges which need continued R&D investment.

Cybersecurity Threats and Data Integrity Risks

Military simulations are increasingly digital and networked; the potential for cyberattacks, data breaches and the sabotage of systems is significant. A key concern is to ensure the security of simulation data which often contains sensitive information that could be harmful if disclosed. In order to maintain trust with their defense clients and protect vital national security interests, companies are required to make significant investments in cybersecurity controls, encryption technologies, and secure network architectures.

Rising Demand for Cost-Effective and Safe Training Solutions

Simulation as a facilitator for dealing with dangers and expenses of live training exercises. The world's defense forces are implementing simulations to train personnel on complex maneuvers without wasting real assets including fuel, ammunition and aircraft time. And this trend is creating significant opportunities for manufacturers of fully immersive and modular training systems designed for the unique needs of a given military service.

Integration of Next-Generation Technologies (AI, VR, AR)

Simulators are undergoing a revolution in the market with the integration of Artificial Intelligence, Virtual Reality, Augmented Reality, and Machine Learning. Next-gen simulations can adapt dynamically based on how trainees are performing, create hyper-realistic environments, and replicate complex battlefield conditions in real-time. Businesses that use these technologies to increase realism, lower costs, and improve training performance stand to grow significantly.

The United States dominates the Military vehicles and aircraft simulations market due to its significant defense budget and focus on next-generation training technologies. The USA Department of Defense actively invests in simulation-based training to enhance combat readiness and reduce operational costs. Advancements in VR (Virtual Reality), AR (Augmented Reality), and AI-driven simulators are fueling innovation.

Additionally, increasing reliance on unmanned systems requires sophisticated simulation programs for both manned and unmanned platforms. Collaboration between defense contractors and tech firms is expanding the market scope, while modernizing pilot and crew training continues to be a primary focus.

| Country | CAGR (2025 to 2035) |

|---|---|

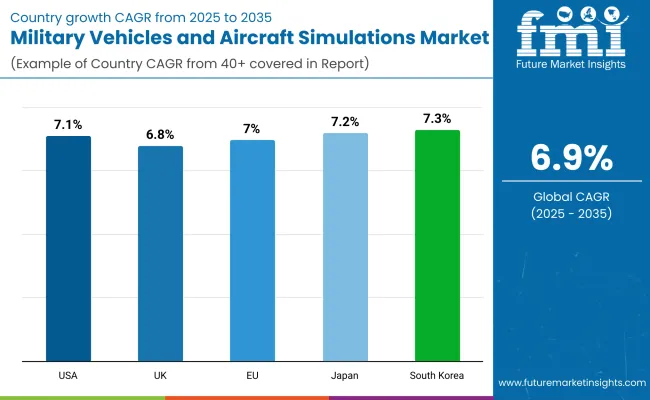

| USA | 7.1% |

The United Kingdom is witnessing strong growth in the Military Vehicles and Aircraft Simulations market, supported by its Future Combat Air System (FCAS) program and ongoing investments in military modernization. British defense forces are increasingly adopting advanced simulators to train pilots and vehicle operators more cost-effectively.

The rising emphasis on reducing training risks and enhancing mission preparedness is pushing demand for immersive simulation solutions. Additionally, public-private partnerships in defense technology development are strengthening the country's position in simulation training technologies for land and air platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Across the European Union, the Military vehicles and aircraft simulations market is gaining momentum as countries seek cost-effective and high-fidelity training solutions. Nations like Germany, France, and Italy are heavily investing in simulation technologies to maintain force readiness amid evolving security threats.

The European Defense Fund (EDF) and collaborative defense programs are accelerating the integration of AI, VR, and cloud-based simulations. The need for interoperability among allied forces is further encouraging the adoption of standardized simulation systems for both ground vehicles and aircraft across the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.0% |

Japan’s Military vehicles and aircraft simulations market is expanding rapidly, driven by the nation’s ongoing defense modernization efforts. Rising regional tensions and a strategic push to bolster air and ground forces are prompting investment in simulation-based training.

Japan’s Ministry of Defense is increasingly adopting advanced simulation platforms to improve the capabilities of both Self-Defense Forces and joint operations with allied nations. Emphasis on integrating AI and big data analytics into simulators enhances training realism, while partnerships with domestic tech firms are strengthening simulation innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

South Korea is experiencing strong growth in the Military Vehicles and Aircraft Simulations market, driven by a growing need for readiness amid evolving security dynamics on the Korean peninsula. The South Korean military actively adopts simulation systems for aircraft, armored vehicles, and unmanned systems training.

Government initiatives to modernize armed forces and enhance joint training exercises with allied countries are boosting the adoption of advanced simulation platforms. Additionally, the domestic development of indigenous simulation technologies is positioning South Korea as a key player in regional defense training innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

The military vehicles and aircraft simulations market is experiencing significant growth due to the rising emphasis on cost-effective, safe, and realistic training environments. Simulators reduce operational costs, minimize accident risks during training, and extend the lifespan of real vehicles and aircraft by limiting their use in training missions.

Technological advances such as VR (Virtual Reality), AR (Augmented Reality), and AI-based adaptive learning are also revolutionizing simulation capabilities. As global defense budgets rise and militaries prioritize modernization, demand for highly sophisticated simulation technologies that replicate real battlefield conditions is soaring, particularly in North America, Europe, and parts of Asia-Pacific.

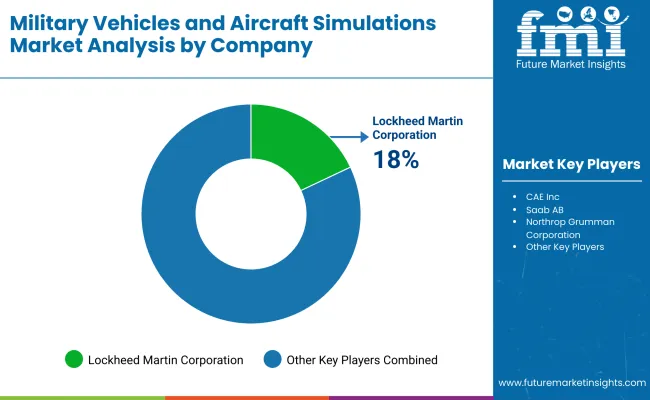

Lockheed Martin Corporation (18 to 20%)

Lockheed Martin holds a dominant share of the market, fueled by its extensive experience in simulation systems for advanced aircraft such as the F-35 Lightning II. The company’s integration of AI-based threat modeling and real-time battlefield updates into simulators sets a new benchmark for realism.

Strategic collaborations with government agencies and militaries worldwide ensure consistent revenue streams. Lockheed’s aggressive R&D investments in immersive simulation technologies are expected to keep it at the forefront of the defense simulation industry throughout the next decade.

CAE Inc. (15-17%)

CAE Inc. is a major force in simulation and training, offering cutting-edge VR and mixed-reality systems for military vehicles and aircraft. Their focus on modular simulators allows for quick updates and flexibility across multiple platforms, from tanks to helicopters.

The company’s emphasis on collaborative training environments, where crews operate together in synthetic battlefields, enhances realism and combat readiness. CAE's strong international presence positions it as a preferred partner for defense modernization programs globally.

Northrop Grumman Corporation (10-12%)

Northrop Grumman is leveraging AI and autonomous systems expertise to innovate next-generation military simulation platforms. Their offerings, especially in simulating electronic warfare and unmanned aerial vehicle (UAV) operations, cater to rapidly evolving combat needs

Northrop’s simulators support distributed mission operations (DMO), allowing pilots and ground forces to train together virtually. Continued investments in cybersecurity and digital twin technologies are key pillars of Northrop’s strategy to capture greater market share moving forward.

Saab AB (8-10%)

Saab AB is known for its agile, modular simulation systems tailored to the needs of smaller and mid-sized military forces. Their portable and deployable training environments provide flexibility, enabling rapid adaptation to changing mission profiles.

Saab’s expertise in combining live, virtual, and constructive (LVC) training enhances realism without the logistical complexity of traditional exercises. With growing demand for mobile and cost-effective solutions, Saab is well-positioned for expansion, especially across emerging markets in Asia and Eastern Europe.

Other Key Players (43-49% Combined)

Other players, including Cubic Corporation, Thales Group, and Rheinmetall AG, are actively developing specialized simulations, such as convoy protection training, air-to-air combat drills, and asymmetric warfare scenarios. The combined impact of these companies is significant, driving innovation and diversifying simulation offerings beyond traditional armored and aviation domains. Focus on cyber training modules and unmanned systems simulations is increasing across this broader competitive field, ensuring vibrant market dynamics through 2035.

The overall market size for military vehicles and aircraft simulations market was USD 6,767.5 million in 2025.

The military vehicles and aircraft simulations market expected to reach USD 13,188.9 million in 2035.

Increased defense budgets, rising need for cost-effective training, technological advancements, and geopolitical tensions will drive military vehicles and aircraft simulations market demand during the forecast period.

The top 5 countries which drives the development of cargo bike tire marketare USA, UK, Europe Union, Japan and South Korea.

Platform application segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Military Communications Market Analysis by Component, Application, End User & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA