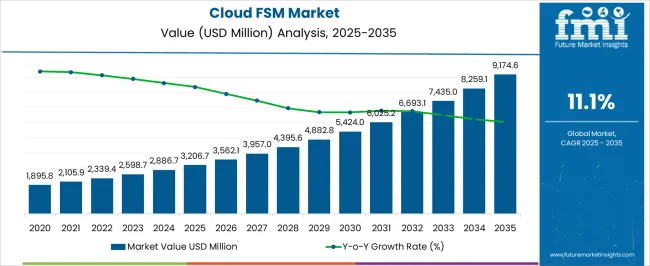

The Cloud Field Service Management (FSM) Market is estimated to be valued at USD 3206.7 million in 2025 and is projected to reach USD 9174.6 million by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Field Service Management (FSM) Market Estimated Value in (2025 E) | USD 3206.7 million |

| Cloud Field Service Management (FSM) Market Forecast Value in (2035 F) | USD 9174.6 million |

| Forecast CAGR (2025 to 2035) | 11.1% |

The cloud field service management market is expanding rapidly due to the growing need for real time workforce optimization, seamless scheduling, and enhanced customer engagement. Organizations across industries are increasingly deploying cloud based FSM solutions to improve operational efficiency and reduce service delays.

The rise of mobile workforce operations, integration of IoT enabled devices, and adoption of AI driven analytics are further accelerating market growth. Cloud deployment ensures scalability, cost efficiency, and faster implementation timelines, which are particularly valuable in highly dynamic service environments.

Regulatory emphasis on data transparency and the increasing demand for predictive maintenance are also contributing to adoption. The outlook remains positive as enterprises continue to shift from manual service processes toward digitally enabled platforms that enhance both productivity and customer satisfaction.

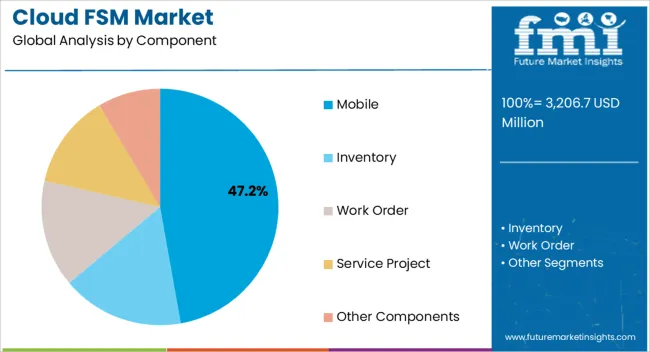

The mobile component segment is expected to hold 47.20% of the total market revenue by 2025 within the component category, positioning it as the leading segment. Growth in this segment is being driven by the rising reliance on smartphones and mobile applications to manage field operations efficiently.

Mobile solutions enable technicians to access work orders, service history, and inventory data in real time, thereby improving first time fix rates and reducing downtime. The flexibility to update job status instantly and capture customer feedback directly has made mobile platforms indispensable for field service organizations.

As enterprises aim to streamline operations and enhance service delivery, mobile functionality remains central, consolidating its leadership in the component category.

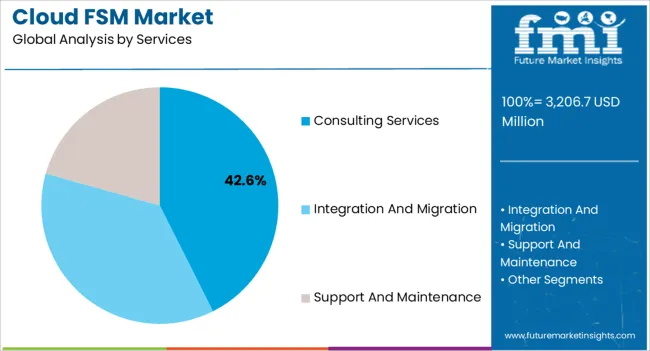

Consulting services are projected to account for 42.60% of market revenue within the services category by 2025, making it the dominant subsegment. This leadership is attributed to the need for expert guidance in integrating cloud FSM platforms with existing enterprise systems, customizing workflows, and optimizing service delivery models.

Organizations often rely on consulting services to achieve smooth digital transformation while ensuring compliance with regional and industry specific standards. The demand for tailored strategies that align with unique business objectives has further boosted the importance of consulting services.

As enterprises seek to maximize ROI from their FSM investments, the consulting services subsegment continues to play a pivotal role in ensuring successful deployment and long term value creation.

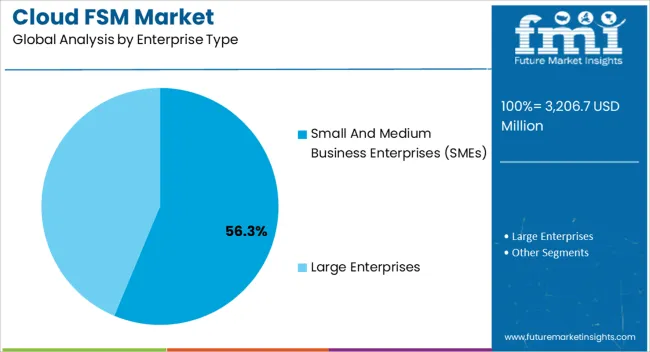

The small and medium business enterprises segment is expected to contribute 56.30% of the total market revenue by 2025 within the enterprise type category, positioning it as the largest segment. This growth is driven by the increasing adoption of cloud based FSM solutions by SMEs seeking cost effective, scalable, and easy to implement platforms.

SMEs benefit significantly from mobile enabled field service tools that streamline scheduling, workforce tracking, and customer interaction without heavy infrastructure investment. The flexibility to scale operations and pay as you go models has further encouraged widespread adoption in this segment.

With rising competition and heightened customer expectations, SMEs are increasingly embracing cloud FSM platforms to remain agile and competitive, reinforcing their dominance in the enterprise type category.

In 2020, the net worth of total cloud field service management solutions adopted globally was a mere USD 1,625.1 million. From 2020 to 2025, a CAGR of 9.5% was registered for the market raising its value to USD 2,340.6 million by its end.

Some advanced cloud field service management applications now have intelligent resource management capabilities that assist businesses in effectively managing their personnel. They also help learn important information about the performance, productivity, and skill gaps of their technicians by utilizing real-time data and analytics.

The increasing use of IoT and cloud-based services boost the growth of the cloud field service management market. Lower costs and greater efficiency are driving the demand for the cloud field service management (FSM) market.

As cloud field service management provides access to customer information from any location, a reduction in operational overheads and fuel expenses, mobile workforce management, increased productivity, and improved customer satisfaction. Large companies use cloud field solutions to monitor and manage the activity and workforce on the field, which drives market growth.

A few of the applications of cloud field service management is consultations, customer support, sales, and maintenance among others. For instance, Oracle Field Service is a cloud-based solution that increase the efficiency of mobile workers by connecting them with customers and offices.

Although the cloud field service management (FSM) market has numerous end-uses, there are numerous obstacles that pose a challenge to market growth.

Lack of awareness of the operational effectiveness and other benefits of technologically advanced systems is another factor projected to have a negative impact on the growth of the cloud field service management (FSM) market over the forecast period.

Maintaining the integration of existing Field Service management with cloud service management solutions is the key challenge most vendors face in the cloud field service management (FSM) market.

| Category | By Component Type |

|---|---|

| Top Segment | Inventory Cloud Field Service Management |

| Market Share in Percentage | 30.1% |

| Category | By Service |

|---|---|

| Top Segment | Cloud Field Service Management Integration and Migration |

| Market Share in Percentage | 49.8% |

Field insights allow for efficient resource planning, training initiatives, and performance assessments, empowering organizations to maximize their personnel through data-driven decisions. By adopting FSM services, businesses can optimize employees' potential, improve the quality of their services, and facilitate scalable expansion. Also, with territory planning improvements, businesses can efficiently map and assign jobs based on client preferences, technician proximity, and geographic coverage.

| Regional Market Comparison | North America |

|---|---|

| Global Market Share in Percentage | 27.6% |

| Regional Market Comparison | Europe |

|---|---|

| Global Market Share in Percentage | 20.1% |

North America was the leading cloud field service management market, and the trend is expected to continue into the forecast period since North America has several cloud field service companies in the world. The region is forecast to have a 32.2% total cloud field service management market share.

North America is expected to be the next dominant region witnessing high adoption rates for the cloud field service management market during the forecast period. With the rapid technological development and an increase in organizations in North America, demand for the cloud field service management market is anticipated to rise in the region.

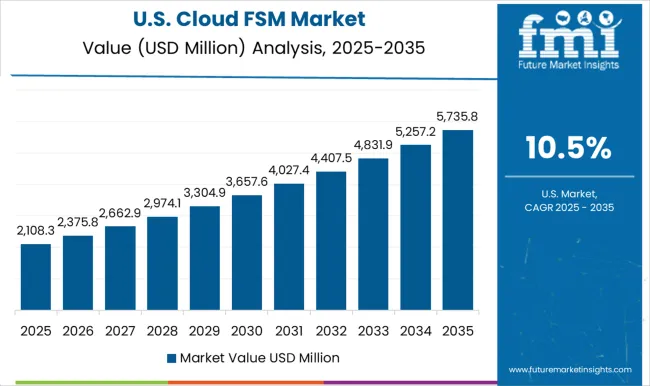

| Regional Market Comparison | United States |

|---|---|

| Global Market Share in Percentage | 19.9% |

| Regional Market Comparison | Germany |

|---|---|

| Global Market Share in Percentage | 7.1% |

| Regional Market Comparison | Japan |

|---|---|

| Global Market Share in Percentage | 2.9% |

| Regional Market Comparison | Australia |

|---|---|

| Global Market Share in Percentage | 2.1% |

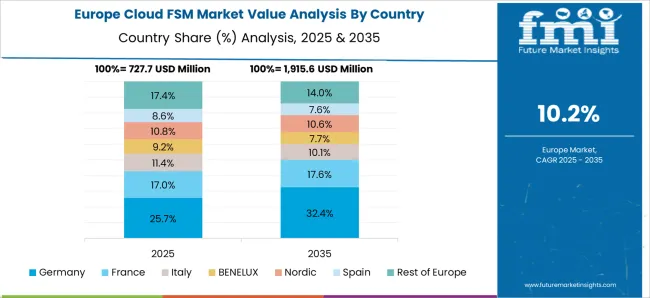

According to FMI, Europe is expected to provide immense growth opportunities for the cloud field service management market due to the expansion of the business sector in the region. The cloud field service management market is expected to witness sustained growth over the forecast period.

The growth of the cloud field service management market is driven by the increasing demand for efficient computing frameworks by small and medium size business enterprises in the region. Europe accounts for 20.7% of revenue in the global cloud field service management market.

| Regional Markets | United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 10.5% |

| Regional Markets | China |

|---|---|

| CAGR (2025 to 2035) | 13.4% |

| Regional Markets | India |

|---|---|

| CAGR (2025 to 2035) | 15.6% |

BiznusSoft Field Service, NextService, Managemart.com, The Kantata Cloud for Professional Services, Binzusoft, and Smart Serv are some startup companies operating in the cloud field service management market.

In June 2025, Kantata, a SaaS platform-based company closed its first quarter, operating as a new company following the successful merger of Mavenlink and Kimble Applications. Through this merger, the firm aim to deliver a strong results driven by the growth of its client roster.

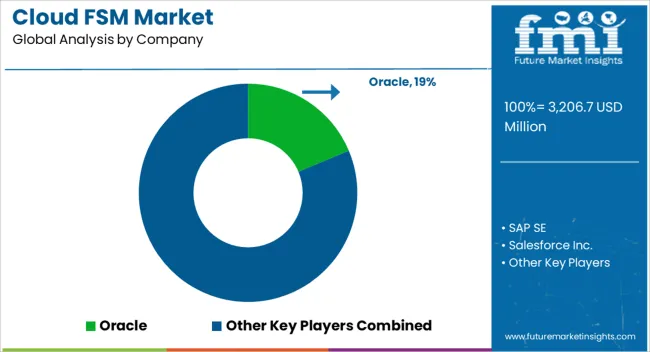

A few of the key participants present in the global cloud field service management market include Salesforce.Com, Inc., SAP SE, Oracle Corporation, IBM Corporation, Servicemax Inc., Microsoft Corporation, Acumatica Inc., and Astea International Inc., among others.

Attributed to the presence of several participants, the market is highly competitive. While global players such as Salesforce.Com, Inc., SAP SE, Oracle Corporation, and IBM Corporation account for considerable market size, several regional-level players are also operating across key growth regions.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 11.1% from 2025 to 2035 |

| Expected Market Value (2025) | USD 3206.7 million |

| Anticipated Forecast Value (2035) | USD 9174.6 million |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million or USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | By Component, By Services, By Enterprise, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; The Middle East and Africa (MEA) |

| Key Countries Profiled | United States, Canada, Mexico, Brazil, Germany, Italy, United Kingdom, Spain, France, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Salesforce.Com, Inc.; SAP SE; Oracle Corporation; IBM Corporation; Servicemax Inc.; Microsoft Corporation; Acumatica Inc.; Astea International Inc. |

| Customization & Pricing | Available Upon Request |

The global cloud field service management (FSM) market is estimated to be valued at USD 3,206.7 million in 2025.

The market size for the cloud field service management (FSM) market is projected to reach USD 9,174.6 million by 2035.

The cloud field service management (FSM) market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in cloud field service management (FSM) market are mobile, inventory, work order, service project and other components.

In terms of services, consulting services segment to command 42.6% share in the cloud field service management (FSM) market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Cloud Encryption Market Size and Share Forecast Outlook 2025 to 2035

Cloud-RAN (Radio Access Network) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Firewalls Market Size and Share Forecast Outlook 2025 to 2035

Cloud Workload Protection Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Drug Discovery Platform Market Size and Share Forecast Outlook 2025 to 2035

Cloud Authentication Market Size and Share Forecast Outlook 2025 to 2035

Cloud OSS BSS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA