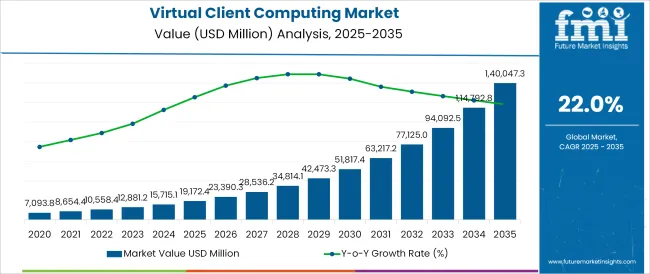

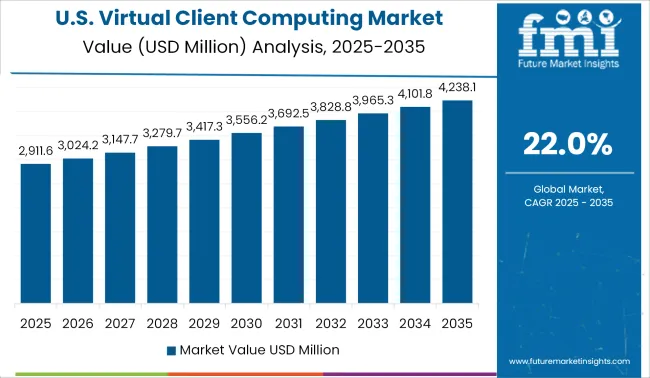

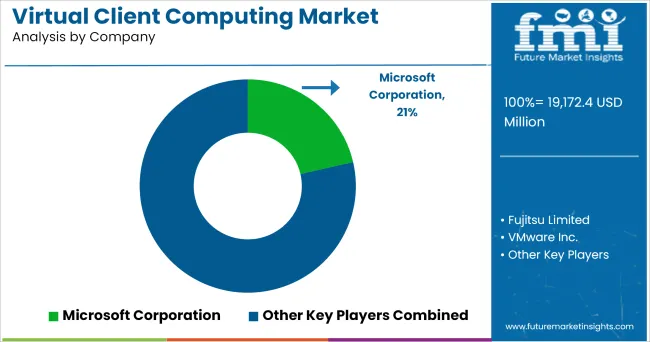

The Virtual Client Computing Market is estimated to be valued at USD 19,172.4 million in 2025 and is projected to reach USD 140,047.3 million by 2035, registering a compound annual growth rate (CAGR) of 22.0% over the forecast period.

The virtual client computing market is expanding rapidly, driven by the increasing adoption of digital workplace solutions and the need for secure, remote access to enterprise applications. Industry publications and technology leadership briefings have emphasized the growing demand for centralized computing environments that improve IT manageability and reduce endpoint vulnerabilities.

Businesses across industries have accelerated virtual desktop infrastructure (VDI) and application virtualization adoption to support hybrid workforces and streamline IT operations. Cloud service providers and technology vendors have launched scalable solutions that deliver virtual computing capabilities with improved latency, flexibility, and cost-effectiveness.

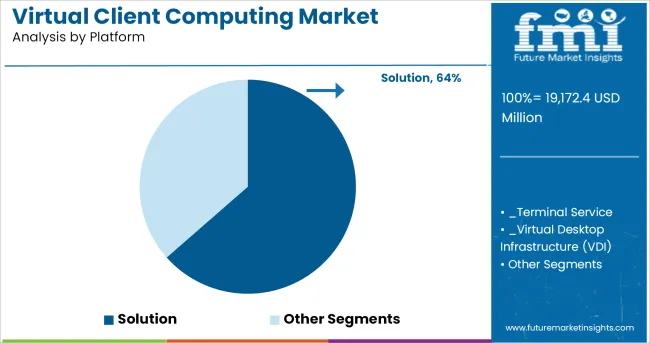

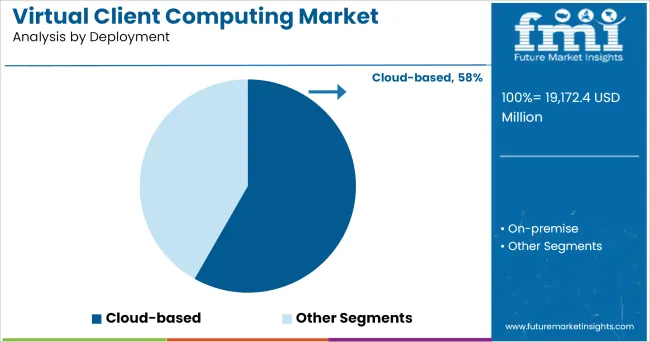

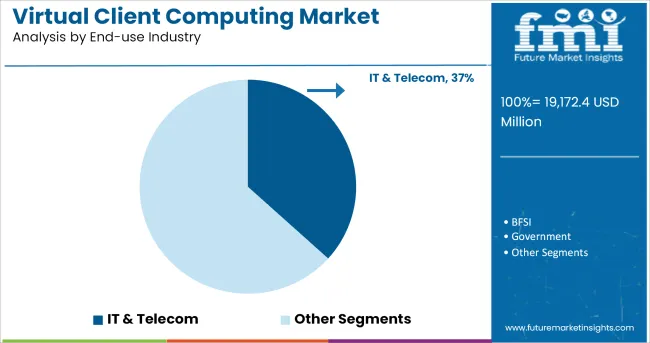

Additionally, cybersecurity concerns and compliance mandates have driven organizations to implement virtual environments that ensure secure data access and storage. Looking ahead, market growth will be shaped by continuous enhancements in cloud-based platforms, integration of artificial intelligence for workload optimization, and increased demand from sectors requiring highly secure computing environments. Segmental leadership is expected from the Solution platform, Cloud-based deployment models, and IT & Telecom end-use industry, reflecting evolving enterprise IT priorities.

The market is segmented by Platform, Deployment, and End-use Industry and region. By Platform, the market is divided into Solution, Terminal Service, Virtual Desktop Infrastructure (VDI), Virtual User Session (VUS), Others, Services, Training & Consulting, Integration & Deployment, and Support & Maintenance. In terms of Deployment, the market is classified into Cloud-based and On-premise.

Based on End-use Industry, the market is segmented into IT & Telecom, BFSI, Government, Healthcare, Manufacturing, Retail, Media & Entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solution segment is projected to hold 63.5% of the virtual client computing market revenue in 2025, reinforcing its leadership among platform types. Growth in this segment has been driven by the increasing enterprise need for complete virtual computing environments that combine software, applications, and virtualization management tools.

Businesses have prioritized solutions that provide a unified platform for desktop virtualization, application delivery, and secure endpoint access, enhancing IT efficiency. Technology vendors have continually expanded their solution offerings with integrated security features, workload balancing, and multi-cloud compatibility, addressing enterprise scalability needs.

Organizations have favored bundled solutions over fragmented services to reduce vendor management complexity and improve deployment timelines. With digital transformation initiatives accelerating, the Solution segment is expected to sustain its dominance, as enterprises continue to seek comprehensive and cost effective virtual client computing environments.

The Cloud-based segment is projected to contribute 58.2% of the virtual client computing market revenue in 2025 maintaining its position as the leading deployment model. Growth of this segment has been propelled by the widespread shift toward scalable and flexible IT infrastructures that enable remote workforce enablement.

Cloud deployments have been preferred by enterprises for their ability to support rapid provisioning, lower upfront investments, and simplified IT maintenance. Cloud service providers have enhanced their offerings with secure, high availability environments and geographic redundancy, making cloud-based virtual computing a preferred choice for business continuity planning.

Additionally, regulatory compliance capabilities and built-in disaster recovery features have made cloud deployments attractive for regulated industries. As more enterprises adopt hybrid and multi cloud strategies to optimize workload performance, the Cloud-based segment is expected to remain the primary deployment model for virtual client computing environments.

The IT & Telecom segment is projected to hold 36.7% of the virtual client computing market revenue in 2025, securing its position as the leading end-use industry. Growth of this segment has been driven by the sector's early adoption of virtualization technologies to support globally distributed workforces and complex IT operations.

IT service providers and telecom companies have deployed virtual client computing solutions to streamline software delivery, secure remote access, and optimize infrastructure management. These industries have required scalable and secure virtual environments to support software development, network management, and customer service operations across geographically dispersed teams.

Industry initiatives aimed at modernizing internal IT operations and enhancing customer-facing platforms have further driven adoption. With the continued evolution of 5G networks, cloud-native services, and digital transformation programs, the IT & Telecom segment is expected to sustain its growth, reinforcing its leadership in virtual client computing adoption.

The increasing need for improved user productivity and enhanced information security is one of the major factor that fuel the demand for the virtual client computing market.

There is a continuing trend of using mobile computing devices and rising demand for an agile workforce will robust virtual client computing market during the forecast period.

Cloud-based deployment is expected to contribute maximum revenue share owing to the advancements in information sharing technologies and increasing use of mobile devices. It also offers different features such as eliminating complexities, reduce the customers work effort, increase flexibility, regularly updated, and others. The reliability of such benefits drives the growth of the virtual client computing market.

The USA is one of the substantial markets for virtual client computing globally. North America is expected to capture largest market share in terms of revenue, in the virtual client computing due to the rise in adoption of cloud computing technologies and the presence of various virtual client computing providers in the region.

Furthermore, USA is the dominant country in the North America virtual client computing market accounting for around 15% to 20% of the market share in 2024. Virtual client computing software needs very active and flexible IT support.

The adoption of virtual client computing is expected to rise significantly across SMEs and large businesses across the East Asia. East Asia is expected to arise as the highest-growing regional market during the forecast period, due to the presence of developing economies and increasing adoption of virtual client computing in data centers and BPOs.

Some of the key players such as Huawei Technologies Co., Ltd., Hitachi, Ltd., Fujitsu Limited, and others are focused on increased adoption of cloud computing, analytics, and data virtualization solution for business operations. As per the report, East Asia is known as a primary market, and is expected to continue showing high demand for virtual client computing during the forecast period.

Some of the leading providers of virtual client computing include

Providers of virtual client computing have been focusing on introducing new and innovative virtual client computing solutions with including an advanced feature for different fields such as healthcare, IT & telecom, retail, and BFSI. For instance, in September 2020, Microsoft launched True Desktop VDI with Windows virtual desktop for commercial use.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global virtual client computing market is estimated to be valued at USD 19,172.4 million in 2025.

The market size for the virtual client computing market is projected to reach USD 140,047.3 million by 2035.

The virtual client computing market is expected to grow at a 22.0% CAGR between 2025 and 2035.

The key product types in virtual client computing market are solution, terminal service, virtual desktop infrastructure (vdi), virtual user session (vus), others, services, training & consulting, integration & deployment and support & maintenance.

In terms of deployment, cloud-based segment to command 58.2% share in the virtual client computing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA