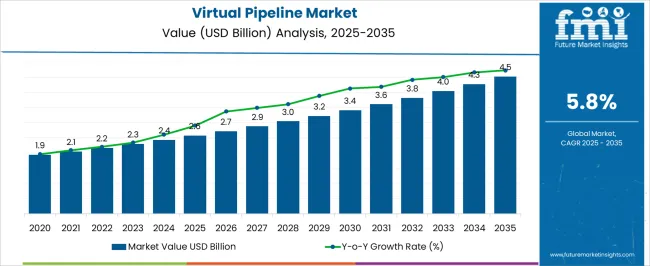

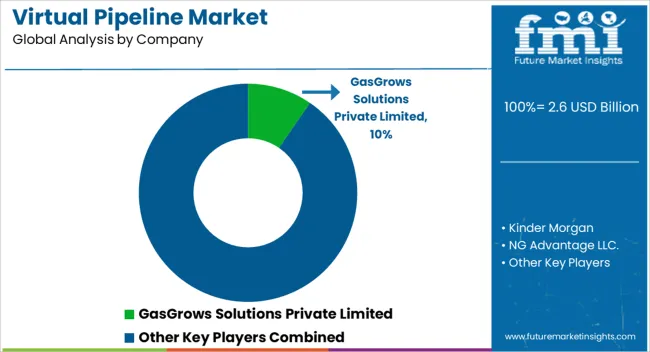

The virtual pipeline market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. The growth contribution index highlights that volume accounts for the largest share of incremental growth, particularly in the early to mid-phase of the forecast period. Increasing deployment of virtual pipelines for natural gas delivery in regions lacking fixed infrastructure underpins this trend.

Demand rises as industries, remote communities, and power generation facilities adopt these systems to secure a consistent and flexible energy supply. Technological progress in transport and storage solutions further supports volume expansion by reducing logistical constraints. Price growth, while a secondary contributor, plays a crucial role in enhancing the overall market value. Customization of virtual pipeline systems, integration of monitoring technologies, and adherence to stricter safety and regulatory standards push average transaction values upward.

Over time, premium service contracts and advanced equipment integration contribute a greater share to growth. By the end of the forecast window, the multiplication factor of 1.73x illustrates that both volume adoption and value upgrades complement each other, with volume providing the foundation while pricing innovation sustains the long-term revenue trajectory.

| Metric | Value |

|---|---|

| Virtual Pipeline Market Estimated Value in (2025 E) | USD 2.6 billion |

| Virtual Pipeline Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The virtual pipeline market is driven by five primary parent markets with specific shares. Natural gas distribution leads with 40%, where virtual pipelines transport gas to regions without fixed pipeline infrastructure. Power generation contributes 25%, supplying gas to remote plants for electricity production. Industrial manufacturing accounts for 15%, where factories and processing units require consistent natural gas supply. Transportation fuels represent 10%, supporting LNG and CNG distribution for vehicles.

Residential and commercial applications hold 10%, providing clean energy solutions to communities in off-grid locations. Together, these segments define demand for virtual pipelines and drive technological and logistical advancements. Recent developments in the virtual pipeline market focus on efficiency, safety, and sustainability. Companies are introducing advanced cryogenic tanks, composite cylinders, and optimized transport modules to improve capacity and reduce losses. Digital monitoring and IoT-enabled tracking systems are being deployed for real-time logistics and safety management. Expansion of LNG and CNG demand in transportation and power sectors is accelerating the adoption of virtual pipelines. Partnerships between energy providers and logistics firms are strengthening supply chains. Growing emphasis on cleaner fuels and the need to serve remote areas are positioning virtual pipelines as a critical solution in global energy distribution.

The virtual pipeline market is gaining traction as an alternative to conventional gas distribution networks, addressing infrastructure limitations and offering flexibility in fuel delivery across remote and underserved regions. The system’s ability to transport compressed or liquefied natural gas without reliance on physical pipelines has positioned it as a critical solution in regions with challenging terrain or limited grid access.

Growing environmental concerns and the global push for cleaner energy sources are accelerating demand for gas-based virtual pipeline solutions, especially in sectors transitioning away from diesel and coal. The market outlook remains positive, driven by rising investments in decentralized energy systems, favorable regulatory frameworks, and the expanding role of natural gas in energy transition strategies.

As logistical innovations reduce transportation costs and improve delivery reliability, virtual pipelines are expected to play an increasingly strategic role in gas distribution networks worldwide.

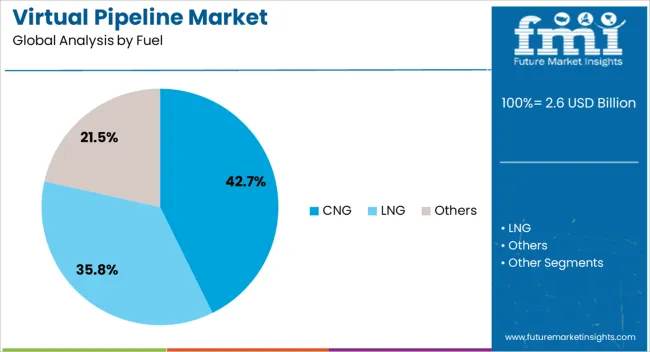

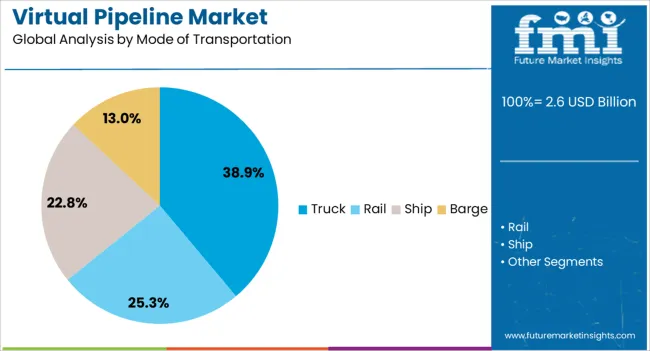

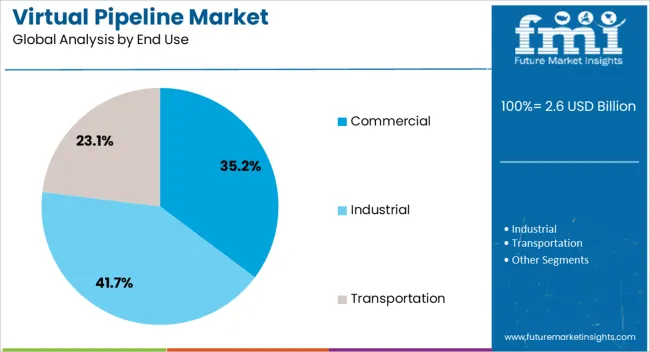

The virtual pipeline market is segmented by fuel, mode of transportation, end use, and geographic regions. By fuel, virtual pipeline market is divided into CNG, LNG, and Others. In terms of mode of transportation, virtual pipeline market is classified into Truck, Rail, Ship, and Barge. Based on end use, virtual pipeline market is segmented into Commercial, Industrial, and Transportation. Regionally, the virtual pipeline industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CNG segment dominates the fuel category with a 43% market share, driven by its cost-effectiveness, reduced carbon emissions, and broad applicability across power generation, transportation, and industrial use cases. Compressed Natural Gas is widely favored for its compatibility with existing combustion technologies and its superior energy-to-emission ratio compared to other fossil fuels.

The segment has gained momentum due to increased government incentives supporting clean fuel adoption, alongside rising demand for mobile energy solutions in remote regions. Virtual pipeline operators are leveraging CNG’s transportability to reach off-grid areas, ensuring reliable energy access without the need for extensive pipeline infrastructure.

Continued technological advancements in compression, storage, and safety systems are expected to reinforce CNG’s leadership in the virtual pipeline fuel landscape.

The truck segment accounts for 39% of the virtual pipeline market under mode of transportation, owing to its operational flexibility, scalability, and ability to serve remote end-user locations efficiently. Trucks provide a reliable and cost-effective method for moving natural gas between compression stations and off-grid demand centers, bypassing the high capital expenditure of fixed pipeline infrastructure.

This segment benefits from continuous enhancements in trailer design, storage capacity, and multi-modal integration, which have significantly improved the economics and safety of gas transport. The deployment of truck-based virtual pipelines is especially prominent in areas with intermittent or seasonal energy demands, where fixed infrastructure would be underutilized.

As the energy logistics ecosystem evolves, the truck segment is expected to retain its dominance, supported by route optimization technologies and increasing fleet investments by virtual pipeline service providers.

The commercial segment leads the end use category with a 35% share, reflecting its strong reliance on stable, low-emission energy sources to power operations across various sectors including retail, hospitality, and public infrastructure. Virtual pipelines offer commercial users a dependable and scalable gas supply solution without the complexity of connecting to physical pipeline grids, making them particularly valuable in expanding suburban or semi-urban regions.

The ability to secure predictable fuel deliveries helps businesses reduce operational risks, meet sustainability targets, and lower energy costs. Adoption within this segment is further driven by policy incentives, rising fuel price volatility, and the need for backup or supplementary energy in grid-constrained zones.

As commercial energy strategies increasingly prioritize flexibility and resilience, virtual pipelines are expected to become a standard component in gas procurement plans across multiple industries.

The virtual pipeline market is expanding as shippers and utilities seek flexible alternatives to fixed pipeline infrastructure for transporting natural gas, LNG, hydrogen, LPG, and specialty gases. Virtual pipeline solutions use road tankers, ISO cryogenic containers, tube trailers, rail tank cars, and small scale LNG carriers to move gaseous and cryogenic fuels between production sites, terminals, and end users. The model enables rapid deployment for remote industrial sites, island grids, mining operations, and seasonal demand peaks. Integration with bunkering, CNG stations, and hydrogen refueling networks enhances energy security and supply resilience while supporting decarbonization initiatives through bio and renewable gas carriers.

Primary drivers for the virtual pipeline market include the need for rapid supply solutions where fixed pipelines are uneconomical, lengthy permitting timelines, and rising demand from industrial heat, power generation, and transport sectors. Remote mining camps, islands, and distributed power plants rely on delivered LNG and CNG to replace diesel, lowering fuel costs and emissions. Growth in LNG small scale infrastructure, increasing investment in hydrogen pilot projects, and expansion of gas bunkering for maritime fuel strengthen demand. Regulatory pushes for lower carbon fuels and incentives for energy resilience encourage utilities and private offtakers to adopt virtual pipelines, enabling seasonal balancing, emergency supply, and flexible sourcing from global LNG spot markets.

Opportunities for virtual pipeline providers arise from hydrogen distribution, small scale LNG rollouts, and mobile refueling services. As green hydrogen production scales at electrolyzer hubs, road and rail delivery offers interim logistics prior to pipeline build out, enabling industrial users to access renewable hydrogen. Small scale LNG plants and satellite liquefaction projects support localized gasification networks for power, industry, and bunkering, creating demand for ISO tank leasing, cryogenic trailers, and truck mounted vaporizers. Integration with renewable biogas producers and cluster electrification projects creates pathways for blended fuels. Service providers that offer turnkey solutions including storage, regasification, scheduling, and emissions compliant transport can capture new contracts with utilities, shipping companies, and large industrial customers.

Key trends include digital freight scheduling, telematics for cryogenic assets, and modular liquefaction and regasification units that reduce time to market. Asset trackers, remote telemetry, and predictive maintenance improve uptime for ISO tanks and tankers, while digital contracting platforms streamline short term capacity bookings. Modular small scale liquefiers and mobile vaporizers enable seasonal or temporary deployments for festivals, construction camps, and disaster response. Policy frameworks for hydrogen blending, emissions reporting, and fuel quality standards are influencing equipment specifications and routing strategies. Cross modal solutions that combine road, rail, and coastal shipping reduce unit costs and expand coverage, enabling more competitive delivered gas prices versus liquid fuels in underserved regions.

Despite advantages, virtual pipeline expansion faces restraints including higher unit transport cost compared with mass pipeline networks for very large continuous flows, stringent safety and handling requirements for cryogenic and high-pressure gases, and complex cross-border regulations. Capital and operating expenses for cryogenic trailers, ISO tanks, and specialized rail cars are significant, while maintenance and certification add recurring costs. Permitting for storage and regasification in populated areas can delay projects, and variability in local fuel standards complicates the interoperability of these facilities. Insurance and liability for hazardous cargo, plus the need for trained personnel for transfer operations, increase project complexity.

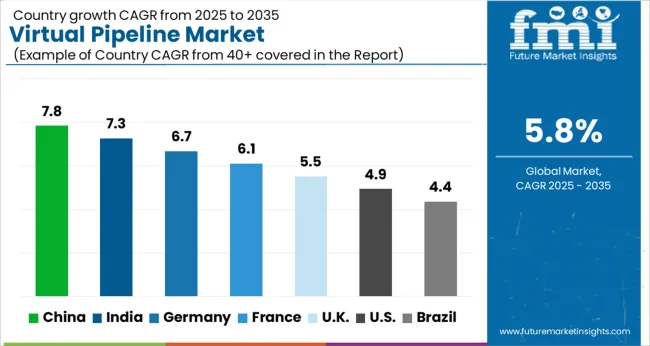

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The virtual pipeline market is projected to grow at a CAGR of 5.8% through 2035, with increasing adoption of natural gas transport solutions where conventional pipelines are not feasible. China records the highest growth at 7.8%, a 1.34× multiple of the global average, driven by large-scale energy diversification and LNG distribution projects. India follows at 7.3%, a 1.26× multiple, supported by expanding energy access initiatives and infrastructure gaps addressed by containerized gas delivery. Germany stands at 6.7%, 1.15× of the benchmark, with OECD-backed regulations promoting cleaner energy distribution and reduced dependency on fixed pipeline infrastructure. The United Kingdom posts 5.5%, slightly below the global trend, shaped by investments in flexible transport systems for industrial gas supply. The United States records 4.9%, a 0.84× multiple, where market expansion is moderated by a well-established pipeline network yet benefits from demand in remote and temporary sites. BRICS countries emerge as strong drivers, while OECD regions enhance the market with technological standards and regulatory frameworks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The virtual pipeline market in China is expected to expand at a CAGR of 7.8%, driven by rising natural gas consumption and the need to transport it to regions without fixed pipeline infrastructure. Mobile storage units, LNG tankers, and ISO containers are widely deployed to bridge the gap between production facilities and end-use sites. Investment in clean energy and government-backed programs supporting wider gas distribution are reinforcing adoption. Domestic logistics providers and international equipment manufacturers are collaborating on efficient, cost-effective solutions. Coastal regions and industrial clusters are leading demand for LNG-based virtual pipelines, while investments in digital monitoring and fleet optimization are enhancing reliability and safety.

The virtual pipeline market in India is forecast to grow at a CAGR of 7.3%, supported by expansion of city gas distribution networks and demand for natural gas in remote regions. LNG and CNG are transported using cryogenic tankers and specialized ISO containers to supplement limited physical pipeline infrastructure. Government initiatives promoting gas-based economies and clean fuel adoption are strengthening the role of virtual pipelines in bridging supply gaps. Energy companies are investing in dedicated virtual pipeline fleets to serve industrial clusters, power plants, and transport hubs. Startups are entering the market with digital tracking systems to enhance operational transparency and scheduling efficiency.

The virtual pipeline market in Germany is projected to expand at a CAGR of 6.7%, supported by LNG distribution to industrial customers and municipalities not connected to national grids. Infrastructure investments are directed toward LNG fueling stations and containerized transport solutions that complement existing pipeline networks. Companies are emphasizing safety compliance, digital fleet monitoring, and low-emission transport vehicles. The focus on energy diversification and reduced reliance on imported pipeline gas is increasing deployment of mobile distribution systems. Collaboration between logistics firms, energy suppliers, and technology providers is enabling more efficient delivery of LNG and CNG to remote or high-demand sites.

The virtual pipeline market in the United Kingdom is set to grow at a CAGR of 5.5%, shaped by the need to ensure energy availability in regions without direct pipeline connectivity. LNG and CNG deliveries are facilitated by road-based fleets and ISO containers, with applications across industrial facilities, utilities, and transport fueling stations. Companies are focusing on safety standards, cryogenic handling systems, and vehicle efficiency to optimize operations. Demand is particularly strong in Scotland and rural areas where pipeline infrastructure is limited. Strategic investments are being directed toward hybrid fleets and digital systems that track energy delivery and usage in real time.

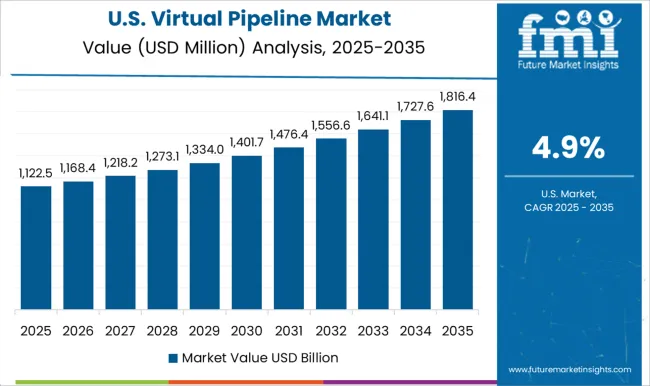

The virtual pipeline market in the United States is forecast to grow at a CAGR of 4.9%, supported by LNG and CNG distribution across regions lacking full pipeline coverage. Rising demand from industrial hubs, utilities, and transportation is driving deployment of mobile storage and cryogenic transport fleets. Federal and state-level clean energy programs are promoting wider adoption of gas-based alternatives to coal and oil. Companies are investing in digital scheduling platforms, advanced ISO containers, and specialized transport vehicles to improve cost efficiency and safety. Expansion of LNG fueling infrastructure and long-haul trucking fleets further strengthens growth prospects in the US.

Competition in the virtual pipeline sector revolves around expanding natural gas accessibility through modular, transportable solutions that bypass the need for traditional infrastructure. GasGrows Solutions Private Limited is strengthening its role in flexible energy delivery by supporting industries with mobile gas supply systems. Kinder Morgan, a global name in energy infrastructure, has extended its capabilities into virtual pipeline solutions to optimize natural gas distribution across underserved regions. NG Advantage LLC specializes in virtual pipeline logistics, delivering compressed natural gas (CNG) to commercial and industrial clients that lack direct pipeline connections.

Snam SPA, a European energy leader, has been innovating in clean energy distribution with scalable virtual pipeline technologies that complement its pipeline network. Stabilis Solutions, Inc. focuses on liquefied natural gas (LNG) distribution, offering customized solutions for industries and remote communities. FIBA Technologies, Inc. provides high-pressure gas storage and transportation systems essential to the safe operation of virtual pipelines. Hexagon Agility has emerged as a key player with advanced composite cylinder systems designed for efficient CNG and LNG transport. Petroliam Nasional Berhad (PETRONAS) and Gas Malaysia Virtual Pipeline Sdn. Bhd. have built regional capabilities in Asia, extending gas accessibility to off-grid areas. Air Products and Chemicals, Inc. contributes with advanced cryogenic technologies for LNG handling, while Galileo Technologies S.A. delivers modular compression and transport systems enabling greater flexibility. Xpress Natural Gas operates large-scale CNG logistics in North America, supported by CNG Services Limited in Europe. Aggreko integrates temporary power solutions with virtual gas supply, and Gáslink - Gás Natural, S.A. enhances natural gas accessibility across Portugal, completing a competitive landscape focused on efficient and sustainable energy transport.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Fuel | CNG, LNG, and Others |

| Mode of Transportation | Truck, Rail, Ship, and Barge |

| End Use | Commercial, Industrial, and Transportation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GasGrows Solutions Private Limited, Kinder Morgan, NG Advantage LLC., Snam SPA, Stabilis Solutions, Inc., FIBA Technologies, Inc., Hexagon Agility, Petroliam Nasional Berhad (PETRONAS), Gas Malaysia Virtual Pipeline Sdn. Bhd., Air Products and Chemicals, Inc., Galileo Technologies S.A., Xpress Natural Gas, CNG Services Limited, Aggreko, and Gáslink - Gás Natural, S.A. |

| Additional Attributes | Dollar sales by pipeline type and end use, demand dynamics across natural gas, LNG, and energy distribution, regional trends in remote and distributed supply, innovation in transport, storage, and monitoring technologies, environmental impact of emissions and energy use, and emerging use cases in peak shaving, emergency supply, and off-grid energy solutions. |

The global virtual pipeline market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the virtual pipeline market is projected to reach USD 4.5 billion by 2035.

The virtual pipeline market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in virtual pipeline market are cng, lng and others.

In terms of mode of transportation, truck segment to command 38.9% share in the virtual pipeline market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LNG Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA