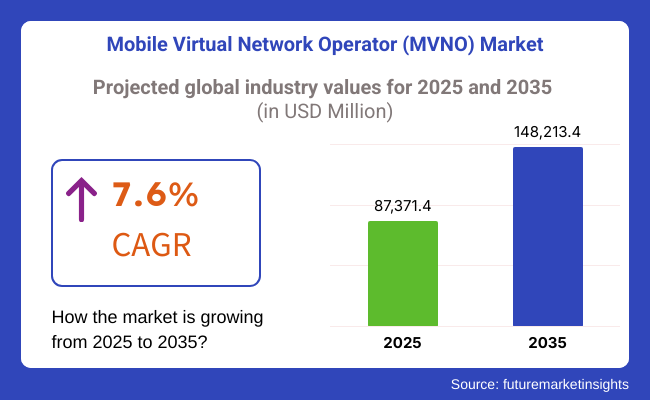

The global mobile virtual network operator (MVNO) market is projected to grow significantly, from USD 87,371.4 million in 2025 to USD 148,213.4 million by 2035 and it is reflecting a strong CAGR of 7.6%. The MVNO market is witnessing significant growth due to the increasing demand for cost-effective and flexible mobile services.

Businesses and consumers are looking for affordable and customized connectivity options, driving MVNOs to expand their service offerings. As digital transformation accelerates, MVNOs are playing a key role in bridging connectivity gaps across industries.

MVNOs operate in a highly regulated environment, with telecom-specific compliance mandates such as GDPR in Europe and FCC guidelines in the USA Regulations require MVNOs to implement strong risk management, data protection measures, and customer privacy safeguards. Ensuring compliance with these evolving legal frameworks is essential to avoid penalties and maintain customer trust.

The increasing reliance on third-party service providers exposes MVNOs to cybersecurity risks, including data breaches and network vulnerabilities. To mitigate these risks, MVNOs must implement continuous monitoring, real-time risk assessment, and advanced security measures to safeguard their networks and customer data. Strengthening cybersecurity frameworks is critical in maintaining service integrity and regulatory compliance.

North America leads the MVNO market, driven by a strong regulatory focus and advanced telecom infrastructure. The presence of major solution providers further supports market expansion. Meanwhile, emerging markets like India and Australia are experiencing rapid MVNO adoption due to growing demand for affordable mobile services and increasing digital transformation initiatives. These trends indicate sustained growth and evolving risk management needs across global MVNO markets.

Governments are also increasing the adoption of industry-specific MVNO. The European Commission directed that every smart meter and connected vehicle must have embedded mobile connectivity by 2024, with an estimated 35% growth in the partnership of IoT MVNO with automotive and energy sectors set to rise. More similarly, Japan enacted policies enhancing mobile connectivity for inbound travelers, and as a result, travel SIM card ;usage doubled during peak tourism seasons.

Now armed with regulatory support and growing demand from all sectors, MVNOs are set to broaden their strategic role beyond traditional telecom service provision, delivering niche solutions that improve customer experience while creating new revenue streams. With vertical digital transformation disrupting a multitude of industries, specialized MVNOs will also continue to serve an important function in connecting the dots, plugging gaps, and becoming relevant partners.

| Operational Model | Value Share (2025) |

|---|---|

| Service Provider MVNO | 42.8% |

The service provider MVNO is expected to grow steadily between 2025 and 2035, reaching 42.8% of the market in 2025 with a compound annual growth rate (CAGR) of 9.2%. Reseller MVNOs are entirely dependent on host operators, whereas service provider MVNOs retain greater management control (for tasks like billing, customer service, and service bundling).

Their flexibility makes them appealing substitutes for conventional Mobile Network Operators (MILLIONOs) by allowing them to offer affordable pricing, customized data plans, and cutting-edge services like global roaming, mobile payments, and entertainment bundle packages. These days, revenue-sharing businesses that provide flexible worldwide connectivity, such as Google Fi, Lycamobile, and Mint Mobile, are well-liked.

In 2025, the MVNO market share of Brand Reseller MVNO segments will reach 28.6%. Brand Reseller MVNO focuses on marketing and customer acquisition, while MILLIONOs provide the infrastructure and deliver services, thus playing a critical role for MVNO. This is an especially compelling model for existing brands in retail, e-commerce, and financial services.

Supermarket (Tesco Mobile (UK) quality-grade) mobile (London-based Tesco set up mobile to land-banking and patent-invest) A Canada-based company 7-Eleven SpeakOut Wireless offers brand equity in pursuit of more ( again pre-packed, cheap mobile product without operational infrastructure Huawei does it for a long time) they just offer company badges with business purpose to achieve cheap, packaged things.

Added regulatory support is also firing up growth. Service Provider MVNOs accounted for more than 60% of new registrations over the last 12 months, demonstrating their growing weight. Governments around the world are relaxing licensing requirements and opening up spectrum availability, enabling MVNOs to compete more effectively. As demand for customized mobile solutions increases and telecom infrastructure improves, Service Provider MVNOs are projected to dominate the market in the next decade.

| Type | Value Share (2025) |

|---|---|

| Discount | 32.5% |

Focusing on the current mobile service market in Egypt, the Discount MVNO segment represented 32.5% of the total market share in 2025 due to the affordability of prepaid and postpaid mobile plans for cost-conscious consumers. MVNOs are cost-focused by nature, usually with thin margins and buying network capacity in bulk from host operators.

In recent years, companies such as Tracfone (USA), Aldi Talk (Germany), and Lycamobile have made a name for themselves within this sector through the introduction of flexible contracts and lower international call prices, meeting the needs of budget-conscious users, students, and immigrants.

The discount MVNO segment with 32.5% of the 2025 market, targeting price sensitive end users with value-factor on prepaid and postpaid mobile plans. These wholesale operators typically provide low-cost service and thin profit margins, combined with the ability to purchase bandwidth in bulk from host operators.

Over the years, players such as Tracfone (USA), Aldi Talk (Germany), and Lycamobile have already seen great success in growing within this category by providing flexible, no-contract plans with competitive international calling rates, appealing to budget users, students, and immigrants.

The global market of mobile virtual network operator (MVNO) is expanding as a result of various factors such as increasing demand for low-cost and tailored telecom services. Retail customers value low-cost prepaid plans, flexible data plans, and international roaming.

Businesses emphasize high-speed connectivity, security, and customized solutions for workforce mobility. IoT and M2M use cases are a key growth driver, with sectors using MVNOs for uninterrupted connectivity in smart devices, fleet management, and industrial automation. Telecom resellers are extending MVNO services to niche segments, with a focus on brand differentiation and bundling value-added services.

Government and public services focus on secure communication networks, emergency response connectivity, and nationwide coverage. Future trends are 5G-enabled MVNOs, eSIMs adoption, artificial intelligence-enabled analytics for customized plans, and cloud-native infrastructure to enhance operational efficiencies and customer experience.

| Company | Contract/Development Details |

|---|---|

| Iliad | Extended its long-term agreement with Nokia to support its mobile networks across France and Italy, including the deployment of 5G technologies. |

| Bharti Airtel | Signed a multi-billion dollar agreement with Ericsson to enhance 4G and 5G coverage in India, deploying centralized radio access network (RAN) and Open RAN-ready solutions. |

From 2020 to 2024, the Mobile Virtual Network Operator (MVNO) market expanded progressively with increasing demand for low-cost mobile services, subscription-based data plans, and niche market products. MVNOs took advantage of existing mobile network infrastructure controlled by mass-market carriers in trying to provide tailor-made services appealing to specific categories of individuals such as price-conscious customers, overseas travelers, and IoT users.

The arrival of eSIM technology and cloud platforms enabled MVNOs to offer uninterrupted connectivity and real-time dynamic plan adjustments. Competition increased as new entrants focused on value-added services like rollover data, international roaming, and bundled content. In spite of thin margin threats and dependency on host networks, MVNOs focused on customer experience enhancement and creation of 5G-based services.

From 2025 to 2035, customer service through AI, 6G networks, and network slicing will be the drivers of growth in the market. Platforms based on AI will enable predictive customer support, dynamic data allocation, and self-metric plans related to consumption patterns. 6G networks will offer enhanced bandwidth and latency, and MVNOs will be able to offer high-performance streaming, gaming, and IoT connection.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Spectrum-sharing policies attracted new MVNO entrants. | AI-based regulatory frameworks simplify compliance for digital MVNOs. |

| MVNOs started utilizing 5G and network slicing for specialized applications. | AI-based network orchestration maximizes real-time bandwidth allocation. |

| MVNOs focused on niche segments, like IoT and business connectivity. | AI-based hyper-personalized plans maximize customer experience and loyalty. |

| Sophisticated encryption and fraud prevention technologies are used. | Quantum-resilient security maintains data integrity for next-generation MVNO networks. |

| Competitive prices and digitalization drove MVNO growth. | Network automation through AI minimizes operating expenses and maximizes efficiency. |

The greatest problem is the reliance on network resources. MVNOs base their work on the network of Mobile Network Operators (MILLIONOs), and poor contractual relationships or a fail in service delivery can lead to the poor state of service. The fact that MILLIONOs hold a major part of the deal may entail too high leasing for MVNOs and consequently a crippled price competitiveness.

Emergent technological changes are yet a concern. The advent of 5G networks and eSIM technologies may lead to shifts in the dynamics of the market, to the advantage of MILLIONOs or forcing costly infrastructural changes. Non-avoiding trouble to the customer making deal for integration of tech would walk off the customers.

In the end, customer acquisition and churn respectively remain risks. MVNOs with their budget-friendly consumer products take away customers that are more likely to be on the move than the competition. Switching to the new MVNO brings about the expenditures around the marketing and servicing as well. Thus, customer loyalty and retention are the values that must be taken out through these strategies and making the revenues to be on a good level for the time to come.

Tier 1 vendors are the leading players within the market, including pervasive global scale, well-known brand valuation, and huge partnerships with Mobile Network Operators (MILLIONOs). Most of these vendors are multi-regional, with a variety of service portfolios not limited to consumers or enterprises but also niche MVNO services such as IoT access and private networks.

They have preferential network access and better prices and conditions because they have signed large-scale contracts with MILLIONOs. Moreover, Tier 1 MVNOs focus on digital transformation, customer experience, and data analytics to remain competitive. They have ample financial support that enables rapid expansion into emerging markets and studying the best methods of integrating 5G services.

MVNO tier 2 includes vendors with a regional operation model, also serving targeted consumers or industry verticals. They are moderately present in the market, with strategic partnerships that rely on them to achieve service delivery benefits.

Many Tier 2 MVNOs differentiate themselves by focusing on different market niches like ethnic communities, retail sectors, or travel connectivity services. They have flexible pricing models, customized plans, and specialized customer service, all of which give them a competitive advantage.

They do not hold much influence like Tier 1 vendors, but with agile business models, they can quickly adjust their business according to changing consumer preferences. The continued growth of digital services, cloud-based mobile plans, and eSIM technology also empowers Tier 2 players to upgrade their offerings without large capital inflows. However, competitive intensity in this segment remains high, with pricing pressures and regulatory compliance challenges impacting operations.

Tier 3 vendors on the MVNO side generally consist of smaller independent players with low availability. These vendors are often targeted at very localized markets and cater to demographics like students, expatriates, or rural communities. They excel with hyper-personalized offerings and budget plans that appeal to cost-sensitive shoppers.

Compare this with Tier 3 MVNO, which cannot negotiate significant capacity with MILLIONOs due to negotiation gatekeeping, challenges that prevent it from obtaining highly attractive supervision agreements from MILLIONOs, increasing its basic operating costs, and minimizing network resources.

Most of these players depend on their partnerships with retail chains, eCommerce, or digital service providers to reach a wider base of consumers. With digital-only mobile services and app-based customer engagement strategies, some of the Tier 3 MVNOs are growing despite their smaller nature. Teaching is unlikely to scale much due to financial constraints and pricing pressures from larger players.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 10.7% |

| China | 9.1% |

| Germany | 6.3% |

| Japan | 8.0% |

| The USA | 7.1% |

China is implementing eSIM technology at a high pace, and this is leading to MVNO growth. eSIM technology eliminates physical SIM cards, enabling easy switching between cellular operators. The technology reduces logistics costs and provides a better customer experience, and MVNOs are able to provide flexible and cost-competitive plans.

Key Chinese smartphone players, such as Huawei and Xiaomi, are embedding newer smartphones with eSIM capabilities, driving consumer uptake. The nation's drive to digitalize has also driven eSIM adoption in IoT, such as smart meters, IoT-connected vehicles, and industrial automation. The telecom operators and MVNOs still have confidence in embracing eSIM-based services, and the MVNO market of China is expected to see a CAGR of 9.1% in 2025 to 2035.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| eSIM Adoption | Increased usage in smartphones and IoT devices, reducing logistics costs and increasing flexibility. |

| Government Support | Regulatory approvals pave the way for eSIM usage beyond IoT, allowing growth into consumer devices. |

| Digital Transformation | IoT adoption in smart meters, industrial automation, and connected vehicles drives demand. |

The Indian government is actively encouraging digital inclusion, opening huge growth opportunities for MVNOs. Initiatives such as Digital India and BharatNet focus on expanding coverage in rural and remote regions where conventional telecom services are still scarce. Thus, MVNOs offer affordable mobile services to underdeveloped societies.

Indian MVNOs are likely to operate with home service providers for low-cost mobile connectivity, bridging the digital divide. Increasing market demand for low-cost prepaid plans and mobile financial services is pushing the use of MVNOs in India even more.

The Indian government's plans for linking more than 700,000 villages under BharatNet assure rural high-speed internet connectivity. This feature has the potential to provide MVNOs with innovative schemes and plans specifically designed for rural customers, including pay-as-you-go data services and digital payment services.

Mobile subscriptions in rural regions grew more than 12% in a year, which is successful for such plans. With a growing mobile consumer base and robust government support, India's MVNO market will grow at a CAGR of 10.7% from the forecast period.

India's Growth Drivers

| Key Drivers | Details |

|---|---|

| Digital Inclusion | Government schemes such as Digital India and BharatNet enhance rural connectivity. |

| Low-Cost Plans | Low-cost prepaid plans by MVNOs are provided to underpenetrated areas. |

| Rural Mobile Adoption | Indian rural mobile subscriptions rose more than 12% last year. |

The fierce competition in the American telecom market is compelling MVNOs to broaden the selection of services and provide lower-priced mobile plans. Major telecom operators like AT&T, Verizon, and T-Mobile rent network capacity to the MVNOs so that they are able to supply discounted copies of the typical carrier plans.

This competitive landscape compels MVNOs to differentiate in terms of dimensions of unlimited data plans, specialized business solutions, and bundled services like streaming or cloud storage services. Consumers are now opting for MVNOs as they are contract-free and cheaper, resulting in higher market growth.

To ensure competition, the USA government came up with policies ensuring fair access to telecom infrastructure. The Federal Communications Commission (FCC) recently released guidelines for ensuring that MVNOs have access to competitive wholesale rates by incumbent carriers so that there won't be anti-competitive strategies. More than 10% of mobile subscribers in the USA are already on MVNO services, and expansion continues. The USA will experience strong growth in the MVNO market, with a market-leading share of 69.2% in 2025.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Competitive Market | MVNOs are competing on business services, bundled deals, and unlimited data plans. |

| Government Policies | FCC policies guarantee fair prices and access to telecom infrastructure. |

| Consumer Demand | More than 10% of mobile subscribers in the USA are using MVNOs, with year-on-year growth. |

Japan's MVNO industry is on a steady growth path because demand for IoT connections and integration of smart devices is on the rise. With industries such as transport, healthcare, and manufacturing adopting IoT applications, MVNOs are benefitting from the trend through the provision of tailor-made IoT connectivity services. Japan's progress in 5G networks also supports MVNO services by providing high-speed and secure data transmission services.

Government policies are also fueling Japan's MVNO growth. The Ministry of Internal Affairs and Communications encourages MVNOs through regulation favoring healthy competition and reallocation of spectrum. Japan's increasing aging population is also creating demand for remote healthcare services through telemedicine services, under which MVNOs are offering low-cost connectivity solutions for telemedicine purposes. Japan's MVNO market is expected to reach a growth CAGR of 8.0% during the forecast period 2025 to 2035.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| IoT Connectivity | MVNO IoT solutions are based on healthcare, transport, and manufacturing industries. |

| 5G Expansion | High-speed networks improve the quality and dependability of MVNO servics. |

| Government Regulations | Rules ensure level playing and support growth in MVNO. |

The MVNO market in Germany is expanding as a result of fair competition policies backed by the government and network-sharing agreements. The Federal Network Agency has introduced policies forcing the leading telecom players to provide network access to MVNOs at affordable rates, enabling new entrants into the market. The regulatory landscape leads to low prices and innovation for MVNOs.

Germany's high demand for low-cost mobile services both from enterprises as well as individuals is another growth driver. More and more enterprises are using MVNOs as a cost-saving measure, particularly in sectors like logistics and retail, where connectivity is central.

Germany's focus on digitalization is also making its way into growing IoT application demand, with MVNOs leading the way in offering connectivity solutions. Germany's MVNO market will grow at a 6.3% CAGR between 2025 to 2035.

Germany's Growth Drivers

| Key Drivers | Details |

|---|---|

| Regulatory Support | Shared networks allow MVNOs to leverage large telco networks at low prices. |

| Business Adoption | Companies in the logistics and retail sectors use MVNOs for cheap connectivity. |

| IoT Growth | Mobile IoT usage demands fuel the expansion of the MVNO market. |

The MVNO market has expanded its outreach to several operators with more cost-effective network agreements, niche-specific services, and innovative pricing mechanisms to differentiate them from their competitors.

The anathema leading to an increased demand for IoT connection mobility in enterprises, as well as flexible plans for consumers, is driving growth within this environment, wherein such effects are likely to be amended by changing regulatory frameworks and continued technological advancements like eSIM and 5G.

The main players dominating the MVNO market are Lycamobile, Tracfone Wireless, and Lebara, which have low-priced international calling plans, prepaid services, and well-established distribution structures. Retail-based MVNOs like Virgin Mobile and Tesco Mobile use brand loyalty to win the customer base. At the same time, digital-first providers like Giffgaff work more on community-based models primarily focused on flexibility.

The industry is being transformed by AI-driven customer support, bundled service models, and multi-network roaming capabilities. Operators have to find an equilibrium between low-cost pricing and high-quality service delivery to retain customers while maintaining profitability.

Strategic factors that affect competition include regulatory policies, MILLIONO partnerships, and digital transformation. Flexible, data-driven pricing models, robust customer loyalty schemes, and next-gen telecom innovations will build a competitive advantage in MVNOs for fast evolution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lycamobile | 12-16% |

| Tracfone Wireless | 10-14% |

| Lebara | 8-12% |

| Virgin Mobile | 6-10% |

| Tesco Mobile | 5-9% |

| Other Players (Combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lycamobile | Global MVNO leader specializing in low-cost international calling and prepaid SIM services. |

| Tracfone Wireless | USA-based prepaid MVNO, acquired by Verizon, offers budget-friendly mobile plans. |

| Lebara | Focuses on international calling, migrant communities, and competitive data plans. |

| Virgin Mobile | Operates under multiple network agreements, leveraging brand power and lifestyle services. |

| Tesco Mobile | UK-based MVNO integrated with Tesco's retail ecosystem, offering Clubcard rewards. |

Key Company Insights

Lycamobile (12-16%)

Top-most largest MVNO in the world, extending its operations in the area of low-cost international calling and prepaid plans over more than 23 countries.

Tracfone Wireless (10-14%)

Recently acquired by Verizon, thus preserving its role as a leader among USA prepaid providers.

Lebara (8-12%)

Stronghold in Europe through specializing in niche markets among the ethnic and migrant communities.

Virgin Mobile (6-10%)

Operates in several regional markets, taking advantage of brand recognition and bundled mobile services.

Tesco Mobile (5-9%)

A successful supermarket-based MVNO with loyalty-aligned pricing and incentives.

Other Key Players (40-50% Combined)

In January 2025, UK-leading MVNO Lyca Mobile partnered with Revolut Pay to expand customer payment experiences as Revolut Pay's initial partner with a UK MVNO. In November 2024, Boost Mobile announced rapid strides toward setting up shop as a Mobile Network Operator (MILLIONO) rather than as merely an MVNO and having a plan by the end of the year to cover 80% of America's population.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 87,371.4 million |

| Projected Market Size (2035) | USD 148,213.4 million |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million subscribers for volume |

| Operational Models Analyzed (Segment 1) | Reseller MVNO, Service Provider MVNO, Full MVNO |

| Subscriber Types Analyzed (Segment 2) | Business, Consumer |

| Organization Sizes Analyzed (Segment 3) | Small & Mid-sized Organization, Large Organization |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the MVNO Market | Lycamobile, Tracfone Wireless, Lebara, Virgin Mobile, Tesco Mobile, Boost Mobile, Giffgaff, PosteMobile, Red Pocket Mobile, Freenet AG |

| Additional Attributes | Dollar revenue by MVNO type (discount, premium, ethnic, media), Market trends in service bundling and digital-only MVNOs, Regulatory frameworks supporting MVNO entry in telecom sectors, Regional consumer pricing dynamics and churn rate reduction strategies |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of Operational Model, the segment is segregated into Reseller MVNO, Service Provider MVNO and Full MVNO.

In terms of Subscriber Type, the segment is segregated into Business and Consumer.

In terms of Organization Size, it is distributed into Small & Mid-sized Organization and Large Organization.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The global mobile virtual network operator (MVNO) industry is projected to witness CAGR of 7.6% between 2025 and 2035.

The global mobile virtual network operator (MVNO) industry stood at USD 87,371.4 million in 2025.

The global mobile virtual network operator (MVNO) industry is anticipated to reach USD 148,213.4 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 8.9% in the assessment period.

The key players operating in the global mobile virtual network operator (MVNO) Industry Lycamobile, Tracfone Wireless, Lebara, Virgin Mobile, Tesco Mobile, Boost Mobile, Giffgaff, PosteMobile, Red Pocket Mobile, Freenet AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Operational Model, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 13: Global Market Attractiveness by Type, 2024 to 2034

Figure 14: Global Market Attractiveness by Operational Model, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 28: North America Market Attractiveness by Type, 2024 to 2034

Figure 29: North America Market Attractiveness by Operational Model, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 44: Latin America Market Attractiveness by Operational Model, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by Operational Model, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by Operational Model, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by Operational Model, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 104: East Asia Market Attractiveness by Operational Model, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by Operational Model, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Operational Model, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Operational Model, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Operational Model, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by Operational Model, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Mobile Infrastructure Market Growth – Trends & Forecast 2023-2033

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Network Function Virtualization (NFV) Market Share & Industry Leaders

Network Function Virtualization (NFV) Market by Component, by Enterprise Size and by End User & Region Forecast till 2035

Virtual Dispersive Networking (VDN) Market Growth – Trends & Forecast 2025 to 2035

UK Network Function Virtualization (NFV) Market Insights – Demand, Size & Industry Trends 2025-2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

GCC Network Function Virtualization (NFV) Market Report – Trends & Innovations 2025-2035

USA Network Function Virtualization (NFV) Market Insights – Size, Share & Growth 2025-2035

Japan Network Function Virtualization (NFV) Market Trends – Growth, Demand & Forecast 2025-2035

Germany Network Function Virtualization (NFV) Market Analysis – Size, Share & Forecast 2025-2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA