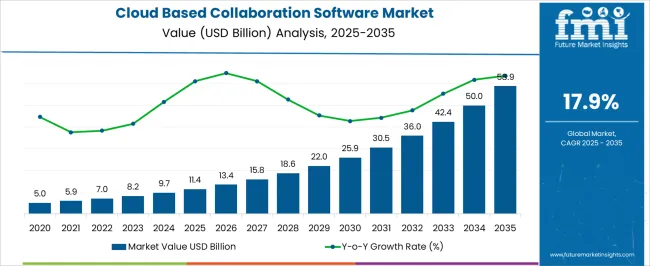

The Cloud Based Collaboration Software Market is estimated to be valued at USD 11.4 billion in 2025 and is projected to reach USD 58.9 billion by 2035, registering a compound annual growth rate (CAGR) of 17.9% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Based Collaboration Software Market Estimated Value in (2025 E) | USD 11.4 billion |

| Cloud Based Collaboration Software Market Forecast Value in (2035 F) | USD 58.9 billion |

| Forecast CAGR (2025 to 2035) | 17.9% |

The cloud based collaboration software market is advancing rapidly, fueled by the widespread digital transformation of enterprises and the demand for scalable, remote-friendly communication platforms. Corporate announcements and technology journals have emphasized how hybrid work adoption has accelerated the integration of cloud-driven tools to ensure real-time collaboration across geographically distributed teams.

Investment disclosures from software companies highlight sustained spending on infrastructure security, AI-driven features, and workflow automation to improve user experience and data protection. Additionally, industry-wide trends show organizations are shifting from on-premises systems to cloud deployments to reduce capital expenditure and improve operational flexibility.

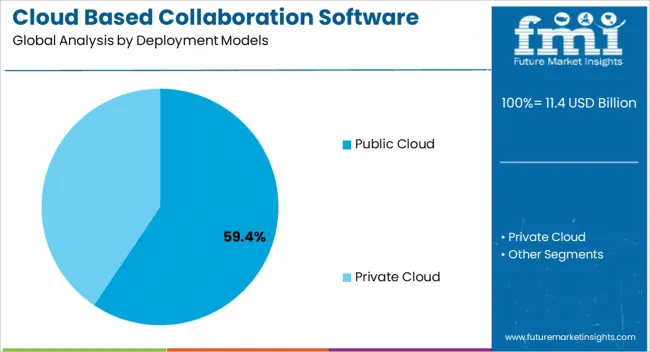

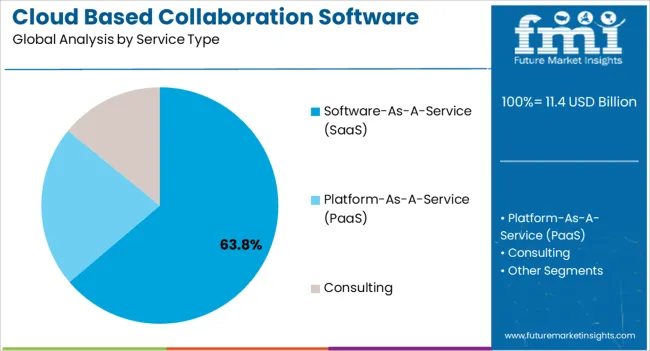

Public and private sectors alike are investing in advanced collaboration platforms to streamline workflows, integrate third-party applications, and support mobile-first usage patterns. Looking ahead, growth opportunities are expected to emerge from AI-enabled virtual assistants, enhanced cybersecurity protocols, and region-specific compliance offerings. Segmental strength is being shaped by the preference for public cloud deployments, the dominance of software-as-a-service delivery models, and rising adoption of unified communication and collaboration solutions.

The Public Cloud segment is projected to hold 59.40% of the cloud based collaboration software market revenue in 2025, sustaining its position as the preferred deployment model. This dominance has been driven by the scalability, cost-effectiveness, and ease of implementation associated with public cloud infrastructure.

Enterprises have increasingly adopted public cloud platforms to support rapid onboarding and flexible licensing, reducing the need for in-house IT resources. Technology publications have highlighted how public cloud providers continuously invest in data centers, security enhancements, and global availability zones, making them highly attractive for organizations of varying sizes.

Furthermore, public cloud deployments allow seamless integration with popular productivity tools and third-party applications, improving organizational agility. As businesses continue to embrace hybrid and remote work structures, the reliance on public cloud solutions is expected to remain strong, supported by their ability to deliver collaboration at scale with minimal upfront investment.

The Software-As-A-Service (SaaS) segment is projected to account for 63.80% of the cloud based collaboration software market revenue in 2025, emerging as the leading service delivery model. Growth in this segment has been driven by the flexibility of subscription-based offerings that minimize capital costs while providing continuous access to the latest software updates.

SaaS platforms have been favored by enterprises due to their ability to deliver collaboration tools via the web without complex installations or infrastructure requirements. Industry reports and company disclosures have noted that SaaS solutions facilitate faster deployment, cross-device compatibility, and regular feature enhancements, aligning with evolving business needs.

Additionally, SaaS vendors have integrated advanced analytics, AI-driven recommendations, and customizable dashboards, enhancing user productivity. With enterprises seeking to streamline vendor management and adopt agile IT strategies, the SaaS delivery model is expected to maintain its leadership in the market, strengthened by continuous innovation and global scalability.

The Unified Communication and Collaboration segment is projected to contribute 54.60% of the cloud based collaboration software market revenue in 2025, retaining its leadership among solution types. This growth has been supported by the increasing need for integrated platforms that consolidate messaging, video conferencing, file sharing, and workflow management into a single interface.

Organizations have prioritized unified solutions to reduce the complexity of managing multiple tools and to enhance employee engagement across distributed teams. Analyst presentations and enterprise technology strategies have emphasized how unified communication platforms improve efficiency by enabling seamless interaction and reducing downtime.

Furthermore, these platforms are being enhanced with AI-driven transcription, real-time translation, and intelligent scheduling, strengthening their role in workplace productivity. As digital workplaces evolve and collaboration requirements expand, unified communication and collaboration solutions are expected to remain central to enterprise strategies, ensuring consistent, secure, and scalable communication environments.

The primary factor that is driving the market growth is the implementation of cloud-based collaboration software services by businesses.

These businesses are utilizing cloud based collaboration software to enhance the operational efficiency, which is rapidly growing owing to the rising trend of mobility and bring your own device (BYOD). The major advantage of cloud based collaboration software that is shaping the market is that the software ensures all documentation is kept within the same workplace to avoid keeping track of different versions of attachments.

Workforce productivity and low cost are also predicted to influence the market outlook in a positive manner. On the flip side, lack of data security and high internet dependency may act as one of the major restraints faced by vendors in cloud based collaboration software market.

In 2025, the North American region held a significant portion, about 33.9%, of the market share for cloud-based collaboration software. This dominant position in the global market was attributed to the region's abundance of cloud-based solution providers. The market in the region is also expanding on account of the fact that cloud platforms were embraced early on for scalability and flexibility.

Leading companies in the area are placing a significant emphasis on strategic communication between teams working on projects from different locations. This is driving up demand for cloud-based collaboration software. This is due to the advance and strong technological sector in the USA, at the same time, the fact that major technology sector businesses are also from USA.

With the rising adoption of the software in countries like USA and Canada, they are poised to showcase growth in the forecasting period. These efforts are expected to extend the reach of unified communication and web conferencing solutions while also introducing innovative features in their software. This is likely to streamline operations for businesses of various scales in these countries. For example, tech-giant Amazon and a prominent global automaker Stellantis N.V., went into a series of multi-year agreements. These agreements were made to ensure the transformation of the in-vehicle experience of customers of the Stellantis and take the mobility industry in the direction of a software-driven future.

The cloud based collaboration software industry size is expanding rapidly in Europe. This growth is a direct outcome of the increasing adoption of technology. Businesses in the region are placing a strong emphasis on enhancing customer experiences. This emphasis is driven by their desire to distinguish themselves from competitors in the market.

In 2025, the Europe cloud based collaboration software market secured a portion of 20.4%. This can be attributed to the growing adoption of cloud-based technologies by businesses, coupled with the expansion of hybrid cloud solution. Google, IBM, Salesforce, and AWS control a sizeable portion of the cloud-based service market in Spain today and are actively developing important cloud technologies.

Various businesses in the UK are going through shift in digital landscape. The digital transformation also includes the integration of cloud-based solutions and different types of cloud based collaboration tools to improve the productivity. Meanwhile, the companies that are using these cloud-based collaboration tools must ensure that they are complying with the regulation such as GDPR (General Data Regulation).

Cloud-based solutions are experiencing significant demand in Germany, leading to an increased need for team collaboration software. The country boasts robust automotive and manufacturing industries. Both are witnessing a growing requirement for heightened productivity and efficiency. This inclination has prompted manufacturing enterprises to embrace automated solutions, including automated material handling equipment. These dynamics collectively contribute to the escalating demands within Germany.

A legion of start-ups are emerging, in turn bringing about emerging trends in the cloud based collaboration software industry.

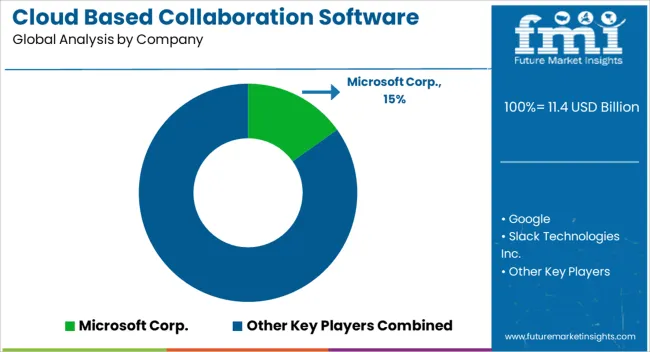

As international and regional, both types of competitors are eyeing a major part of market share, the market is quite competitive.

In order to gain competitive advantage, the businesses in the market are focusing on partnerships, acquisitions and mergers.

For instance:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 18.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Deployment Models, Service Type, Solution Type, Enterprise Size, Vertical Type, Region |

| Regions Covered | North America; Latin America; The Asia Pacific; Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Microsoft Corp.; Google; Slack technologies Inc.; Aspect software; Cisco Systems; Oracle; Salesforce.com Inc.; Jive software Inc.; Mitel Networks Corporation; Box Inc. |

| Customization | Available Upon Request |

The global cloud based collaboration software market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the cloud based collaboration software market is projected to reach USD 58.9 billion by 2035.

The cloud based collaboration software market is expected to grow at a 17.9% CAGR between 2025 and 2035.

The key product types in cloud based collaboration software market are public cloud and private cloud.

In terms of service type, software-as-a-service (saas) segment to command 63.8% share in the cloud based collaboration software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Cloud API And Management Platforms And Middleware Market Size and Share Forecast Outlook 2025 to 2035

Cloud Encryption Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA