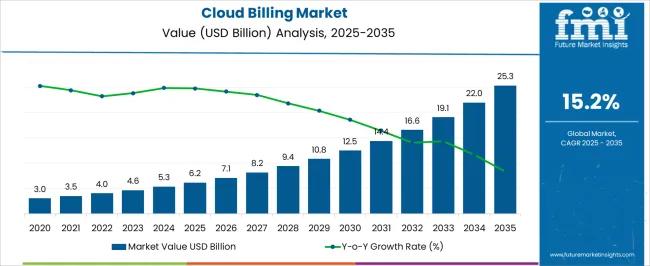

The Cloud Billing Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 25.3 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Billing Market Estimated Value in (2025 E) | USD 6.2 billion |

| Cloud Billing Market Forecast Value in (2035 F) | USD 25.3 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The cloud billing market is expanding rapidly as enterprises increasingly transition toward digital-first operations and adopt scalable cloud infrastructures. The rising adoption of SaaS applications, coupled with the need for cost transparency and usage-based pricing models, is fueling demand for efficient billing solutions.

Organizations are prioritizing automated billing platforms that integrate with existing enterprise systems, enabling seamless revenue management, compliance, and customer engagement. Advancements in analytics and AI are further enhancing billing accuracy and personalization, allowing providers to optimize pricing strategies and reduce revenue leakage.

Regulatory pressures related to data security and financial transparency are also contributing to widespread deployment across industries. The market outlook remains positive, driven by growing enterprise migration to cloud ecosystems, rising demand for subscription models, and the increasing complexity of hybrid and multi-cloud billing requirements.

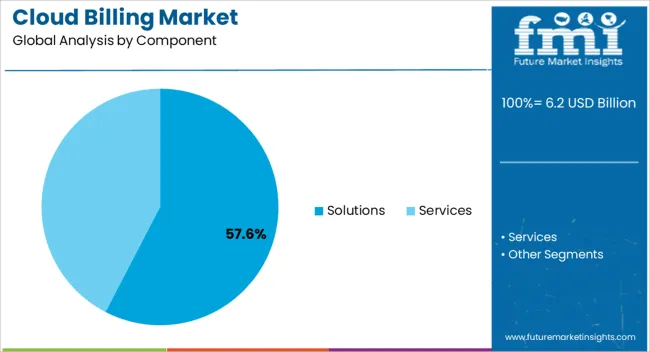

The solutions segment is expected to hold 57.60% of total market revenue by 2025 within the component category, making it the leading contributor. Growth is being driven by rising demand for automated billing platforms that can handle diverse pricing models, including usage-based, tiered, and subscription structures.

Enterprises are prioritizing comprehensive billing solutions that improve revenue recognition, streamline financial operations, and ensure compliance with evolving regulations. Integration with customer relationship management and enterprise resource planning systems has further strengthened the adoption of these solutions.

As organizations scale their digital offerings, the need for robust billing infrastructure has positioned the solutions segment at the forefront of the market.

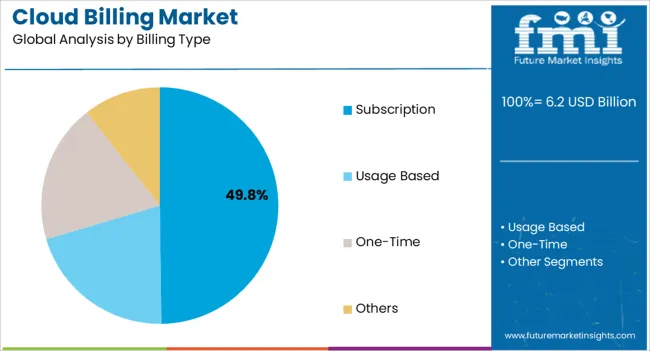

The subscription billing type segment is projected to account for 49.80% of total revenue by 2025, making it the dominant category under billing type. The rise of recurring revenue models across software, media, and digital services has accelerated adoption.

Enterprises value the predictability, flexibility, and customer retention benefits offered by subscription billing frameworks. Enhanced consumer preference for pay-as-you-go services and the ability to scale offerings dynamically have further boosted demand.

Companies are leveraging subscription models to increase lifetime customer value and align pricing with usage patterns. This has reinforced the dominance of subscription billing as a preferred monetization approach across industries.

Global Cloud Billing Market Historical Analysis (2020 to 2025) Vs. Forecast Outlook (2025 to 2035)

The net valuation of the market was estimated at around USD 2,348.4 million in the year 2020. In the following years between 2020 and 2025, it registered a growth rate of 14.6% and concluded at a valuation of USD 4,034.1 million.

Enterprises all over the world are increasing their investments; hence the demand for cloud billing systems is increasing to maintain operations. Governments are introducing programs to assist companies during the epidemic, with a specific focus on small and medium-sized enterprises (SMEs).

According to Zuora's Subscription Impact Report: during this period, four out of five subscription companies continued to grow despite the economic slowdown, and 50% of subscription companies continued to grow at the same rate without suffering any negative effects from the pandemic.

Cloud Billing is Gaining Popularity Globally due to its Cost-saving and Great Business Agility Benefits for Enterprises of all Sizes.

Companies are always looking for ways to reduce their capital expenditures and operational costs. The current competitive environment and global economic crisis have pushed the use of cost-effective business model restructuring strategies. With its cost-cutting and improved business agility benefits for businesses of all sizes, emerging sales of cloud billing systems are gaining a lot of momentum throughout the world.

Organizations' demand for cloud billing is expected to improve their billing operations, improving the entire client experience. Cloud billing solutions save money for businesses since they lower the number of IT resources and infrastructure needed as well as decreasing the risk of vendor lock-in for billing activities. Because they replace human procedures, these billing solutions result in cheap capital and operational costs.

One of the most critical criteria for effective corporate operations is cyber security. Data breaches and cyber-attacks have expanded dramatically in recent years, and many businesses are ignorant of the problem, leaving them exposed to data loss.

Demand for cloud billing is expected to have unsecured data and insufficient cyber security processes in place, putting them vulnerable to data loss. Customer data, product information, and income details are all processed via cloud billing solutions. This sort of data is critical for any firm, and its compromise might have a negative influence on the brand's image, market position, and business strategy. As a result, rising cyber-attacks and data thefts are projected to limit the worldwide sales of cloud billing system development.

BI is the process of gathering, integrating, analyzing, and presenting corporate data using a variety of technologies and methods. It gives organizations information about client behavior and products, as well as assists them in making better decisions. In the current environment, the demand for cloud billing systems for online purchasing is growing, while brick-and-mortar stores strive to obtain detailed information on their operations.

Sales of cloud billing systems are the most crucial component in revenue. By displaying inconsistencies in sales statistics and product consumption, revenue data might provide insights concerning revenue leakages. Billing and revenue data may give benefits such as quick insights into the health of a digital transformation project and the ability to make timely adjustments by examining the impact of system changes on KPIs.

Demand for cloud billing systems may help with things like consumer purchasing behavior analysis, managing complicated financial structures and parameters, and creating and implementing new pricing models, among other things. As a result, businesses are attempting to develop more BI and insights.

Sales of cloud billing system solutions are because of a lot of benefits, but sometimes also fluctuate due to fees and overheads. These systems' licenses are charged per user or number of clients, and many users acquire few licenses than they need to keep expenses down.

The billing system functions best when there is a significant demand for cloud billing systems, IT infrastructure, and consistent connections. Nevertheless, businesses in developing nations frequently have connectivity and IT infrastructure challenges. Because these systems manage critical company data, continuous system maintenance is required to assure high dependability. As a result, the high cost of installation, maintenance, and related operations is projected to be a concern for sales of cloud billing system companies throughout the world.

The market is segmented into by component, billing type, deployment type, service model, organization size, vertical, and region. By component, the market is further sub-segmented into solutions and services. By billing type, there are several sub-segments in which the market is expanding like subscription, usage-based, one-time, and many others.

By deployment type, services provided by increasing demand for cloud billing systems are private cloud and public cloud. The market report is further segmented with more relevant data and values.

With automatic recurring billing for license- and usage-based accounts, cloud billing solutions help capture the value of the cloud services portfolio, In turn, it results in great operational efficiency with a strong CAGR expectation of 15.1%. The fundamental disadvantages of manual billing, such as time consumption and danger, are driving demand for cloud billing solutions, which give full visibility and insights into cloud services.

Cloud billing solutions enable businesses to get to market quickly and generate huge revenues from their product lines.

| Category | By Component |

|---|---|

| Top Segment | Solution |

| Market Share in Percentage | 72.3% |

| Category | By Billing Type |

|---|---|

| Top Segment | Subscription |

| Market Share in Percentage | 33.7% |

Various resources, like software, storage, virtual servers, and hardware, are made available to client organizations through the internet in the public deployment paradigm.

The services provided by the public cloud model are either free or available on a subscription basis. It enables enterprises to satisfy their scalability requirements, offers a pay-per-use pricing strategy, and assures simplicity of setup.

Businesses may use public clouds to improve the efficiency of their operations; hence this segment is expected to have a strong CAGR of 15% by 2035.

Customers that use the cloud lose about 45% of their money, and cloud billing solutions are intended to help them save money. Bills for public cloud service use are generated by cloud billing solutions, which also include daily, weekly, and monthly performance statistics.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| North America | 35.2% |

| Europe | 22.4% |

North America is estimated to account for a significant market share during the projection period. For main industries, including telecoms, IT, BFSI, and telephony, North America is predicted to be the promising market.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| The United States | 23.1% |

| Germany | 8.8% |

| Japan | 5.7% |

| Australia | 2.1% |

The manufacturing sector accounts for 15% of the United States of America’s economic production, according to the Bureau of Economic Analysis (which is run by the US Department of Commerce). Various manufacturing enterprises have ceased operations as a result of the lockout, and consequently, they are employing a few cloud services.

North America is divided into two parts such as the United States and Canada. The United States is predicted to contribute significantly to the growth of the sales of cloud billing systems in North America. Cloud billing solutions and service providers are projected to see significant growth in Canada.

| Regional Markets | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom | 17.2% |

| China | 16.3% |

| India | 19.1% |

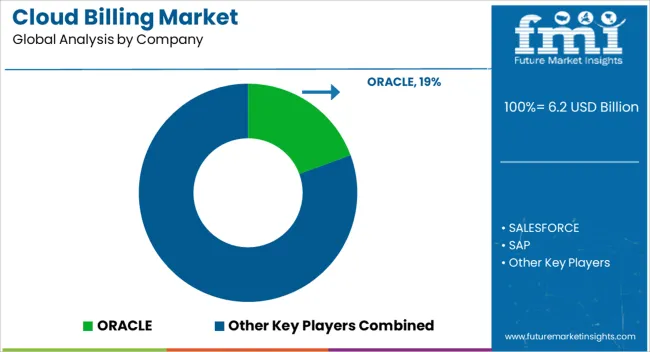

To expand their services in the market, demand for cloud billing among suppliers has used a variety of organic and inorganic development tactics such as:

The research offers a competitive analysis of the cloud billing market's leading competitors, including company profiles, recent advancements, and important market strategies.

Recent Developments in the Cloud Billing Market:

The global cloud billing market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the cloud billing market is projected to reach USD 25.3 billion by 2035.

The cloud billing market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in cloud billing market are solutions and services.

In terms of billing type, subscription segment to command 49.8% share in the cloud billing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Cloud API And Management Platforms And Middleware Market Size and Share Forecast Outlook 2025 to 2035

Cloud Encryption Market Size and Share Forecast Outlook 2025 to 2035

Cloud Service Assurance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA