The cloud ERP industry in Latin America is expanding steadily, driven by increasing digital transformation across enterprises and the regional shift toward scalable, cost-efficient IT infrastructure. Organizations are adopting cloud ERP solutions to enhance data integration, streamline operations, and improve real-time decision-making.

The market benefits from the rising adoption of subscription-based models, which lower upfront investment and improve accessibility for small and medium enterprises. Regional growth is also supported by government initiatives promoting cloud adoption and the proliferation of local data centers improving latency and compliance.

Public cloud deployments are gaining traction due to flexibility and faster implementation, while large enterprises continue to invest in hybrid systems for security and customization. With ongoing modernization in sectors such as manufacturing, retail, and BFSI, the Latin American cloud ERP market is positioned for long-term expansion.

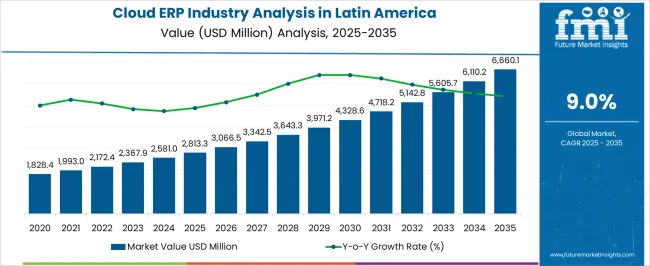

| Metric | Value |

|---|---|

| Cloud ERP Industry Analysis in Latin America Estimated Value in (2025 E) | USD 2813.3 million |

| Cloud ERP Industry Analysis in Latin America Forecast Value in (2035 F) | USD 6660.1 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

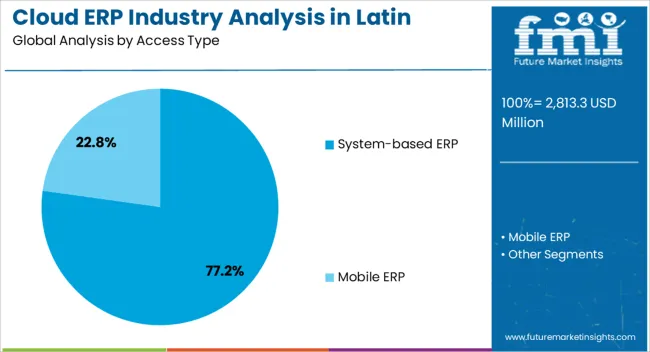

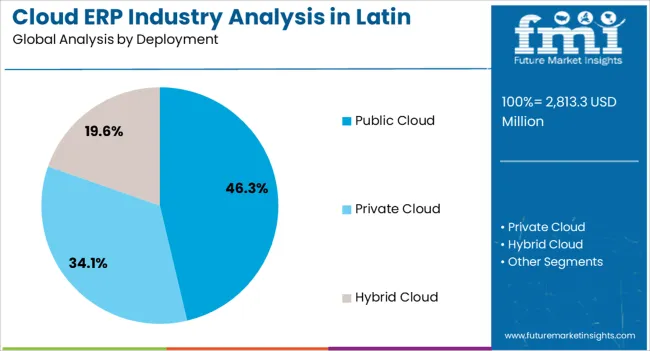

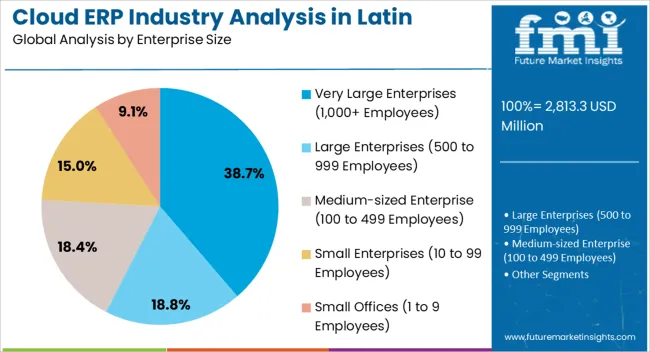

The market is segmented by Access Type, Deployment, Enterprise Size, and ERP Module and region. By Access Type, the market is divided into System-based ERP and Mobile ERP. In terms of Deployment, the market is classified into Public Cloud, Private Cloud, and Hybrid Cloud. Based on Enterprise Size, the market is segmented into Very Large Enterprises (1,000+ Employees), Large Enterprises (500 to 999 Employees), Medium-sized Enterprise (100 to 499 Employees), Small Enterprises (10 to 99 Employees), and Small Offices (1 to 9 Employees). By ERP Module, the market is divided into Finance & Accounting, Human Capital Management, Supply Chain Management, Customer Relationship Management, Sales & Marketing, Procurement, Manufacturing, Inventory Management, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The system-based ERP segment dominates the access type category, representing approximately 77.20% share. This dominance is driven by enterprises seeking integrated systems that consolidate diverse business processes into a unified platform.

System-based solutions provide centralized data visibility and support complex operational structures, making them ideal for large organizations with multiple departments. The segment benefits from enhanced analytics capabilities, modular flexibility, and interoperability with third-party applications.

As Latin American businesses continue to scale digitally, system-based ERP solutions are preferred for their ability to streamline workflows and maintain consistent performance. With continuous advancements in AI-driven process automation, this segment is expected to sustain its leadership across the region.

The public cloud segment leads the deployment category, accounting for approximately 46.30% share. Its prominence is attributed to lower implementation costs, easy scalability, and rapid deployment, which appeal to both SMEs and large enterprises.

Public cloud platforms enable efficient resource utilization while minimizing infrastructure management burdens. Increased trust in cloud security, coupled with compliance improvements and local data residency support, has accelerated adoption.

The segment also benefits from strong vendor presence and expanding service portfolios tailored to regional business needs. As organizations prioritize agility and remote accessibility, public cloud ERP deployments are projected to dominate the Latin American market in the coming years.

The very large enterprises segment holds approximately 38.70% share of the enterprise size category, reflecting high demand among organizations with complex, multi-location operations. These enterprises leverage ERP systems for data-driven management, compliance control, and scalability across diverse operational units.

Cloud-based ERP solutions allow them to centralize processes while maintaining flexibility in resource allocation. Growth in this segment is further supported by ongoing modernization initiatives and the need to replace legacy systems.

With increasing digital investments and strong adoption across sectors such as manufacturing and financial services, very large enterprises are expected to remain key contributors to the regional ERP landscape.

The Latin America Cloud ERP industry experienced a CAGR of 7%, reaching a value of USD 2,580.6 million in 2025, from 2020 to 2025. During this period, the demand for Cloud ERP solutions grew significantly due to a surge in digital transformation.

The Latin America Cloud ERP industry is expected to experience significant growth from 2025 to 2035 due to digital transformation initiatives across low-income group countries like Paraguay, Uruguay, Venezuela, and others. Businesses sought scalable, cost-effective, and agile solutions for real-time data access, streamlined processes, and advanced technologies.

The cloud ERP solution providers in the region emphasized industry-specific customization, mobile accessibility, and data security to meet regional requirements. Cloud ERP became essential for navigating the challenges and opportunities of the Latin American business environment.

Industry Growth Outlook by Key Countries

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Mexico | 10.7% |

| Brazil | 9.2% |

| Chile | 7.5% |

The Cloud ERP industry in Mexico is expected to acquire a share of 45.3% by 2035, expanding at a CAGR of 10.7%. The demand for Cloud ERP in Mexico is expected to experience significant growth through the projected years due to

The sales of Cloud ERP software in Brazil are expected to acquire a 27.6% share, expanding at a CAGR of 9.2% during the forecast period. Some noticeable trends that are likely to impact the industry in Brazil include:

The Cloud ERP industry in Chile is anticipated to acquire a 5.8% share at a CAGR of 7.5% during the forecast period. Some of the prominent factors that are expected to strengthen the cloud ERP industry trends in Chile include:

Based on access type, the system-based ERP is expected to dominate the Cloud ERP industry in Latin America, with a share of 77.2% in 2025.

Growth Outlook by Access Type

| Access Type | Value Share (2025) |

|---|---|

| System-based ERP | 77.2% |

| Mobile ERP | 22.8% |

The mobile ERP segment is expected to dominate the Cloud ERP industry in the region with a CAGR of 12.3% from 2025 to 2035. The industry is driven by the following factors:

The demand for Cloud ERP solutions is accelerating in Latin America due to its easy accessibility on mobile and desktop for financial data, supply chains, and management tools. To stay ahead of the competition in such a circumstance, both established and emerging players must adopt advanced techniques for business intelligence.

Product Innovation

Established companies providing Cloud ERP systems for businesses in Latin America are focusing on product innovation, continuous research, and investing in emerging technologies like artificial intelligence and machine learning. They aim to enhance features, customize capabilities, and user experience while staying updated with evolving industry requirements to meet diverse business needs in the region.

Strategic Partnerships and Collaborations

Cloud-based ERP service providers in the region are forming strategic partnerships with technology providers, industry specialists, and regional players to scale up their business. Cloud ERP vendors primarily focus on ERP solutions and cater to diverse customer needs, fostering growth and sustainability.

Expansion into Emerging Countries

Cloud-based enterprise resource planning in Brazil and Mexico is expanding into other countries by tailoring solutions to local needs. They are also forming strategic partnerships and leveraging a strong network of channel partners to capitalize on the growing demand for next-gen cloud ERP products.

Mergers and Acquisitions

Key players in Latin America frequently use mergers and acquisitions to consolidate their positions, extend their product range, and gain access to new clients.

Key Developments in the Latin America Cloud ERP Industry

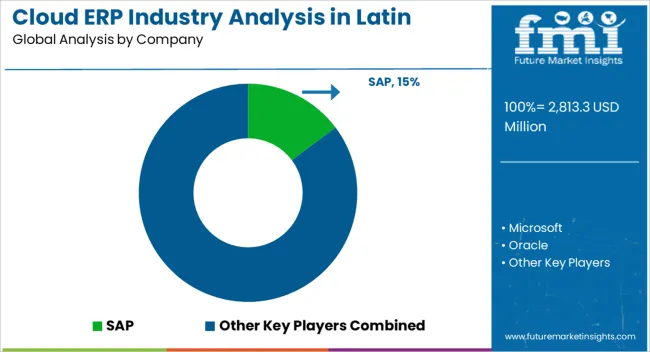

The global cloud erp industry analysis in latin america is estimated to be valued at USD 2,813.3 million in 2025.

The market size for the cloud erp industry analysis in latin america is projected to reach USD 6,660.1 million by 2035.

The cloud erp industry analysis in latin america is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in cloud erp industry analysis in latin america are system-based erp and mobile erp.

In terms of deployment, public cloud segment to command 46.3% share in the cloud erp industry analysis in latin america in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hyperscale Cloud Industry Market Trends – Growth & Forecast 2024-2034

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

EduTech Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Fintech as a Service Market Analysis – Growth & Trends 2024-2034

Walk-in Cooler & Freezer Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA