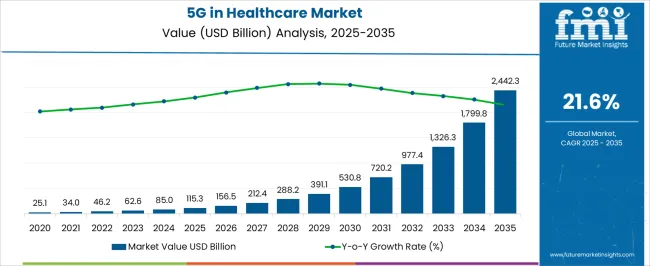

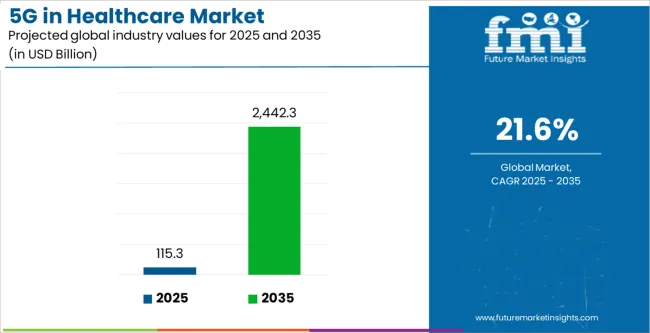

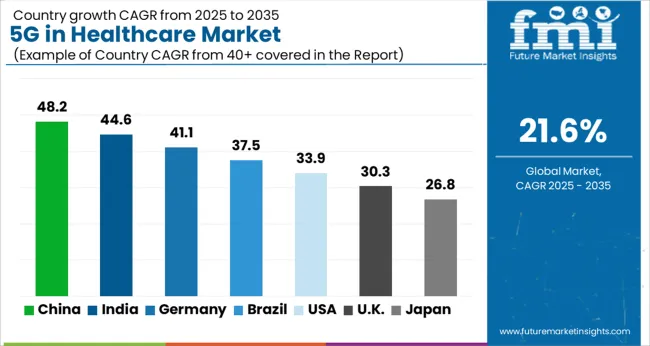

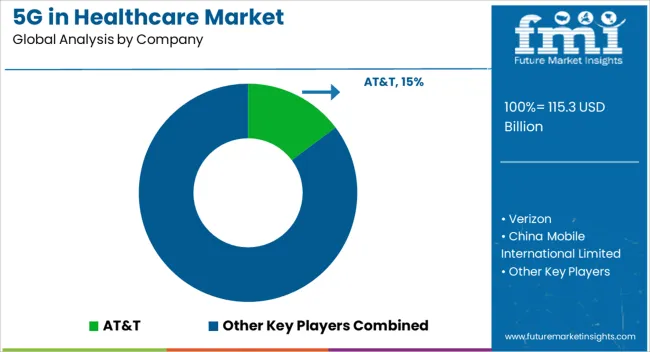

The 5G in Healthcare Market is estimated to be valued at USD 115.3 billion in 2025 and is projected to reach USD 2442.3 billion by 2035, registering a compound annual growth rate (CAGR) of 21.6% over the forecast period.

| Metric | Value |

|---|---|

| 5G in Healthcare Market Estimated Value in (2025 E) | USD 115.3 billion |

| 5G in Healthcare Market Forecast Value in (2035 F) | USD 2442.3 billion |

| Forecast CAGR (2025 to 2035) | 21.6% |

The 5G in healthcare market is progressing at a rapid pace, driven by the growing need for high-speed connectivity, low latency communication, and seamless data integration across critical healthcare operations. The deployment of 5G technology is enabling real-time transmission of large medical imaging files, remote surgical assistance, and advanced telemedicine services.

This has created opportunities for improved patient outcomes, operational efficiency, and broader accessibility to quality care, particularly in underserved regions. Current adoption trends reflect strong support from government initiatives, healthcare digitalization programs, and increasing collaboration between telecom providers and healthcare organizations.

Future outlook is reinforced by the expansion of smart hospitals, growth in connected medical devices, and the rising demand for continuous monitoring and predictive analytics. With sustained investments in infrastructure and ongoing advances in network security, 5G adoption is expected to transform healthcare delivery models, establishing a strong foundation for personalized and data-driven patient care.

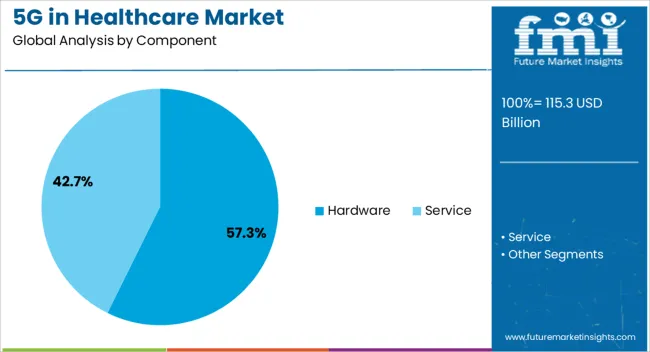

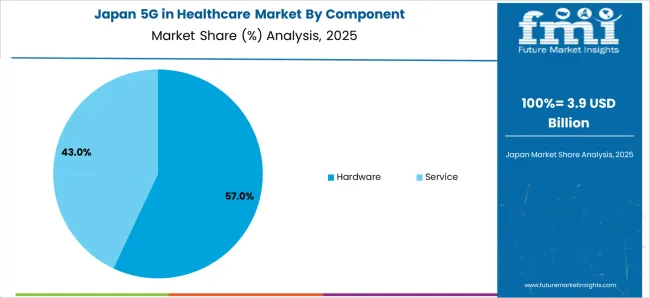

The hardware segment dominates the component category, accounting for approximately 57.3% of the 5G in healthcare market. This dominance is driven by the extensive demand for physical infrastructure, including routers, sensors, small cells, and network equipment required to establish reliable high-speed connections.

Hospitals and healthcare facilities are investing heavily in upgrading their IT and communication infrastructure to support 5G-enabled applications such as connected ambulances, advanced imaging, and tele-ICUs. The segment’s growth is further supported by rising adoption of Internet of Medical Things (IoMT) devices, which depend on robust hardware integration to ensure uninterrupted data flow.

Continued advancements in chipsets, antennas, and edge computing hardware have improved both efficiency and scalability. With infrastructure investment forming the backbone of healthcare digital transformation, the hardware segment is expected to sustain its leading role in the market.

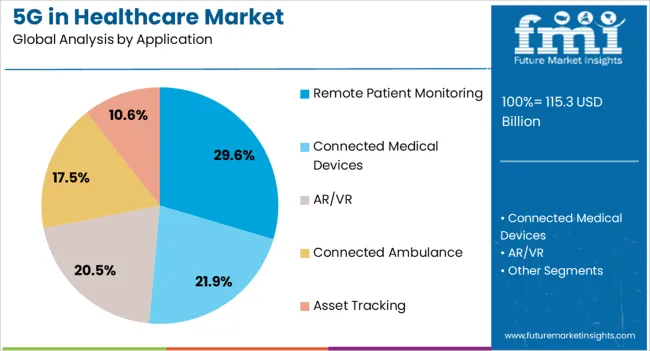

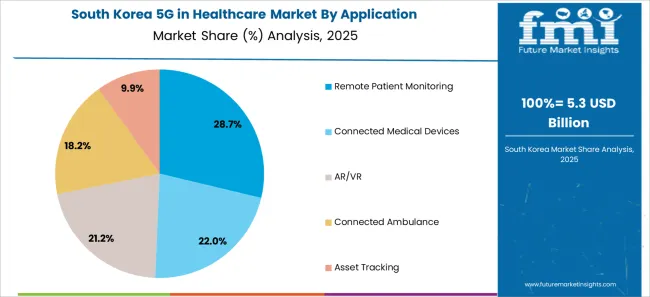

The remote patient monitoring segment holds approximately 29.6% share of the application category, reflecting its significant role in reshaping healthcare delivery models. The adoption of 5G-enabled monitoring systems allows for continuous, real-time collection of vital health data from patients outside traditional clinical settings.

Low latency and high network reliability ensure accurate and timely communication between patients and healthcare providers, improving treatment adherence and reducing hospital readmissions. The segment is further supported by the increasing prevalence of chronic diseases and the growing preference for home-based care solutions.

Integration of wearable devices, biosensors, and AI-driven analytics has enhanced the effectiveness of remote monitoring, offering both clinical and economic benefits. With the rising emphasis on preventive care and patient-centered healthcare systems, remote patient monitoring is positioned to remain a key growth driver.

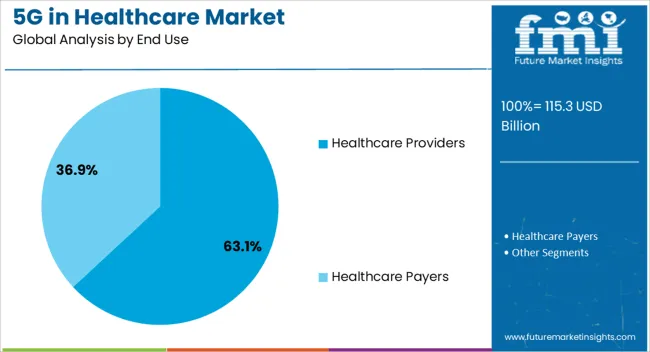

The healthcare providers segment leads the end-use category, contributing approximately 63.1% of the 5G in healthcare market. This segment’s dominance is attributed to the rapid digital transformation initiatives being undertaken by hospitals, clinics, and specialized healthcare facilities.

Providers are leveraging 5G connectivity to enable teleconsultations, cloud-based imaging, and advanced robotic-assisted procedures, thereby improving operational efficiency and patient outcomes. Investments in smart hospital infrastructure and connected care ecosystems are further driving demand for 5G integration.

The segment also benefits from collaborative partnerships with telecom operators and technology vendors, facilitating tailored solutions for clinical workflows. With healthcare providers at the forefront of adopting innovations that enhance care delivery, this segment is expected to maintain its strong position as the largest end-user group in the market.

The 5G in healthcare market was valued at USD 25.1.0 billion in value in 2020. The market progressed at a remarkable CAGR of 38.3% over the historical period from 2020 to 2025.

The pandemic necessitated the use of superior communication technologies like 5G as medical professionals scrambled to administer the proper treatment to patients. 5G was also utilized to aid in medicines and vaccines reaching remote areas of the world. In 2025, the market was pegged to be USD 62.2 billion.

| Attribute | Details |

|---|---|

| Market Value (2020) | USD 25.1.0 billion |

| Historical CAGR (2020 to 2025) | 38.3% |

| Historical Market Valuation (2025) | USD 62.2 billion |

Long-Term Analysis of the 5G in Healthcare Market

The 5G in healthcare market is estimated to have a size of USD 115.3 billion in 2025. The progress of the market is pegged to be extraordinary over the period from 2025 to 2035, with a CAGR of 35.7%.

Though the rate of progress for the market is anticipated to be slightly lower in the forecast period than in the historical period, the market is still ripe with opportunities. The rise in remote healthcare monitoring and the need for better communication between patients and doctors, as well as among the medical professionals themselves, is driving the market. By 2035, the market size is anticipated to have jumped to USD 1,800 billion.

5G in healthcare comes in the form of both hardware and services, with hardware being the dominant component. Of the various uses for 5G in healthcare, remote patient monitoring is the most common application.

Hardware is expected to progress at a CAGR of 35.6% through 2035. Some of the key drivers include:

| Attributes | Details |

|---|---|

| Top Component | Hardware |

| CAGR (2025 to 2035) | 35.6% |

Remote patient monitoring is anticipated to progress at a CAGR of 35.5% over the forecast period. Some of the key drivers for its progress include:

| Attributes | Details |

|---|---|

| Top Application | Remote Monitoring Devices |

| CAGR (2025 to 2035) | 35.5% |

The adoption of 5G in healthcare is increasing all over the world, with the Asia Pacific marked for special growth. Increasing healthcare needs, coupled with the technological advancement of the region, make Asia Pacific a lucrative regional market.

North America and Europe’s affluence means an increasing number of people have access to 5G technology. The use of 5G is seeping into the healthcare sector of the region.

The market is set to register a CAGR of 38.3% in South Korea over the forecast period. The key drivers for the magnificent growth are:

The CAGR for the 5G in healthcare market in Japan is tipped to be 37.1% through 2035. Some of the key factors driving market growth are:

The market is expected to register a CAGR of 36.1% in China. Some of the key trends include:

The market in the United Kingdom is expected to progress at a CAGR of 36.3% until 2035. Key factors driving the growth are:

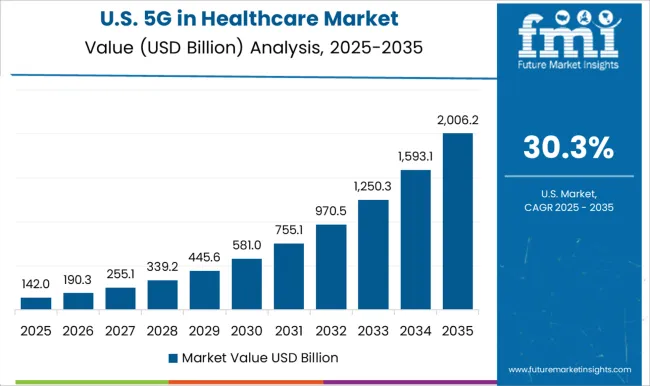

The market in the United States is anticipated to register a CAGR of 36.0% over the forecast period. Some prominent factors driving growth are:

Providers of 5G for healthcare services are using the medium of partnership to strengthen ties with medical technology providers. Collaborations are also being done with healthcare institutions and research facilities. Acquisitions and mergers are common in the market. By means of acquisitions and mergers, general 5G providers are entering the healthcare sector.

Recent Developments in the 5G in Healthcare Market

The global 5G in healthcare market is estimated to be valued at USD 115.3 billion in 2025.

The market size for the 5G in healthcare market is projected to reach USD 2,442.3 billion by 2035.

The 5G in healthcare market is expected to grow at a 21.6% CAGR between 2025 and 2035.

The key product types in 5G in healthcare market are hardware and service.

In terms of application, remote patient monitoring segment to command 29.6% share in the 5G in healthcare market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Market Size and Share Forecast Outlook 2025 to 2035

5G RAN Market Size and Share Forecast Outlook 2025 to 2035

5G Security Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

5G Fixed Wireless Access Market

5G-Enhanced Surveillance Market

5G Tester Market Growth – Trends & Forecast 2019-2027

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA