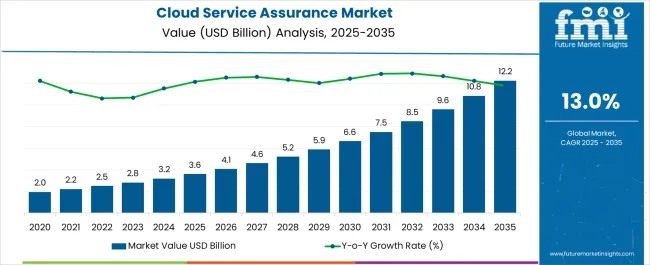

The Cloud Service Assurance Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 12.2 billion by 2035, registering a compound annual growth rate (CAGR) of 13.0% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Service Assurance Market Estimated Value in (2025 E) | USD 3.6 billion |

| Cloud Service Assurance Market Forecast Value in (2035 F) | USD 12.2 billion |

| Forecast CAGR (2025 to 2035) | 13.0% |

The cloud service assurance market is expanding rapidly due to the growing reliance on cloud based infrastructure, increased demand for uninterrupted service availability, and the rising complexity of hybrid and multi cloud environments. Organizations are prioritizing solutions that provide end to end visibility, proactive monitoring, and rapid fault resolution to maintain business continuity.

The adoption of advanced technologies such as artificial intelligence, machine learning, and predictive analytics is enabling faster detection of anomalies and improved service performance. Additionally, regulatory requirements across industries are pushing enterprises to implement robust assurance frameworks to ensure compliance and data security.

With enterprises continuing to migrate critical workloads to the cloud, the market outlook remains highly favorable, supported by investments in automation, service quality optimization, and customer experience enhancement.

The large enterprises segment is expected to hold 57.20% of total revenue in 2025, making it the dominant enterprise size category. This dominance is being driven by the ability of large organizations to invest in advanced assurance solutions that manage complex and distributed IT environments.

Their large scale operations and reliance on mission critical applications necessitate higher levels of service reliability, compliance adherence, and performance monitoring. Economies of scale allow these enterprises to deploy sophisticated AI enabled assurance systems and integrate them across multiple service layers.

Additionally, strategic partnerships with cloud providers and managed service vendors have accelerated adoption in this segment. These factors collectively reinforce the leadership position of large enterprises in the cloud service assurance market.

The healthcare and medical vertical is projected to contribute 38.60% of market revenue by 2025, making it the leading vertical. Growth in this segment is being fueled by the digitalization of healthcare infrastructure, rising adoption of electronic health records, and the need to ensure compliance with stringent data privacy regulations.

The critical nature of patient care services demands uninterrupted availability and secure access to cloud based applications and data. Healthcare providers are increasingly deploying assurance solutions to monitor service performance, reduce downtime, and secure sensitive health information.

Moreover, the rapid adoption of telemedicine, remote diagnostics, and connected medical devices has further emphasized the need for robust cloud assurance capabilities. This strong reliance on digital systems has positioned healthcare and medical as the foremost vertical driving market growth.

Companies are offering contextual, autonomous cloud solutions that enhance enterprise IT service outputs via performance management and end-to-end configuration capabilities. Self-learning operational models improve service quality by predicting storage, processing, and usage requirements, and facilitating cloud-to-cloud capacity upgrades.

Such companies are offering cloud computing portfolios with cloud service assurance solutions for native and hybrid cloud infrastructures. Cloud service assurance solutions identify the root causes of performance issues and offer actionable insights to resolve the issues.

Cloud orchestration, cloud governance, and advanced algorithms for cloud service assurance ease configuration management for enterprises, while preventing application and service outages. Cloud service assurance solutions leverage software development and IT operations (DevOps) automation, along with usage analytics, to facilitate resources as per demand.

Automated monitoring and provisioning of the cloud enhances user experience and improves service management.

Digital transformation is reforming enterprise operations that require monitoring, management of storage capacities, and data security. Reforms in such capabilities improve operational productivity for end-users. Strategy consultants, business operations analysts, and cloud computing solutions and service providers are focusing on every aspect of procurement direction end-users might choose while incorporating a cloud computing strategy.

Underlying cloud infrastructure and service have come to a point where uptime is the most expected feature. End-users are finding it difficult to choose cloud solutions and service providers based solely on claims of staffing support, available software packages, or data center space. Companies are now expected to include cloud service assurance techniques that the cloud solution and service providers adhere to.

End-users are focusing on integrating their infrastructure into the cloud in order to enhance archival capabilities and ensure quick data access. End-users move their critical data to cloud-based storage to facilitate quick archival and retrieval of data.

However, such end-users are facing data security concerns while migrating their critical data to cloud infrastructure. Such challenges have an adverse impact on the attractiveness of cloud computing solutions and services, thus restricting the growth of the cloud service assurance market during the forecast period.

The cloud service assurance market in North America was the dominant market in 2020 in terms of market value. Over the forecast period, the cloud service assurance market in the USA is likely to be the most attractive market in terms of sustainable revenue generation.

Increasing demand for cloud service assurance in the U.S. may be owed to constant upgrades implemented into the cloud technology to enhance enterprise digital rights management and data management platforms.

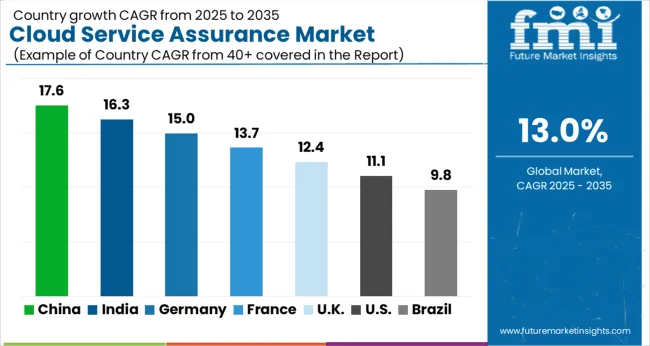

The accelerated adoption of cloud computing tools and services will enable the Southeast Asia Pacific regional market to register the fastest growth rate during the forecast period. The cloud service assurance market in Europe is expected to offer the highest absolute opportunity by the end of the forecast period.

The strong growth rates in Europe and the Southeast Asia Pacific region may be owed to the booming telecommunication and IT industry in economies like Spain, France, India, and ASEAN countries.

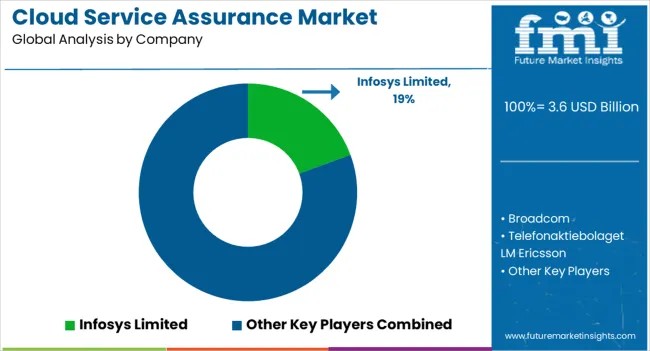

Some of the key competitors in the global cloud service assurance market are Infosys Limited; Broadcom; Telefonaktiebolaget LM Ericsson; Hewlett Packard Enterprise Development LP; NEC Corporation; AMDOCS; Accenture; Comarch SA; Huawei Services (Hong Kong) Co., Limited; Nokia; and IBM, among others.

Following are some key tactics incorporated by the key players competing in the global cloud service assurance market:

The cloud service assurance market report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators, and governing factors, along with market attractiveness as per segment. The market report also maps the qualitative impact of various market factors on market segments and geographies.

The global cloud service assurance market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the cloud service assurance market is projected to reach USD 12.2 billion by 2035.

The cloud service assurance market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in cloud service assurance market are large enterprises and small- and medium-sized enterprises (smes).

In terms of vertical, healthcare and medical segment to command 38.6% share in the cloud service assurance market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Cloud API And Management Platforms And Middleware Market Size and Share Forecast Outlook 2025 to 2035

Cloud Encryption Market Size and Share Forecast Outlook 2025 to 2035

Cloud-RAN (Radio Access Network) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Firewalls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA