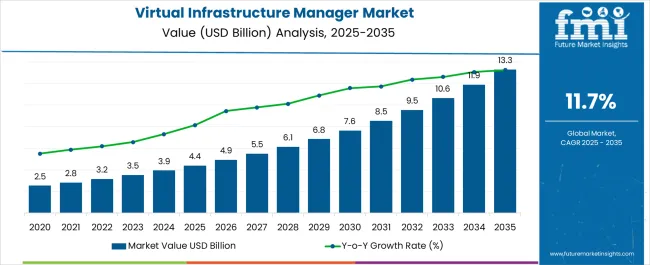

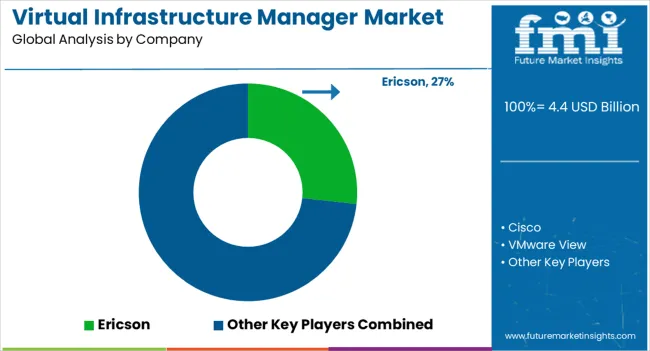

The Virtual Infrastructure Manager Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period.

| Metric | Value |

|---|---|

| Virtual Infrastructure Manager Market Estimated Value in (2025 E) | USD 4.4 billion |

| Virtual Infrastructure Manager Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 11.7% |

The virtual infrastructure manager market is expanding rapidly as enterprises accelerate digital transformation, cloud adoption, and the need for scalable infrastructure solutions. Increasing complexity in IT environments and the requirement for seamless integration across hybrid and multi cloud ecosystems are pushing organizations toward advanced infrastructure management platforms.

Demand is further supported by cost optimization initiatives and the growing importance of security, compliance, and real time monitoring across critical sectors. Continuous innovation in automation, AI driven analytics, and self service orchestration is enhancing operational efficiency and reducing downtime, strengthening the adoption trajectory.

The future outlook is favorable as both private and public sector organizations increasingly rely on virtual infrastructure managers to support workload consolidation, data center optimization, and business continuity.

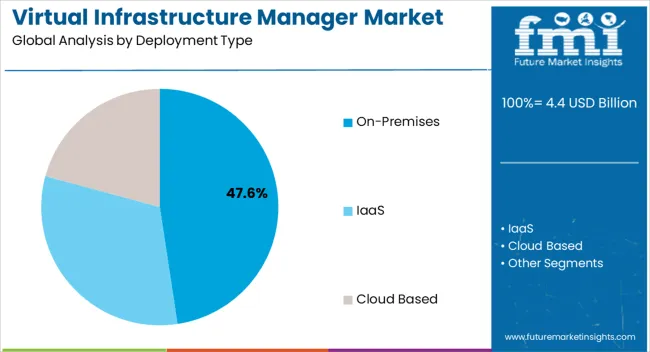

The on premises deployment type segment is expected to account for 47.60% of total revenue by 2025, establishing it as the leading deployment model. This is attributed to enterprises maintaining greater control over sensitive data, regulatory compliance, and security frameworks.

Industries operating under stringent governance prefer on premises solutions to safeguard mission critical operations and ensure uninterrupted access. Additionally, integration with legacy systems and reduced dependency on external cloud providers have reinforced the preference for this model.

Organizations with significant investment in existing data centers continue to leverage on premises infrastructure managers, ensuring reliability and customization tailored to specific enterprise requirements.

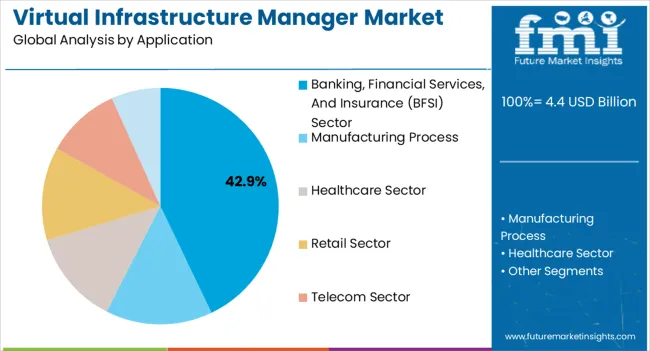

The banking financial services and insurance sector is projected to represent 42.90% of total revenue by 2025 within the application category, making it the dominant vertical. This dominance is fueled by the sector’s need for secure, scalable, and compliant infrastructure to support high transaction volumes and sensitive financial data.

Regulatory obligations and data privacy laws have accelerated adoption of infrastructure management solutions that enhance transparency and operational oversight. The shift toward digital banking, fintech integration, and real time analytics is further driving reliance on robust virtual infrastructure managers.

Enhanced disaster recovery, fraud detection, and secure workload management have cemented the BFSI sector as the primary application domain.

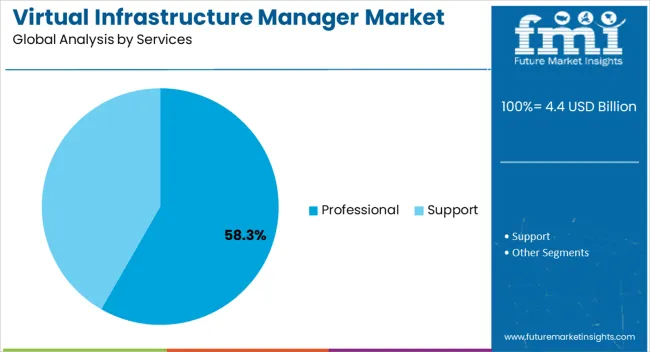

The professional services segment is anticipated to hold 58.30% of market revenue by 2025, positioning it as the leading service category. Growth is supported by enterprises requiring expert consultation, integration, and customization to maximize value from infrastructure investments.

Professional services deliver tailored deployment strategies, training, and maintenance that help organizations align infrastructure management with business objectives. Increasing demand for managed services, automation, and optimization expertise has reinforced reliance on professional providers.

The ability to reduce complexity, ensure compliance, and deliver cost effective scalability has established professional services as the most influential contributor to market growth.

Drivers:

Virtual infrastructure manager market growth is attributed to several factors, such as:

Issues with the tracking of physical machines and virtual machines are expected to hinder the growth of the virtual infrastructure manager market. Also, the lack of qualified professionals is expected to present challenges to the market for virtual infrastructure managers.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| North America | 27.7% |

| Europe | 24.3% |

North America is expected to hold a significant share of the global market, accounting for 29.2% of the market share during the forecast period owing to the increasing demand for infrastructure monitoring in the region.

Market growth in North America region is mainly driven by high adoption of bringing your own device (BYOD) policies, cloud adoption among several end-user segments, and increasing workplace flexibility requirements. Furthermore, with the presence and availability of global brands, there are significant growth prospects for North America’s market.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| The United States | 17.6% |

| Germany | 10.5% |

| Japan | 5.4% |

| Australia | 3.9% |

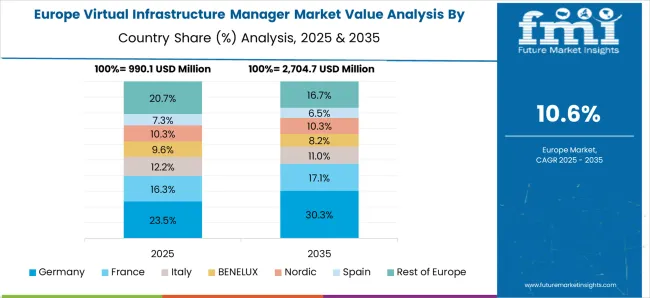

The market report explains that Europe is projected to hold a considerable share of 21.1% of the global market for virtual infrastructure managers during the forecast period. Within the European Union, continuous technological advancements are occurring throughout the region, such as in Norway, Finland, Sweden, Denmark, the Netherlands, Switzerland, and the United Kingdom, which holds a leading position in national technological strength.

A position in this area contributes to the development of advanced software and technology in the industrial sector. Also, virtual infrastructure manager is expected to be positively impacted by the trend of BYOD and remote working prevalent in Europe, fuelling the adoption of virtual infrastructure managers.

| Regional Markets | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom | 8.9% |

| China | 10.5% |

| India | 15.4% |

How is the Start-up Ecosystem in the Virtual Infrastructure Manager Market?

The market report explains that new business models are emerging all the time, sometimes due to market changes and technological advancements, culminating in new, exciting trends. To develop the right frameworks and architectures, start-ups are intensifying their focus on innovation and resorting to mergers and acquisitions.

Several companies are focusing on organic growth strategies such as product launches, product approvals, patents, and events. Further, inorganic growth strategies observed in the market were acquisitions, collaborations and partnerships. These activities have paved the way for the expansion of business and the customer base of market players.

Key players in the market are expected to benefit from significant growth opportunities in the future. This is due to the increasing demand for filter products in the global market.

| Category | By Application |

|---|---|

| Top Segment | Manufacturing Process |

| Market Share in Percentage | 28.1% |

| Category | By Services |

|---|---|

| Top Segment | Support |

| Market Share in Percentage | 52.1% |

Recent Developments in the Virtual Infrastructure Manager Market

The market report explains that the players are investing significantly in research and development so that they can introduce new and innovative applications to offer traffic analysis details across LAN, WAN, and cloud environments. With the advent of new service provider functions, the market has become mainstream.

Cloud-based management is used mainly for mobile core services and virtual networking services and is deployed globally in telecommunications data centers mainly in the central and regional regions. Many competitors in the market adopted partnerships as a key strategy to expand their geographical footprint and upgrade their product technologies.

The leader in cloud data services, NetApp, announced on April 29, 2024, that it acquired CloudJumper, a leader in virtual desktop infrastructure (VDI) and remote desktop services (RDS). This acquisition may enable NetApp to deliver a comprehensive solution that combines virtual desktop management and application management. This also enables customers to deploy, manage, monitor, and optimize those environments from a single provider using any public cloud.

The leading players operating in this market include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 11.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | By Deployment Type, By Application, By Services, By Region |

| Regions Covered | North America Market; Latin America Market; Europe Market; East Asia Market; South Asia and Pacific Market; The Middle East & Africa (ME&A) Market |

| Key Countries Profiled | The United States, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC, South Africa |

| Key Companies Profiled | Ericson; Cisco; VMware View; IBM PowerVM; Netapp; Enterprise Management Associates Inc.; CA Technologies; SevOne; Fujitsu Ltd.; Avaya Inc. |

| Customization& Pricing | Available Upon Request |

The global virtual infrastructure manager market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the virtual infrastructure manager market is projected to reach USD 13.3 billion by 2035.

The virtual infrastructure manager market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in virtual infrastructure manager market are on-premises, iaas and cloud based.

In terms of application, banking, financial services, and insurance (bfsi) sector segment to command 42.9% share in the virtual infrastructure manager market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Mobile Infrastructure Market Growth – Trends & Forecast 2023-2033

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA