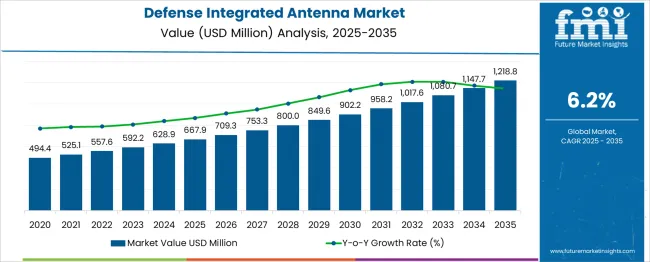

The Defense Integrated Antenna Market is estimated to be valued at USD 667.9 million in 2025 and is projected to reach USD 1218.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. A Half-Decade Weighted Growth analysis reveals key trends in market expansion. Between 2025 and 2030, the market increases from USD 667.9 million to USD 958.2 million, contributing USD 290.3 million in growth.

This period accounts for approximately 37% of the total market expansion, driven by rising demand for advanced communication systems in military applications. During this phase, the market grows at a CAGR of 7.5%, reflecting the adoption of next-generation integrated antennas in defense systems. In the second half of the decade, from 2030 to 2035, the market continues to rise, adding USD 260.6 million, reaching USD 1,218.8 million.

The growth rate during this period stabilizes at a slightly lower CAGR of 4.9%, contributing around 33% of the total growth. This slower growth is indicative of the market approaching a stage of maturity, where innovation remains steady but with more gradual adoption. The weighted growth analysis shows that the first half of the forecast period is more dynamic, while the second half is marked by a consolidation phase as defense industries continue to integrate advanced antenna technologies at a steady pace.

| Metric | Value |

|---|---|

| Defense Integrated Antenna Market Estimated Value in (2025 E) | USD 667.9 million |

| Defense Integrated Antenna Market Forecast Value in (2035 F) | USD 1218.8 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The defense integrated antenna market is advancing steadily, supported by modernization initiatives in communication systems, increased reliance on secure data transmission, and rising procurement of advanced platforms across air, land, and sea domains. The emphasis on multi-band, software-defined communication systems has accelerated demand for compact, integrated antennas capable of operating across diverse frequency spectrums.

Increased investments in ISR (Intelligence, Surveillance, and Reconnaissance), electronic warfare, and satellite communication networks are further driving antenna integration across next-generation defense platforms. Enhanced threat detection, jamming resistance, and long-range targeting enabled through adaptive antennas are shaping procurement priorities globally.

As militaries pursue interoperability and real-time connectivity in joint operations, integrated antenna systems are emerging as key enablers of network-centric warfare. Future growth will be sustained by advancements in beam steering technologies, low-profile composite materials, and embedded communication subsystems designed to support faster, more agile battlefield communications.

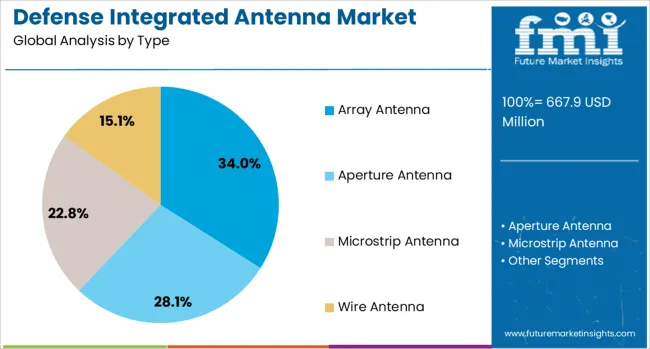

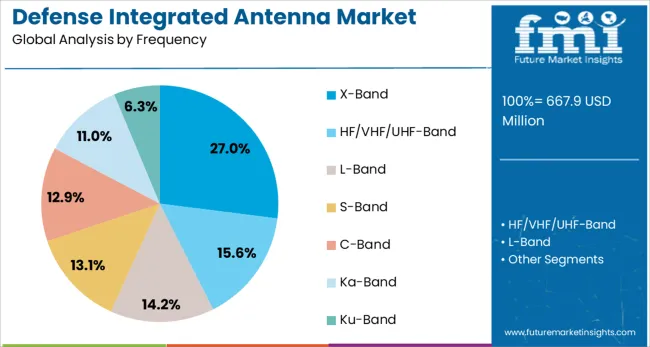

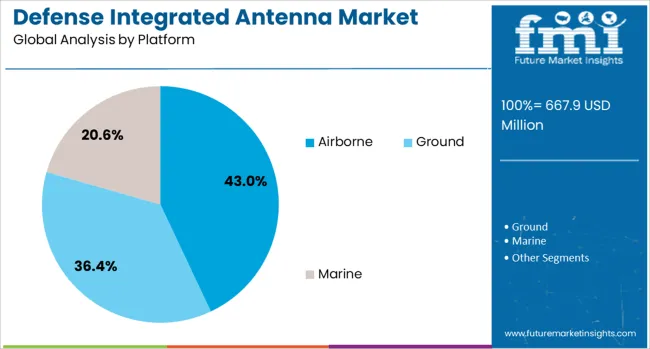

The defense integrated antenna market is segmented by type, frequency, platform application, and geographic regions. The defense integrated antenna market is divided into Array Antenna, Aperture Antenna, Microstrip Antenna, and Wire Antenna. In terms of frequency, the defense integrated antenna market is classified into X-Band, HF/VHF/UHF-Band, L-Band, S-Band, C-Band, Ka-Band, and Ku-Band. The defense integrated antenna market is segmented into Airborne and Ground Marine.

The defense integrated antenna market is segmented into Communication, Navigation & Surveillance, and Telemetry. Regionally, the defense integrated antenna industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Array antennas are expected to account for 34.00% of the total market revenue in 2025, making them the leading antenna type in the defense sector. This dominance is being driven by their ability to offer electronic beam steering, improved directivity, and robust performance in contested electromagnetic environments.

Array configurations enable simultaneous multi-mission support, enhancing battlefield flexibility and command responsiveness. These antennas are being widely deployed in phased array radar systems, electronic countermeasures, and situational awareness equipment across platforms.

Their low latency, enhanced tracking precision, and ability to dynamically adapt to target movement make them highly suitable for modern threat landscapes. Continued integration into modular communication architectures and the shift toward software-defined radios are reinforcing the relevance of array antennas in next-generation defense networks.

X-Band frequencies are projected to hold 27.00% of the total revenue share in 2025, establishing this band as the most utilized in defense applications. Their selection is attributed to superior propagation characteristics, which make them optimal for long-range radar and tactical communications.

X-Band antennas enable higher resolution imaging and faster target acquisition, essential for missile guidance, airborne surveillance, and advanced fire-control systems. The frequency's balance between atmospheric penetration and data throughput positions it favorably for beyond-line-of-sight (BLOS) communications.

With increasing demand for high-capacity, secure links in dynamic combat scenarios, X-Band is expected to remain central to future antenna configurations. Its compatibility with satellite payloads and unmanned systems has further bolstered deployment across expanding digital battlefield infrastructure.

Airborne platforms are forecast to contribute 43.00% of the total market share in 2025, positioning them as the dominant application base for integrated defense antennas. The growth of this segment is being fueled by the rising deployment of fighter jets, UAVs, and surveillance aircraft requiring lightweight, aerodynamic communication and radar systems.

Integrated antennas support stealth, high-altitude connectivity, and multi-domain operations, making them ideal for modern aerial platforms. Enhanced requirements for situational awareness, real-time video transmission, and secure command relay from airborne assets are driving further integration.

With militaries expanding their airborne fleets to support reconnaissance, EW, and electronic support measures, the need for compact, embedded antennas capable of wideband functionality has intensified. Technological advancements in conformal and flush-mounted designs are also helping reduce drag while maintaining performance, further supporting widespread use in the airborne domain.

The defense integrated antenna market is expanding due to the increasing demand for advanced, secure communication systems in military applications. The need for lightweight, efficient, and reliable antennas for communication, navigation, and surveillance in various defense platforms is driving growth. While high development and maintenance costs present challenges, technological advancements in miniaturization and the integration of 5G and AI are opening new opportunities. These innovations are enhancing communication capabilities, particularly in unmanned systems, and providing a strong foundation for the continued growth of the defense integrated antenna market.

The growing need for advanced and secure communication systems in defense applications is a primary driver for the defense integrated antenna market. Modern military operations demand robust, reliable, and real-time communication, driving the demand for integrated antennas that offer seamless connectivity. The integration of antennas into defense systems allows for reduced space, weight, and power consumption, which are critical factors for military vehicles, aircraft, and satellite systems. The rising focus on national security and defense technology modernization is further propelling market growth. The increasing defense budgets, especially in emerging economies, are driving the demand for advanced integrated antennas capable of supporting advanced communication, navigation, and surveillance systems.

One of the significant challenges in the defense integrated antenna market is the high cost of research, development, and maintenance associated with these advanced technologies. Developing integrated antennas that meet the strict performance, size, and durability requirements for defense applications demands significant investment. The complexity of designing antennas that can operate efficiently in extreme environmental conditions further adds to the development costs. The maintenance and repairs for defense communication systems are often expensive, especially for military operations in remote or challenging environments. These high costs can limit widespread adoption, particularly in countries with smaller defense budgets or those facing economic constraints.

The defense integrated antenna market offers substantial opportunities driven by technological advancements, particularly in the miniaturization of antenna systems. The need for lightweight, compact, and highly efficient antennas for military vehicles, drones, and wearable devices is growing. These developments open the door for smaller, more powerful antennas that can be integrated into diverse defense applications without compromising functionality. The increasing use of unmanned systems, including drones and autonomous vehicles, provides significant growth opportunities for integrated antennas. Furthermore, the rise in demand for advanced radar, communication, and surveillance systems in defense is contributing to the expansion of the market, offering manufacturers the chance to innovate and meet emerging military needs.

One of the prominent trends in the defense integrated antenna market is the integration of 5G and artificial intelligence (AI) technologies to enhance communication capabilities. The demand for higher data transmission speeds and more reliable communication systems in defense applications is driving the adoption of 5G technology, which promises lower latency and increased bandwidth. Additionally, AI is being increasingly used in defense systems for real-time data analysis, threat detection, and network optimization, all of which rely on advanced antenna systems. The use of AI to adapt and improve the efficiency of antenna systems in real-time is becoming more prevalent, helping military forces gain a tactical advantage. This trend is reshaping the defense communication landscape, making antennas smarter and more adaptable.

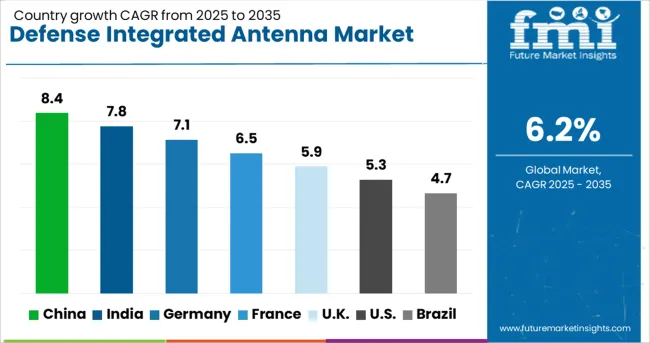

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The defense integrated antennas market is projected to grow at a CAGR of 6.2% from 2025 to 2035. Among the top markets, China leads at 8.4%, followed by India at 7.8%, Germany at 7.1%, the United Kingdom at 5.9%, and the United States at 5.3%. These rates translate to a growth premium of +35% for China, +25% for India, and +10% for Germany compared to the global baseline, while the UK and USA show slower growth. The divergence in growth rates reflects national differences in defense investments, with BRICS countries like China and India showing rapid military modernization, while OECD nations, such as the USA and UK, see steady growth fueled by technological advancements in communication systems and defense collaborations. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 8.4% through 2035, driven by the country’s large-scale investments in defense technology and infrastructure. As a global leader in defense innovation, China is increasing its focus on advanced communication systems, including defense integrated antennas, to support military operations and communication networks. The demand for integrated antennas in satellite communications, radar systems, and military vehicle networks is on the rise, supported by China’s efforts to modernize and enhance its military capabilities. The country’s strong defense industry, coupled with rising research and development efforts, ensures continued market expansion.

India is projected to grow at a CAGR of 7.8% through 2035, driven by increasing investments in defense infrastructure and technology. As India strengthens its military capabilities, the demand for advanced communication systems, including defense integrated antennas, is rising. The country’s focus on enhancing its defense systems, including satellite communication, radar, and wireless networks, is accelerating market growth. Additionally, the modernization of India’s armed forces, combined with growing defense budgets, is expected to fuel the adoption of integrated antennas in various defense applications. India's robust defense sector, combined with government initiatives, further supports the demand for advanced antennas.

Germany is expected to grow at a CAGR of 7.1% through 2035, supported by increasing demand for advanced communication systems in defense applications. Germany's strong focus on modernizing its military infrastructure and increasing investments in advanced technologies, such as satellite communication and radar systems, is driving the adoption of defense integrated antennas. As the country enhances its defense communication networks, the demand for these antennas continues to rise. Additionally, Germany’s participation in NATO and its growing defense collaborations further stimulate the need for robust and secure communication technologies, boosting market growth.

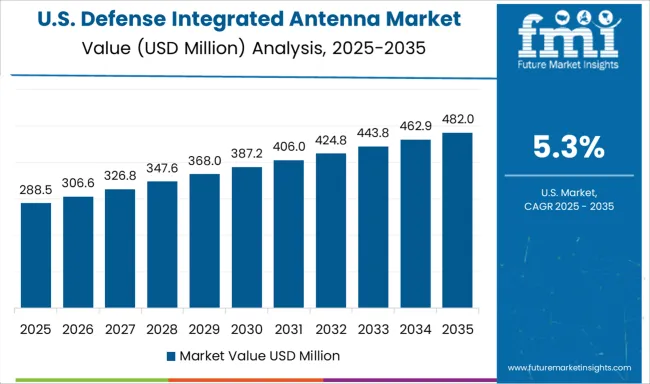

The United States is projected to grow at a CAGR of 5.3% through 2035, driven by the country’s continued leadership in defense and military technology. The USA military’s reliance on advanced communication networks, including satellite and radar communication, drives demand for integrated antennas. The country’s focus on upgrading its defense infrastructure and military capabilities, including advanced radar systems, communication satellites, and tactical vehicles, is contributing to steady market growth. Additionally, the growing emphasis on cybersecurity and secure communication further boosts the demand for robust integrated antenna systems in military applications.

The United Kingdom is projected to grow at a CAGR of 5.9% through 2035, driven by steady demand for defense integrated antennas, especially in defense communication systems. The UK’s commitment to enhancing its military and defense infrastructure, alongside investments in satellite communications and radar systems, supports continued growth in the market. The demand for secure communication networks for military operations, including airborne and naval defense, is expected to drive further market adoption. The increasing focus on defense modernization and the UK’s strategic role in global defense collaborations ensures strong growth prospects for the integrated antenna market.

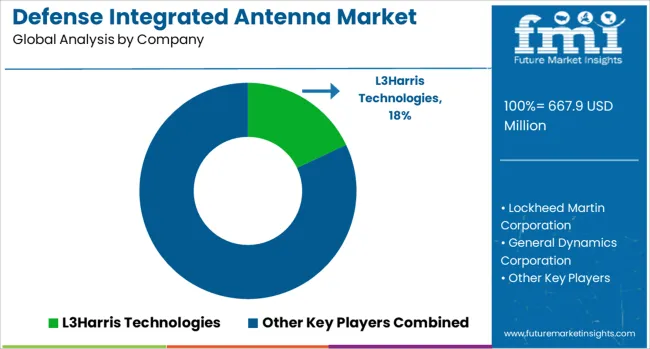

The defense integrated antenna market is driven by major players specializing in advanced communication and radar technologies for military applications, including satellite communication, secure data transmission, and radar systems. L3Harris Technologies leads the market with its cutting-edge integrated antenna systems, providing highly reliable solutions for both ground-based and airborne defense platforms.

Lockheed Martin Corporation and General Dynamics Corporation are also key players, offering advanced integrated antenna systems for tactical communication, electronic warfare, and missile defense applications, often focusing on system integration and robustness in hostile environments. Thales Group and Rohde & Schwarz supply highly specialized antennas for radar, satellite communication, and defense electronics, catering to both commercial and military markets.

Honeywell International Inc. and Airbus provide aerospace-grade integrated antenna systems for communication and surveillance platforms, ensuring enhanced connectivity and real-time data sharing for defense operations. These companies emphasize technological innovation in miniaturization, multi-band functionality, and the integration of artificial intelligence for signal processing.

Competitive differentiation in this market depends on factors such as frequency range, signal fidelity, operational reliability in extreme conditions, and the integration of advanced materials and coatings to enhance durability. Barriers to entry include the high cost of development, advanced manufacturing processes, and regulatory compliance with defense industry standards. Strategic priorities include expanding military-grade communication capabilities, developing multi-function antenna systems, and enhancing network security features for defense applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 667.9 Million |

| Type | Array Antenna, Aperture Antenna, Microstrip Antenna, and Wire Antenna |

| Frequency | X-Band, HF/VHF/UHF-Band, L-Band, S-Band, C-Band, Ka-Band, and Ku-Band |

| Platform | Airborne, Ground , and Marine |

| Application | Communication, Navigation & Surveillance, and Telemetry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L3Harris Technologies, Lockheed Martin Corporation, General Dynamics Corporation, Thales Group, Rohde & Schwarz, Honeywell International Inc., and Airbus |

| Additional Attributes | Dollar sales by antenna type (satellite communication, radar, electronic warfare) and end-use segments (military, aerospace, defense contractors). Demand dynamics are driven by increasing defense spending, the need for secure communications, and the integration of advanced radar and electronic warfare systems in modern military operations. Regional trends show North America and Europe leading the market due to high defense budgets and technological advancements, while Asia-Pacific is emerging as a growth region driven by defense modernization programs. |

The global defense integrated antenna market is estimated to be valued at USD 667.9 million in 2025.

The market size for the defense integrated antenna market is projected to reach USD 1,218.8 million by 2035.

The defense integrated antenna market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in defense integrated antenna market are array antenna, aperture antenna, microstrip antenna and wire antenna.

In terms of frequency, x-band segment to command 27.0% share in the defense integrated antenna market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA