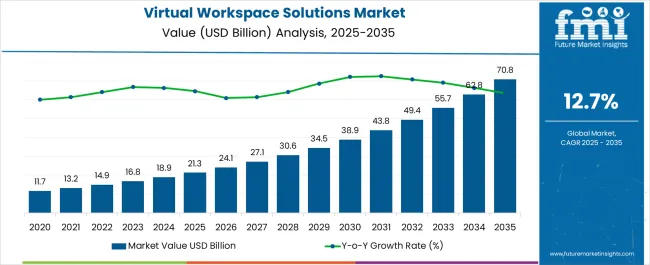

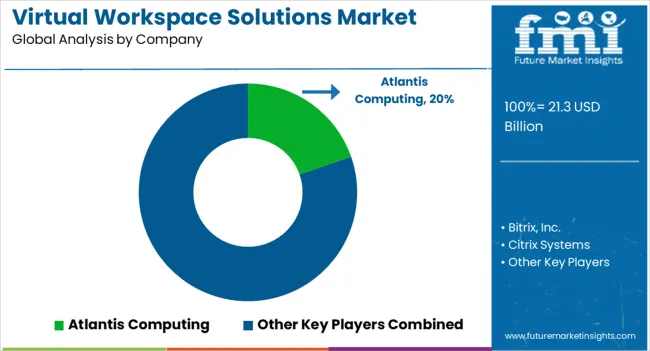

The Virtual Workspace Solutions Market is estimated to be valued at USD 21.3 billion in 2025 and is projected to reach USD 70.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

| Metric | Value |

|---|---|

| Virtual Workspace Solutions Market Estimated Value in (2025 E) | USD 21.3 billion |

| Virtual Workspace Solutions Market Forecast Value in (2035 F) | USD 70.8 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The growing adoption of subscription based services has made deployment scalable for organizations of different sizes while maintaining seamless access to resources across devices and geographies. Regulatory compliance and data privacy standards are further accelerating investments in secure virtual work environments.

The market outlook remains strong as organizations continue to modernize IT infrastructure and enhance employee productivity with tools that align with digital transformation initiatives.

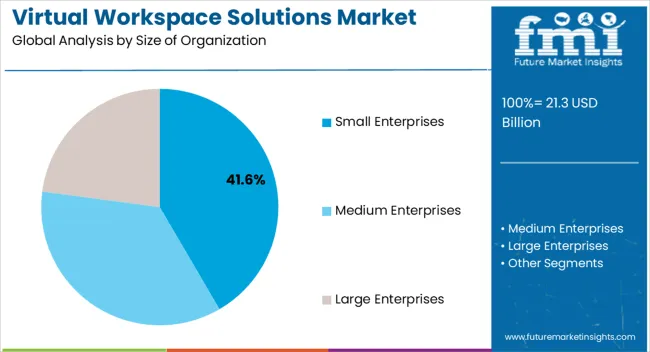

The small enterprises segment is projected to hold 41.60% of total revenue by 2025, making it the leading size of organization category. This dominance is supported by the affordability and scalability of virtual workspace solutions, which allow small businesses to deploy enterprise grade tools without heavy upfront investments.

The ability to integrate communication, file sharing, and workflow management in a unified platform has improved operational efficiency for small enterprises. Additionally, the subscription based pricing model provides flexibility in scaling solutions with business growth.

With increasing competition and digital adoption across small businesses, the reliance on cost effective and collaborative workspace solutions has continued to strengthen this segment’s market share.

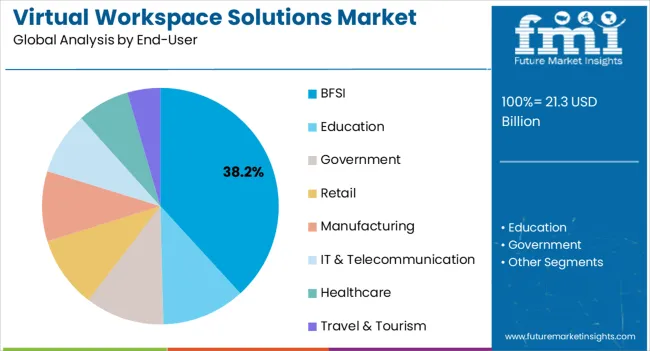

The BFSI segment is expected to account for 38.20% of total revenue by 2025, positioning it as the leading end user category. This growth is being driven by the sector’s emphasis on secure and compliant digital environments to manage sensitive financial data.

Virtual workspace solutions have supported distributed workforce models while ensuring adherence to regulatory standards and robust cybersecurity protocols. Enhanced collaboration tools have facilitated remote advisory services, digital banking operations, and secure communication with clients.

The integration of virtual workspaces into BFSI has improved employee productivity, streamlined operations, and strengthened customer engagement. These factors have collectively reinforced BFSI as the dominant end user segment in the virtual workspace solutions market.

Rapid Globalization

It is anticipated that with rapid globalization, businesses are to operate at international levels, and virtual workspace solutions are always preferred by organizations, fueling the demand for these solutions.

Collaborative Environment

Virtual workspace solutions combine multiple types of collaboration and communication tools into one platform that enables the users to find all the required resources in one place, making it convenient and easy to be deployed in the virtual workspace solutions desk.

Virtual Lifecycle Management

There is an increase in the demand for virtual lifecycle management facilities, improved data security, management facilities, and high availability of management tools, leading to more adoption of virtual workspace solutions and deriving the demand in the market.

Fast, Cost-Effective Solutions

The organizations are using virtual workspace solutions, as it helps them sustain in the global competition by delivering fast and cost-effective solutions to the enterprises and their employees. It streamlines multiple ends of the working line at the same time for employees as well as consumers.

Centralized Data Storage

The use of virtual workspace solutions allows centralized data storage and management to be easily possible, which results in a reduction of data loss and provides information security, and this serves as a key factor in driving the growth of the market.

The driving above factors, there is a continuous investment by manufacturers observed in advanced technologies for enhancing the performance of the virtual workspace solution tools, further boosting the demand for these solutions.

It is identified that although there is an end number of benefits offered to employees by virtual workspace solutions, certain factors can pose a threat and hinder the market growth during the forecast period. Some of these restraining factors are:

Therefore, these factors are anticipated to curb the market's growth during the forecast period.

| Attributes | Details |

|---|---|

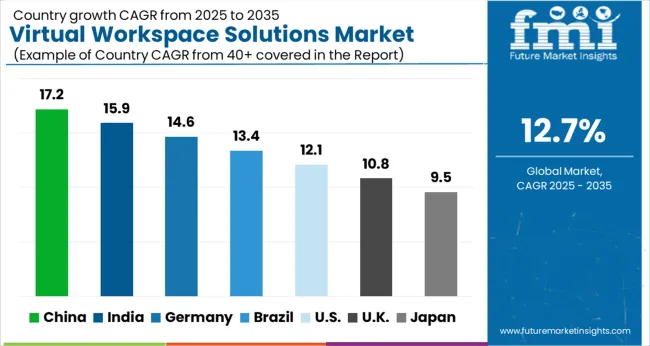

| Market CAGR (2025 to 2035) | 13.4% |

| Market Valuation (2025) | USD 16.6 billion |

| Market Valuation (2035) | USD 58.8 billion |

| Countries | Market Value Share in 2025 |

|---|---|

| United States | 17.6% |

| Germany | 10.4% |

| Japan | 4.5% |

| Australia | 3.4% |

| Countries | Market CAGR Value in 2025 |

|---|---|

| China | 11.2% |

| India | 15.6% |

| United Kingdom | 10.7% |

North America is expected to be the prior promising region for major verticals and is anticipated to dominate the global virtual workspace solutions market. Currently, the North American regions are cumulatively accountable for 27.7% of the total market share for virtual workspace solutions.

Due to this region being the home to a huge number of enterprises, coupled with abundant technical expertise, it is more likely to adopt virtual workspace solutions on a large scale. The telecommunication, ITes, BFSI, and manufacturing sectors of North America are adopting this solution for advanced IT infrastructures, which is fueling the market size of virtual workspace solutions.

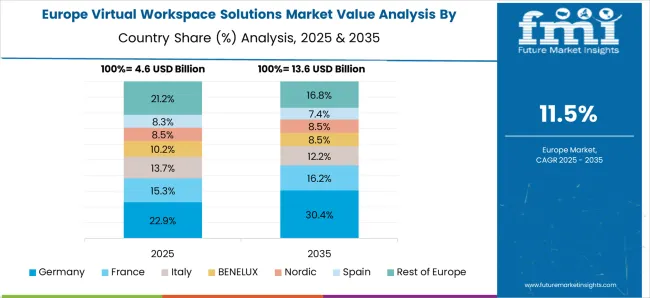

Europe is projected to hold the second-larger share of the global market. At present, the European region is accountable for 24.4% of the total market share of virtual workspace solutions.

This growth at a substantial rate over the forecast period can be attributed to the rise in the deployment of workspace tools due to their benefits, such as reduction in total costs of ownership, simplification of the management of IT infrastructure, and more.

These advantages are coupled with government grants for Research and Development activities to further expand the market size of virtual workspace solutions.

How are the Start-up Companies Revolutionizing the Global Market?

With regular advancements, the manufacturers in the start-up ecosystem for virtual workspace solutions are stepping up their efforts. Startups in the market for virtual workplace solutions are concentrating on a number of extra features for deployment to support the widespread adoption of this solution.

Startups are capturing the market with cutting-edge virtual solutions and scalable remote technologies, promoting the global market share.

| Attributes | Details |

|---|---|

| Abodoo | Founded by Wexford-based Vanessa Tierney and Ben Wainwright in 2020. The idea behind the business was that new technologies and more flexible conditions would make remote work a reality for more people. |

| Bluescape | A Silicon Valley-based SaaS company that has created a visual collaboration platform. Launched by Haworth and Obscura Digital, the platform enables individuals and teams to create, interact and share content. |

| Brandlive | A SaaS start-up that was founded in 2010 by Fritz Brumder and Ben McKinley. It offers a live video platform that brands and retailers can use to interact with their audience and employees for training, marketing, and commerce purposes. |

What is Trending among the Key Market Players in the Global Market?

The key players in this market adopted product launch, partnership, and expansion as their key strategies to meet the changing consumer demands. Additionally, it is anticipated that mergers and acquisitions in the market for virtual workspace solutions are likely to help the acquiring company expand its footprint on both a regional and global scale, in addition to strengthening its current portfolio.

The top three players contributing to the market share are:

Accenture

In February 2024, Accenture announced the acquisition of Imagine, a provider of a cloud-based platform. The acquisition enables Accenture to enhance offerings of cloud-based services for digital services and solutions.

Atos Syntel

In December 2024, Atos joined forces with Vodafone Spain to launch a new digital workplace offering for Vodafone Business customers in Spain.

Wipro

In June 2024, Wipro launched a digital inspection solution to improve workplace safety and experience. The solution is available to clients both in perpetual or subscription-based license models, with no additional cost for mobility.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, United Kingdom, Japan, India, China, Australia, Germany |

| Key Segments Covered | Size of Organization, End Users, Region |

| Key Companies Profiled | Atlantis Computing; Bitrix, Inc.; Citrix Systems; Cisco Systems Inc.; Dell Inc.; Ivanti Software; Microsoft Corporation; Matrix42; RingCube Technologies; Sococo; BLUESCAPE; PRYSM; VMware, Inc.; Amazon Workspaces; BLUESCAPE |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global virtual workspace solutions market is estimated to be valued at USD 21.3 billion in 2025.

The market size for the virtual workspace solutions market is projected to reach USD 70.8 billion by 2035.

The virtual workspace solutions market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in virtual workspace solutions market are small enterprises, medium enterprises and large enterprises.

In terms of end-user, bfsi segment to command 38.2% share in the virtual workspace solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA