The segments would induce a robust and smooth expansion in the global carbide tools market from 2025 to 2035. Due to its hardness, wear resistance, and high-speed cutting-edge capability, carbide tools are commonly used for machining. Carbide tools are well appropriate for industries due to the ability to ensure high levels of product or surface finish and sufficient process efficiency with reduced downtime.

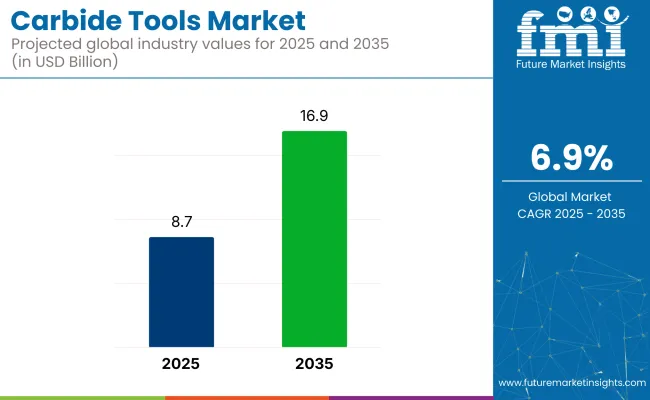

Carbide Tools Market Value is around USD 8.7 Billion in 2025. The growth is at a CAGR of 6.9%. The market size will grow at the rate of 6.9% and USD 16.9 Billion by 2035.

This growth is driven by advances in materials technology, an increase in usage of high-performance cutting tools, and demand for lightweight components in automotive and aerospace applications. Expected to grow further with the latest type of methods and technologies, including nanostructured carbide coatings, hybrid carbide composite materials, and automated tooling

The growing push toward EV and sustainability in manufacturing should provide new opportunities for carbide tool makers as well. Due to the unmatched ability to lower cycle times and enhance surface finish and homogeneity of production, carbide tools will further continue as the most powerful engine of industrial productivity and quality.

The growth rate of 6.9% CAGR is representative of the trend of carbide tools being deployed in growing industrial applications as the world is investing more in advanced manufacturing methods and high-speed machining methods, contributing to the growth in the market.

The North American carbide tools market continues to be buoyed by a mature manufacturing sector, increasing adoption of advanced machining technologies, and demand for precision-engineered components. As the Canadian and USA automotive industries invest in lightweight materials and electric vehicle production, the need for high-performance cutting tools will drive demand.

Besides, the aerospace industry in North America is dependent on carbide tools for machining high-strength alloys and composites that are utilized in aircraft components. The surge in the adoption of advanced manufacturing technologies, including additive manufacturing or smart machining solutions in the region, indicates market growth.

Europe accounts for a roundabout share of the global carbide tools market in the function of a strong automotive manufacturing base, aerospace market, and maintenance of quality standards. Germany, France, and Italy are at the forefront of advanced manufacturing and precision engineering, leading to significant demand for carbide-cutting tools.

For years, the move to electric vehicles (EVs) across Europe has led OEMs to embrace carbide tools for machining lightweight materials and high-strength alloys.

Moreover, the aerospace industry’s need for reliable, wear-resistant cutting tools propels market growth. The focus on sustainability and energy efficiency in the area also promotes the creation of longer-lasting carbide tools that have a smaller impact on the environment.

The carbide tools market in the Asia-Pacific region is expected to grow faster owing to the growing manufacturing base, the rising investments in infrastructures and increasing automotive production.

Well-established automotive and electronics industries in China, India, Japan, and South Korea are amongst the key contributors to the tooling industry as this directly propels the demand for high-quality cutting tools, and significantly is a market on its own, making a substantial impact on the tooling revenue market as well.

Regional market growth is expected to be supported by the increasing focus on precision manufacturing and the adoption of advanced machining technologies.

Moreover, a favorable environment for carbide tool manufacturers is created due to the various government initiatives to promote industrial automation, digitalization, and skill development. Asia-Pacific will emerge as a key market for carbide tools in the next decade with increasing exports and a strong focus on quality.

Challenges

Rising raw material & supply chain disruptions

In addition, the Carbide Tools Market is also facing rising prices of the raw materials required, the supply chain fluctuating, and the manufacturing process coming with rigid rules and regulations.

Carbide tools ubiquitous in sectors like automotive, aerospace, construction, and metal fabrication require tungsten carbide and cobalt, both of which are susceptible to market price volatility tied to mining constraints and geopolitical trends. Additionally, the global supply chain disruption owing to transportation delays and raw material shortage has impacted production schedules and increased operational costs for the manufacturers.

In response to these challenges, companies must prioritize securing and diversifying the sourcing of raw materials, maximize recycling programs for carbide and residual powder, and explore more advanced manufacturing techniques such as additive manufacturing and automated precision grinding to streamline production and cut costs.

Opportunity

Growing Demand for High-performance cutting tools and Smart Machining Solutions

The growing implementation of high-precision machining and smart manufacturing will offer ample growth prospects for the Carbide Tools Market. The demand for durable, wear-resistant cutting tools is increasing as industries are making a transition towards automation and efficiency-driven production.

Improvement of tool life and performance in high-speed machining is being enhanced by advanced carbide tool coatings, such as diamond-like carbon (DLC) and titanium aluminium nitride.

Additionally, as we embrace Industry, sensorized carbide tools deliver ongoing data on their wear and tear, making it possible to predict when a tool needs to be replaced and ensuring optimal tool life cycles. Investing in smart machining tools, digital twin technology, and sustainable carbide processing initiatives will help companies become key players in the changing fabric of tool manufacturing.

Between 2020 and 2024, the Carbide Tools Market grew gradually due to the growing demand for highly accurate cutting tools in manufacturing and construction projects. The automotive and aerospace sectors especially used carbide tools to improve machining accuracy and reduce material waste.

Still, supply chain disruption and high costs of raw materials create challenges as manufacturers have to explore alternative materials and coatings at a competitive rate. Moreover, companies focused on offering customization options for tools based on machining requirements in various industries which enhanced overall production efficiency.

In the longer term, from 2025 to 2035 perspective, the carbide tool manufacturing market will be characterized by developments facilitated by machining optimization aided by AI, hybrid tooling methods, and automation in production lines. Shortly, Nano-coated carbide tools with better wear resistance and thermal stability will also be developed, resulting in longer tool life and better machining accuracy.

Moreover, transitioning to green and energy-efficient manufacturing paves the way for carbide recycling programs, minimizing reliance on newly mined resources. With demand for precision engineering increasing in sectors including renewable energy, medical devices, and EV (electric vehicle) manufacturing, the next leaps of carbide tool innovation will come from combining AI-based analytics with sustainable material sourcing and automation-driven production techniques.

Grows in industries such as renewable energy, medical devices, and electric vehicle (EV) production, companies that integrate AI-based analytics, sustainable material sourcing, and automation-driven production techniques will lead the next phase of carbide tool innovation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shifts | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with industry machining standards |

| Technological Advancements | Growth in multi-layer coatings and precision tool grinding |

| Industry Adoption | Increased use in automotive, aerospace, and construction |

| Supply Chain and Sourcing | Dependence on tungsten and cobalt with price volatility |

| Market Competition | Dominance of established cutting tool manufacturers |

| Market Growth Drivers | Rising demand for high-performance cutting tools in the industry. |

| Sustainability and Energy Efficiency | Initial efforts to improve carbide recycling efficiency. |

| Integration of Smart Monitoring | Limited adoption of IoT-enabled cutting tools |

| Advancements in Tool Material Innovation | Use of conventional carbide tool coatings |

| Market Shifts | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | The expansion of sustainability mandates the promotion of carbide recycling and coatings. |

| Technological Advancements | Integration of AI-driven machining optimization, Nano-coated carbide tools, and digital twin technology. |

| Industry Adoption | Expansion into EV production, renewable energy, and high-precision medical manufacturing. |

| Supply Chain and Sourcing | Diversification into recycled carbide and alternative super hard materials. |

| Market Competition | Rise of digital-first toolmakers specializing in smart carbide tooling solutions. |

| Market Growth Drivers | Increased investment in automation and AI-driven predictive maintenance. |

| Sustainability and Energy Efficiency | Full-scale adoption of closed-loop carbide recovery programs and low-energy tool manufacturing. |

| Integration of Smart Monitoring | AI-powered wear tracking and cloud-based machining analytics and real-time process optimization. |

| Advancements in Tool Material Innovation | Development of ultra-hard composite materials, graphene-enhanced coatings, and hybrid carbide-ceramic tooling. |

Carbide tools are widely used in the United States across various industries, including automotive, aerospace, and manufacturing. Strong growth in high-performance carbide cutting tools is driven by the accelerating rise of electric vehicle manufacturing, the extensive expansion of aerospace manufacturing, and a strong network of CNC machining companies.

The USA aerospace and defense industry, which encompasses Boeing, Lockheed Martin, and Raytheon, is also a big consumer of carbide tools in its applications for machining high-strength alloys and composites. Gear shifts towards automation and AI-centric machining solutions are being made fast in the industry, directly propelling the need for carbide end mills, drills, and inserts.

Due to constant developments in tool coatings, a growing trend towards CNC machining, and a substantial investment into high-precision manufacturing, the USA carbide tools market is more likely to see significant growth.

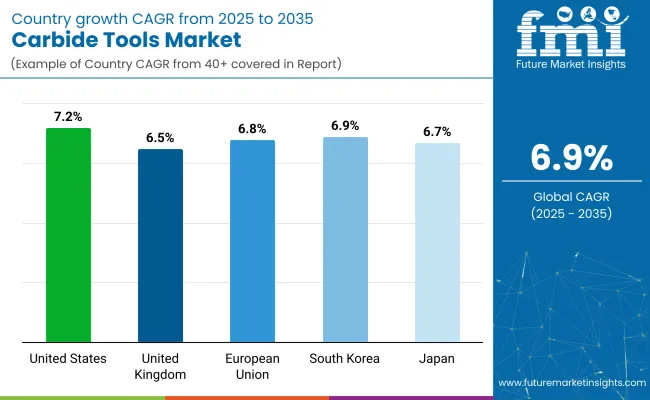

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

UK aerospace industry is a leading user of carbide cutting tools for high-temperature alloys and titanium parts, while players like Rolls-Royce, BAE Systems, and Air Borne are big names.

A concurrent demand for high-performance carbide tools is being spurred in the renewable energy project sector, most notably the manufacture of wind turbine components, and offshore drilling. Furthermore, the implementation of smart manufacturing and automation in the field of CNC machining is a vital factor driving the market growth.

The UK carbide tools market is expected to witness stable growth owing to constant developments in tool performance and rising demand for wear-resistant coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The European Union carbide tools market is anticipated to grow steadily further in the forecast period, because of the rising industrial automation, increasing production of electric vehicles (EV) and persistent demand in precision engineering sectors. CNC machining, automotive manufacturing, and aerospace are driving the use of carbide tools in Germany, France, and Italy.

The rise of sustainable manufacturing, and EU regulations promoting energy-efficient machining processes, are driving the adoption of advanced carbide tooling solutions. Furthermore, demand in the market is increasing due to investments in high-speed machining and additive manufacturing.

The increasing focus on high-performance machining solutions, along with substantial government backing for industrial automation, will spur growth in the EU carbide tools market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.8% |

The demand for carbide tools from automotive, electronics and precision engineering industries in Japan has resulted in a strong market growth in Japan. Japan is the main consumer of carbide cutting tools for ultra-precision machining and the base of major automobile and CNC machining manufacturers.

In addition, the growth of the 5G infrastructure markets and the semiconductor manufacturing industry are driving the demand for micro-machining carbide tools.

The Japanese carbide tools market is poised for stable growth going forward, owing to regular investments in high-speed and precision machining and growing R&D initiatives in tool coatings and nano-carbide materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.7% |

Increasing adoption of carbide tools in automotive, electronics, and heavy industries is also among the factors that will help in the steady growth of the South Korean carbide tools market. The rationale for carbide tool adoption in South Korea goes beyond the investments made to streamline native CNC fabrication in the maturing machine market as well as due to the solid domestic semiconductor manufacturing industry.

Ford and GM and Chrysler and Toyota and others aren't unique in this, of course - V6 and V8 and four-cylinder and hybrid are popular engines for these companies as well, even if they come in slightly smaller sizes than their American competitors -. Still, in the automotive world, Hyundai and Kia lead the charge in high-performance carbide cutting tools, often focusing on precision machining of engine components, chassis and battery assembly parts. Moreover, market demand is driven by smart factories and industrial automation.

New developments in high-speed machining, strong government support towards Industry 4.0, and increasing demand for wear-resistant carbide tools will support the growth of the South Korean carbide tools market during the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

Growing adoption of high-performance cutting and drilling products by industries for better productivity, accuracy, and enhanced tool life, the market has a a large share coming from the cutters and drills segment. Renowned for their durability, tools made from solid carbide are crucial to machining, automotive production, aerospace, and industrial fabrication, which makes them less optional and more essential across high-tolerance and heavy-duty metalworking jobs.

Thanks to their high durability and extreme heat resistance, carbide cutters have become some of the most commonly used machining tools and maintain high cutting capacity. Carbide cutters boast exponentially better tool life, surface finish, and material removal rate capabilities than traditional high-speed steel (HSS) tools, making them the ideal choice for heavy-duty machining applications.

Increased need for hardware such as smooth-contoured environments, 3D profiling, and high-speed milling in the aerospace and automotive component manufacturing sectors is aiding the adoption of high-performance carbide cutting tools, as precision producers are required to focus on improving tool efficiency and surface finish quality. According to research, ball end cutters decrease machining time by another 30%, which guarantees improved productivity in complex geometrical milling applications.

The growing application of corner rounding cutters across mold and die-making with a high-strength carbide tip is expected to widen market reach, leading corner rounders to widespread usage in tooling fabrication and metal finishing processes, thereby fuelling the market growth.

In addition, AI-driven cutting optimization, real-time analysis of tool wear, and automated feed rate adjustments have all contributed to growing adoption in ensuring that precision machining operations use cutting tooling effectively, with longer tool life and wastage minimized.

Multi-flute deburring cutters were recently developed with improved chip evacuation to keep heat build-up to a minimum, maximizing market growth and offering better performance in high-speed machining applications.

For better adaptability in composite material cutting and wood processing applications, routing and sinking cutters are widely used, with carbide-coated edges for higher wear resistance, further supporting the market's growth.

While they offer advantages in precision cutting, long tool life, and performance in high-speed machining, they are unsuitable for applications requiring ultra-fine finishing, have high manufacturing costs, and are brittle compared to HSS tools.

Nonetheless, the market growth of carbide-cutting tools persists as innovative solutions like nanostructured carbide coatings, artificial intelligence (AI) machining parameter optimization, and carbide-ceramic hybrid composite tools become more cost-efficient, durable, and efficient.

Carbide drills are widely accepted and popular in the market, mostly in areas such as precision drilling, hole-making, and deep-hole applications, as industries look to implement high-speed, wear-resistant drilling tools to improve productivity and accuracy.

Carbide drills are a different type of tool than conventional drilling tools, because this type of instrument has superior hardness, great heat resistance, and durability, increasing the efficiency of these processes during high-load or high-precision drilling operations.

CNC machining is experiencing a surging demand for centre drills with carbide-coated tips, proven increased rigidity for greater accuracy in whole placements; in milling and drilling, manufacturers have adopted high-precision drilling tools, ensuring precision in initial whole placement. Carbide centre drills have been proven to reduce whole misalignment errors by over 50% compared to HSS drills when machining in an automated setup!

The reach of slot drills in automotive and aerospace manufacturing is expanding, thanks to multi-flute carbide tips that optimize aggressive material removal, enhancing market demand and resulting in widespread end-user adoption in machining structural components and components.

AI-powered drilling analytics equipment with real-time wear detection and automated depth control has helped increase adoption even more, as it aids in better efficiency and prevents replacing expensive tools in high-volume drilling jobs.

High-performance types of tools also further boosted the market, spade drills feature carbide-reinforced edges that give the tool a long lifespan while drilling and reaming hard materials and they also provide a great advantage for improving the efficiency of industrial-grade applications.

Increased market growth reinforced by ultra-fine carbide grains enabling better finish of the hole and allowing for the minimized formation of burrs rights actors from adopting to micro-machining in electronics manufacturing with adoption of dream drills and spot drills.

While these features provide a significant benefit to the drilling process, carbide drills, unfortunately, have higher fragility in impact-driven applications, higher procurement costs, and increased sensitivity to improper machining parameters.

Nevertheless, advances in carbide matrix reinforcement, AI-based drill path optimization, and next-generation self-lubricating drill coatings enhance performance, flexibility, and cost-effectiveness, guaranteeing further growth of carbide drilling implements.

Carbide tools based on hand and machine forms are classified into two dominant market drivers as end-use industries continue to adopt high-precision cutting or drilling solutions to optimize manual operations and improve automated machining workflows.

Tools of this type, mainly composed of carbide, are now one of the predominant solutions utilized during fine machining, fine grinding, and craftsmanship methods in their hand-based form. They offer optimal lifetime (wear and sharpening), extreme sharpness, and noticeable edge retention. Carbide-tipped hand tools have longer wear resistance than conventional hand tools, providing longevity in detailed cutting, engraving, and shaping applications.

With artisans, engineers, system planners, and machinists prioritizing their tools to offer backend-life, precision burrs, and engraving blanks developed to tighten the small adjustments, escalating demand by using carbide hand tools in custom machining and metalworking and hand tools based entirely at carbide, that's displaying promising growth for the market. Hence, using carbide-tipped hand tools improves cutting precision by up to 40%, improving consistency in manual machining tasks, according to research.

Hand-based carbide reamers and tipped bores in fine machining are rapidly expanding with their self-aligning capabilities, improving whole accuracy, which has improved market demand and increased adoption in toolmaking, prototype development, and small-scale machining operations.

The use of AI-assisted tool calibration systems with real-time sharpening and wear tracking of carbide hand tools drives greater adoption for enhancing efficiency and minimizing downtime in precision manual machining setups.

Hand-based carbide tools will always have limitations in terms of initial cost, brittleness in impact, and impact suitability, and they lessen work-positive in mass production scenarios despite the fact that they are much more precise in fine detail machining while bringing along longer-lasting tooling life and better sharpness retention.

Nevertheless, groundbreaking advancements in nano-coating reinforcement, AI-supported tool wear analytics, and hybrid carbide-metal composite tool configurations are bolstering durability, transitional functionality, and cost-efficiency, thereby paving the way for sustained growth of screen-carbide tools within the industry.

The high cost of carbide tools creates a great opportunity with machine-based carbide tools dominating the market owing to increased automation in CNC machining, industrial fabrication, and high-speed material processing, with manufacturers spending more on high-efficiency carbide tooling to enhance resultant production and to increase precision.

Unlike hand-based tools, carbide tools can be enterprise-wide, leveraging the scale of production to lower costs by providing superior heat resistance, optimized cutting geometries, and tool rigging in automated machining environments.

Increasing use of machine carbide cutting and milling tools for CNC precision engineering that covers multi-axis carbide mills for machining intricate geometries is fuelling high-performance machine carbide tools demand with industries moving toward autonomous machines and automation.

Carbide-threaded mills and conically tapered end mills have become vital in aerospace and defense manufacturing as path optimization technologies advance for surface finishing with precision, which in turn has reinforced product demand in the global market, ensuring higher adoption rates in high-tolerance machining activities.

The adoption has been further driven by the presence of AI-enabled adaptive cutting technologies, which vary spindle speed in real-time and adjust depth-of-cut in an automatic manner, which leads to better efficiency and decreased tool replacement costs in high-load machining applications.

However, machine-based carbide tools come with challenges, including high capital investment requirements, an increased likelihood of tool chipping under extreme loads, and complexity when applied across multi-material cutting applications.

Emerging innovations of AI-assisted machining, self-healing carbide coatings, and hybrid multi-material carbide tool designs are, however, overcoming challenges related to performance, cost-efficiency, and long-term sustainability, ensuring continued adoption and growth for machine-based carbide tools.

Growing demand for high-precision machining, durability, and efficacy in automotive, aerospace, construction, and manufacturing industries are contributing to the growth of the carbide tools market.

This is when enterprises are now aiming towards optimizing AI-based tools and focusing on peace high-speed cutting engineering delivery alone with PVD coatings for wear resistance for cost-effective productivity and longevity. The market consists of an array of global production of cutting tools and specialty carbide tooling providers, each of which drives technological advancements in milling and drilling, turning, and grinding applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sandvik AB | 15-20% |

| Kennametal Inc. | 12-16% |

| Iscar Ltd. (IMC Group - Berkshire Hathaway Inc.) | 10-14% |

| Mitsubishi Materials Corporation | 8-12% |

| Walter AG (A Sandvik Company) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sandvik AB | Develops high-performance carbide cutting tools, AI-powered machining solutions, and wear-resistant coatings. |

| Kennametal Inc. | Specializes in solid carbide tools, indexable inserts, and high-speed drilling and milling solutions. |

| Iscar Ltd. (IMC Group) | Manufactures precision carbide tools for aerospace, automotive, and industrial machining applications. |

| Mitsubishi Materials Corporation | Provides heat-resistant carbide tooling solutions for extreme cutting conditions and high-precision machining. |

| Walter AG (A Sandvik Company) | It offers index-able and solid carbide milling, drilling, and turning tools with enhanced tool life technology. |

Key Company Insights

Sandvik AB (15-20%)

Carbide tools technology, Sandvik Provides smart machining solutions, AI for cutting tool optimization, and sophisticated tool coatings.

Kennametal Inc. (12-16%)

Kennametal focuses on solid carbide and index-able cutting tools for high-speed machining and exceptional tool life.

Iscar Ltd. (IMC Group) (10-14%)

Iscar features precision carbide tooling for complex machining, resulting in productivity and cutting efficiency.

Mitsubishi Materials Corporation (8-12%)

Mitsubishi is a manufacturer of high-performance carbide cutting tools; their specialty is heat-resistant applications and precision engineering.

Walter AG (A Sandvik Company) (5-9%)

Walter produces high-end carbide tools for milling, drilling, and turning, incorporating wear-resistant coatings and AI-based tracking of performance.

Other Key Players (40-50% Combined)

Next-generation carbide tool innovations, AI-driven machining analytics and advanced wear-resistant coatings are contributed by several cutting tool peddlers and carbide tool specialists. These include:

The overall market size for Carbide Tools Market was USD 8.7 Billion in 2025.

The Carbide Tools Market expected to reach USD 16.9 Billion in 2035.

The demand for carbide tools will be driven by factors such as their high durability, wear resistance, and precision, making them essential in manufacturing, aerospace, automotive, and construction industries. The increasing demand for high-performance tools, automation, and advanced machining technologies will further fuel market growth.

The top 5 countries which drives the development of Carbide Tools Market are USA, UK, Europe Union, Japan and South Korea.

Cutters and Drills Drive Market Growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boron Carbide Market Analysis & Trends 2025 to 2035

Silicon Carbide (SiC) Coating Market Size and Share Forecast Outlook 2025 to 2035

Hafnium Carbide Market Size and Share Forecast Outlook 2025 to 2035

Silicon Carbide Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Carbide Market Size and Share Forecast Outlook 2025 to 2035

Tungsten Carbide Market

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Striking Tools Market Size and Share Forecast Outlook 2025 to 2035

Survival Tools Market Trends - Growth & Forecast 2025 to 2035

UK Power Tools Market Analysis – Size, Share & Forecast 2025-2035

KSA Power Tools Market Insights – Trends, Demand & Growth 2025-2035

Diagnostic Tools for EVs Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA