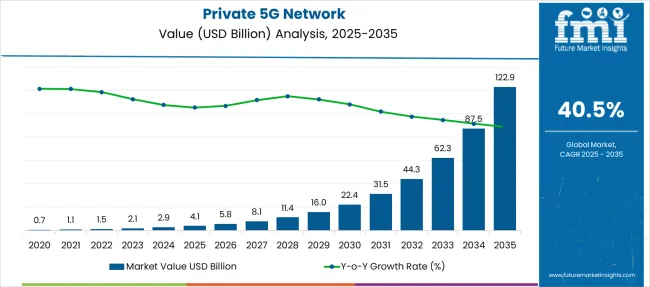

The Private 5G Network Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 122.9 billion by 2035, registering a compound annual growth rate (CAGR) of 40.5% over the forecast period.

Analysis shows absolute dollar opportunity across the decade is USD 118.8 billion, distributed unevenly. Phase 1 (2025–2028) contributes only USD 7.3 billion as deployments remain proof-of-concept heavy. Phase 2 (2028–2032) is the inflection point, adding USD 62.9 billion, driven by industrial automation, manufacturing, and edge computing rollouts.

Phase 3 (2032–2035) contributes USD 48.6 billion, dominated by mission-critical IoT and enterprise adoption in logistics and energy sectors. Annual increments leap from USD 2 billion (2025) to USD 35 billion (2035), signaling aggressive scale-up. While Asia-Pacific accounts for 45% of the incremental value, North America captures high ARPU through early premium service models. The steepest revenue slope occurs between 2030–2033, confirming the window for CAPEX-heavy operators to maximize returns before pricing erosion hits.

The growth curve shows an exponential rise rather than a gradual slope, indicating a transformative phase driven by Industry 4.0, edge computing, and ultra-reliable low-latency connectivity requirements. Unlike traditional wireless solutions, private 5G networks are gaining traction in manufacturing, logistics, and mission-critical environments where security, bandwidth, and network autonomy are key.

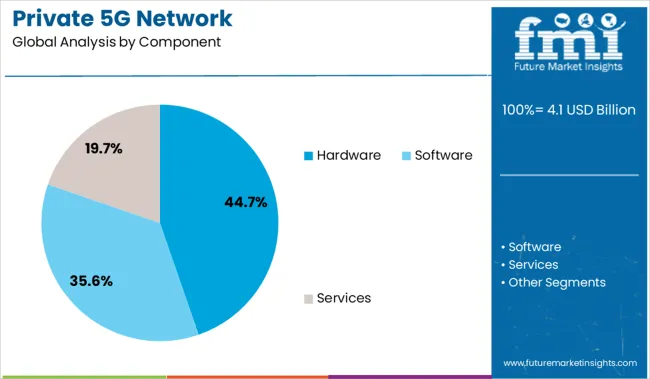

Hardware leads with 44.7% share in 2025, supported by the deployment of small cells, base stations, and edge infrastructure essential for network setup. The steep incline post-2027 reflects accelerated adoption in industrial automation, smart factories, and large-scale IoT deployments, as enterprises seek control over network performance and data sovereignty. The global landscape is witnessing aggressive moves by telecom giants, infrastructure providers, and system integrators, focusing on strategic alliances, spectrum acquisition, and turnkey 5G network solutions.

| Metric | Value |

|---|---|

| Private 5G Network Market Estimated Value in (2025E) | USD 4.1 billion |

| Private 5G Network Market Forecast Value in (2035F) | USD 122.9 billion |

| Forecast CAGR (2025 to 2035) | 40.5% |

The private 5G network market is expanding as enterprises demand ultra-reliable, low-latency connectivity for mission-critical operations. Industries such as manufacturing, logistics, and energy are adopting private 5G to enable automation, real-time monitoring, and IoT integration, improving operational efficiency. The technology supports advanced use cases like autonomous vehicles, AR/VR-enabled maintenance, and predictive analytics in smart factories.

Rising cybersecurity concerns are pushing businesses toward dedicated 5G infrastructure, offering enhanced control over data traffic compared to public networks. Regulatory approvals for localized spectrum and partnerships between telecom operators and enterprises further accelerate deployment. Growing demand for edge computing, combined with private 5G’s ability to handle massive device density, positions it as a key enabler of Industry 4.0 strategies and digital transformation initiatives.

The 5G network market is segmented by component, spectrum, industry vertical, and region. By component, it includes hardware such as radio access networks, core networks, backhaul and transport systems, base stations, antennas, and routers, along with software covering network management, security, virtualization, and application software. It also comprises services such as installation and integration, data services, and support and maintenance. In terms of spectrum, the segmentation includes licensed spectrum, sub-6 GHz, mmWave (millimeter wave), unlicensed spectrum, shared unlicensed spectrum, CBRS, and dynamic spectrum sharing.

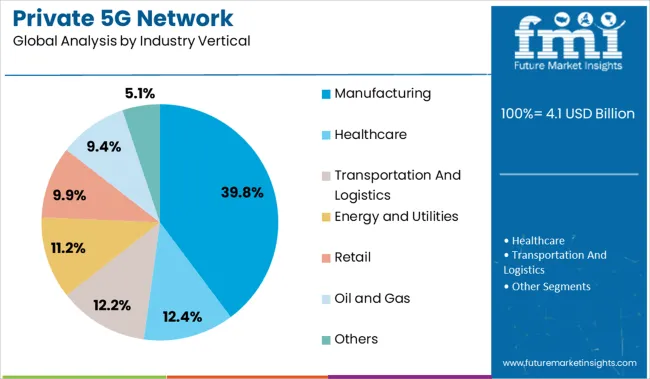

Based on industry vertical, the market spans manufacturing, healthcare, transportation and logistics, energy and utilities, retail, oil and gas, and other sectors. Regionally, the market encompasses North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Hardware remains the largest component in private 5G deployment, accounting for 44.7% of the USD 4.1 billion market. This includes small cells, base stations, routers, and edge devices essential for high-bandwidth and low-latency performance. Software follows at 35.6%, driven by network orchestration, AI-enabled traffic optimization, and security management solutions for enterprise-specific customization. Services account for 19.7%, reflecting demand for system integration, maintenance, and managed network services.

Rising adoption of virtualization and network slicing is shifting focus toward software-driven solutions, enabling scalability and cost optimization. Vendors are bundling hardware with advanced software packages, while partnerships with cloud service providers and managed service firms are expanding, allowing enterprises to overcome deployment complexity and skill gaps effectively.

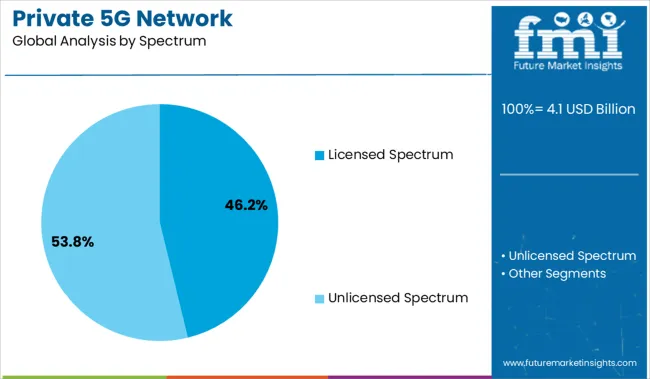

Licensed spectrum holds 46.2%, supported by enterprises seeking ultra-reliable and secure connectivity, particularly in critical environments like energy and transportation. Unlicensed spectrum leads with 53.8% share, favored by enterprises for its cost-effectiveness and easier accessibility without heavy regulatory procedures. Manufacturing, healthcare, and logistics sectors increasingly prefer unlicensed bands for localized deployment with quick scalability.

Telecom operators and large industrial players dominate this segment due to their ability to manage high compliance costs and complex integrations. Growing spectrum allocation flexibility across regions is accelerating deployments across both categories, shaping competitive strategies for vendors and network providers.

Manufacturing dominates the private 5G network landscape with 39.8% share, driven by Industry 4.0 initiatives, automation, and real-time data analytics for smart factories. Healthcare holds 12.4%, leveraging private 5G for telemedicine, robotic surgeries, and secure data exchange in hospitals. Transportation and logistics account for 12.2%, enabling connected fleets, smart warehouses, and autonomous vehicle operations.

Energy and utilities (11.2%) and oil and gas (9.4%) use 5G for predictive maintenance and remote operations in critical environments. Retail (9.9%) focuses on in-store connectivity and immersive customer engagement, while other sectors (5.1%) explore AR/VR-enabled services. The shift toward edge computing and low-latency networks positions private 5G as a transformative solution for operational efficiency across industrial ecosystems.

On-premise deployments across manufacturing, mining, logistics, and energy sectors lead growth. Large facilities are using private 5G for equipment monitoring, robotics coordination, and real-time analytics. North America and Asia-Pacific lead current installations, with enterprise demand expanding in Europe and the Middle East. Use cases are expanding across smart factories, ports, and utility grids. Deployment models now range from standalone networks to hybrid systems with localized core integration, enabling higher reliability and lower latency.

Growth is led by on-premise deployments across manufacturing, mining, logistics, and energy sectors. Large facilities are using private 5G for equipment monitoring, robotics coordination, and real-time analytics. North America and Asia-Pacific lead current installations, with enterprise demand expanding in Europe and the Middle East. Use cases are expanding across smart factories, ports, and utility grids. Deployment models now range from standalone networks to hybrid systems with localized core integration, enabling higher reliability and lower latency.

Enterprises are deploying Private 5G Network Markets to replace legacy Wi-Fi and wired infrastructure in industrial settings. Manufacturing plants have shifted to multi-access edge platforms powered by private 5G to coordinate autonomous guided vehicles and real-time quality control. Energy facilities and remote mining sites use dedicated 5G cells for perimeter surveillance, drone monitoring, and asset diagnostics in areas without stable macro coverage. Multi-layer encryption and user-level access settings are increasingly configured at the edge, enabling secure operations even during external network outages. Implementation times have decreased as vendors offer modular core packages tailored to specific sectors. Local spectrum availability through government allotments and unlicensed access bands has made private 5G viable across mid-tier and enterprise-scale facilities.

Private 5G deployment remains capital intensive, with full site installations often exceeding USD 400,000 per campus across hardware, software, and support. Return on investment timelines remain above 30 months in many verticals, limiting uptake among mid-sized firms. Device ecosystem fragmentation continues, with limited availability of industrial sensors and handsets that support targeted 5G frequencies.

End-to-end integration requires advanced planning tools and protocol translation layers, especially when existing Wi-Fi, LoRa, or SCADA systems remain active. System downtime during migration phases adds operational risk, particularly in high-throughput production zones. Regulatory uncertainty around spectrum rights and power limits in some regions further complicates the procurement process and delays commercial rollout across multi-site organizations.

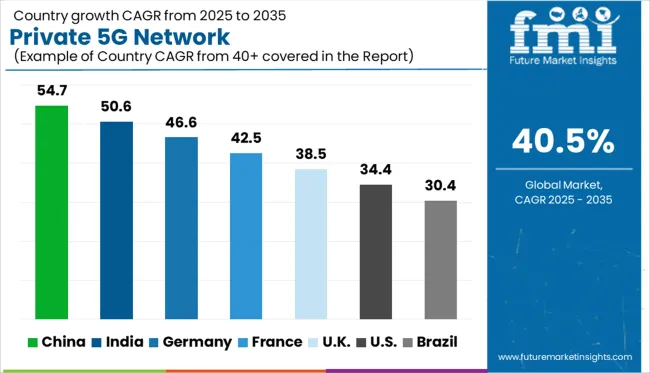

| Countries | CAGR |

|---|---|

| China | 54.7% |

| India | 50.6% |

| Germany | 46.6% |

| France | 42.5% |

| UK | 38.5% |

| USA | 34.4% |

| Brazil | 30.4% |

The global Private 5G Network Market is projected to expand at a CAGR of 40.5% between 2025 and 2035. China (BRICS) leads with a growth rate of 54.7%, exceeding the global average by 14.2 percentage points, fueled by aggressive industrial digitalization and state-backed infrastructure rollouts. India (BRICS) follows at 50.6% (+10.1 pp), supported by smart manufacturing, logistics modernization, and public-private pilot deployments.

Among OECD nations, Germany registers 46.6% (+6.1 pp), driven by factory automation, private spectrum allocation, and 5G campus networks. France reports 42.5% (+2.0 pp), reflecting a steady pace of adoption in healthcare, defense, and transport sectors. The United States (OECD) posts 34.4%, trailing the global average by 6.1 pp, as spectrum policy fragmentation and deployment costs slow broader rollouts. The report features insights from 40+ countries, with the top five shown below.

China records a 54.7% growth rate in Private 5G Network Markets, well above the global average of 40.5%. Factory automation, industrial robotics, and port logistics are pushing enterprise demand for dedicated 5G coverage. Core deployments are linked to smart manufacturing zones and cross-sector cloud integration.

Telecom firms are launching preconfigured 5G packages for use within restricted geofenced zones. Analysts report that network slicing is now standard in pilot zones tied to vehicle-to-infrastructure test corridors. Local governments have funded integration programs that combine machine vision and edge computation across large logistics centers.

India reports a 50.6% growth rate in private 5G, outpacing the global rate of 40.5%. Adoption is concentrated in manufacturing, warehousing, and public utility zones. Enterprise zones near rail corridors are being prioritized for spectrum-licensed deployments.

Equipment suppliers are offering single-facility kits with full integration support. Local authorities are enabling tower access on leased industrial rooftops to reduce infrastructure delays. Factory owners have begun bundling cloud processing units with private network cores to streamline setup. Analysts cite growing coordination between state-run infrastructure banks and telecom integrators.

United States reports a 34.4% growth rate in Private 5G Network Markets, below the global average of 40.5%. The market is driven by aerospace, defense manufacturing, and tech campuses requiring isolated bandwidth. Network cores are being bundled with local edge data centers for on-premises routing.

Spectrum allocation is segmented under CBRS, prompting companies to deploy shared-access configurations. Delays in zoning approvals have slowed expansion across dense industrial zones. Most rollouts are limited to trial-stage deployments operated by large-cap multinationals. Analysts indicate uptake remains slower in mid-scale logistics operations.

Germany posts a 46.6% growth rate in Private 5G Network Markets, higher than the global figure of 40.5%. The market is led by chemical, automotive, and logistics hubs requiring high-reliability wireless networks. Mid-size firms are deploying private cores with in-factory signal load controls.

Policy directives have enabled faster licensing for indoor-only industrial coverage. Vendor-neutral 5G cores are being adopted in export-heavy regions to ensure device interoperability. Analysts report that indoor mapping systems tied to robotics fleets are pushing firms to segment bandwidth across task lanes.

France reports a 42.5% growth rate in the Private 5G Network Market, above the global average of 40.5%. Market activity is focused on port terminals, transport yards, and data management zones. Private spectrum deployment is being supported through national planning zones set up for industrial broadband testing.

Vendors have installed modular 5G units in shipping hubs where fixed-line connections are restricted. Telecom operators are working with railway logistics firms to provide train-to-depot connectivity using 5G routing grids. Device makers are localizing sensor firmware to operate within pre-certified network configurations.

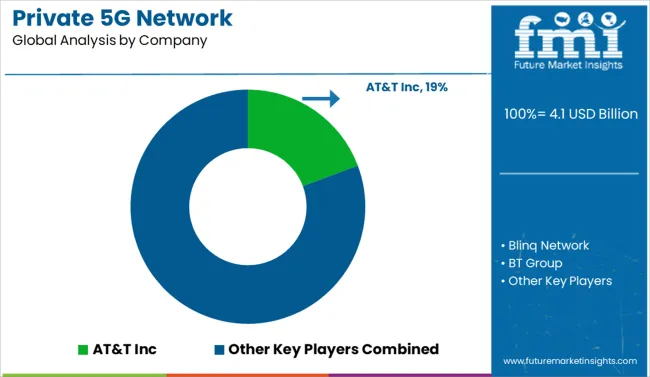

Private 5G Network Market deployments in 2025 are being shaped by enterprise automation, localized data processing, and sector-specific connectivity demands. AT&T Inc. leads the market with a 19.3% share, offering private cellular networks tailored for industrial campuses and government facilities.

Verizon Communications and Vodafone Ltd are expanding managed 5G infrastructure to support manufacturing, energy, and transportation hubs. Ericsson, Nokia, and Huawei Technologies are supplying turnkey systems with integrated core, RAN, and orchestration tools. Cisco Systems and Juniper Networks provide backend support through secure routing and network management solutions.

Mavenir and Radisys are scaling Open RAN offerings for flexible enterprise adoption. The market is increasingly defined by low-latency control systems, dedicated spectrum licenses, and custom-built network slices for real-time operations.

In 2025, Three Ireland and Ericsson launched 3Business Broadband Pro, a managed private 5G service tailored for enterprise use, providing dedicated connectivity, enhanced security, and network control to support demanding business operations and applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Component | Hardware, Radio Access Network, Core Network, Backhaul and Transport, Base Stations, Antennas, Routers, Software, Network management software, Security Software, Virtualization Software, Application Software, Services, Installation and Integration, Data Services, and Support and Maintenance |

| Spectrum | Licensed Spectrum, Sub-6 GHz, MmWave (Millimeter Wave), Unlicensed Spectrum, Shared Unlicensed Spectrum, CBRS, and Dynamic Spectrum Sharing |

| Industry Vertical | Manufacturing, Healthcare, Transportation And Logistics, Energy and Utilities, Retail, Oil and Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AT&T Inc, Blinq Network, BT Group, Cisco Systems, Deutsche Telekom, Fujitsu, Huawei Technologies Co., Ltd., Juniper Networks, Kyndryl, Mavenir, NEC Corporation, Nokia, Radisys, Samsung Electronics Co., Ltd., Sterlite, Telefonaktiebolaget LM Ericsson, T-Systems International GmbH, Verizon Communications, and Vodafone Ltd |

| Additional Attributes | Dollar sales by deployment model and industry vertical, growing demand in manufacturing and logistics automation, stable rollout across campuses and smart infrastructure, advancements in network slicing and edge computing drive low-latency performance and enterprise-level customization |

The global private 5G network market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the private 5G network market is projected to reach USD 122.9 billion by 2035.

The private 5G network market is expected to grow at a 40.5% CAGR between 2025 and 2035.

The key product types in private 5G network market are hardware, radio access network, core network, backhaul and transport, base stations, antennas, routers, software, network management software, security software, virtualization software, application software, services, installation and integration, data services and support and maintenance.

In terms of spectrum, licensed spectrum segment to command 46.2% share in the private 5G network market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

Private Tutoring Market Forecast and Outlook 2025 to 2035

Private Label Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Private Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Private office-based clinics Market Size and Share Forecast Outlook 2025 to 2035

Private LTE Market Size and Share Forecast Outlook 2025 to 2035

Private Cloud Services Market by Services, Type, Industry Vertical, and Region – Growth, Trends, and Forecast through 2025 to 2035

Private Security Market Growth – Trends & Forecast 2024-2034

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

5G Solid State Switches Market Size and Share Forecast Outlook 2025 to 2035

5G Gain Block Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA