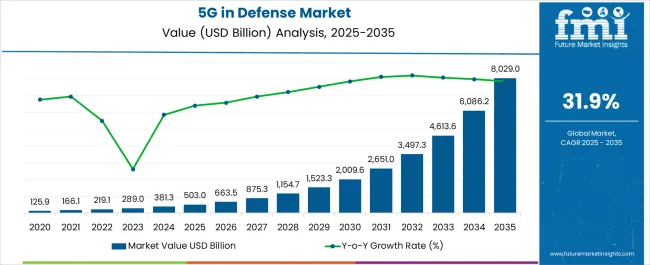

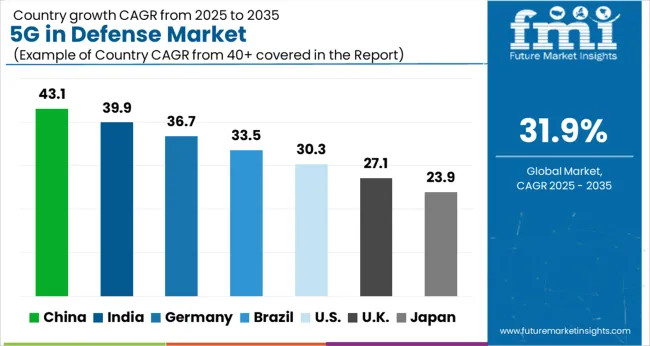

The 5G in Defense Market is estimated to be valued at USD 503.0 billion in 2025 and is projected to reach USD 8029.0 billion by 2035, registering a compound annual growth rate (CAGR) of 31.9% over the forecast period.

| Metric | Value |

|---|---|

| 5G in Defense Market Estimated Value in (2025 E) | USD 503.0 billion |

| 5G in Defense Market Forecast Value in (2035 F) | USD 8029.0 billion |

| Forecast CAGR (2025 to 2035) | 31.9% |

The 5G in defense market is advancing rapidly, fueled by the need for high-speed, low-latency communication systems that enhance mission-critical operations and situational awareness. Defense journals and government technology reports have emphasized the role of 5G in enabling secure connectivity for command-and-control systems, unmanned vehicles, and sensor networks.

Investments from defense ministries and collaborations with telecom providers have accelerated the deployment of pilot programs and testbeds across military bases and operational environments. The integration of 5G into defense ecosystems has also been supported by advancements in spectrum allocation and secure communication protocols, addressing national security priorities.

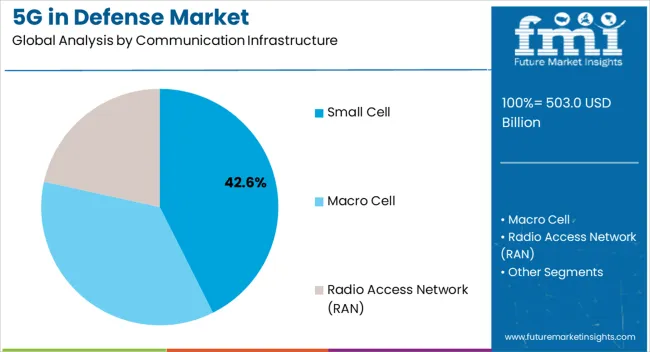

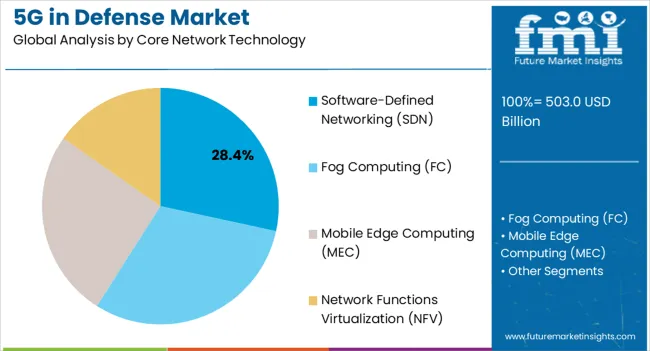

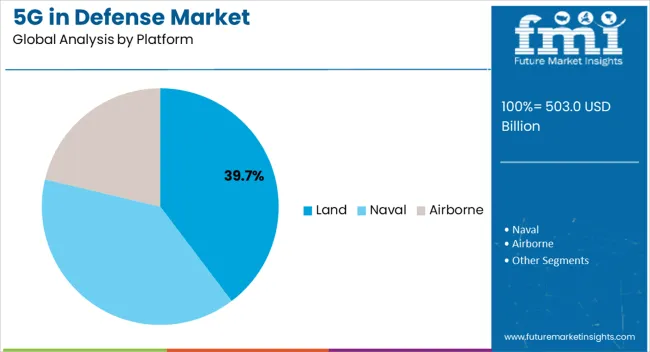

Future adoption is expected to be shaped by the development of interoperable systems, integration with artificial intelligence, and the expansion of edge computing capabilities to support real-time battlefield decisions. Segmental growth is projected to be led by small cells in communication infrastructure, software-defined networking (SDN) in core network technologies, and land-based platforms, each driven by scalability, adaptability, and operational necessity.

The Small Cell segment is projected to account for 42.6% of the 5G in defense market revenue in 2025, reflecting its critical role in establishing dense and reliable communication networks. Growth of this segment has been driven by the ability of small cells to enhance coverage and capacity in confined or complex environments such as military bases, urban combat zones, and naval vessels.

Defense publications have noted that small cells support low-latency communications and enable seamless connectivity for unmanned aerial and ground systems. Their compact form factor and flexibility in deployment have made them suitable for rapid installation in both fixed and mobile defense operations.

Furthermore, small cells reduce dependency on large infrastructure by allowing localized networks to be established with greater resilience. These attributes have secured their widespread adoption in defense applications, ensuring reliable communication in mission-critical environments.

The Software-Defined Networking (SDN) segment is anticipated to hold 28.4% of the 5G in defense market revenue in 2025, maintaining its position as the leading core network technology. This dominance has been driven by SDN’s capability to provide centralized control, improved network agility, and enhanced security—features critical for defense operations.

Defense technology reports have highlighted that SDN allows dynamic reconfiguration of networks to adapt to changing operational requirements in real time. The programmability of SDN has also enabled defense organizations to strengthen cyber defense measures, isolating threats and ensuring secure data flow.

Additionally, SDN supports seamless integration with advanced technologies such as AI and cloud platforms, enabling predictive analysis and automated network management. With increasing demand for network resilience and operational flexibility, SDN has emerged as the preferred approach to managing defense communication infrastructure under 5G frameworks.

The Land platform segment is projected to contribute 39.7% of the 5G in defense market revenue in 2025, consolidating its role as the leading platform. This segment’s growth has been driven by the deployment of 5G-enabled systems in ground-based defense operations, including command centers, armored vehicles, and mobile communication units.

Defense organizations have prioritized land platforms as they form the backbone of military logistics, surveillance, and tactical operations. The integration of 5G into land-based systems has enhanced capabilities in real-time data transfer, augmented reality-assisted training, and unmanned ground vehicle coordination.

Reports from defense agencies have also emphasized that land platforms benefit most immediately from 5G’s scalability, as they require robust, adaptable, and secure connectivity in diverse operational environments. With rising investments in modernizing ground forces and expanding digital battlefield infrastructure, the land segment is expected to sustain its dominant position in the 5G defense ecosystem.

As per the 5G in defense market research by Future Market Insights, historically, from 2020 to 2025, the market value of the 5G in defense market increased at around 82.8% CAGR. With an absolute dollar opportunity of USD 8143.3 billion, the market is projected to reach a valuation of USD 3.8 billion by 2035.

The 5G mobile network can connect almost everyone and everything, including objects, gadgets, and machines. The utilization of remarkably fast 5G networks for defense and security objectives could expand ISR systems and processing, upgrade logistics operations for increased efficiency, and develop new command and control ways, among other things. MILITARY EQUIPMENT AND TECHNOLOGY COMPANIES WILL USE 5G software and hardware for current and future systems, benefiting from valuable properties such as quick response times and wide bandwidths, allowing for significantly fast transmission and reception of images demonstrating real-time battlefield scenarios.

The growing reliance on big data for decision-making is projected to drive the increased need for 5G networks of defense equipment. The increased use of real-time data for decisive decision-making has raised substantial data collections. With faster and more thorough communication, the 5G network will establish the capacity to take huge amounts of data more swiftly. Through its 5G network, this new wireless network would allow for real-time data transfer from unmanned aerial vehicles and surveillance drones to command centers, boosting situational awareness and tactical reconnaissance.

Defense program demand will propel interoperability forward in the defense market. End-to-end slicing for unique end users can be carried out via 5G networks. Slices can be tailor-made to offer system performance needed by programs such as autonomous cars and trucks and automated process technology.

Some materials can be optimized because of this broader, higher spectrum and bandwidth. Additionally, 5 G's greater bandwidth can contribute to logistics and supply chain management by providing real-time insight into logistics using various sensors. Higher government investment in 5G will likely lead to its success in the defense market.

The high cost of building 5G infrastructure has slowed the growth of 5G in defense industry. The 5G network is built on fiber infrastructure, which requires considerable investment to grow. Similarly, macrocells, which employ low frequency waves to cover larger distances and provide intermittent network services, have a higher installation rate than small cells and femtocells. Furthermore, the 5G network core is based on Software-defined Networking (SDN) and Network Function Virtualization (NFV), both of which use HTTP and REST API protocols, both of which have vulnerabilities that can be exploited with tools, raising the risk of cyberattacks.

The 5G network has been shown to boost the performance of autonomous systems. China, the United States, and Israel are testing and using 5G technology in their military forces. Countries in Europe, such as France and Italy, are also planning to integrate 5G in their military forces. The US Army planned to deploy an array of battle robots at various combinability factors, including autonomous navigation, surveillance, and IED evacuation, according to the Federation of American Scientists (FAS) report Artificial Intelligence and National Security, written in November 2024. These devices would be utilized along with the fighting vehicle that could be manned.

The Navy created the Rapid Autonomy Integration Lab (RAIL) to build, assess, certify, and deploy new and improved autonomous systems. The 5G network is said to have improved the efficiency of autonomous systems by providing faster speeds and more capacity. As a result, the market is expected to be driven by an increase in the adoption of autonomous systems and connected devices due to their better and higher performance on the 5G network.

5G enables governments worldwide to deliver secure, dependable, and agile safety for their citizens and assets. These characteristics encourage governments to boost their funding for 5G technology development. For example, Taiwan's National Communications Commission (NCC) offered a subsidy of USD 380.7 Million to five telecom operators for the implementation of a 5G network from 2024 to 2025. This demonstrates governments' intentions to encourage the development of 5G technologies.

Government subsidies, R&D grants for 5G suppliers, and other forms of government assistance assist telecom companies and other enterprises involved in the 5G industry in creating high-cost infrastructures and services to promote the growth of 5G. This move benefits several companies, including L3Harris Technologies, Inc., Raytheon Technologies Corporation, Telefonaktiebolaget LM Ericsson, and Nokia Corporation. Brazil, China, and India intend to introduce 5G in both private and government applications.

The rise of the 5G sector is aided by government funding. During the forecast period, the increase in government efforts is likely to boost the growth of the 5G in the military market.

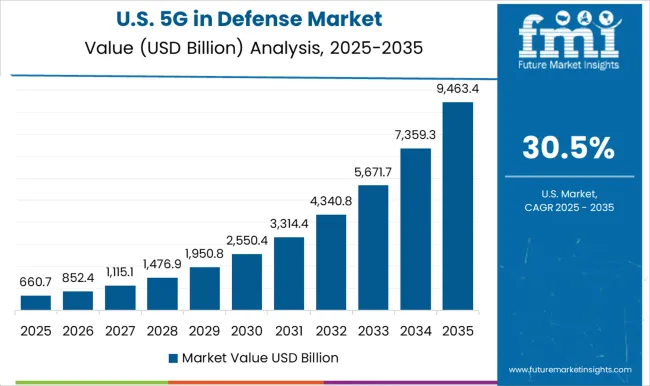

Due to the increased investment in 5G technology by the US Department of Defense, the market in North America is projected to account for the fastest growth in the 5G defense market throughout the projection period. Furthermore, the expanding use of connected systems through IoT, increased demand for low-latency communication technology, and the allotment of a wide frequency band to the US military have given new chances for developers to create 5G components and improve the system's efficiency.

Since governments in the region are attempting to increase the processing and operation of ISR (intelligence, surveillance, and reconnaissance) systems, the 5G in military market in the Asia Pacific is expected to hold the second highest share throughout the projection period.

The United States is expected to account for the highest market share of USD 8143.3 billion by the end of 2035. The United States is projected to be the world leader in developing and deploying 5G technology, accounting for a large portion of the global market. 5G technology improves the speed and functionality of ISR systems, enables the creation of more advanced command and control systems, improves augmented and virtual reality applications, facilitates maintenance processes, and enhances logistical efficiency using technologies like blockchain.

5G network operators' large-scale deployment of small cells is the main reason responsible for the proliferation of tiny segments of 5G networks. The speed at which 5G data is transferred is expected to increase as 5G network operators continue to expand their use of small cells.

Small cell networks are expected to play an important role in the implementation of 5G communications infrastructure because of their contribution to deployment. Communication speed will increase substantially with the introduction of 5G networks, and small cells aid 5G initiation. They are expected to bring an important impact to the 5G communications infrastructure market.

The airborne segment is forecasted to grow at a CAGR of over 31% during 2025 to 2035. Airborne applications such as drones and mission-critical communications will be able to perform more efficiently as 5G technology advances. Rapid advancements in 5G networks and infrastructure and increased usage of IoT devices and 5G networks are driving this segment's growth. The goal is to modernize communication systems, improve interconnectivity, and minimize response time during critical moments. Another significant element driving revenue growth in the market is the increased use of automated vehicles for surveillance, intelligence gathering, and target recognition.

Over the forecast period, the Ultra-reliable Low-Latency Communications (URLLC) segment is projected to lead in terms of revenue contribution to the global market. The 5G network is projected to be 100 times faster than the 4G network, which means that communication networks in military operations will be able to act quickly and successfully in critical importance situations. This will create extra demand for the URLLC services that are presently used in military applications.

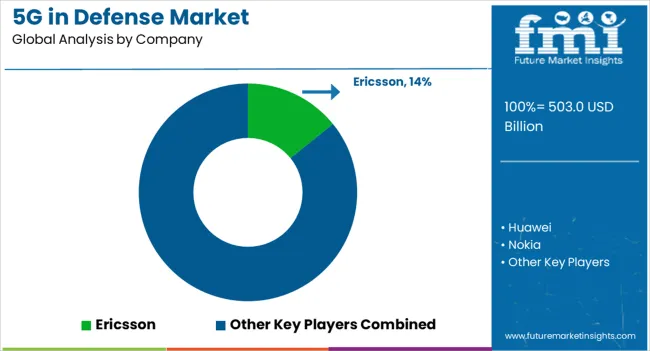

Some of the key market participants in 5G in defense market include Ericsson, Huawei, Nokia, Samsung, NEC, Thales Group, L3Harris Technologies, Inc., Raytheon Technologies, Ligado Networks, and Wind River Systems Inc.

The global 5G in defense market is estimated to be valued at USD 503.0 billion in 2025.

The market size for the 5G in defense market is projected to reach USD 8,029.0 billion by 2035.

The 5G in defense market is expected to grow at a 31.9% CAGR between 2025 and 2035.

The key product types in 5G in defense market are small cell, macro cell and radio access network (ran).

In terms of core network technology, software-defined networking (sdn) segment to command 28.4% share in the 5G in defense market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Electromechanical RF Switch Market Size and Share Forecast Outlook 2025 to 2035

5G Solid State Switches Market Size and Share Forecast Outlook 2025 to 2035

5G Gain Block Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronic Market Size and Share Forecast Outlook 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

Defense Communication System Market Size and Share Forecast Outlook 2025 to 2035

Defense Aircraft Materials Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA