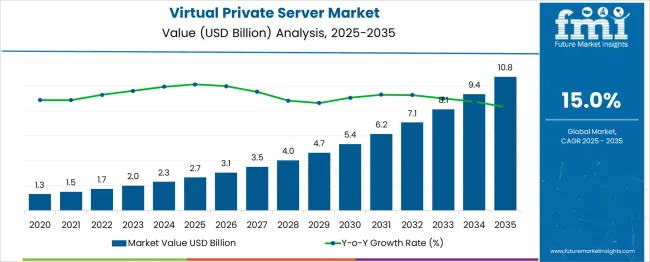

The Virtual Private Server Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 10.8 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

The virtual private server (VPS) market is projected to experience robust growth throughout the decade, rising from USD 1.3 billion in 2021 to USD 4.7 billion by 2030, representing an absolute dollar opportunity of USD 3.4 billion over this period. This expansion equates to a CAGR of approximately 15.4%, highlighting strong demand for flexible, cost-efficient, and secure hosting solutions across enterprises and digital businesses. Year-wise progression emphasizes steady and accelerating growth.

The market begins at USD 1.3 billion in 2021 and moves to USD 1.5 billion in 2022, supported by small and medium-sized enterprises (SMEs) adopting VPS for cost savings and control compared to shared hosting. By 2023, the value reaches USD 1.7 billion, and by 2024, it rises further to USD 2.0 billion, reflecting increased adoption in e-commerce, SaaS platforms, and content streaming services.

In 2025, the market grows to USD 2.3 billion, and by 2026, it reaches USD 2.7 billion, driven by rising demand for scalable virtual infrastructure to support remote operations and high-traffic applications. The latter half of the decade shows significant acceleration, as the market hits USD 3.1 billion in 2027, USD 3.5 billion in 2028, and USD 4.0 billion in 2029, before achieving USD 4.7 billion by 2030.

This strong performance is fueled by enhanced cybersecurity features, growing virtualization needs, and cloud integration for hybrid IT environments. Businesses prioritizing data privacy, performance optimization, and cost-effective hosting are expected to drive future adoption. Vendors that offer high-performance VPS with managed services, security compliance, and global data center networks will dominate this rapidly evolving segment.

| Metric | Value |

|---|---|

| Virtual Private Server Market Estimated Value in (2025 E) | USD 2.7 billion |

| Virtual Private Server Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The virtual private server (VPS) segment accounts for an estimated 10% to 12% share within the overall web hosting and cloud infrastructure services market, which includes shared hosting, dedicated servers, and managed cloud services. Within the broader cloud computing market, its share is relatively small, likely 2% to 3%, as large-scale Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) solutions dominate. In the data center services market, VPS contributes around 5%, driven by growing adoption among SMBs and developers seeking cost-efficient, scalable hosting environments.

The VPS model is particularly valued for offering greater control and resource allocation than shared hosting, at a fraction of the cost of dedicated servers. Its role is becoming more critical with the rise of small businesses migrating to digital platforms, e-commerce expansion, and increased demand for virtual environments that support flexible application deployment.

VPS hosting serves as a bridge between traditional hosting and full-scale cloud solutions, making it attractive for businesses requiring moderate computing power without heavy capital expenditure. The segment is expected to maintain steady growth as virtualization technologies advance, containerization expands, and demand for managed VPS solutions rises.

With increasing emphasis on performance optimization, cybersecurity, and compliance, VPS providers are integrating features such as SSD storage, automated backups, and enhanced DDoS protection to remain competitive in the evolving digital infrastructure landscape.

The virtual private server (VPS) market is expanding steadily as enterprises and developers seek cost-efficient alternatives to dedicated servers while retaining strong performance, flexibility, and control. VPS environments, offering dedicated virtualized resources, are being increasingly favored over shared hosting due to growing concerns around data privacy, application uptime, and customizability.

The rise in digital transformation initiatives, particularly among small and medium-sized enterprises, has contributed to the uptake of VPS solutions, as businesses require scalable hosting environments for web applications, content management systems, and development platforms. Technological advancements such as containerization, enhanced virtualization, and integration of AI-based resource allocation are further enhancing the value proposition of VPS offerings.

Availability of easy-to-use control panels, API integrations, and multi-region deployment capabilities is supporting global VPS adoption. Regulatory frameworks emphasizing localized data storage and data sovereignty are also prompting businesses to consider VPS solutions with regional customization, thereby strengthening the market’s growth trajectory across developed and emerging economies.

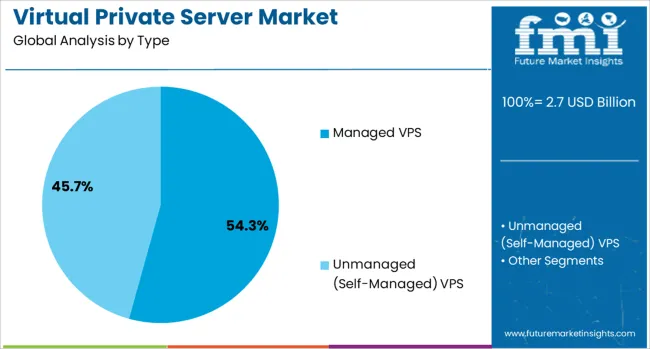

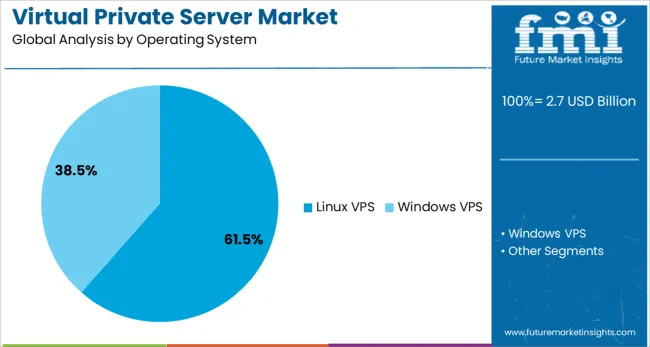

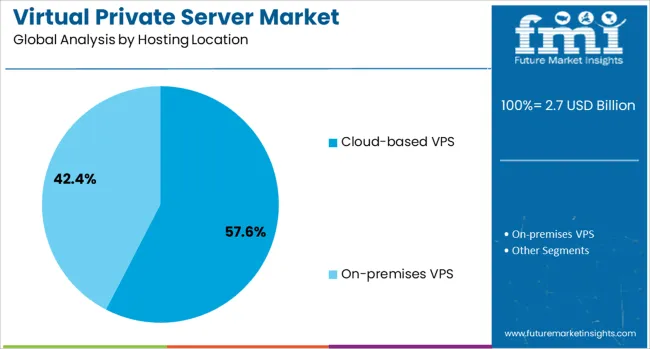

The virtual private server market is segmented by type, operating system, hosting location, deployment model, and end-user and geographic regions. By type of the virtual private server market is divided into Managed VPS and Unmanaged (Self‑Managed) VPS. In terms of operating system of the virtual private server market is classified into Linux VPS and Windows VPS. Based on hosting location of the virtual private server market is segmented into Cloud-based VPS and On-premises VPS.

By deployment model of the virtual private server market is segmented into Public VPS Hosting, Private VPS Hosting, and Hybrid VPS Hosting. By end-user of the virtual private server market is segmented into Web Hosting Providers & ISPs, Small & Medium-sized Enterprises, Large Enterprises, Developers & Digital Agencies, E‑commerce Businesses, and Gaming & Streaming Platforms. Regionally, the virtual private server industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The managed VPS segment is anticipated to account for 54.3% of the total revenue share in the virtual private server market in 2025, reflecting its growing popularity among enterprises seeking simplified server management. This segment’s dominance is driven by the increasing preference for hosting solutions that offer maintenance, monitoring, automatic updates, and security support without requiring in-house technical expertise.

Businesses with limited IT resources are increasingly opting for managed VPS to ensure high availability, optimized performance, and reduced risk of downtime. Service providers are offering advanced SLAs, automated backups, and DDoS protection as part of managed plans, further elevating their appeal across ecommerce, fintech, and digital services sectors.

The growing need to meet compliance standards and implement robust cybersecurity protocols is also influencing the adoption of managed hosting environments. With rising demand for reliable infrastructure combined with ease of operation, the managed VPS segment continues to attract a broad customer base, driving consistent revenue growth in the overall VPS market.

Linux VPS is expected to represent 61.5% of the overall revenue share in the virtual private server market in 2025, driven by its open-source nature, stability, and cost-effectiveness. The segment’s leading position is being supported by the widespread use of Linux-based environments in software development, web hosting, and cloud-native applications.

Organizations are increasingly favoring Linux VPS due to its lower operating costs, extensive community support, and compatibility with a wide range of programming languages and tools. The flexibility offered by distributions such as Ubuntu, CentOS, and Debian has enabled developers and businesses to customize server environments for specific workload requirements.

In addition, the enhanced security controls, resource efficiency, and performance optimization associated with Linux-based virtualization are aligning well with enterprise requirements for scalable infrastructure. The integration of Linux VPS within CI/CD pipelines, container orchestration, and DevOps workflows is further strengthening its role as the preferred operating system in the evolving VPS landscape.

Cloud-based VPS is projected to hold 57.6% of the total revenue share in the virtual private server market in 2025, supported by the increasing demand for dynamic resource scalability and global accessibility. This segment’s growth is being driven by the need for flexible hosting solutions that can adapt in real time to fluctuating traffic and compute requirements.

Businesses are leveraging cloud-based VPS environments to deploy websites, applications, and development tools with minimal upfront infrastructure investments. The availability of globally distributed data centers, coupled with automated provisioning, high uptime guarantees, and API-driven integrations, is further enhancing the value of cloud-based VPS offerings.

Cloud-native features such as load balancing, real-time failover, and elastic storage are aligning with enterprise goals around resilience and operational efficiency. As more organizations migrate workloads to the cloud for agility and scalability, the demand for cloud-based VPS is expected to accelerate, reinforcing its position as the dominant hosting architecture in the virtual server ecosystem.

Virtual private server demand is rising due to cost efficiency, scalability, and enhanced control compared to shared hosting. Security, customization, and managed service options are accelerating adoption across businesses seeking reliable and compliant hosting environments.

Demand for Virtual Private Server services has been increasing as businesses seek cost-effective and scalable hosting alternatives compared to dedicated servers. This preference has been influenced by the ability to achieve flexible resource allocation without compromising security and performance. The market has observed significant traction from SMEs migrating workloads to virtual environments to manage unpredictable traffic volumes and optimize operational expenses. Data-driven enterprises have prioritized VPS solutions due to improved control over configurations and better isolation compared to shared hosting models. Cloud integration with VPS offerings is expanding adoption across sectors, enabling faster application deployment and ensuring reliable infrastructure for critical business processes.

Security and performance optimization have become primary considerations for VPS adoption, supported by heightened concerns over data breaches and downtime in shared hosting environments. Businesses have adopted VPS to maintain administrative control, ensuring resource segregation and compliance with industry-specific requirements. Hosting providers have integrated advanced management tools, improving monitoring and resource allocation for end users. Preference for custom operating system configurations and dedicated IP addresses is driving migration from traditional hosting frameworks. VPS providers are offering diverse pricing tiers and managed services, allowing organizations to achieve enterprise-grade hosting features without the high capital expenditure associated with physical servers.

The surge in digital transformation across SMEs and the rapid expansion of e-commerce platforms are significant drivers for the VPS market. Businesses increasingly prefer VPS over shared hosting due to improved control, better resource allocation, and enhanced security at an affordable cost. VPS offers flexibility for growing enterprises that require scalable infrastructure without investing in expensive dedicated servers. The shift toward online retailing, digital content streaming, and cloud-based SaaS platforms further strengthens this trend. Increased internet penetration, coupled with the need for robust uptime and performance, positions VPS as an ideal choice for startups and mid-sized organizations looking to balance affordability with operational efficiency.

Virtualization technologies and hybrid cloud solutions are reshaping VPS adoption patterns. Organizations prioritize VPS for its ability to integrate seamlessly with public and private clouds while maintaining predictable costs and data control. Enhanced virtualization enables multi-tenant environments with higher utilization rates, reducing infrastructure overhead. Coupled with cloud-native security, managed VPS services now cater to businesses seeking compliance, backup, and disaster recovery solutions. This dynamic is further amplified by remote work models, which demand secure, scalable virtual infrastructure for distributed teams. Vendors offering automation, AI-driven monitoring, and performance optimization are expected to capture a competitive edge as enterprises transition toward hybrid IT architectures.

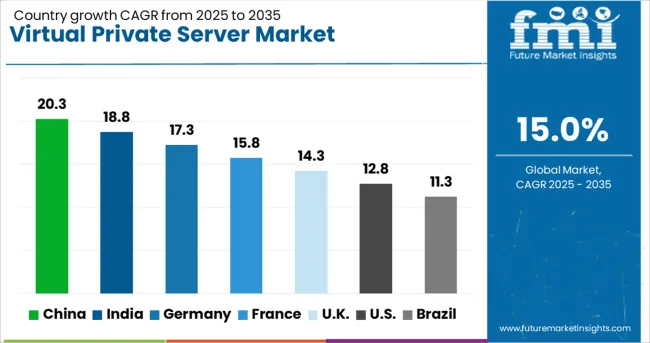

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The virtual private server industry, projected to expand at a global CAGR of 15.0% from 2025 to 2035, is showing diverse growth rates across major regions. China is witnessing a 20.3% CAGR, driven by increasing cloud adoption and enterprise migration toward virtualized environments. India follows with an 18.8% CAGR, supported by SME adoption and affordable managed VPS services tailored for developing digital ecosystems. Germany is observing a 17.3% CAGR, driven by demand for secure hosting and compliance-focused solutions within its advanced IT infrastructure.

The United Kingdom is experiencing a 14.3% CAGR as VPS solutions gain preference over shared hosting in e-commerce and financial sectors. The United States, with a 12.8% CAGR, continues to maintain stable demand through enterprise-level managed services and hybrid hosting integration. While mature economies demonstrate consistent VPS usage, emerging markets like China and India represent significant expansion potential due to cost-sensitive yet security-conscious adoption patterns. The report includes comprehensive coverage of 40+ countries, with the top five regions highlighted as an indicative reference.

The CAGR for the virtual private server market in China stood at 13.2% during 2020–2024 and accelerated to 20.3% in the 2025–2035 period. This significant rise has been linked to aggressive cloud infrastructure development and strong investments in enterprise virtualization by domestic technology leaders. Government-backed digital transformation programs in provincial and national sectors have enabled greater VPS integration for e-commerce and fintech. The growing number of startups seeking cost-efficient server hosting options has amplified demand. China’s strategic prioritization of data sovereignty regulations has driven enterprises to deploy VPS within local jurisdiction rather than using foreign data centers.

The CAGR in India was around 12.1% from 2020–2024 and surged to 18.8% from 2025–2035. This acceleration has been attributed to rapid digitization among SMEs and expansion of managed hosting ecosystems in Tier 2 and Tier 3 markets. India’s preference for hybrid deployment and localized service pricing has fostered growth for VPS adoption across financial services, e-commerce, and IT-enabled services. Cloud service providers have expanded partnerships with data center operators to address latency and compliance demands. Managed VPS solutions tailored for high-traffic retail and streaming platforms have become essential for businesses scaling digital operations.

Germany recorded a CAGR of nearly 11.4% during 2020–2024, which improved to 17.3% for the 2025–2035 period. The demand surge has been driven by enterprises migrating to secure virtualized environments to comply with stringent EU data protection frameworks. Increased reliance on VPS by manufacturing and financial firms for hosting critical applications has strengthened adoption. Cloud-integrated VPS models have gained traction as German businesses demand higher security, data residency, and operational autonomy. Enterprise spending on VPS for multi-cloud strategies has been prioritized to ensure resilience and compliance with regional regulatory norms.

The CAGR in the United Kingdom moved from about 9.3% in 2020–2024 to 14.3% across 2025–2035. The upward trajectory is connected to widespread adoption of VPS by e-commerce and financial institutions seeking improved scalability and security. Hosting providers have expanded managed services tailored for high-availability applications and compliance with UK-specific data standards. Increased competition among regional and global players has resulted in affordable managed VPS options for businesses transitioning from shared hosting. The evolution of edge data centers has further supported low-latency VPS deployments across major metropolitan hubs.

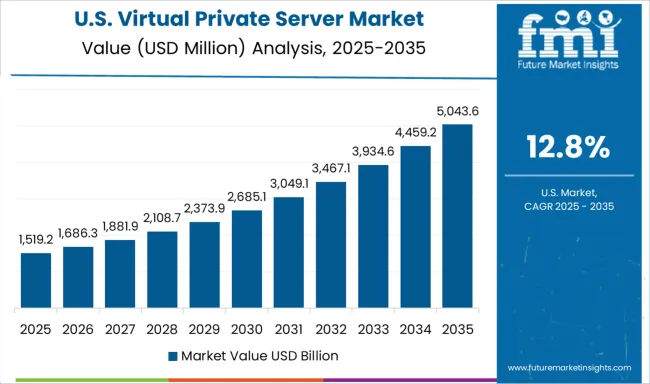

The CAGR in the United States was 8.7% during 2020–2024 and reached 12.8% between 2025 and 2035. The relatively moderate rise compared to emerging markets is explained by market maturity and widespread adoption of hybrid hosting models by enterprises. VPS growth has been influenced by demand from SMBs leveraging managed services for predictable cost structures and enhanced control. Providers have focused on advanced control panels, automation features, and integration with developer tools to retain a competitive advantage. The gradual migration of workloads to containerized VPS environments has created new opportunities for innovation within managed hosting services.

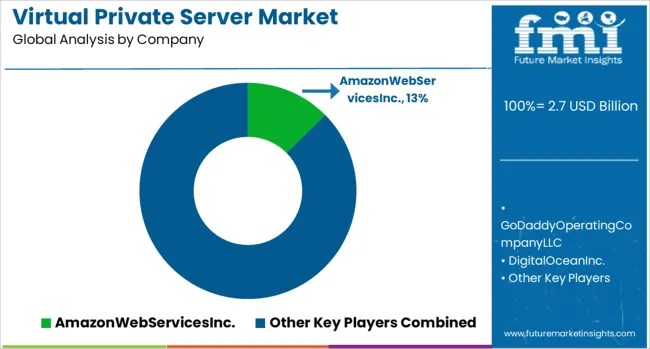

The virtual private server (VPS) market is witnessing strategic advancements as leading providers prioritize high-performance infrastructure, enhanced security, and flexible scalability to meet the dynamic hosting needs of global enterprises. Industry giants such as Amazon Web Services (AWS), GoDaddy Operating Company LLC, and DigitalOcean Inc. are spearheading innovation with automated resource allocation, API-driven provisioning, and compliance-ready environments.

These capabilities are designed to support businesses transitioning from shared hosting to VPS for greater control, cost efficiency, and reliability. Managed VPS offerings are a focal point for these providers, enabling clients to outsource server maintenance while benefiting from superior uptime and performance. Furthermore, edge-based deployment models have emerged as a critical strategy to reduce latency, particularly for latency-sensitive sectors like e-commerce, gaming, and SaaS applications.

Established vendors such as United Internet AG, Rackspace Inc., and OVH are differentiating through multi-cloud compatibility and enterprise-grade control panels, which appeal to regulated industries requiring advanced security, granular configuration, and strict data residency compliance. In contrast, mid-tier players like Linode LLC, Hostinger International Ltd., and Endurance International Group are targeting the small and medium-sized enterprise (SME) segment with developer-friendly features, competitive pricing, and simplified integration options.

Emerging VPS companies, including Liquid Web, A2 Hosting, Vultr Holdings Corporation, and Hostwinds LLC, are focusing on container-ready VPS instances and hybrid hosting solutions to merge affordability with dedicated resources. Specialized hosting providers such as InMotion Hosting, DreamHost LLC, and Plesk International GmbH emphasize user-centric control panels, automation, and rapid deployment models to simplify the adoption process for businesses seeking scalability without technical complexity. This evolving competitive landscape underscores a clear trend toward automation, cloud integration, and security-driven differentiation, which will remain pivotal in shaping long-term market.

In May 2025, AWS announced a $5 billion+ strategic investment with HUMAIN to build an “AI Zone” in Saudi Arabia, covering infrastructure, AI training, and Bedrock services.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Type | Managed VPS and Unmanaged (Self‑Managed) VPS |

| Operating System | Linux VPS and Windows VPS |

| Hosting Location | Cloud-based VPS and On-premises VPS |

| Deployment Model | Public VPS Hosting, Private VPS Hosting, and Hybrid VPS Hosting |

| End-User | Web Hosting Providers & ISPs, Small & Medium-sized Enterprises, Large Enterprises, Developers & Digital Agencies, E‑commerce Businesses, and Gaming & Streaming Platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmazonWebServicesInc., GoDaddyOperatingCompanyLLC, DigitalOceanInc., UnitedInternetAG, RackspaceInc, OVH, LinodeLLC, HostingerInternationalLtd., EnduranceInternationalGroup, LiquidWeb, A2Hosting, VultrHoldingsCorporation, HostwindsLLC, InMotionHosting, DreamHostLLC, PleskInternationalGmbH, SavariTechnologies, JustHostInc., NamecheapInc., and TekTonic |

| Additional Attributes | Dollar sales, market share by deployment type, competitive positioning, pricing trends, adoption by SMEs vs enterprises, regulatory compliance impact, emerging AI-driven hosting demand, and growth projections across key industries. |

The global virtual private server market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the virtual private server market is projected to reach USD 10.8 billion by 2035.

The virtual private server market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in virtual private server market are managed vps and unmanaged (self‑managed) vps.

In terms of operating system, linux vps segment to command 61.5% share in the virtual private server market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Virtual Dispersive Networking (VDN) Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA