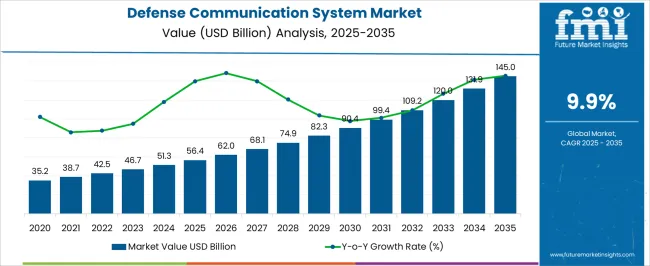

The Defense Communication System Market is estimated to be valued at USD 56.4 billion in 2025 and is projected to reach USD 145.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

| Metric | Value |

|---|---|

| Defense Communication System Market Estimated Value in (2025 E) | USD 56.4 billion |

| Defense Communication System Market Forecast Value in (2035 F) | USD 145.0 billion |

| Forecast CAGR (2025 to 2035) | 9.9% |

The defense communication system market is witnessing steady expansion supported by the growing need for secure, real time, and resilient communication infrastructure across defense operations. Rising geopolitical tensions, modernization initiatives, and the integration of advanced technologies such as satellite communication, software defined radios, and encrypted systems are driving widespread adoption.

Governments are increasingly investing in communication platforms that ensure interoperability across air, land, and naval forces while maintaining cyber resilience. The adoption of artificial intelligence and machine learning for secure data transmission and battlefield awareness is further enhancing operational efficiency.

As defense agencies prioritize robust connectivity, mission critical reliability, and advanced surveillance capabilities, the market outlook remains positive with sustained investments in innovation and infrastructure upgrades.

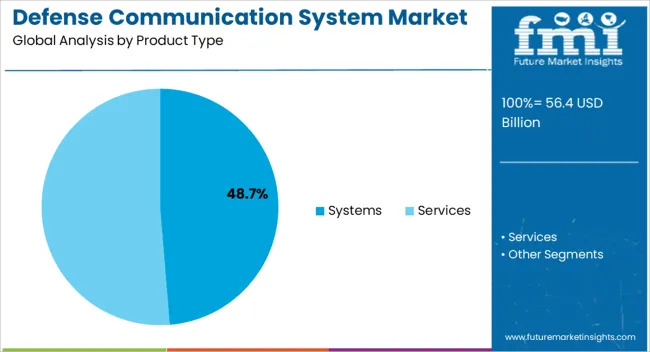

The systems segment is projected to account for 48.70% of the overall market by 2025, positioning it as the most significant product type. This dominance is attributed to the increasing requirement for integrated and secure communication networks that connect diverse platforms across defense ecosystems.

Systems provide scalability, reliability, and interoperability, making them vital for command and control operations. Their integration with advanced cybersecurity frameworks and satellite based technologies further strengthens their value.

As defense modernization projects continue to emphasize seamless connectivity and real time decision making, systems remain the cornerstone of product adoption in the defense communication system market.

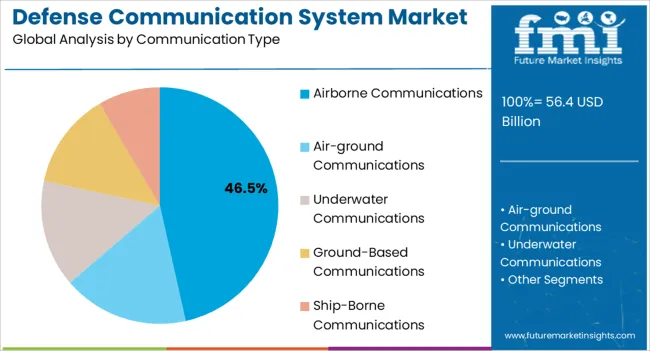

The airborne communications segment is expected to contribute 46.50% of total market revenue by 2025 within the communication type category, making it the leading segment. The growth of this segment is driven by increasing demand for secure and uninterrupted communication during air missions, including surveillance, reconnaissance, and combat operations.

Airborne platforms require robust communication systems that ensure high speed data transfer, low latency, and secure connections in contested environments. The rising procurement of next generation aircraft, drones, and unmanned aerial vehicles has also reinforced reliance on advanced airborne communication systems.

These factors have collectively positioned airborne communications as the leading communication type within the market.

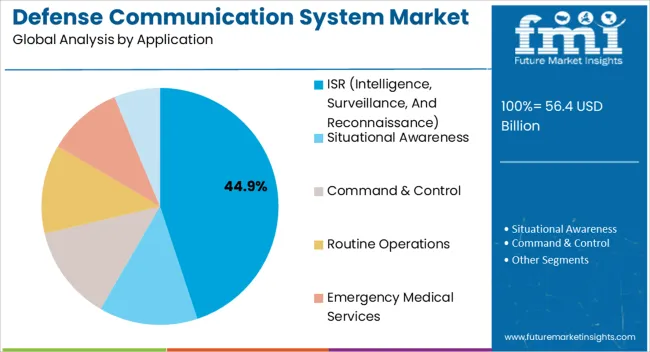

The ISR application segment is anticipated to hold 44.90% of the overall market by 2025, making it the most prominent application category. The growth is being propelled by the rising emphasis on intelligence gathering, surveillance accuracy, and reconnaissance efficiency in modern warfare.

Advanced communication systems are enabling defense agencies to collect, process, and share real time battlefield information, thereby improving situational awareness and decision making. Increased investments in drone based surveillance, satellite imagery, and integrated communication nodes have further supported this segment’s expansion.

With growing reliance on actionable intelligence for both defensive and offensive strategies, ISR remains the dominant application driving demand in the defense communication system market.

The market is anticipated to face some hurdles by innovation across a wide range of engineering disciplines, along with future waveform upgrades. However, numerous countries have recognized the security risks posed by foreign UUVs, prompting them to establish defense communication systems using low-frequency sonars.

Defense high-frequency communication systems (DHFCS) are the world's most modern tactical communications networks, as well as the most automated system. ADF now has a new level of communication capability thanks to its remarkable range and capacity to automatically identify the best frequency. Also, its ability to connect without operator interaction and great connection speed is expected presently making it the most notable market segment.

The rising adoption of Internet of Things (IoT) technology is significantly improving many aspects of military operations, besides communication. Also, the adoption of IoT in military services is strengthening their intelligence reconnaissance operations surveillance by reducing the need for active communication.

Recent improvements in low-power computing, miniaturization, and radio frequency are also creating high-growth opportunities for defense communication system providers. Going ahead, some leading players are now incorporating digital identification, and machine-to-machine communication techniques to gain a competitive edge over their rivals.

Based on the defense communication system market survey report numbers, the net worth of the market stood at USD 35.2 billion. Defense communication system sales rose at an average annual growth rate of 7.8% from 2020 to 2025. Continuous advances in defense infrastructure by several economies were the main driving force for this appreciable growth of the market.

Many countries slashed military spending thereby lowering the demand during the years 2024 and 2024 because of the pandemic impact on the economy. However, rising tensions between Russia and Ukraine in 2024 encouraged countries to possess advanced tactical weapons helping manufacturers reclaim their market share.

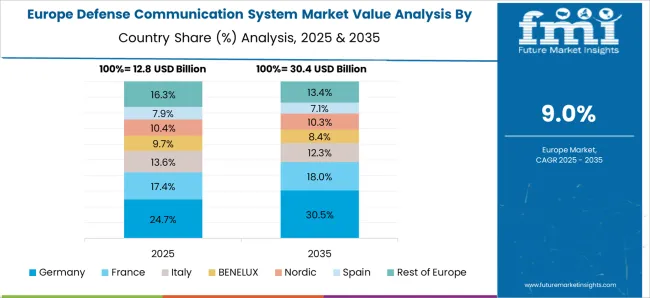

Because of high spending on national defense, demand for defense communication systems in North America and Europe remains relatively high than in other regions. North America’s defense communication system market accounted for a market share of around 36.5% in the global landscape in 2025. The sales of defense communications systems in the countries of Europe secured 24.8% of the global market share in 2025.

The demand for defense communication systems in countries of Latin America accounted for 4.4% of the global market share in 2025. During the forecast years, sales in the region are expected to be driven by rising border safety issues.

Asia Pacific market is expected to rise notably and recorded 28% of the global market share in 2025. High government investments in military and defense equipment are presenting an attractive potential for defensive communication system providers in the region.

The Middle East and Africa together accounted for only 6.3% of the worldwide market share in 2025. This regional market is likely to grow at a slow pace than other regions; however, improving by the end of the projected period.

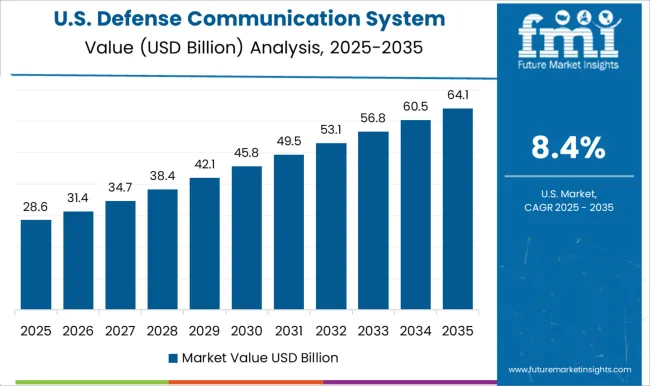

The United States defense sector is known for having a huge network of logistical and remote operations that needs continuous monitoring. As such, demand for defense communication systems with modern technologies is always high in the country.

The United States Army is planning to spend more than USD 56.4 billion on new handheld man-pack radios by 2025, according to its budget reveals. These radios are only a part of the army8.49;s updated battlefield network spending, which it wants to expand every two years going ahead.

| Regional Markets | Global Market Share in Percentage |

|---|---|

| The United States | 20.5% |

| Germany | 7.6% |

| Japan | 5.4% |

| Australia | 56.4.2% |

Up to half of all defense spending in Europe is spent by 56.4 countries, namely the United Kingdom, France, and Germany. Germany is the leading region for the production and sales of defense communication systems owing to its strong industrial and manufacturing base. Though the domestic demand for defense equipment in Germany is insignificant the manufacturers have captured a considerable share in the international market.

The requirement for the defense communication system in the United Kingdom is growing incessantly these years intending to strengthen military power. Similarly, France is also anticipated to present some key growth opportunities during the forecast years.

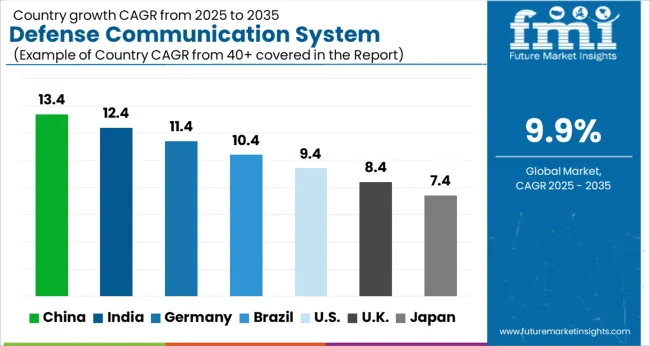

| Regional Markets | CAGR (20256.4 to 2056.456.4) |

|---|---|

| The United Kingdom | 8.7% |

| China | 9.7% |

| India | 12.1% |

China is known to be one of the advanced military powers along with a robust market for all types of advanced defense equipment and communication technologies. Interestingly, FMI finds the marine defense communication systems industry, in particular, is projected to see significant expansion in China over the coming years.

There is a significant need for coastal security systems, and a significant increase in marine commerce operations is supporting China’s market growth. Furthermore, China8.49;s marine communication system business is rising as a result of obligatory government laws and expanding marine commercial operations.

Satellite communication is critical to preserving the integrity of international borders with advanced communications and observation systems. Bandwidth demand has grown dramatically as operational needs have increased and technical innovations have evolved at a quick pace.

Expansion of satellite communication infrastructure aids in the development of new terrestrial broadcasting networks, which improves operational coordination. As a result of the expansion of satellite communication infrastructure, demand for the communication system segment is increasing notably.

Radio systems are also helpful in communicating through radio waves. Because sonar systems are effective against mines and aid in anti-submarine warfare, they are widely used in naval combat. To boost their marine capabilities, many countries are upgrading their naval fleets rendering the radio segment at a promising growth rate through 2035.

| Category | Product Type |

|---|---|

| Top Segment | Systems |

| Market Share in Percentage | 58.7% |

| Category | Military Branch |

| Top Segment | Land Force Defense Communication System |

| Market Share in Percentage | 40.3% |

Currently, the use of wireless communication systems in the land forces defense sector is quite high and dominates the overall market. As land forces constitute the first line of defense, so years of efforts to modernize it has supported such growth of this segment. Most of the leading manufacturers operating in the market today focus on this segment due to high sales opportunities.

Ship-to-ship and ship-to-shore communication are both parts of marine communication systems that is gaining traction in recent years. New technologies in the field of marine communication systems are constantly strengthening this segment nowadays. A significant share of the marine communication equipment market is held by local and emerging marine communication providers, resulting in a highly concentrated market.

Air forces also utilize satellite and radio communication channels. However, less dependence on this military branch has kept the demand for defense communication systems limited in this segment.

Companies are focusing on providing advanced communication products by leveraging the latest technologies. They further aim at expanding their product portfolios with innovations in defense management solutions. Continuous refinement in the defense sector is also creating high competition among participants for technological breakthroughs in communication systems, thereby diversifying the market.

Industries producing defense communication system components are continually focusing on providing leading products following up on the revised mandates of military organizations. They are also following the strategy of entering into collaborations and partnerships with other big players to get new market opportunities.

In developed markets, opportunities for defense communication system makers remain strong as they have advanced beyond basic two-way communication to multiple-device communication. Further, the advancement of communication systems with low-latency point-to-point wireless links is expected to bring in several opportunities.

Significant advancement and integration of IoT have resulted in the manufacturing of robust defense communication devices in recent years. During the forecast years, fusing many such cutting-edge technologies can be an appropriate step for existing players to expand their business.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Türkiye, South Africa, GCC Countries |

| Key Market Segments Covered | By Product Type, By Application, By Military Branch, By Region |

| Key Companies Profiled | General Dynamics Corporation; Airbus S.A.S.; QinetiQ Group PLC; BAE Systems PLC; Northrop Grumman Corporation; Rockwell Collins Inc.; Lockheed Martin Corporation; Raytheon Company; Thales Group; Harris Corporation |

| Pricing | Available upon Request |

The global defense communication system market is estimated to be valued at USD 56.4 billion in 2025.

The market size for the defense communication system market is projected to reach USD 145.0 billion by 2035.

The defense communication system market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in defense communication system market are systems, _satellite communication systems, _radar & sonar systems, _radio systems, services, _consulting services, _testing & integration services and _support & maintenance services.

In terms of communication type, airborne communications segment to command 46.5% share in the defense communication system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Defense Electronic Market Size and Share Forecast Outlook 2025 to 2035

Defense Aircraft Materials Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronics Obsolescence Market Size and Share Forecast Outlook 2025 to 2035

Defense Integrated Antenna Market Size and Share Forecast Outlook 2025 to 2035

Biodefense Market Analysis – Size, Share & Forecast 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

CBRNE Defense Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Communication Platform as a Service (CPaaS) Market Analysis - Size, Share & Forecast 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

V2X Communication Module Market Size and Share Forecast Outlook 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA