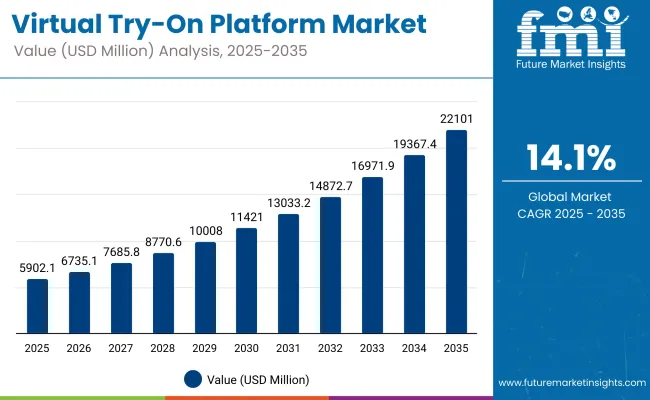

The Global Virtual Try-On Platform Market is projected to grow from USD 5,902.1 million in 2025 to USD 22,101.0 million by 2035, at a CAGR of 14.1%.

Global Virtual Try On Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 5,902.1 million |

| Market Forecast Value in (2035F) | USD 22,101.0 million |

| Forecast CAGR (2025 to 2035) | 14.1% |

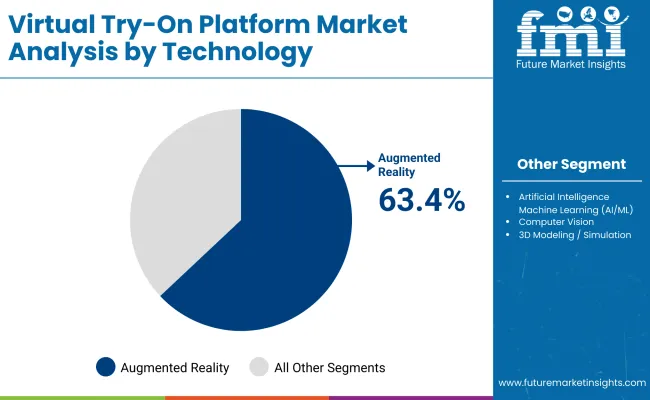

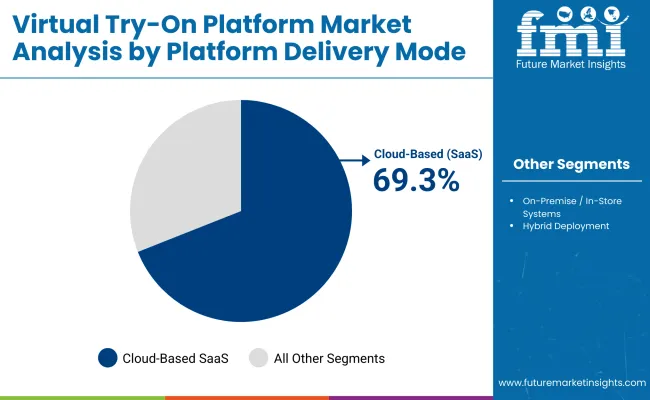

Cloud-Based SaaS platforms will dominate with a 69.3% market share, while Augmented Reality (AR) will lead the technology segment with a 63.4% share in 2025. GlobalVirtual Try-On Platform Market Size and Share Forecast Outlook 2025 to 2035 The GlobalVirtual Try-On Platform Market is expected to record a valuation of USD 5,902.1 million in 2025 and USD 22,101.0 million in 2035, with an increase of USD 16,198.9 million, which equals a growth of 275% over the decade. The overall expansion represents a CAGR of 14.1% and a nearly 4X increase in market size.

During the first five-year period from 2025 to 2030, the market increases from USD 5,902.1 million to USD 11,421.1 million, adding USD 5,519.0 million, which accounts for 34% of the total decade growth. This phase records steady adoption in apparel, beauty retail, and eyewear try-ons, driven by the need for personalization and return reduction. Augmented Reality platforms dominate this period as they cater to over 60% of mobile and web-based deployments requiring real-time visual overlays.

The second half from 2030 to 2035 contributes USD 10,679.9 million, equal to 66% of total growth, as the market jumps from USD 11,421.1 million to USD 22,101.0 million. This acceleration is powered by widespread deployment of digital avatars, AI-based personalization engines, and social-commerce-integrated virtual try-on systems.

Artificial Intelligence / Machine Learning solutions gain rapid ground, and hybrid deployments (cloud + in-store smart mirrors) capture a larger share above 30% by the end of the decade. Analytics-driven SaaS and API-led subscriptions drive recurring revenue, increasing the software share beyond 40% in total value.

From 2020 to 2024, the Virtual Try-On Market grew from USD 2,800 million to USD 5,000 million, driven by hardware-centric AR adoption. During this period, the competitive landscape was dominated by AR solution providers controlling nearly 70% of revenue, with leaders such as Perfect Corp., ModiFace, and MemoMi focusing on fashion and beauty applications.

Competitive differentiation relied on AR realism, 3D fitting precision, and integration into mobile/e-commerce apps, while AI and analytics were still emerging. Service-based models had limited traction, contributing less than 15% of the total market value.

Demand for Virtual Try-On solutions will expand to USD 5,902.1 million in 2025, and the revenue mix will shift as software, analytics, and platform subscriptions grow to over 40% share. Traditional visualization-first providers face rising competition from digital-first players offering AI-based fit prediction, cloud-enabled avatar try-ons, and mobile-native virtual styling engines.

Major AR vendors are pivoting to hybrid models, integrating personalization AI and workflow automation to stay competitive. New entrants specializing in cloud interoperability, avatar commerce, and industry-specific APIs are gaining traction. The competitive advantage is moving away from AR rendering alone to end-to-end platform ecosystems combining software, data, and continuous engagement.

Advancements in augmented reality (AR) and artificial intelligence (AI) have significantly improved the realism and accuracy of virtual try-on experiences, enabling real-time body and face mapping across apparel, eyewear, and cosmetics categories. Cloud-based deployment has accelerated adoption by offering scalable and cost-efficient solutions, particularly for mid-sized retailers and D2C brands. The widespread use of smartphones and high-quality front-facing cameras has made virtual try-on technology accessible to the mass market, further supported by integrations with e-commerce websites and mobile apps.

Growing demand for personalization, return reduction, and enhanced customer engagement in online shopping is fueling the adoption of virtual try-on platforms. Retailers are increasingly deploying AR and AI-enabled platforms to simulate fit, style, and product compatibility. In-store smart mirrors, mobile-based facial scanning, and avatar-based try-ons are becoming standard across apparel chains, optical brands, and beauty retailers. Segment growth is being led by cloud-based SaaS platforms, AR technology in the visualization stack, and AI/ML models for fit prediction and personalization.

The market is segmented by application, technology, platform delivery mode, end user type, and region. Application segments include apparel & fashion, footwear, eyewear, beauty & cosmetics, jewelry & watches, and furniture & home décor reflecting diverse usage across retail domains. Technology segmentation covers augmented reality (AR), artificial intelligence/machine learning (AI/ML), computer vision, 3D modeling/simulation, virtual reality (VR), and mixed/holographic reality each enabling different levels of visualization and personalization.

Platform delivery modes include cloud-based SaaS platforms, on-premise/in-store systems such as AR mirrors, and hybrid deployments combining both for omnichannel operations. End user types include retailers and direct-to-consumer (D2C) brands, e-commerce marketplaces, specialty retail chains (optical, cosmetics, furniture), technology developers (via SDK/API integrations), and omnichannel enterprises leveraging both online and physical touchpoints. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with strong growth observed in China, India, the USA, Germany, the UK, and Japan.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Apparel & Fashion | 39.6% |

| Others | 60.4% |

The Apparel & Fashion segment is projected to contribute 39.6% of the Virtual Try-On Platform Market revenue in 2025, maintaining its lead as the dominant application category. This is driven by the widespread demand for digital fitting rooms, size prediction tools, and AR-based visualization in online fashion retail. Brands are increasingly turning to try-on platforms to enhance customer engagement, reduce return rates, and improve conversion during online purchases.

The segment’s continued growth is fueled by integration with mobile apps, e-commerce platforms, and virtual closets that allow users to preview full outfits. As Gen Z and millennial shoppers demand more immersive and personalized experiences, fashion remains the most responsive sector to virtual try-on innovation. Apparel & Fashion is expected to remain the core driver of market traction, especially across North America, Europe, and emerging Asia-Pacific e-retail ecosystems.

| Technology Segment | Market Value Share, 2025 |

|---|---|

| Augmented Reality (AR) | 63.4% |

| Others | 36.6% |

The Augmented Reality (AR) segment is projected to contribute 63.4% of the Virtual Try-On Platform Market revenue in 2025, firmly leading the technology stack. AR's dominance is driven by its ability to offer real-time, camera-based overlays for face, body, and product try-ons through smartphones and web browsers. The technology has become a staple in beauty, eyewear, and apparel retail experiences.

AR’s growth is supported by improved rendering engines, facial/body tracking precision, and device compatibility. Retailers leverage AR to create frictionless shopping journeys, allowing customers to virtually try products before purchase enhancing satisfaction and brand loyalty. As 5G, AI, and camera hardware continue to evolve, AR is expected to retain its leadership in the virtual try-on experience stack, bridging digital and physical commerce.

| Platform Delivery Segment | Market Value Share, 2025 |

|---|---|

| Cloud-Based (SaaS) | 69.3% |

| Others | 30.7% |

The Cloud-Based (SaaS) segment is projected to contribute 69.3% of the Virtual Try-On Platform Market revenue in 2025, making it the most dominant platform delivery mode. Its rise is attributed to the scalability, affordability, and ease of integration offered to retailers and D2C brands of all sizes. SaaS-based platforms enable faster deployments, remote updates, and flexible pricing models suitable for both enterprise and mid-market users.

As omnichannel and mobile commerce expand globally, SaaS platforms are favored for their compatibility with e-commerce engines, mobile apps, and API ecosystems. Vendors continue to invest in performance, uptime, and security while also embedding analytics and personalization layers. Cloud-based delivery is expected to remain the operational backbone of virtual try-on ecosystems, particularly in fashion, cosmetics, and lifestyle retail sectors.

Driver

SaaS and API-First Retail Architecture

A major driver of the Virtual Try-On Platform Market is the industry-wide shift toward SaaS and API-first infrastructure. Retailers are rapidly moving away from custom-built AR modules and hardware-heavy setups, instead opting for cloud-native platforms that offer scalable virtual try-on services.

These platforms provide seamless integration via APIs and SDKs, enabling faster deployment across e-commerce websites, mobile apps, and omnichannel systems. This architectural shift allows VTO providers to serve a broader client base, including mid-sized and fast-scaling brands, without high setup costs, while also ensuring version control, real-time updates, and cross-device compatibility.

Mid-Market Brand Adoption in Asia and LATAM

Another powerful driver comes from increased adoption by Tier-2 and Tier-3 brands in emerging markets such as China, India, Brazil, and Indonesia. As VTO platforms become more affordable and user-friendly, mid-sized fashion, beauty, and optical brands are subscribing to off-the-shelf SaaS solutions instead of investing in in-house AR development.

These businesses are attracted by low-cost entry points, localized language support, and smartphone compatibility, which makes advanced try-on experiences accessible to a wider demographic. This growing long-tail demand is significantly expanding the global revenue pool for VTO platform providers.

Restraint

Lack of 3D Asset Standardization

One of the key restraints limiting market scalability is the absence of standardized protocols for 3D asset creation and management. Retailers and brands often provide product visuals in non-uniform forms, which require manual conversion, retopology, or optimization before integration into virtual try-on systems.

This increases implementation time and cost, especially when onboarding large catalogs in apparel, jewelry, or cosmetics. Without universal 3D modeling guidelines or industry-wide asset compatibility frameworks, VTO vendors must maintain large service teams, reducing platform-level automation and affecting onboarding efficiency for new clients.

Device Limitations in Emerging Markets

Despite strong smartphone penetration globally, many mid-tier devices in emerging markets lack the advanced camera systems, processing speeds, or AR framework support (like ARKit/ARCore) needed for high-quality try-on experiences. This creates significant disparities in rendering quality, avatar tracking, and facial/body alignment, particularly on low-end Android devices.

As a result, virtual try-on platforms are often forced to deliver simplified or static try-on experiences to accommodate hardware limitations, which reduces the immersive quality and risks weakening consumer confidence in the feature’s accuracy.

Trend

AI-Based Fit Prediction and Body Avatars

A key trend transforming the virtual try-on ecosystem is the integration of AI-based sizing and fit recommendation systems alongside 3D avatar creation. Rather than simply showing how a product looks, platforms are evolving to simulate how it fitsusing AI to estimate body measurements from photos, recommend SKUs by brand-specific sizing charts, and personalize fit for different body shapes.

This trend is especially strong in fashion and lingerie categories, where incorrect sizing is a primary reason for returns. Fit personalization is emerging as a core value proposition, making VTO platforms not just visual tools but performance drivers for online conversion.

Try-On Integration in Social Commerce and Creator Retail

Another emerging trend is the expansion of virtual try-on capabilities into social commerce platforms like TikTok, Douyin, Instagram, and Snapchat. These platforms are enabling influencers and creators to showcase products using embedded VTO tools directly within livestreams, stories, and shoppable posts.

This creates a new monetization model for virtual try-on providers, who are now servicing creator economies in addition to traditional retail clients. As younger consumers gravitate toward creator-led shopping, this integration of AR try-on into influencer marketing and affiliate commerce is reshaping how virtual try-on platforms are adopted and monetized.

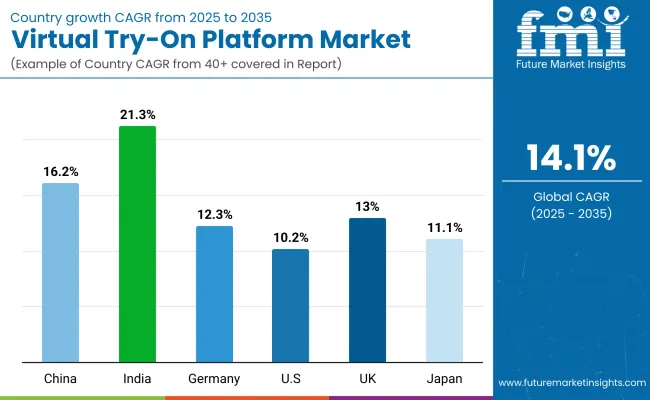

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 16.2% |

| India | 21.3% |

| Germany | 12.3% |

| USA | 10.2% |

| UK | 13.0% |

| Japan | 11.1% |

The Global Virtual Try-On Market shows a pronounced regional disparity in adoption speed, strongly influenced by smartphone penetration, AI infrastructure maturity, and the retail sector’s digital transforming efforts. Asia-Pacific emerges as the fastest-growing region, anchored by China at 16.2% CAGR and India at 21.3%. This acceleration is driven by large-scale retail digitization, aggressive e-commerce expansion, and government-backed mandates for AI and AR integration in consumer technology sectors.

China’s regulatory framework promoting AI-based retail transforming in fashion and beauty further accelerates adoption of virtual try-on solutions for real-time product engagement and conversion optimization. India’s trajectory reflects rising integration of AR-based try-on tools by apparel, eyewear, and beauty brands targeting Gen Z and mobile-first users, supporting both domestic demand and export-oriented D2C platforms. Europe maintains a strong growth profile, led by Germany at 12.3% and the UK at 13.0%, supported by stringent online consumer protection standards, omnichannel retail compliance, and sustainability reporting.

High adoption of cloud-native AR platforms and retailer investments in zero-return shopping experiences keep Europe ahead of North America, particularly in virtual try-on for personalization, size optimization, and eco-conscious shopping. North America shows moderate expansion, with the USA at 10.2% CAGR, reflecting maturity in digital commerce and slower mass-market AR adoption relative to Asia-Pacific. Growth in North America is more software and experience-driven, with increasing demand for AI-enhanced avatar personalization, SaaS-based VTO licensing, and integrations with social commerce platforms rather than pure device-based try-on solutions.

| Year | USA Virtual Try On Market (USD Million) |

|---|---|

| 2025 | 1670.29 |

| 2026 | 1862.83 |

| 2027 | 2077.56 |

| 2028 | 2317.04 |

| 2029 | 2584.13 |

| 2030 | 2882.00 |

| 2031 | 3214.21 |

| 2032 | 3584.71 |

| 2033 | 3997.92 |

| 2034 | 4458.76 |

| 2035 | 4972.73 |

The Virtual Try-On Market in the United States is projected to grow at a CAGR of 10.2%, led by sustained investment in beauty and cosmetics try-on platforms. AR-powered beauty tech is the dominant application, with 43.3% of the USA market in 2025, driven by brands adopting virtual makeup trials and skin analysis solutions. The market also benefits from partnerships between SaaS try-on providers and large e-commerce platforms. While the hardware base is mature, most growth is now software and integration-led, especially in personalized avatars and cross-platform sync.

The Virtual Try-On Market in the United Kingdom is expected to grow at a CAGR of 13.0%, fueled by innovation in omnichannel retail and AR-driven product visualizations. Eyewear and home décor brands are piloting hybrid try-on platforms that integrate in-store smart mirrors with cloud-based recommendation engines. In the apparel sector, UK retailers are using body scan-based fitting solutions to reduce returns and improve sizing accuracy. Consumer electronics retailers are integrating AR overlays to guide product usage and setup.

India is witnessing the fastest growth in the Virtual Try-On Market, with a forecasted CAGR of 21.3% through 2035. Beauty and fashion brands are rapidly scaling AR try-on features in tier-1 and tier-2 cities, driven by increasing smartphone usage and consumer comfort with digital shopping. Retailers are investing in AI-powered facial mapping and size prediction models to expand reach across regional languages and platforms. India’s booming e-commerce and D2C startup ecosystem is accelerating adoption of plug-and-play SaaS-based try-on solutions.

| Market Share | 2025 |

|---|---|

| China | 17.1% |

| India | 4.5% |

| Germany | 6.2% |

| USA | 28.3% |

| UK | 5.2% |

| Japan | 7.1% |

| Market Share | 2035 |

|---|---|

| China | 20.5% |

| India | 8.8% |

| Germany | 6.5% |

| USA | 22.5% |

| UK | 5.8% |

| Japan | 7.4% |

The Virtual Try-On Market in China is expected to grow at a CAGR of 16.2%, supported by government push for retail digitization and dominance of mobile-based commerce. China holds a 17.1% global share in 2025, forecasted to rise to 20.5% by 2035, with AI/ML-based try-on technologies leading at 45.8% market share. Chinese tech firms are embedding virtual try-on into social shopping apps, especially for apparel and footwear. The domestic market also shows strong momentum in integrating try-on with facial recognition for cosmetics and optical categories.

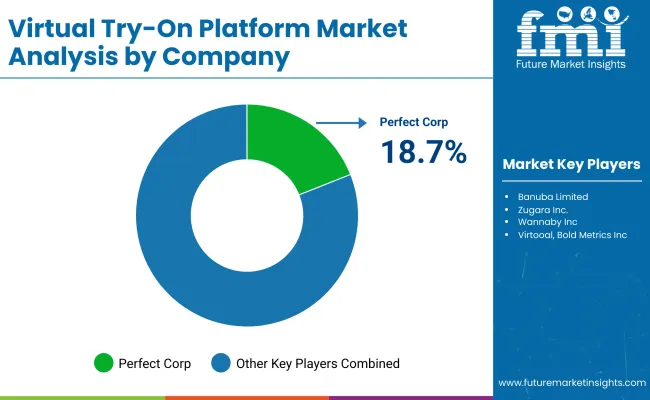

The Virtual Try-On Market is moderately fragmented, with a mix of global SaaS leaders, AR specialists, and niche-focused tech firms competing across apparel, beauty, eyewear, and home décor applications. Global frontrunner Perfect Corp. commands an 18.7% market share in 2025, establishing its dominance through AI-driven beauty tech, virtual makeup trials, and skin diagnostic integrations.

The company’s partnerships with e-commerce and smartphone OEMs have enabled large-scale deployment of cloud-based try-on solutions. Mid-sized innovators such as Vue.ai, 3DLOOK, and Banuba Limited are rapidly scaling through custom-fit solutions for fashion and AI-based avatar generation. Their strength lies in combining deep learning models with scalable SDKs for omnichannel retailers.

These players are also tapping into the growing demand for personalization and body scan accuracy in apparel sizing and fit prediction. Specialized providers like Zugara, Inc., MemoMi Labs Inc., and Virtooal focus on embedded AR experiences for optical retail and in-store augmented mirrors. Their competitive edge lies in seamless integration into existing retail infrastructure and API-based deployments for niche use cases like eyewear visualization and cosmetic color matching.

The competitive landscape is evolving from standalone AR apps toward integrated SaaS ecosystems that offer real-time analytics, AI personalization engines, and hybrid platform flexibility (cloud + in-store). Subscription-based revenue models and cross-platform interoperability are becoming key differentiators as the market moves toward enterprise-scale adoption.

Key Developments in Global Virtual Try On Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,902.1 million |

| Application Segments | Apparel & Fashion, Footwear, Eyewear, Beauty & Cosmetics, Jewelry & Watches, Furniture & Home Décor |

| Technology | Augmented Reality (AR), Artificial Intelligence / Machine Learning (AI/ML), Computer Vision, 3D Modeling / Simulation, Virtual Reality (VR), Mixed Reality / Holography |

| Platform Delivery Mode | Cloud-Based (SaaS Platforms), O n-Premise / In-Store Systems , Hybrid Deployment (Cloud + In-Store Integration) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Perfect Corp., Vue.ai, 3DLOOK, Banuba Limited, Zugara Inc., Wannaby Inc. ( Wanna ), Virtooal , Bold Metrics Inc., MemoMi Labs Inc., Metail Ltd., Tryon Technology Inc., BodyBlock AI, DeepAR , Styku Inc., AnthillAR Inc. |

| Additional Attributes | Dollar sales by application and platform type, dominance of AR and SaaS delivery, expansion of D2C and e-commerce VTO solutions, sector-specific innovation in cosmetics and fashion, integration with AI/ML and face/body scanning, China and India as fastest-growing markets, strategic partnerships with retailers and marketplaces, cloud-native SDK/API availability and cross-device deployment trends. |

The global Virtual Try-On Market is estimated to be valued at USD 5,902.1 million in 2025.

The market size for the Virtual Try-On Market is projected to reach USD 22,101.0 million by 2035.

The Virtual Try-On Market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in the Virtual Try-On Market are AR-based virtual try-on tools, AI/ML-driven size and fit solutions, and face/body scanning applications integrated via SaaS or hybrid platforms.

In terms of technology, the Augmented Reality (AR) segment will command 63.4% share in the Virtual Try-On Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA