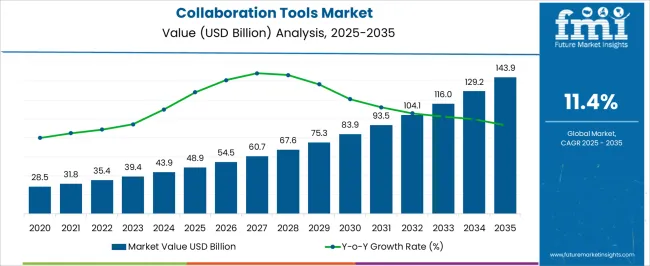

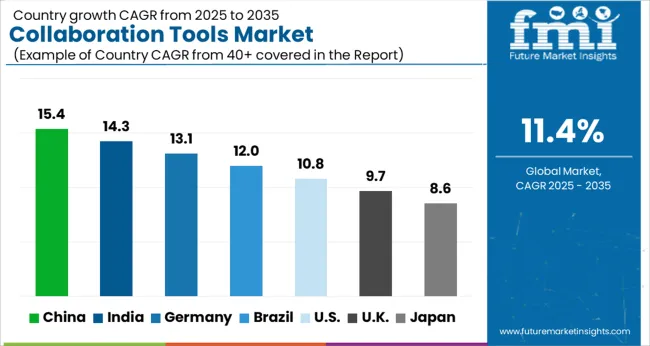

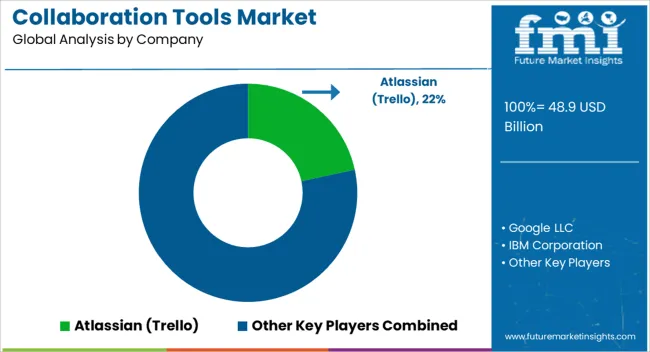

The Collaboration Tools Market is estimated to be valued at USD 48.9 billion in 2025 and is projected to reach USD 143.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period.

| Metric | Value |

|---|---|

| Collaboration Tools Market Estimated Value in (2025 E) | USD 48.9 billion |

| Collaboration Tools Market Forecast Value in (2035 F) | USD 143.9 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The collaboration tools market is experiencing sustained momentum driven by the increasing adoption of digital communication platforms, hybrid working models, and the need for real time project management across global enterprises. Businesses are investing in secure and scalable collaboration ecosystems that enhance productivity, reduce operational silos, and enable seamless integration across departments and geographies.

Advances in artificial intelligence, cloud infrastructure, and API integration have strengthened the efficiency and versatility of collaboration solutions. Regulatory focus on data security and compliance has further accelerated investment in both on premise and cloud deployments.

The market outlook remains positive as enterprises prioritize collaboration platforms that support innovation, flexible work environments, and customer engagement, ultimately reinforcing their role as critical enablers of modern business operations.

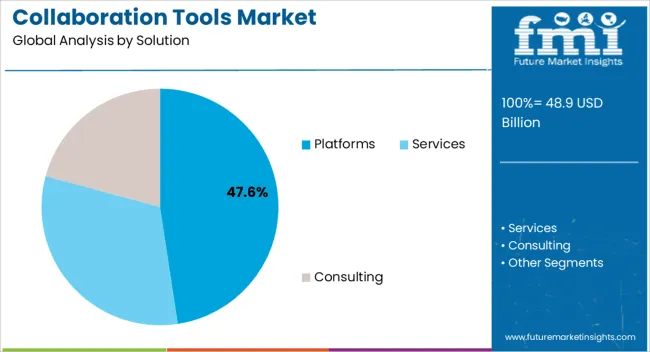

The platforms solution segment is expected to contribute 47.60% of total market revenue by 2025, making it the most significant solution type. Growth is being propelled by the ability of platforms to unify communication, file sharing, and project management functions into a single ecosystem.

Enterprises are increasingly relying on integrated solutions that reduce the complexity of managing multiple applications while offering scalability and compatibility with third party software. As organizations expand their remote and hybrid workforce structures, platforms have become essential for fostering collaboration, streamlining workflows, and enhancing team productivity.

The value of platforms has also been strengthened by continuous innovation in AI driven insights and security features, positioning this segment as the dominant solution choice.

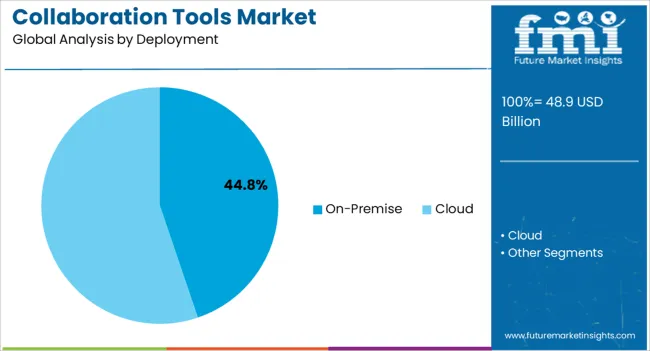

The on premise deployment segment is projected to account for 44.80% of market revenue by 2025, demonstrating its strong market presence. This preference is influenced by organizations requiring high levels of data privacy, customization, and control over their IT infrastructure.

Industries such as finance, government, and healthcare continue to adopt on premise solutions due to strict regulatory mandates and security considerations. The ability to integrate with legacy systems and offer tailored solutions that address specific operational needs has reinforced the appeal of on premise deployment.

Despite the rise of cloud alternatives, the reliability, compliance assurance, and customization capabilities of on premise systems have allowed this segment to retain a leading share of the market.

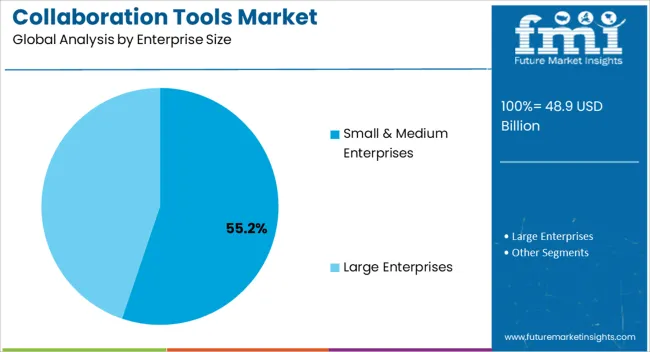

The small and medium enterprises segment is projected to hold 55.20% of overall market revenue by 2025, positioning it as the leading enterprise size category. Growth is supported by the increasing need for cost effective, easy to deploy, and scalable collaboration solutions that cater to limited IT resources.

SMEs are adopting these tools to enhance team communication, customer engagement, and operational efficiency while maintaining budgetary control. The availability of subscription based models and open source options has made collaboration technologies more accessible to this segment.

As SMEs continue to expand their digital footprint and embrace hybrid work structures, the adoption of collaboration tools within this category is expected to accelerate, ensuring their dominant share in the market.

The factors such as increasing inclination towards digitizing workspace and increasing demand for cloud communication solutions and growing mobile workers are expected to drive the demand for the collaboration tools market.

Advancements in collaboration and interactive technologies have made communication solutions more dynamic and integrated, which enables people to share information via multimedia technology.

Content sharing, digital data streaming, and mobile connectivity solutions are turning meeting rooms into dynamic locations. This makes it possible for people from other countries, states, and continents to be involved in a place for decision-making, problem-solving, and risk-control processes.

Workspace digitization is accelerating at a robust pace. Therefore, many collaboration tool vendors are focusing on developing more dynamic solutions to meet the demands of customers. This, in turn, is driving the growth of the collaboration tools market.

Continuous innovation in cloud communication is resulting in greater choice, flexibility, and cost-saving solutions for enterprise communication. By adopting cloud communication solutions, enterprises are benefited from standardized capabilities and total interoperability across different locations of an enterprise.

Nowadays, many enterprises are adopting cloud communication solutions for video and web conferencing to reduce the complexity of implementation and maintenance processes. Thus, the rise in demand for cloud communication solutions is driving the growth of the collaboration tools market.

Conference calls, videos, and other tools have become more popular in the increasingly connected global corporate environment. As a result, the global collaboration tools market is expected to generate substantial revenues in the coming years.

Collaboration tools can be used for personal conversations, which has fuelled the growth of the market. In the coming years, the corporate world is also expected to become more and more popular with workflow systems and hyperlinks.

For organizations, virtual reality and augmented reality allow real-time remote collaboration experiences. These technologies are used by businesses to provide location-based information services. QR codes provide users with information about the items and services that a company provides.

Remote teams are becoming more frequent in enterprises. Use of virtual reality and augmented reality technologies can allow employees to collaborate even when they are not physically present in the same location. Augmented reality and virtual reality enable immersive boardroom experiences, tracking body language, supporting avatars, and changing backgrounds, among other things.

Users can cooperate on product creation and development in the digital world by utilizing the multiuser features of augmented reality and virtual reality.

RealSense, for example, offers virtual reality devices that may change the background of a live streamer's content to better presentations for everyone.

The collaboration tools market was valued at USD 35,890.2 million in 2025, with a 9.3% CAGR from 2020 to 2025.

Over the last decade, the collaboration tools industry has seen a considerable increase in demand. The increased use of shared whiteboards, chat systems, decision support tools, and video communication systems across industrial and commercial units is responsible for this significant rate of expansion.

Multiplayer video games are another division that has driven the market demand.

Collaboration technologies are essential for ensuring the seamless efficiency of distant work. As a result, all these factors bode well for the expansion of the collaboration tools market, ensuring a historical growth trajectory from 2020 to 2025.

The growing availability and popularity of web-based collaboration tools are expected to pave the road for expansion. Collaboration tools enable smaller firms to increase their worldwide reach, while larger enterprises improve inter-organizational communication.

The collaboration tools market is projected to grow profitably as a result of all these advantages.

Strategic collaborations aid in the acceleration of the industry for collaboration technologies. To strengthen their position in the collaboration tools market, the players engage in mergers and acquisitions, collaborations, and growth initiatives. These actions eventually contribute to the expansion of the collaboration tools market's growth rate.

| Historical CAGR (2020 to 2025) | 9.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 11.4% |

| Year | Value |

|---|---|

| 2020 | USD 25,101.7 million |

| 2025 | USD 35,890.2 million |

| 2025 | USD 39,407.4 million |

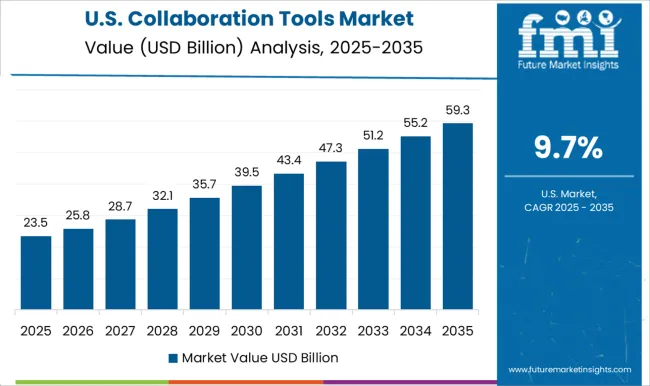

| Country | The United States |

|---|---|

| Projected CAGR (2025 to 2035) | 8.2% |

| Market Valuation (2025) | USD 12.10 billion |

| Market Valuation (2035) | USD 26.6 billion |

| Country | The United Kingdom |

|---|---|

| Projected CAGR (2025 to 2035) | 11.5% |

| Market Valuation (2025) | USD 2.39 million |

| Market Valuation (2035) | USD 7.1 million |

| Country | China |

|---|---|

| Projected CAGR (2025 to 2035) | 11.6% |

| Market Valuation (2025) | USD 2.57 billion |

| Market Valuation (2035) | USD 7.7 million |

| Country | Japan |

|---|---|

| Projected CAGR (2025 to 2035) | 6.5% |

| Market Valuation (2025) | USD 2.56 million |

| Market Valuation (2035) | USD 4.8 million |

| Country | India |

|---|---|

| Projected CAGR (2025 to 2035) | 13.2% |

| Market Valuation (2025) | USD 3.62 billion |

| Market Valuation (2035) | USD 12.5 billion |

Value Shares:

| Countries/ Regions | Value Share (2025) |

|---|---|

| North America | 27.6% |

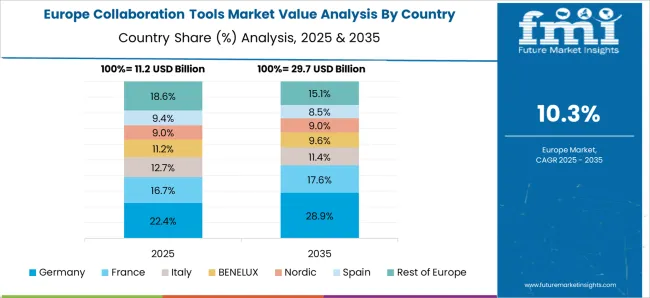

| Europe | 22.3% |

| The United States | 16.5% |

| Germany | 6.5% |

| Japan | 4.3% |

| Australia | 2.6% |

North America is likely to have a sizable market share. In 2025, the region attained 27.6% market share. Within the region, the United States grabbed 16.5% collaboration tools market share in the same year. Rising utilization of collaboration tools with enhanced capabilities is bolstering regional growth. Some advanced features include web conferencing,

communication, and coordination tools, and collaboration portals. The increased usage of web conferences among firms can be attributed to the rising need for visual meetings. This also saves organizations’ travel time and expands user comfort. The rising availability of high-quality internet connections is facilitating such digital possibilities.

Few of the collaboration tools market's top players, such as Microsoft Corporation and Slack Technologies Inc., are headquartered in the United States. The region is experiencing technological advancements due to the use of Artificial Intelligence (AI), particularly in collaboration software.

Germany is one of the most developed countries across the European region and one of the most prominent in terms of internet penetration and digital transformation in recent years.

For instance, in June 2020, TeamViewer announced that its online meeting tools are now integrated with Zoho CRM, a cloud-based customer relationship management platform.

These tools, which are immediately available on the Zoho Marketplace, were built using a cloud-based platform for integrating online meeting applications with Zoho CRM. Such business development strategies by key players in the country are set to increase the demand for the collaboration tools market.

The demand for collaboration tools is rising in Germany due to the country's intense demand for cloud-based solutions. The country's manufacturing and auto industries are thriving.

Owing to the growing demand for significant productivity and efficiency in these industries, manufacturing organizations are more inclined to utilize automated solutions such as automated material handling equipment. Such ingredients are in significant demand in the market of Germany.

India is anticipated to leap forward at 13.2% CAGR from 2025 to 2035. The growth of India is projected to leave behind all its competitors in the coming years. New launches are being made, taking into consideration the evolving workforce requirements.

For instance, in April 2025, Oracle launched Oracle ME, which is a comprehensive employee experience platform. This innovation helps organizations assure employee success and boost employee engagement.

Further, it helps business leaders and HR by providing solutions for communication, listening, and productivity. Among the plethora of advantages, its ability to retain talent by creating a more trusted and supported work environment is deemed crucial. Great market potential in India owing to budding businesses is expected to endow India with rapid growth.

China witnesses a continuous development of digitized workspaces. Hence it fuels the demand for remote working solutions within enterprises. The demand for remote solutions has increased rapidly in various verticals and has created potential growth opportunities for the collaboration tools market.

For instance, in April 2020, WeCom launched as 1st version of WeChat Work in China. This resulted in many companies shifting to remote work. Therefore, the rising adoption of remote work in China is propelling the demand for collaboration tools.

China is the world's leading vehicle manufacturing market. Consumers in China now have significant disposable income. The country's logistics market is likely to increase gradually in the coming years. Infrastructure improvements, greater domestic consumption, and expanding demand for low-cost third-party logistics providers are all factors contributing to this expansion.

The implementation incorporates both on-premise and cloud components. The cloud segment is expected to increase at a rapid rate throughout the forecast period, with a CAGR of 12.7%.

The cloud-based deployment technique may handle a wide range of devices and channels, including computers, cell phones, tablets, social media, and websites. Rising internet usage and smartphone ownership are driving the creation of online content for various social media platforms.

Cloud-based deployment of collaboration tools solutions is growing in popularity due to benefits such as scalability, integration, and usage extension. As a result, organizations install public or private cloud platforms based on their needs and budgets.

Among the enterprise size, the demand for collaboration tools among the large enterprise-size segment is more. The large enterprise size segment is expected to record a CAGR of 8.9% over the forecast period. However, the small & medium enterprise size segment is estimated to grow almost 2.6X market by 2035.

Unified communication and collaboration give a seamless user experience by integrating multiple technologies and tools such as telephony calling, voice, instant messaging, desktop sharing, video, and audio conferencing, that help people work together more effectively anywhere and on any device.

Therefore, the adoption of collaboration tools in large enterprises has shown significant growth in recent years.

| Category | Enterprise Size |

|---|---|

| Top Segment | Large Enterprises |

| Market Share | 55.4% |

Since the solution, the collaboration platform segment is expected to dominate throughout the forecast period. The market size of the collaboration platform segment is expected to expand up to 2.7X of by 2035. The platform segment is set to register a CAGR of 12.4% from 2025 to 2035.

Collaboration tools include unified messaging, enterprise file sharing & synchronization, and portals & intranet platforms. These help to incorporate text, audio, or video communication and to improve security for data exchanges between enterprise resources. Thus, the rising adoption of collaboration platforms across various industries is set to drive demand during the forecast period.

| Category | Solution |

|---|---|

| Top Segment | Platforms |

| Market Share | 56.7% |

Key vendors across the globe are focusing on acquisitions, joint ventures, and investments in enterprise collaboration solutions. This helps the company’s business growth and enables them to maintain their positions in the collaboration tools market.

Also, key players are continuously looking for new ways to serve their customers and expand their business by making significant research & development investments.

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 48.9 billion |

| Market Size Value (2035) | USD 143.9 billion |

| Market Analysis | USD billion/million for Value |

| Key Region Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan; The Middle East & Africa |

| Key Segments | By Solution, By Deployment, By Enterprise Size, By Industry, By Region |

| Key Companies Profiled | Atlassian (Trello); Google LLC; IBM Corporation; Microsoft Corporation; Slack; Dropbox; Oracle Corporation; Smartsheet Inc.; Zoho Corporation Pvt. Ltd.; Hootsuite Inc.; Nulab Inc.; Diligent Corporation; EXo Platform; TeamViewer; Egnyte; Aurea Software, Inc. (Jive Software); Igloo Software; Samepage; Wimi; Evernote Corporation |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global collaboration tools market is estimated to be valued at USD 48.9 billion in 2025.

The market size for the collaboration tools market is projected to reach USD 143.9 billion by 2035.

The collaboration tools market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in collaboration tools market are platforms, _unified messaging, _enterprise file sharing & synchronization, _portals & intranet platforms, _project management platforms, _enterprise social networks, services, _integration service, _technical support and consulting.

In terms of deployment, on-premise segment to command 44.8% share in the collaboration tools market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collaboration Display Market Size and Share Forecast Outlook 2025 to 2035

Brow Tools Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Design Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Carbide Tools Market Growth - Trends & Forecast 2025 to 2035

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Striking Tools Market Size and Share Forecast Outlook 2025 to 2035

Survival Tools Market Trends - Growth & Forecast 2025 to 2035

UK Power Tools Market Analysis – Size, Share & Forecast 2025-2035

KSA Power Tools Market Insights – Trends, Demand & Growth 2025-2035

Diagnostic Tools for EVs Market Growth - Trends & Forecast 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Tools Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA