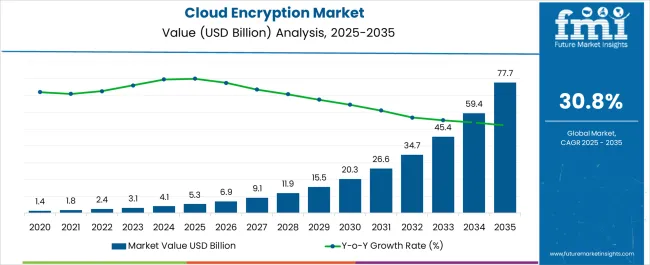

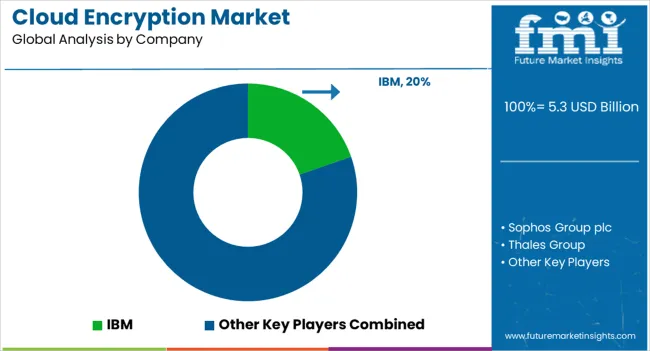

The Cloud Encryption Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 77.7 billion by 2035, registering a compound annual growth rate (CAGR) of 30.8% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Encryption Market Estimated Value in (2025 E) | USD 5.3 billion |

| Cloud Encryption Market Forecast Value in (2035 F) | USD 77.7 billion |

| Forecast CAGR (2025 to 2035) | 30.8% |

The cloud encryption market is gaining momentum as enterprises increasingly prioritize data security, regulatory compliance, and trust in cloud computing infrastructures. Rising incidences of cyberattacks, coupled with the exponential growth of cloud adoption, are driving demand for advanced encryption tools that safeguard sensitive information across multiple deployment models.

Governments and regulatory authorities are tightening data protection frameworks, prompting organizations to integrate encryption as a fundamental layer of their security architecture. Advances in homomorphic encryption, key management systems, and automated encryption-as-a-service offerings are further enhancing adoption.

Cloud providers are increasingly embedding encryption functionalities into their core offerings to strengthen client confidence. The outlook remains promising as industries shift more workloads to the cloud and prioritize zero-trust security frameworks, ensuring cloud encryption remains a critical enabler of safe and compliant digital transformation.

The cloud encryption solution segment is expected to account for 54.20% of total revenue by 2025 within the component category, making it the leading segment. Growth is being driven by heightened demand for scalable and customizable encryption technologies that secure data in transit, at rest, and in use.

Organizations are investing in advanced solutions to meet compliance requirements and address increasing data privacy concerns. The ability of cloud encryption solutions to integrate seamlessly with enterprise applications and provide granular control over data access has accelerated adoption.

As businesses expand their digital infrastructure, encryption solutions continue to play a pivotal role in protecting intellectual property and sensitive customer information, reinforcing their dominance within the component category.

The infrastructure as a service segment is projected to capture 47.90% of market revenue by 2025 within the service model category, positioning it as the most prominent. This dominance is attributed to the widespread shift of enterprises toward scalable and flexible cloud environments.

IaaS providers have integrated strong encryption frameworks to address concerns around multi-tenancy, data breaches, and cross-border compliance challenges. Organizations favor IaaS due to its cost efficiency and customizable infrastructure capabilities, which when paired with encryption, ensure high levels of security without compromising performance.

The convergence of scalability, compliance, and robust encryption practices has strengthened the adoption of IaaS as the preferred service model.

The large enterprises segment is expected to command 62.60% of total market revenue by 2025 within the enterprise size category, establishing it as the leading segment. This leadership is driven by the financial and operational capacity of large organizations to implement enterprise-wide encryption frameworks, including advanced key management systems and multi-cloud security strategies.

Large enterprises face greater risks of cyberattacks and compliance breaches due to the scale of data handled, which has accelerated investment in sophisticated encryption solutions. Their global operations also demand adherence to multiple regulatory frameworks, reinforcing the need for robust and standardized encryption practices.

Consequently, large enterprises continue to dominate due to their proactive security investments, strategic partnerships with cloud providers, and influence in setting industry benchmarks for data protection.

The cloud encryption demand is estimated to grow at a CAGR of 30.9% between 2025 and 2035, in comparison to the CAGR of 27.9% registered between 2020 to 2025.

Earlier, enterprises were involved in management and maintenance of physical, on-premises components which resulted in high installation and maintenance costs and increased the need to purchase infrastructure to store more data.

Adoption of cloud storage has increased as there has been a significant reduction in buying, managing, and maintaining in-house storage infrastructure. Heavy dependency on technology has led to an exponential rise in cyber-attacks, and companies have started investing in encryption technology. Cloud encryption solutions encrypt the connection between cloud and the end point, providing end-to-end encryption and keeping the data private.

The cloud encryption solution segment is estimated to account for a dominant share of 59.6% in 2025. Owing to high adoption of cloud encryption solutions among enterprises, North America is currently dominating the global market.

Enterprises are adopting digital transformation to enhance the efficiency of operations. The pandemic came as a catalyst and prioritized the companies’ digital transformation journey, making cloud adoption a priority for organizations for improving productivity, growth, and sustainability.

Cloud adoption offers service models such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS) that automate the business process, reduce IT overhead costs, help in scaling IT processes and improve overall flexibility of the business process.

The necessity to deploy security measures designed to safeguard cloud-based infrastructure, applications, and data from DDoS attacks, hackers, malwares, and unauthorized user access is propelling the adoption of encryption tools.

By investing in powerful encryption, companies are gaining operational safety and data security that complies with regulations. With growing demand for cloud encryption software and services, the market is expected to expand at a considerable pace over the assessment period.

Cloud storage security is one of the most important issues in cloud computing. Companies using cloud computing for various business processes undergo challenges regarding the protection these systems against cyber-attacks.

These companies use standard encryption methods to secure their processes by encrypting data before storing it to the cloud. The encrypted data needs to be decrypted at every operation by providing private keys to server before executing the required calculations. This affects the confidentiality of data stored in the cloud storage.

Homomorphic encryption is the new security concept capable of performing operations on encrypted data without decrypting the data, which means data processing can be outsourced to a third party without relying on it to keep the data secure. The original data cannot be accessed without the correct decryption key.

The fact that it uses an algebraic system to let users to do a range of computations (or operations) on the encrypted data sets makes it distinct from other types of encryption. It allows to preserve confidentiality of sensible data and to benefit from cloud computing capabilities.

Organizations in the USA are Adopting Encrypted Cloud Backup Services

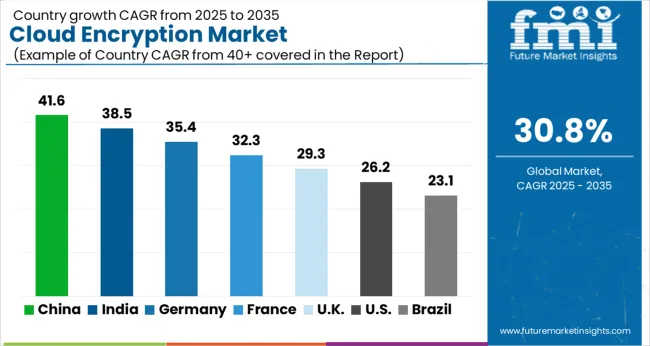

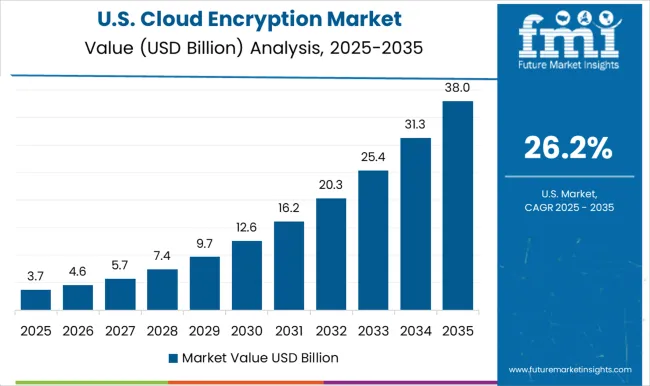

Demand for cloud encryption in the USA is expected to account for nearly 71.5% of the North America market share by 2035. Rising adoption of cloud-based solutions in the USA as they are in the process of shifting from on-premise solutions to cloud-based platforms will fuel growth in the market.

Also, cyber-attacks such as ransomware attacks, DDoS attacks and data breaches are increasing in the USA. Thus, changes and significant investments in cloud security will drive sales of cloud encryption techniques in the country.

Surging Demand for Encrypted Personal Cloud Storage in Indonesia Will Fuel Growth

Sales in Indonesia are estimated to grow at an impressive rate of around 43.2% CAGR between 2025 and 2035. Indonesia is adopting digital technologies to automate and streamline businesses with a clear vision to achieve scalability, security, and agile frameworks in the country.

The pandemic has propelled the demand for hybrid cloud solutions in Indonesia as local enterprises shifted to remote work. With the expansion of Indonesia’s digital footprint, security remains one of the most important considerations among Indonesian businesses. With the growing need for cybersecurity, the demand for cloud encryption software and services are expected to increase in the country.

| Countries | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| Canada | (+)35 |

| France | (+)33 |

| Indonesia | (+)32 |

| Japan | (+)31 |

| China | (+)29 |

The H2’22(O)-H2’22(P) BPS change in Canada was of (+)35 units attributed to the increasing adoption of cloud computing is one of the primary factors driving the growth of the cloud encryption market. As more and more organizations move their data and applications to the cloud, the need for secure data storage and transmission is becoming more important. Where as in France the rise in cyber threats and data breaches, organizations are increasingly concerned about the security of their data. Cloud encryption provides an added layer of protection for sensitive data stored in the cloud leading to the deviation of (+)33 units.

Many industries are subject to strict regulatory compliance requirements regarding the protection of sensitive data. Cloud encryption can help organizations meet these requirements and avoid costly fines for non-compliance resulting in China a BPS change of (+)29 units.

Indonesia encountered a BPS change of (+)32 units for the cloud encryption market as encryption technology has advanced significantly in recent years, making it easier and more cost-effective to implement cloud encryption solutions. This has made it more accessible for smaller organizations to implement cloud encryption.

Japan witnessed a BPS of (+)31 BPS units for the cloud encryption market as more organizations adopt cloud encryption, awareness of the benefits is increasing. Cloud encryption can help organizations protect their sensitive data, reduce the risk of data breaches, and improve overall data security.

Rapid Adoption of Cloud Encryption Services Will Augment Growth

The cloud encryption service segment is expected to create an absolute USD opportunity of USD 77.7 Billion by 2035. Businesses can focus on their core competencies by outsourcing cloud services to a third party, enhancing overall efficiency.

With the emergence of the Pay-As-You-Go (PAYG) model and improved flexibility, small and mid-sized organizations have emerged as the most potential cloud service consumers. Managed cloud encryption services help in laying a strong foundation for security in the cloud that is automated with 24/7 management.

Applications of SaaS Service Models to Remain High

In terms of service model, the SaaS model segment accounted for around 46.3% of the total market share in the global cloud encryption market in 2025. In addition, this segment is likely to grow by 77.7X between 2025 & 2035. SaaS allows enterprises to use cloud-based web applications with a Pay-As-You-Go (PAYG) pricing model.

Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and other emerging technologies are powering SaaS offerings and adoption. Enterprises are benefitting from sophisticated SaaS solutions as they are cost-effective.

Sales of Cloud Encryption in SMEs Will Continue Gaining Momentum

Based on enterprise size, the small and mid-sized enterprises (SMEs) segment is likely to expand by 16.8X during the period. As SMEs have a limited budget for managing business operations and other activities, they are turning to cloud-based solutions to meet their growing business requirements.

As cyber threats are more frequent in SMEs, encryption solutions enhance the security levels of the company’s data by encrypting information and securing it from the reach of hackers. A cloud encryption solution can easily flex and scale to accommodate changing workloads.

Demand for Cloud Encryption in the BFSI Sector Will Gain Traction

In 2025, the BFSI industry dominated the market with the highest share of around 24.2%. The BFSI sector has strong data security requirements as it deals with sensitive and private data of account holders. Banks have enhanced their cybersecurity infrastructure to detect cyber risk with increased investments in cloud encryption.

Cloud data encryption solutions help the BFSI sector by ensuring the security and confidentiality of customer records and information, protection against threats or hazards to the integrity of data, and prevention of unauthorized access. Also, an increase in digital payments is propelling the risk of cyberattacks, which is expected to fuel sales in this segment over the forecast period.

Players in the cloud encryption market are focusing on a variety of strategies, including research and development and investments to support future technologies. In addition to this, players are pursuing inorganic growth strategies such as acquisitions and partnerships with other companies to develop their own cloud encryption to reduce the churn rate.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Germany, the United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa and South Africa |

| Key Segments Covered | Component, Service Model, Enterprise Size, Industry and Region |

| Key Companies Profiled | IBM; Sophos Group plc; Thales Group; Skyhigh Security; Microsoft; Netskope Inc; Lookout; Cisco Systems, Inc; Micro Focus International plc; Atos; Hitachi Solutions, Ltd; Hewlett Packard Enterprise; NortonLifeLock; Trend Micro; TWD Industries; Dell Technologies; WinMagic |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global cloud encryption market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the cloud encryption market is projected to reach USD 77.7 billion by 2035.

The cloud encryption market is expected to grow at a 30.8% CAGR between 2025 and 2035.

The key product types in cloud encryption market are cloud encryption solution, services, _professional service and _managed services.

In terms of service model, infrastructure-as-a-service (iaas) segment to command 47.9% share in the cloud encryption market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA