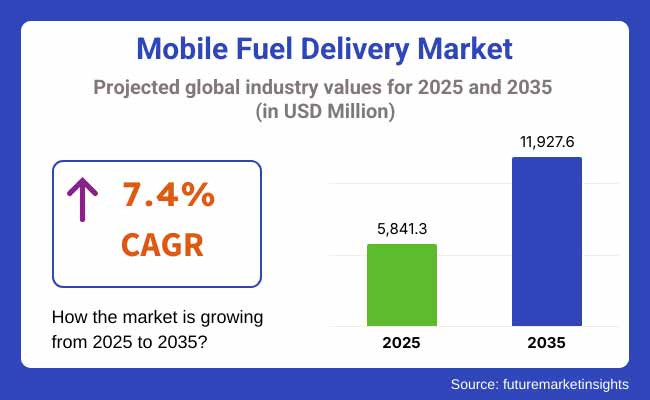

The global mobile fuel delivery market is projected to grow significantly from USD 5.84 billion in 2025 to USD 11.93 billion by 2035, reflecting a strong compound annual growth rate (CAGR) of 7.4% during the forecast period. This robust growth is driven by increasing demand for convenient fuel supply solutions, rising adoption of on-demand services, and growing awareness of mobile refueling benefits in both commercial and consumer segments.

Mobile fuel delivery services provide flexible and time-saving refueling options for vehicles, construction equipment, fleets, and industrial machinery. The convenience of doorstep fuel delivery reduces downtime, enhances operational efficiency, and minimizes environmental risks associated with traditional fueling methods. This service is particularly popular in urban areas, logistics hubs, remote locations, and sectors where continuous equipment operation is critical.

Technological advancements such as mobile apps, GPS tracking, and automated payment systems are enhancing customer experience and operational efficiency. Furthermore, the integration of sustainable fuels like biodiesel and electric charging solutions into mobile delivery platforms is expanding market potential in line with global decarbonization goals.

North America currently leads the mobile fuel delivery market, supported by high fleet volumes, advanced infrastructure, and widespread digital adoption. However, the Asia Pacific region is expected to register the fastest growth due to rapid industrialization, expanding logistics sectors, and increasing investments in digital services.

In a reflective statement, Nour Baki, CMO of Instafuel, remarked, “When we started the business, we were hungry for success, and we came up with a business model that really works. But as it developed, we came to realize that we are not just delivering fuel; we are fundamentally changing the fueling infrastructure of the country.

And what I mean by that is, just like how you get everything else delivered, fuel will be delivered as well. We believe that the gas station model is going to slowly fade away and there’s going to be a new void. We believe mobile fueling, and Instafuel specifically, will be able to fill that void. It will take a huge amount of infrastructure, a huge amount of fuel trucks, and a huge amount of technology.

We are pioneering this whole thing and we believe in 10 years a big portion of Americans’ fuel will be delivered to them. Instafuel is leading the way.” His statement underscores the transformative potential of mobile fuel delivery in redefining the future of fueling infrastructure across the United States.

With rising demand for efficient fuel management and expanding technological integration, the mobile fuel delivery market is poised for sustained growth through 2035.

Diesel commands a 62% share in the mobile fuel delivery market, driven by growing demand for efficient on-site refueling and fleet operational continuity. Trucks dominate the vehicle segment with a 70% share, propelled by advanced mobile fueling fleets equipped with automation and real-time monitoring technologies.

Diesel fuel dominates the mobile fuel delivery market with a 62% share, owing to its widespread use in commercial fleets, construction equipment, and heavy machinery. Mobile diesel refueling services offer a flexible alternative to traditional gas stations, enabling companies in logistics, transportation, and infrastructure to refuel directly at job sites. This approach reduces downtime, enhances operational efficiency, and supports continuous productivity.

The rising demand for ultra-low sulfur diesel (ULSD), driven by stricter environmental regulations, helps reduce emissions and optimize engine performance. Concurrently, digital fuel management systems powered by artificial intelligence are transforming the market by optimizing delivery routes, tracking fuel usage in real time, and ensuring transaction security through blockchain technology.

In response to increasing environmental awareness, many operators incorporate biodiesel blends and renewable diesel options, aligning with sustainability goals and carbon emission reduction mandates. While challenges such as fuel price fluctuations and supply chain constraints persist, innovations in IoT-enabled monitoring and AI-based demand forecasting bolster diesel mobile fuel delivery’s resilience and long-term growth prospects.

Mobile fuel delivery trucks dominate the vehicle segment with a 70% market share, largely due to their ability to provide high-capacity, on-site fueling for diverse sectors including logistics, construction, and agriculture. These trucks are increasingly outfitted with sophisticated features such as integrated dispensing systems, automated metering, and GPS-enabled real-time tracking, which collectively improve route efficiency and reduce fuel wastage.

Fleet operators are adopting IoT technologies for continuous fuel consumption monitoring and predictive maintenance, minimizing downtime and enhancing safety. The integration of AI in route planning and dispatch systems further optimizes operational efficiency by adjusting deliveries based on traffic, fuel demand, and weather conditions.

Sustainability trends have driven the introduction of hybrid and alternative fuel-powered trucks, supporting compliance with increasingly strict emissions regulations. Moreover, the emergence of autonomous fuel delivery vehicles and robotic dispensing systems promises to revolutionize the sector by reducing labor costs and increasing precision.

Despite barriers such as regulatory compliance costs and high capital investment requirements, ongoing technological advancements are expected to sustain robust growth in the mobile fuel delivery truck segment globally, driving greater service reliability and environmental responsibility.

Challenge: Regulatory Compliance and Safety Concerns

The mobile fuel delivery sector has an added challenge of a stringent regulatory environment that governs the transportation and storage of fuel. Governments establish strict safety measures to prevent accidents leaks, spills, fire hazards and companies are compelled to spend immense sums to comply, obtain permits, secure insurance. Further, volatility in fuel prices and taxation regimes impacts a business profitability, increasing mobile fueling companies' investments in cost-effective distribution models.

Opportunity: Expansion of Digital and Sustainable Fuel Solutions

The growing use of digital platforms for ordering, tracking, and payment of fuel offers a huge opportunity for the mobile fuel delivery market. Firms are using AI and IoT-based solutions to streamline fuel logistics, improve customer experience, and maintain regulatory compliance.

In addition, the rising need for sustainable fuels such as biodiesel, renewable diesel, and hydrogen is creating new opportunities for market growth. Companies that add green fuel options to their on-the-go delivery operations are best placed to benefit from environmentally responsible consumers and business customers who embrace carbon neutrality.

The USA mobile fuel delivery market is expanding at a high growth rate with rising demand for on-demand fuel services, growth in commercial vehicle fleets, and growing adoption of digital payment methods in fuel transactions. The increasing last-mile delivery and logistics industry is driving demand for effective refueling services. Moreover, stringent environmental regulations favoring cleaner fuels and technological improvements in mobile fuel dispensing are influencing market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The UK mobile fuel delivery market is growing based on increasing urbanization, growing corporate fleet services, and enhanced usage of fuel delivery apps. The transition to alternative and biofuels is also impacting market trends. Furthermore, strict environmental regulations are pushing companies toward low-emission fuel delivery methods, providing scope for innovation in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

The EU mobile fuel delivery industry is experiencing robust growth with advancements in fuel logistics technology, regulatory encouragement for digital fuel payment systems, and the growth of commercial fleet operations. Germany, France, and Italy are leading the way in adopting smart refueling solutions based on strict carbon emissions policies. The growth of electric and hydrogen refueling services for vehicles is also shaping market trends.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

Japan's market for mobile fuel delivery is increasing consistently, fueled by a robust logistics network, growing fuel dispensing automation, and increased use of fleet management services. Growth in hydrogen refueling stations is also adding to the market growth, as the nation fast-tracks its journey toward zero-emission mobility solutions. Incentives from the government for digital fuel infrastructure are also fostering innovation in fuel logistics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

South Korea's mobile fuel delivery market is reaping rewards from swift industrialization, growth of on-demand services, and high government endorsement of digital fueling technologies. The flourishing e-commerce and logistics industry is increasing demand for mobile fuel delivery services. Investments in hydrogen and alternative fuel stations are also defining the future of the market, with the country's move toward cleaner energy solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

The Mobile Fuel Delivery Market is experiencing significant growth due to the increasing demand for on-demand fuel services and the rising adoption of digital solutions in fuel logistics. Businesses and consumers are seeking convenient refueling options that reduce downtime and enhance operational efficiency.

The market is driven by advancements in mobile app-based fuel ordering, strategic partnerships, and the expansion of service networks. Leading companies are investing in fleet expansion, technology integration, and sustainability initiatives to strengthen their market position.

InstaFuel (18-22%)

As a market leader in mobile fuel delivery, InstaFuel focuses on efficiency, innovation, and customer convenience. The company has invested heavily in fleet expansion and digital platforms to streamline fuel ordering and delivery services.

Fuel Logic (14-18%)

Fuel Logic is one of the market leaders that provides real-time monitoring and fuel management solutions. The company has formed robust business relationships with logistics and fleet management companies to optimize operational efficiency.

Shipley Energy (10-14%)

Shipley Energy is an established energy company providing diversified fuel delivery services. The company is strengthening its mobile fuel delivery network to serve a wider customer base, with a focus on commercial as well as residential areas.

OCCL (8-12%)

OCCL has emerged as one of the key players in the commercial and industrial fuel delivery business. The company utilizes technology-based solutions to maximize fuel logistics and increase delivery efficiency.

The Fuel Delivery (6-10%)

The company has a core emphasis on environmentally friendly and sustainable fuel delivery solutions. It is growing its urban market base by incorporating intelligent technologies in its mobile fueling business.

Other Key Players (30-40% Combined):

The Mobile Fuel Delivery Market is also supported by numerous regional and emerging companies, including:

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.84 billion |

| Projected Market Size (2035) | USD 11.93 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume units as applicable |

| Fuel Types Analyzed (Segment 1) | Diesel, Diesel Exhaust Fluid, Red Diesel, Gasoline, Bulk Fuel |

| Equipment Analyzed (Segment 2) | Truck, Generators, Construction Equipment, Landscaping Equipment, Reefers, Bulk Tanks |

| End-Use Segments Analyzed (Segment 3) | Residential, Commercial, Agriculture |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, China, Japan, India, UAE, Saudi Arabia, South Africa |

| Key Players Influencing the Market | InstaFuel, Fuel Logic, Shipley Energy, OCCL, The Fuel Delivery, Booster Fuels, Filld, Cafu (UAE), Gaston Services, Fuelster Technologies Inc. |

| Additional Attributes | Dollar sales and share by fuel type; regional demand trends highlight North America and Asia Pacific growth; regulatory landscape evolving with environmental norms; competitive benchmarking underscores tech innovation and partnerships; consumer adoption driven by convenience and cost-effectiveness; emerging geographies include Middle East and Africa |

The overall market size for mobile fuel delivery market was USD 5.84 billion in 2025.

The mobile fuel delivery market is expected to reach USD 11.93 billion in 2035.

The the increasing demand for on-demand fuel services and fleet management solutions fuels Mobile fuel delivery Market during the forecast period.

The top 5 countries which drives the development of Mobile fuel delivery Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of fuel type, diesel to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Attractiveness by Fuel Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Equipment, 2023 to 2033

Figure 19: Global Market Attractiveness by End Use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 37: North America Market Attractiveness by Fuel Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Equipment, 2023 to 2033

Figure 39: North America Market Attractiveness by End Use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Fuel Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Equipment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Fuel Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Equipment, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Fuel Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Equipment, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Fuel Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Equipment, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Fuel Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Equipment, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Fuel Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Equipment, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Mobile Fuel Delivery Services

Mobile Money Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA