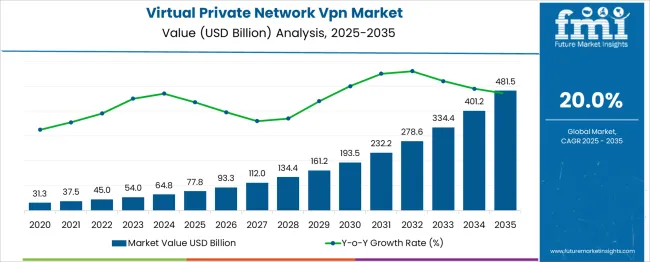

The Virtual Private Network VPN Market is estimated to be valued at USD 77.8 billion in 2025 and is projected to reach USD 481.5 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period. The growth path is not only linear but steepens notably after the midpoint, with an annual increment expanding by larger absolute margins. The CAGR’s credibility is validated by the growth momentum from 2026 to 2034, where revenues rise from USD 93.3 billion to USD 401.2 billion before finally hitting USD 481.5 billion.

The annual growth appears increasingly aggressive, especially after 2029, when compounded effects result in wider monetary gains. The CAGR metric used here accounts for the time-based compounding effect, offering a smoothed growth rate across volatile yearly shifts.

CAGR analysis, when applied to this VPN dataset, reveals not just the pace but also the sustainability of growth over a full decade. This metric confirms the market is undergoing exponential scaling rather than incremental increases, especially post-2028 when higher compounded gains emerge. This trajectory defines the sector as a rapidly maturing, capital-intensive digital infrastructure frontier.

| Metric | Value |

|---|---|

| Virtual Private Network VPN Market Estimated Value in (2025 E) | USD 77.8 billion |

| Virtual Private Network VPN Market Forecast Value in (2035 F) | USD 481.5 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The VPN market is undergoing rapid evolution, driven by the convergence of cybersecurity demands, hybrid work environments, and data localization policies. Growing enterprise reliance on remote access infrastructure and secure virtual environments has intensified the deployment of VPN technologies. Governments and regulatory bodies are increasingly mandating encryption and network anonymity in data-sensitive sectors, contributing to broader VPN adoption across industries.

The rise of IoT ecosystems and edge computing has further accelerated the need for encrypted, multi-node connectivity. Additionally, growing concerns around surveillance, censorship, and personal privacy are driving individual users to seek reliable VPN solutions.

Vendors are investing in scalable architectures, lightweight clients, and cross-platform operability to support expanding endpoint diversity. The market outlook remains strong, supported by technological convergence with zero-trust frameworks and increasing emphasis on compliance-driven network security modernization.

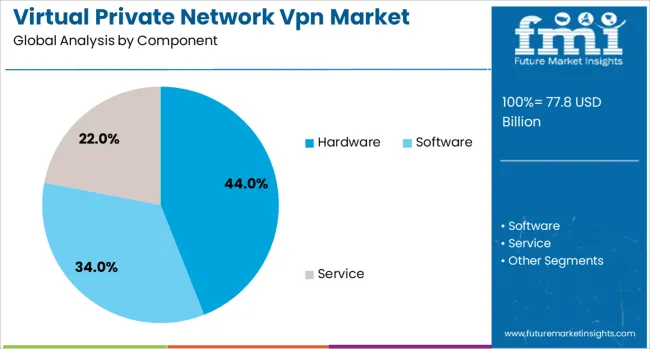

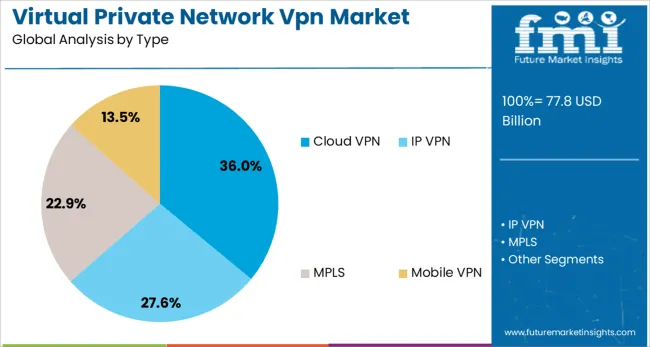

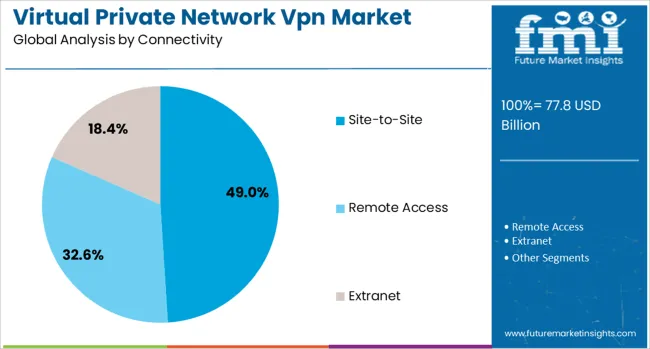

The virtual private network VPN market is segmented by component, type, connectivity application, and geographic regions. The component of the virtual private network VPN market is divided into Hardware, Software, and Service. In terms of the type of the virtual private network VPN market, it is classified into Cloud VPN, IP VPN, and MPLS Mobile VPN. Based on connectivity of the virtual private network VPN ), the market is segmented into Site-to-Site, Remote Access, and Extranet.

By application of the virtual private network VPN market is segmented into Commercial, Service Provider, and Consumer. Regionally, the virtual private network VPN industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is projected to account for 44.0% of the overall VPN market revenue in 2025, positioning it as the leading component type. This leadership is being driven by enterprise demand for dedicated VPN appliances that offer advanced encryption, failover capabilities, and high-throughput traffic management.

Hardware VPNs are often preferred in sectors where performance stability, low latency, and centralized control are critical. Their ability to support complex multi-branch configurations, enhanced firewalls, and integrated security protocols has made them integral to on-premise and hybrid cloud environments.

Additionally, the long-term lifecycle of hardware devices and the ability to scale with firmware upgrades have contributed to sustained demand from large-scale organizations seeking robust network perimeter protection.

Cloud VPNs are expected to hold 36.0% of the total market share in 2025, emerging as the leading type in the evolving VPN landscape. Growth in this segment is being influenced by enterprise digital transformation initiatives and the shift to cloud-native infrastructures.

Cloud VPNs allow scalable, on-demand encrypted connections across distributed devices and geographies without the need for physical infrastructure. Their ease of deployment, lower capital cost, and seamless integration with SaaS applications and cloud platforms have positioned them as preferred solutions for agile businesses.

Enhanced support for remote workforces, mobile device access, and centralized policy enforcement has further solidified cloud VPNs’ relevance in post-pandemic network architectures. The segment continues to benefit from strategic alliances between VPN providers and hyperscale cloud platforms that streamline secure connectivity services.

Site-to-site connectivity is forecast to dominate with a 49.0% share of the VPN market by 2025. This segment’s strength is being reinforced by the increasing need for secure inter-branch communications in globally distributed enterprises.

Site-to-site VPNs enable secure tunneling between corporate data centers, remote offices, and partner networks, ensuring seamless access to centralized resources without compromising data integrity. Their ability to deliver always-on encrypted connections without requiring individual device authentication enhances operational continuity and reduces IT overhead.

This model is particularly favored in finance, logistics, and government sectors where data sovereignty and multi-location coordination are paramount. As businesses expand across geographic boundaries and pursue integrated IT infrastructures, site-to-site VPNs remain a cornerstone for secure enterprise networking.

The VPN market has been shaped by increased digital traffic, data privacy concerns, and the growing need for secure access to organizational networks. VPN services have been adopted to enable encrypted communication over public or shared networks, thereby securing sensitive information and preventing unauthorized surveillance. Enterprises have implemented VPN infrastructure to support hybrid work environments and remote employee access. Regulatory compliance requirements regarding data confidentiality have further reinforced adoption. The market has seen contributions from software developers, cloud service providers, and cybersecurity firms seeking to offer integrated privacy solutions.

Corporate usage of VPNs has been propelled by the rising mobility of workforces and the decentralization of network access. Organizations have implemented secure tunneling protocols to allow employees to connect to internal systems without exposing critical resources to public internet threats. Remote work arrangements, virtual collaboration, and offsite client servicing have necessitated robust network authentication, device verification, and traffic encryption. Split tunneling and multi-protocol support have been integrated into enterprise-grade VPNs to manage bandwidth while retaining security. Authentication via digital certificates and tokens has replaced password-only systems, aligning with stricter internal governance policies. Network security teams have deployed monitoring and logging functions within VPN platforms to detect anomalies and ensure accountability. In sectors like banking, legal, and healthcare, VPN solutions have been prioritized to meet regulatory requirements related to data confidentiality and cyber hygiene.

Performance optimization has been achieved through advancements in VPN protocols, encryption standards, and software integration. WireGuard and OpenVPN protocols have been deployed to offer faster connection speeds and stronger encryption without overloading devices. 256-bit AES encryption has been widely adopted across commercial VPN platforms to meet evolving threat models. VPN client software has been developed to operate seamlessly across Windows, macOS, Android, iOS, and Linux environments. Compatibility with firewalls and intrusion prevention systems has been maintained to ensure smooth operation in corporate networks. Cloud-based VPN solutions have been introduced to eliminate the need for on-premise hardware, offering scalability and centralized management. Browser-based VPNs and smart routing algorithms have been used to reduce latency and improve user experience. Additionally, load balancing and automatic server switching have enhanced service reliability for high-demand users and remote workforces operating across dispersed geographies.

Data privacy regulations and national cybersecurity frameworks have significantly influenced the configuration and usage of VPN technologies. In jurisdictions where data residency laws are enforced, VPN providers have had to maintain local infrastructure and ensure traffic is not routed through restricted regions. GDPR, HIPAA, and CCPA regulations have mandated encryption for data in transit, positioning VPNs as foundational components in compliance strategies. However, regulatory scrutiny of VPN services has increased in regions concerned about illicit content, financial crime, and national security. Government-imposed bans or mandatory registration of VPN services have been observed in select countries, introducing operational risks for providers. Legal mandates for logging and traffic disclosure have challenged the core anonymity claims of some commercial VPN operators. These dynamics have required providers to maintain transparent policies, jurisdiction-aware server deployment, and robust auditing mechanisms to ensure sustained market presence under complex legal environments.

Despite their advantages, VPN implementations have encountered technical limitations and usage challenges. Connection instability, latency, and device incompatibility have been cited as common user complaints, especially in regions with low network quality. Complex setup procedures and misconfiguration risks have made some VPN platforms unsuitable for non-technical users. Free VPN services have faced criticism for data logging practices, intrusive advertising, and limited bandwidth, reducing user trust. In enterprise settings, VPN bottlenecks have emerged when network traffic surges exceed tunnel capacity, affecting performance. Licensing costs for high-scale deployments and staff training requirements have raised adoption barriers among budget-sensitive organizations. Compatibility issues with cloud-native applications and emerging authentication systems have required additional integration efforts. As alternative security solutions such as zero-trust network access gain momentum, VPN providers have faced pressure to evolve beyond traditional tunneling models and incorporate more dynamic threat response capabilities.

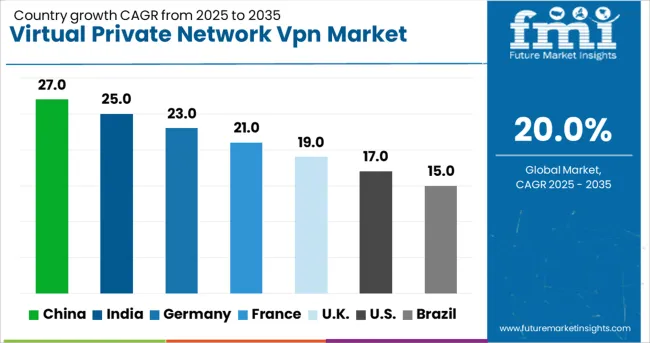

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The VPN market is projected to expand at a CAGR of 20.0% between 2025 and 2035. Growth is driven by rising concerns around online privacy, expanding remote work culture, and stricter data security laws. China leads with a projected 27.0% CAGR, owing to growing internet surveillance, enterprise data protection measures, and mass adoption among mobile users. India follows closely at 25.0%, bolstered by a surge in digital transactions and increasing awareness of cybersecurity. Germany, estimated at 23.0%, benefits from regulatory frameworks such as GDPR that enhance encryption and privacy service adoption. The UK, with 19.0%, is seeing increased deployment across corporate and consumer segments alike. The USA, at 17.0%, maintains stable growth supported by enterprise-level VPN integrations and privacy-focused consumer demand. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 27.0% between 2025 and 2035 in the virtual private network sector, driven by rising remote working infrastructure and demand for encrypted access across enterprise networks. Local technology companies have focused on internal encryption protocols tailored to national internet governance. Providers such as 360 Total Security and Tunsafe have focused on domestic cloud routing to minimize latency and bypass regional throttling. Corporate VPNs have been adopted across export-driven manufacturing zones to maintain international connectivity during cybersecurity reviews. Government scrutiny has increased, yet enterprise demand continues to strengthen the market. Preference for split tunneling and high-speed protocols has been rising among SMEs seeking performance without policy violations.

India is forecast to rise at a CAGR of 25.0% through 2035 as demand grows for secured digital connectivity across small businesses and educational platforms. VPN service providers such as InstaSafe and Lucideus have integrated end-point threat detection into their tunneling solutions, enabling granular control over outbound traffic. Increased access to internet in tier-2 regions and regulatory restrictions on international apps have pushed individuals toward encrypted browsing solutions. Rise in digital nomad employment and adoption of secure browser extensions among younger users have shaped the competitive dynamics. Network providers have invested in obfuscation tools to ensure uninterrupted access in areas with content control triggers.

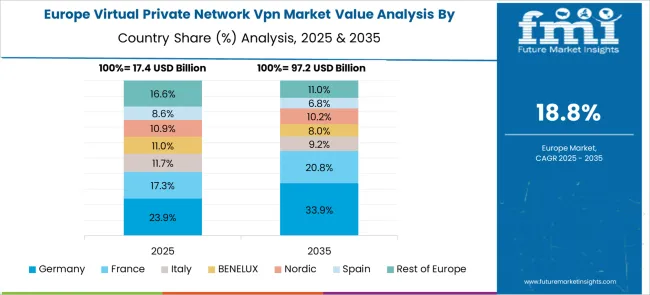

Germany is expected to experience a CAGR of 23.0% from 2025 to 2035 in the VPN landscape, steered by corporate compliance demands and focus on decentralized access policies. Enterprises have adopted split-access VPNs and virtual LAN routing to preserve GDPR-sensitive data across remote teams. German firms like Avira and Steganos have optimized tunneling speeds for business clients prioritizing multi-site encrypted sessions. Growth of hybrid work environments and migration toward zero-trust network access have widened the user base. Security regulations have emphasized transparency in VPN traffic logs, prompting vendors to improve data handling certifications.

The United Kingdom is projected to progress at a CAGR of 19.0% during the forecast window as VPN deployment expands across government departments and financial institutions. Market competition has intensified between native providers and international applications that offer dynamic IP cycling and no-log commitments. Law firms and fintech enterprises have adopted stealth-mode VPN protocols to comply with audit mandates. Growth in online media consumption has also fueled adoption of consumer-grade VPNs, particularly during data breach reports. Remote IT administrators have begun using containerized VPN environments to safeguard against session hijacks.

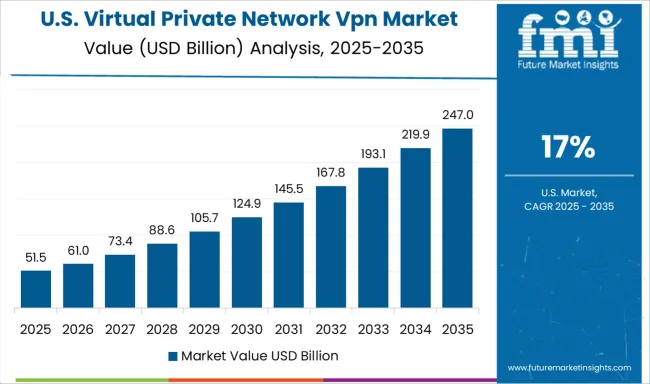

The United States is likely to expand at a CAGR of 17.0% between 2025 and 2035 with cybersecurity policy updates and enterprise-grade VPN integration driving momentum. Corporations such as Cisco and Palo Alto Networks have scaled software-defined perimeter solutions, while legacy firms modernize client-side encryption modules. Private access over remote desktop interfaces has been coupled with multi-factor authentication, reflecting stronger network access hygiene. Growth in cloud-native development and demand for off-premise protection has spurred upgrades in VPN orchestration tools. Consumer VPN platforms have expanded capabilities with advanced threat isolation.

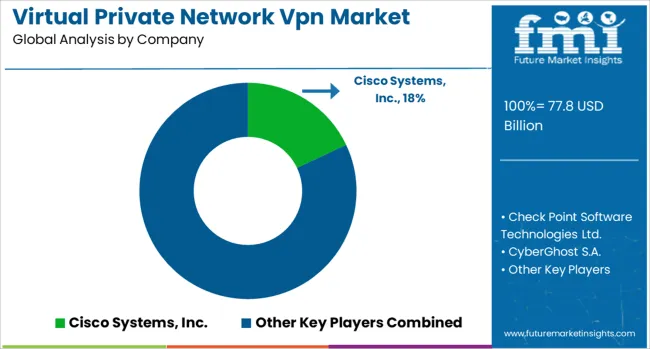

Virtual private networks have become a vital element of cybersecurity frameworks as remote access, data privacy, and digital anonymity continue gaining enterprise and consumer relevance. This market includes global network security providers and independent VPN specialists offering a range of solutions tailored to corporate architectures and individual users.

Cisco Systems, Inc. anchors the enterprise segment with integrated VPN features embedded in its broader security infrastructure, favored by organizations prioritizing centralized IT control. Check Point Software Technologies Ltd. enhances network traffic encryption and threat prevention capabilities through its remote access VPNs, aligning with endpoint and cloud-based security needs. CyberGhost S.A. caters predominantly to privacy-conscious consumers and small businesses, offering user-friendly applications with predefined security configurations.

ExpressVPN targets cross-platform access across regions with strong encryption protocols, performance optimization, and focus on evading geo-restrictions. Google LLC positions its VPN under broader cloud-based consumer protection services, integrating it within device ecosystems to enable streamlined private browsing without separate installation.

Competition pivots around privacy policy transparency, speed retention during encryption, multi-device compatibility, and reliable circumvention of geo-blocking. Providers with zero log policies, fast switching capabilities, and compatibility with secure tunneling protocols such as OpenVPN and WireGuard stand better placed to navigate evolving user demands across regulated and open internet jurisdictions.

| Item | Value |

|---|---|

| Quantitative Units | USD 77.8 Billion |

| Component | Hardware, Software, and Service |

| Type | Cloud VPN, IP VPN, MPLS, and Mobile VPN |

| Connectivity | Site-to-Site, Remote Access, and Extranet |

| Application | Commercial, Service Provider, and Consumer |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., Check Point Software Technologies Ltd., CyberGhost S.A., ExpressVPN, and Google LLC |

| Additional Attributes | Dollar sales by deployment mode and user type, demand dynamics across individual users, small businesses, and large enterprises, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in zero-trust network access, split tunneling optimization, and quantum-resilient encryption protocols, environmental impact of data center energy consumption and server load balancing, and emerging use cases in remote workforce security, IoT device protection, and privacy enhancement for digital financial transactions. |

The global virtual private network VPN market is estimated to be valued at USD 77.8 billion in 2025.

The market size for the virtual private network VPN market is projected to reach USD 481.5 billion by 2035.

The virtual private network VPN market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in virtual private network VPN market are hardware, software and service.

In terms of type, cloud VPN segment to command 36.0% share in the virtual private network VPN market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Virtual Retinal Display Market Insights - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Virtual Tourism Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA