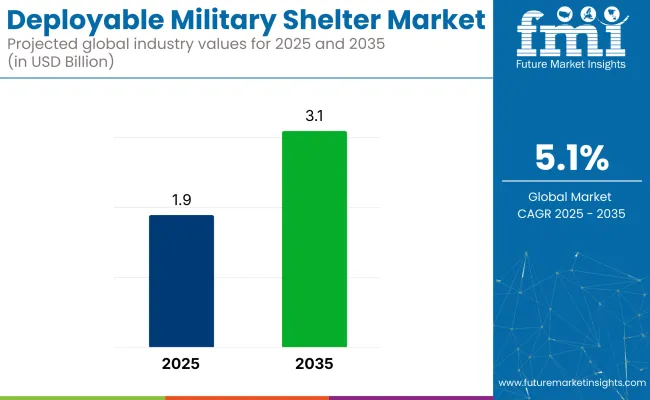

The deployable military shelter market is poised for steady growth, driven by increasing defense budgets, rising geopolitical tensions, and advancements in rapid-deployment infrastructure. Governments worldwide are investing in mobile and modular shelter solutions to enhance operational efficiency, accommodate troops in remote locations, and support disaster relief missions. The market is projected to grow from USD 1.9 billion in 2025 to USD 3.1 billion by 2035, at a CAGR of 5.1% over the forecast period.

The deployable military shelter sector is now heavily under the influence of the trend towards rapid deployment and operational readiness. Alliant infrastructures that fulfill these requisites are in high demand by the armed forces worldwide requiring infrastructure that can quickly be assembled, dismantled, and reallocated in accordance with mission needs. Moreover, climate adaptability has moved to the top of the list of priorities, which in turn has resulted in the manufacture of shelters designed with superior insulation, heating, and cooling systems for extreme conditions.

Also, the market has been scaled by the fast-rising demand for mobile command centers and field hospitals that would ensure that deployable shelters are not only for accommodation but they are also used in strategic, medical, and logistics operations in dynamic environments.

The continuous need for flexible and long-lasting shelter solutions within military operations has been the key driving force for its expansion. Deployable military tents in the air, medical facilities, and command centers are crowded, as well as being in unpredictable weather conditions. The growth trend of defense budgets, specifically in North America and Asia-Pacific regions, is a large part of the track with these solutions seen as mobile infrastructure that is in much-demand.

Alongside, technological innovations such as lightweight fabrics, modular structures, and integrated climate control systems are the major props which have been brought to the forefront by the latest designs and the adaptability of these shelters have been increased. On top of that, the governments are more and more deploying the aforementioned mobile bunkers in their disaster response and humanitarian activities, thus extending their utilization beyond the defense sector only.

Apart from that, the integration of smart gadgets with real-time monitoring systems, high security measures, and remote-controlled arrangement options is benefiting the market as well. Military troops are also more and more developing on shelters through the implementation of ballistic protection, autonomous energy solutions, and advanced communication networks thereby facilitating the smooth co-ordination of activities in the areas of conflict.

Also, the preemptive tension in the conflicting areas is causing the governments to proliferate the purchasing of the pre-deployed shelters even more which have the capacity to sustain the military operations and peace missions in the long run. Furthermore, the application of these shelters in the civilian area through their usage in aiding survivors from disasters is one more reason for the funding being provided by international aid organizations.

North America is the leading and most technologically progressed market for deployable military shelters, which is primarily supported by the significant defense expenditure in the United States. The USA Department of Defense (DoD) is frequently spending money on modular, rapid-deployment infrastructure with the goal of increasing the mobility of military personnel in international missions.

The region is also the home of some of the most prominent defense contractors and shelter makers, such as HDT Global and General Dynamics which are still pioneering in the area of light, durable, and climate-controlled shelters. Another factor is that the USA military alliances with NATO and deployment to other locations for peacekeeping missions generate the need for the mobile shelters.

In Canada, they are also working on the modernization of their deployable shelter capabilities that are adaptable for the arctic areas by means of rigid-winter-resistant structures to maintain military personnel in extreme weather conditions.

Europe's deployable military shelter market is showing steady growth, owing to military reform plans in NATO countries. Countries such as Germany, France, and the UK have been putting their money into mobile command centers, field hospitals, and rapid deployment housing as a way to enhance military readiness. The European Defense Fund (EDF) is also working on budgets for shelter upgrades including energy saving and multi-function capability.

Moreover, the use of the shelters for humanitarian purposes is becoming more frequent, such as refugee camps, and peacekeeping missions in places plagued by conflicts. In addition, the tensions between nations in Eastern Europe, especially caused by the military activities of Russia, led to some countries strengthening their border security with military shelter systems to be ready for rapid deployment and long periods of field operations.

The Asia-Pacific region is the most dynamic in the deployable military shelter market, spearheaded by the respective growth of defense budgets in China, India, Japan, and South Korea. Territorial disputes, border security issues, and military training activities are some of the factors behind the necessity for governments to set up rapidly deployable infrastructures.

For instance, the Indian Army is deploying high-altitude shelters at the Himalayan border to provide support to the troops. In the meantime, the PLA of China has developed and increased the share of mobile command centers and modular barracks to carry out maneuvers in remote and contested issues.

The region is also more vulnerable to natural calamities like (earthquakes, typhoons) which makes governments more induced to obtain deployable shelters for disaster relief and emergency medical services, thus fortifying their market potential that extends outside defense.

The deployable military shelter market around the globe is seeing gradual but strategic development in the Middle East, Africa, and Latin America. In the Middle East, the ongoing unrest and conflicts in countries such as Saudi Arabia, UAE, and Israel are propelling the money into fast-assembly mobile shelters for military base project. In Africa, these shelters are being used not only by governments for defense but also for peacekeeping operations and humanitarian aid in war-torn areas.

The countries in Latin America, especially Brazil and Mexico, are extending their military shelter system through the border and counter-narcotics operations. Additionally, the impact of climate change is leading to the adoption of deployable shelters for case of emergency issues, such as in the military as well as in civilian societies through the reinforcement of the shelters' efficacy.

Innovations in Energy Saving and Sustainable Living Huts

With the increasing emphasis on sustainability and energy efficiency, deployable military shelters stand to gain immensely. Self-sustaining army shelters with solar panels, wind energy systems, and super insulation are on the wish list of numerous countries that are seeking to lessen their reliance on outside power sources. The increasing use of advanced lightweight materials in the construction of army shelters will also be a major factor in making them tougher, more weather-resistant, and easier to transport.

Moreover, the use of water purification systems, smart waste management, and heat recovery ventilation equipment is furthering the sustainability of these huts. When military forces are actively decreasing their carbon footprint, manufacturers who can offer green and highly effective solutions will not just survive but also lead the market, thus accelerating growth in both military and humanitarian training.

Dabbling in Humanitarian Problems and Disaster Relief

Fighting military shelters are more and more on the frontline in crisis situations but are being increasingly used in humanitarian aid, disaster relief, and also the emergency medical response. Initiatives such as United Nations, Red Cross, and other international organizations are the ones financing these evolutionary, sectional, and rapidly implemented just-for-the-purpose-of-tents set up in refugee camps, during natural disasters, and in response to epidemics.

As the world made a huge transition to a more digital and very clouded environment during the COVID-19 pandemic, the necessity for mobile medical shelters surged and proved once more their crucial role during the public health emergencies. As the rise in climate change results in more floods and tornadoes, the demand for emergency shelters still will grow. The companies which offer the same products to both military and civil purposes will possess massive opportunities to strike into the global market.

Inflated Costs and Budget Gaps

The high prices tied with cutting-edge shelter technologies are the main problematic factor in the deployable military shelter market. Military-grade shelters demand for unique fabrics, climate-control systems, not to mention ballistic protection, which makes them the costliest shelters to make and keep. Although the total defense budget in developed countries can help cover these expenses, emerging markets and smaller militaries frequently experience fiscal difficulties.

Plus, the transportation, installation, and maintenance costs add to the overall spending. Countries frequently faced with competing priorities in defense spending may not commit large amounts of money to procure them. Manufacturers, however, should come up with ideas that are cost-effective by forming partnerships with local industry and by also targeting dual-use applications to legitimize their investement in high-quality deployable shelters.

Logistical Complications and Deployment Difficulties

Sitedex deployable military shelters are pressed to arrive at distant and often enemy-held sites just in time for the fighting to start. Sometimes the particular deployment scenario like, terrain conditions, bad weather, and the absence of proper infrastructure which can delay opening the doors. The environments at high altitudes or in deserts areas need the specific modification of shelters as they should withstand high temperatures, sandstorms, and humidity.

Besides, the mission might not be able to deliver full-load because of the supply chain disruption, material shortages, and transportation restriction. The military orders all materials and delivery modes to be adaptable, quick, and transportable, therefore shelters have to be underweight but made of durable materials.

Countering such challenges needs the manufacturers to design the shelters that are easy to transport, modular in nature, and that can fit in a huge range of environmental conditions, thus enabling the crews to perform in challenging field conditions.

The deployable military shelter market has experienced remarkable growth during the period from 2020 to 2024, primarily due to the increase in the defense budget, development in the lightweight and durable materials sector, and also the rise in the global military operations. The mobile, fast-deploying infrastructure, which has been a key demand for military personnel in support of various environments, has been in particular conflict zones and disaster relief missions.

The observed period was technologically improved, which resulted in better insulation, modularity, and renewable energy sources integration. Ascertain horizons 2025 to 2035, the market is expected to count the further breakthroughs with smart shelters, autonomous deployment capabilities, and sustainable design enhancements. Countries all around the world are likely to keep on funding these projects to contribute to the improvement of military readiness and efficiency in remote operations.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with NATO standards and country-specific military specifications. |

| Technological Advancements | Introduction of modular designs, enhanced insulation, and improved durability. |

| Industry-Specific Demand | High demand from armed forces, peacekeeping missions, and disaster relief operations. |

| Sustainability & Circular Economy | Initial use of eco-friendly materials, some integration of solar panels. |

| Production & Supply Chain | Globalized production, reliance on traditional supply chains. |

| Market Growth Drivers | Rising military conflicts, increased defense budgets, and need for mobile infrastructure. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental mandates, emphasis on carbon-neutral structures, and energy efficiency regulations. |

| Technological Advancements | AI-driven deployment systems, self-sustaining energy solutions, and advanced weather-resistant materials. |

| Industry-Specific Demand | Increased civilian-military collaborations, integration with smart surveillance, and automated logistics support. |

| Sustainability & Circular Economy | Full-scale use of biodegradable materials, energy harvesting capabilities, and water purification systems. |

| Production & Supply Chain | Localized manufacturing, 3D printing for rapid on-site production, and reduced logistical dependency. |

| Market Growth Drivers | Focus on rapid deployment solutions, smart shelters with IoT connectivity, and climate-resilient designs. |

The USA deployable military shelter market has become one of the top business sectors owing to the increasing defense budgets and growing requirement for modular and rapidly deployable infrastructure. The overseas operations, disaster relief missions, and border security sectors are the primary forces contributing to enhanced market requirements.

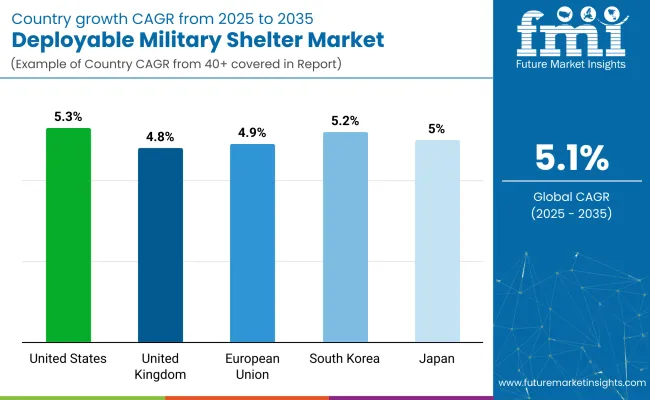

The progress in technology, like the use of lightweight and durable materials for the shelters, is a big plus. The government programs that support military modernization are the other reason. The USA market is expected to expand at a rate of 5.3% per year in the period of 2025 to 2035 as the new developing technologies are integrated into the facility and equipment for security.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

Military shelters are being more and more inquired for in the UK under the NATO commitment and for partaking in various global peacekeeping missions. Government concentration on military readiness and logistics efficiency promotes a desire for these portable and energy-efficient shelters more than ever before.

The imperative for growth of the market is sustained by the government-led defense modernization programs together with defense partnerships. The market is further propelled forward by the implementation of such programs as solar-powered shelters. The UK deployable military shelter market is expected to see a 4.8% increase in Compound Annual Growth rate (CAGR) from 2025 to 2035, due to the assumption of continued mobile defense infrastructure investments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

The European Union mobile military infrastructure sector is the left to be a lead from the collaborative defense projects and the intensifying security threats. Defense spending is on the rise, that is why along with participating in joint military operations among member states, the need for mobile shelter solutions is also being driven. Apart from the above, new innovations in lightweight, weatherproofing materials and automation in the assembly of the products positively affect the acceptance in the market.

These initiatives, which are implemented across the EU for the interoperability of forces, have also been a significant supporter of the growth. The market is foreseen to record a compound annual growth rate of 4.9 percent from 2025 to 2035, being primarily affected by increasing regional defense collaborations and renewal processes.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

The deployable military shelter market of Japan is molded by the above trends that focus on defense security and the threats that regional security is pushing the country. Along with the accessibility and performance improvement, disaster relief shortens the time to eradication the obstacles for damage control and helps people to go back to a normal life. The integration of the latest techniques such as shelter automation and energy-efficient technologies are the major factors in the development of the market.

The backing of government policies and the private sector investment in more military capabilities are the main drivers of market vitality. The company's deployable military shelter segment is anticipated to achieve a 5.0% CAGR over the forecast period due to the strategic steps of the military to build Infrastructures.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The deployable military shelter market in South Korea is supported by the strong backdrop of geopolitical tensions and military sponsorship. The centrality of mobile command centers and rapid deployment units to the operation drives demand. The preferred technological advancements, such as innovation in insulation and the lightweight design of the shelter itself, make it more operationally efficient.

The rise in the number of joint ventures with USA defense contractors also increases the market's capabilities. According to trends related to military modernization and joint security approaches, the South Korean deployable military shelter market will be able to rise at a CAGR of 5.2% from 2025 up to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Rigid Wall Shelter Dominates the Market Due to Durability and Protection

Rigid wall shelters have become the frontrunners in the deployable military shelter market because of their incredible durability, safety, and weather resistance. These military tents are built with metal or composite materials, which act as a protective shield against environmental threats like rain, wind, and UV light. Their modular design enables them to be built quickly and used for a variety of military applications, such as command centers, field hospitals, and storage units.

These are the most wanted shelters during long-term deployment in high-risk operations because of their high-quality building materials and their ability to include insulation and climate control systems. The demand is driven mainly by North America and Europe, where defense modernization programs call for mobile infrastructure solutions. Moreover, the geopolitical tensions running high have increased the interest in the development of durable, rapidly deployable military buildings.

Soft Wall Shelter Gains Traction Due to Lightweight and Cost-Effectiveness

Soft wall shelters are increasingly popular because of their portability, lightweight construction, and efficiency. These soft wall shelters are made from high-strength fabrics and present the flexibility of quick installation in case of emergency and military operations. They take up less space than rigid wall shelters, are more convenient to carry and assemble, and are therefore preferred in-temporary field camps, medical units, and relief operations.

Moreover, soft wall shelters are an excellent solution for harsh environments since they are often reinforced with polymer coatings that increase durability and weather resistance. Countries in the Asia-Pacific and the Middle East are increasingly adopting soft wall shelters due to their competitive price and fast deployment capability in conflict zones and disaster-affected areas. The development of fabric technology, including higher insulation and fire resistance has also led to the use of more diverse materials in the market.

Polymer Fabric is the Key Player Due to High Durability and Adaptability

Polymer fabric prevails as the material used in deployable military shelters, given its light weight, weather resistance, and long durability. The military prefers polymer fabric for soft wall shelters since the material provides remarkable tear resistance, UV protection, and waterproof capabilities. These fabrics are designed for fire resistance and thermal insulation to improve soldier safety in extreme situations. They can also be treated with non-toxic antimicrobial coatings for medical and emergency response units.

The emphasis on recyclable and reusable materials has driven the development of polymer shelters, including self-repair and smart fabric breakthroughs. In addition, the increased military budgets in North America and Asia-Pacific are driving the demand for these efficient materials.

Composite Materials Are Trending with High-Strength and Lightweight Features

Composite materials are embraced in deployable military shelters for the impressive gain of strength-to-weight, resistance to corrosion, and thermal insulation enhancement. Often these materials are a blend of carbon fiber, fiberglass, and other compositions, resembling with the structural power of metals the weight aspect is vastly reduced. Composite shelters, on the other hand, offer greater ballistic protection thus well-suited for risky military operations and extreme environmental conditions.

Their modular nature permits effortless customization, enabling pairing with solar panels, advanced HVAC systems, and smart surveillance equipment. The upcoming military bases and next-generation technological investments are the drivers for composite shelters, particularly in countries with rapid deployment capabilities, like the United States, Europe, and China.

The Deployable Military Shelter Market is expanding due to increasing defense budgets, military modernization, and the need for rapid-deployment infrastructure. Key players, including HDT Global, Roder HTS Hocker, and Alaska Structures, lead the market with innovative, durable, and modular shelter solutions. Technological advancements, such as lightweight materials, energy-efficient insulation, and solar-powered shelters, are shaping industry growth.

Sustainability efforts and market consolidation through mergers and acquisitions further drive competition. North America dominates, while Europe and APAC witness growing demand due to geopolitical tensions. The market's future will be influenced by advancements in smart shelters, ballistic protection, and hybrid energy systems, ensuring rapid deployment and efficiency in military operations worldwide.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| HDT Global | 15-20% |

| Roder HTS Hocker | 12-16% |

| Alaska Structures | 10-14% |

| Weatherhaven | 8-12% |

| Losberger De Boer | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| HDT Global | Specializes in rapid-deployment military shelters, incorporating advanced insulation and weather resistance. |

| Roder HTS Hocker | Provides modular and expandable military shelters with superior climate control features. |

| Alaska Structures | Focuses on energy-efficient and lightweight shelters designed for extreme environments. |

| Weatherhaven | Offers rapidly deployable and rugged shelters with integrated command-and-control solutions. |

| Losberger De Boer | Develops flexible, scalable, and durable shelter solutions for military operations worldwide. |

Key Company Insights

HDT Global

HDT Global is a prominent company that is the world leader in rapid-deployment military shelters with superior weather- and moisture-proofing capabilities. The company deals with the supplies of the USA military and NATO forces, specializing in modular and self-sustaining designs. Their units are integrated with the most energy-efficient systems, HVAC solutions, and ballistic protection in combat conditions.

HDT Global has made a move into the development of smart energy technologies, to be able to enhance both maneuverability and durability in extreme conditions. Thanks to the global coverage of the company, HDT is constantly expanding its product portfolio to be in line with the changing military fight.

The recent developments of the company include hybrid-powered tents and lighter weight composite materials, which are used to transport and deploy more effectively. The company's strong R&D capabilities and strategic partnerships help it to maintain a strong market position.

Roder HTS Hocker

Roder HTS Hocker, a leading European manufacturer of modular and expandable military shelters, makes shelters that are fully adaptable to climate which can work in extreme temperatures and are highly durable. The company is one of the best players in the European, Middle Eastern, and African arenas, providing modular field camps, mobile command centers, and medical shelters.

Their shelters have aluminum frame structures, which assure that they are lightweight yet robust. With the increase in the NATO countries' defense budgets, the company is securing the market by collaboration with local businesses and contracting with governments. Future plans consist of the implementation of technologies that will increase thermal efficiency, the broad spectrum of renewable energy sources, and the construction of tactical tents for military missions in hostile environments.

Alaska Structures

Alaska Structures provides energy-efficient, sustainable, lightweight shelters designed for use in the most demanding environments on the planet and especially, in the polar, desert, or high-altitude regions. The company specializes in rapid deployment and operationally efficient solar-powered military shelters for the USA and allied forces. Their shelters exhibit high strength fabrics, insulation panels as well as integrated HVAC systems that make them durable against the harshest conditions.

Alaska Structures is introducing hybrid energy solutions cutting the expenses of diesel generators in remote places. The company persists and expands by concluding the long-term association with the Army Weberhahn Company and by making investments in command post facilities and listen UAV shelters. The company has been successful in capturing the mobile military base and the extreme weather protection market.

Weatherhaven

Weatherhaven is a deployable command-and-control shelters provider, the majority of which are used for military, humanitarian, and disaster relief applications. The company designs robust, multi-purpose shelters, including but not limited to design mobile hospitals, communication hubs and quickly deployable field offices. The company produces vehicles, which can be used practically anywhere, in Antarctic tundra or tropical summer, by developing multipurpose, rugged shelters, and weather-dependent designs.

Weatherhaven has the eyes on APAC and Latin America and consolidated its market share on the North America&Europe fronts by entering new territories with this plan. Among their advancements, there is an integrated power management system and a structure that is ballistic-resistant. Weatherhaven's partnerships with different government agencies and military organizations have turned the company into a trustworthy supplier in defense and emergency response operations worldwide.

Losberger De Boer

Losberger De Boer is a supplier of military shelters that are flexible, scalable, and durable. The company is a provider of large-scale deployable base camps that mainly cater to defense, peacekeeping, and disaster relief units. Losberger De Boer has managed to get contracts with European military forces and NATO operations which will strengthen the presence of auf Ström department in Europe.

The company is looking into the replacement of the old steel-framed shelters with lightweight aluminum-framed shelters, which are easier to assemble, and project modular expansion, and advanced insulation technology. Its shelters are used for aircraft hangars, logistics hubs, and tactical command centers. Losberger De Boer is actively developing smart shelter systems with automated climate control and improved energy efficiency, ensuring adaptability for modern military requirements.

In terms of Shelter Type, the industry is divided into Rigid Wall Shelter, Soft Wall Shelter

In terms of Material, the industry is divided into Polymer Fabric, Nylon, Polyester, Composite

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Deployable Military Shelter market is projected to reach USD 1.9 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Deployable Military Shelter market is expected to reach USD 3.1 billion.

The Rigid Wall Shelter segment is expected to dominate the market, due to its superior durability, enhanced protection, rapid deployment capability, adaptability to harsh environments, and widespread use in command centers, medical units, and storage.

Key players in the Deployable Military Shelter market include HDT Global, Roder HTS Hocker, Alaska Structures, Weatherhaven, Losberger De Boer.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Deployable Military Shelter Systems Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA