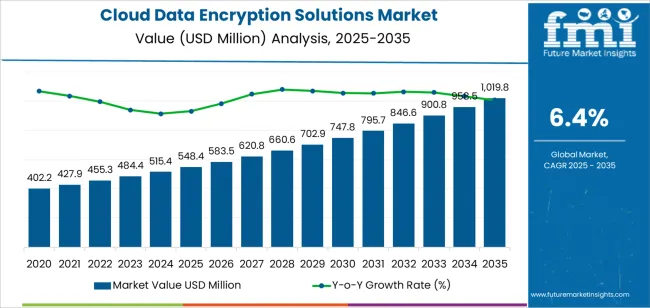

The cloud data encryption solutions market is estimated to grow from USD 548.4 million in 2025 to USD 1,019.8 million by 2035, reflecting a CAGR of 6.4%. As businesses continue to migrate to the cloud for storage and operations, the demand for data security and privacy solutions has become increasingly critical. Cloud data encryption ensures that sensitive information is securely protected from unauthorized access and breaches. This is particularly important in the face of growing data threats and stringent data protection regulations worldwide.

With industries such as banking, healthcare, and e-commerce relying more heavily on cloud infrastructure, the need for secure data encryption solutions is expanding. Additionally, as cloud adoption and data consumption increase, businesses are seeking robust encryption solutions to protect not only data at rest but also data in transit. The market is expected to benefit from advancements in encryption algorithms, the integration of AI and machine learning to enhance security protocols, and a stronger focus on compliance requirements. As organizations prioritize data privacy, the demand for cloud data encryption solutions will continue to grow throughout the forecast period.

The Market Growth Curve for cloud data encryption solutions reflects consistent and steady growth over the forecast period from 2025 to 2035, with a gradual upward trajectory. The market shows a steady acceleration, particularly in the early years, driven by the growing cloud adoption and the increasing importance of data security across industries. The curve in the first phase, from 2025 to 2030, demonstrates a more moderate growth as businesses begin scaling their cloud infrastructures, driving demand for foundational encryption solutions. During this period, the market value will increase from USD 548.4 million to USD 747.8 million, showing an uptick in growth as the need for data protection and regulatory compliance intensifies.

From 2030 to 2035, the curve steers towards a sharper upward incline, reflecting a more pronounced increase in demand for encryption solutions as data privacy concerns and cybersecurity threats continue to rise. The market will grow from USD 747.8 million to USD 1,019.8 million, marking a significant rise driven by increased adoption of cloud services, expansion of remote work environments, and the growing reliance on AI-driven encryption technologies. The curve indicates a steady, yet increasingly accelerated growth towards the end of the forecast period, as enterprises further integrate encryption solutions into their digital transformation strategies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 548.4 million |

| Market Forecast Value (2035) | USD 1,019.8 million |

| Forecast CAGR (2025-2035) | 6.4% |

The cloud data encryption solutions market is being driven by the rapid migration of enterprise workloads to cloud platforms and the rising volume of sensitive data stored and processed there. As firms embrace public, private, and hybrid cloud architectures, encryption solutions have become essential to protecting data at rest and in transit. Strong demand is emerging from sectors such as banking, healthcare, and government, where compliance requirements and data breach risks are especially high. The global cloud encryption market is expected to grow significantly in the coming years.

Another major driver is the proliferation of sophisticated cyber threats and regulatory pressure on data protection. Organizations are adopting encryption capabilities integrated into cloud environments to maintain control over encryption keys, support multi-cloud deployments, and meet frameworks such as GDPR, HIPAA, and other regional standards. Advances in homomorphic encryption, key management services, and automated encryption-as-a-service offerings further support uptake. Nonetheless, complexity in deployment, interoperability challenges, and the rising cost of encryption infrastructure may temper adoption in some segments.

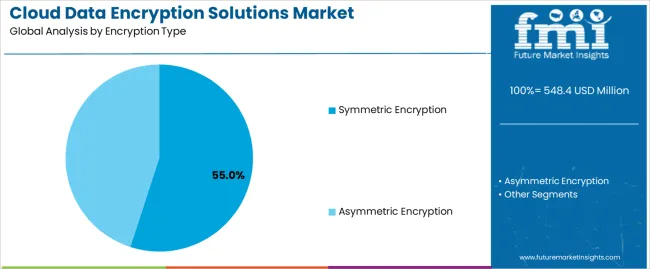

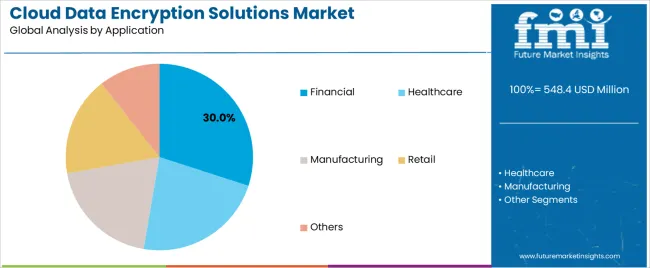

The cloud data encryption solutions market is segmented by encryption type and application. The leading encryption type is symmetric encryption, which holds 55% of the market share, while the dominant application segment is financial, accounting for 30% of the market. These segments play a critical role in the growth of the market, driven by increasing concerns about data security, regulatory compliance, and the need to protect sensitive information in cloud environments.

The symmetric encryption segment leads the cloud data encryption solutions market with a 55% share. Symmetric encryption is widely used due to its efficiency and speed in encrypting large amounts of data. In symmetric encryption, the same key is used for both encryption and decryption, making it a straightforward yet powerful solution for securing data in transit and at rest. This method is especially suitable for high-volume encryption, such as in cloud storage services, where large datasets need to be processed quickly without compromising security.

Symmetric encryption’s dominance is attributed to its balance of performance and security, making it a preferred choice for cloud service providers and businesses looking to protect sensitive data. The increasing adoption of cloud-based services across industries like finance, healthcare, and manufacturing drives the need for efficient encryption solutions, further solidifying symmetric encryption's position as the leading encryption type. As cloud infrastructure expands, symmetric encryption is expected to continue its dominant role in securing data across various sectors.

The financial application segment is the leading application in the cloud data encryption solutions market, capturing 30% of the market share. The financial sector is particularly sensitive to data breaches and financial fraud, making robust data encryption solutions essential for ensuring the confidentiality and integrity of financial transactions and sensitive customer information. Cloud-based banking platforms, online payment systems, and financial data storage require high levels of security to comply with stringent regulatory standards and protect against cyber threats.

The growth of digital banking, mobile payments, and financial technology (fintech) has led to an increased reliance on cloud infrastructure, driving the demand for cloud data encryption solutions in the financial industry. Financial institutions are investing heavily in encryption technologies to safeguard transaction data, prevent unauthorized access, and maintain trust with customers. As regulatory requirements for data protection in finance become more stringent, the financial sector will continue to lead the adoption of cloud data encryption solutions, ensuring that sensitive financial information remains secure.

The cloud data encryption solutions market is evolving rapidly as organisations increasingly migrate workloads to cloud platforms and face more sophisticated cyber threats. Elevated regulatory demands related to data sovereignty and privacy, combined with growing enterprise adoption of multi cloud and hybrid cloud environments, amplify the requirement for robust encryption technologies. Market growth is underpinned by the need to secure data in transit, at rest and in use across various cloud service models. At the same time, complex integration, evolving encryption standards and supply chain constraints shape how vendors and buyers respond.

What Are The Primary Growth Drivers For The Cloud Data Encryption Solutions Market?

Significant drivers for this market include escalating volumes of sensitive data stored and processed in the cloud, which heighten risk exposure and stimulate demand for encryption services. Regulatory frameworks such as GDPR, CCPA and industry specific mandates compel enterprises to embed encryption into their data security strategies. The shift toward cloud native applications, microservices and containerisation further raises the need for flexible and scalable encryption solutions. Advances in encryption technology such as key management services, client side encryption models and homomorphic encryption also broaden adoption by offering enhanced performance, automation and cloud compatibility. Together these factors support strong market momentum.

What Are The Key Restraints In The Cloud Data Encryption Solutions Market?

Despite robust demand, several restraints impede growth. Implementation of encryption across complex cloud infrastructure can be costly in terms of both capital and operational expenditures, which may deter smaller enterprises. Difficulty in integrating encryption solutions with legacy systems, multi cloud platforms and third party services may create interoperability challenges. Skill gaps in managing encryption keys, compliance regimes and cryptographic policies add to organisational burden. Moreover, performance overhead and latency associated with certain encryption methods may discourage adoption in latency sensitive applications. Such barriers may slow uptake in certain segments.

What Are The Emerging Trends In The Cloud Data Encryption Solutions Market?

Key emerging trends include the growth of managed encryption as a service offerings that reduce the burden on internal IT teams and support rapid deployment across cloud platforms. There is a rising focus on client side and end to end encryption models that give organisations stronger control over keys and reduce exposure in shared environments. Developments in quantum resistant encryption and homomorphic encryption are gaining attention as the cloud ecosystem prepares for future proofing against new threats. Additionally, embedding encryption capabilities from the outset of cloud application design (secure by design) and aligning encryption with zero trust architectures are increasingly prevalent among forward looking enterprises.

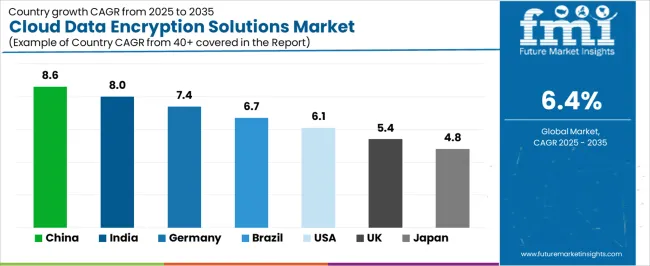

The cloud data encryption solutions market is witnessing strong growth globally, driven by the increasing adoption of cloud computing and the growing concern over data security. As businesses and governments move more of their data to the cloud, the need for robust encryption solutions to protect sensitive information has surged. Countries with strong digital infrastructures, like China and India, are leading the growth due to rapid digital transformation and cloud adoption. Meanwhile, developed markets such as the USA and Germany are experiencing steady growth driven by regulatory pressures and rising cybersecurity concerns. This analysis explores the factors driving the market in key regions and the outlook for cloud data encryption solutions in these countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.6% |

| India | 8% |

| Germany | 7.4% |

| Brazil | 6.7% |

| USA | 6.1% |

| United Kingdom | 5.4% |

| Japan | 4.8% |

China leads the cloud data encryption solutions market with an impressive CAGR of 8.6%. The country's rapid digital transformation, strong investments in cloud computing, and increasing concerns over cybersecurity are the primary drivers of this growth. As China continues to expand its digital economy, cloud adoption across various sectors, including e-commerce, finance, and government, is surging, creating a greater need for cloud data encryption solutions.

The Chinese government's strict data protection regulations and initiatives to ensure the security of sensitive data have further fueled the demand for encryption solutions. With large-scale migration to the cloud and increasing reliance on digital infrastructure, China’s market for cloud data encryption is expected to continue growing at a strong pace, especially as the country focuses on improving its cybersecurity capabilities.

India is experiencing significant growth in the cloud data encryption solutions market, with a CAGR of 8.0%. The country’s expanding digital economy, increasing cloud adoption, and growing concerns over data privacy and security are driving demand for encryption solutions. The rise in data breaches, particularly in sectors like banking, healthcare, and e-commerce, has made data protection a priority, leading businesses to adopt robust cloud encryption solutions.

India's government initiatives, such as the Digital India campaign, have also accelerated the adoption of cloud technologies, which in turn increases the need for cloud security solutions. As India’s cloud infrastructure continues to grow and digital transformation accelerates, the market for cloud data encryption solutions is expected to expand significantly.

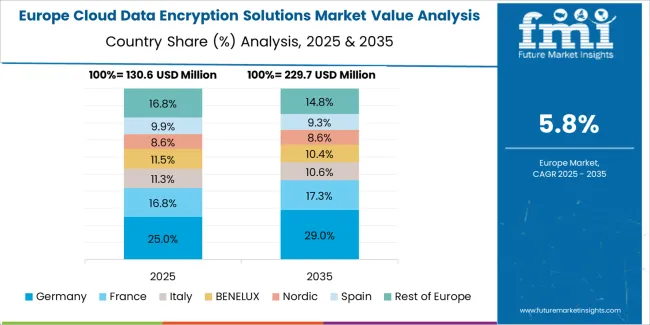

Germany’s cloud data encryption solutions market is projected to grow at a CAGR of 7.4%. As one of Europe’s largest economies, Germany has a strong presence in industries such as automotive, manufacturing, and finance, all of which are increasingly adopting cloud computing. With a heightened focus on data privacy regulations such as GDPR (General Data Protection Regulation), businesses in Germany are investing heavily in cloud data encryption to comply with stringent security standards.

Germany’s robust cybersecurity landscape and regulatory environment are driving the adoption of encryption solutions across sectors. The increasing demand for data protection and privacy across European markets, along with Germany’s commitment to digital transformation, ensures continued growth in the cloud data encryption market.

Brazil’s cloud data encryption solutions market is expected to grow at a CAGR of 6.7%. Brazil’s increasing adoption of cloud technologies, combined with growing concerns over data security, is driving the demand for encryption solutions. The country's rapid digital transformation, especially in sectors such as finance, telecommunications, and e-commerce, has created a need for robust cloud data protection solutions.

Additionally, Brazil’s increasing focus on data privacy regulations and the implementation of standards similar to the European Union’s GDPR has spurred demand for cloud data encryption. As the Brazilian government continues to push for digital innovation and cloud adoption, the market for cloud data encryption solutions is expected to grow steadily.

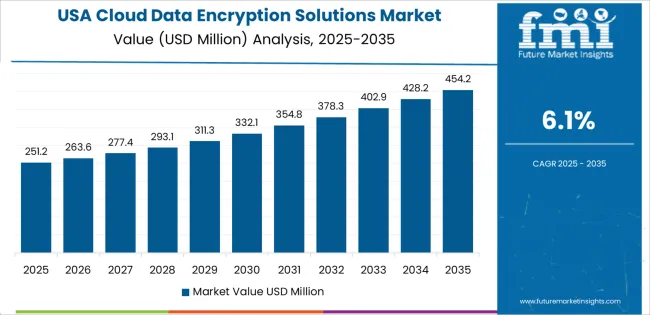

The United States has a projected CAGR of 6.1% for the cloud data encryption solutions market. As one of the largest markets for cloud services, the USA is experiencing strong demand for data encryption solutions driven by the need to secure vast amounts of sensitive data in the cloud. With increasing adoption of cloud computing across industries such as finance, healthcare, and government, the demand for robust encryption solutions is expected to remain strong.

The USA government’s increasing focus on cybersecurity, along with rising concerns over data breaches and cyberattacks, is pushing businesses to invest in cloud encryption technologies. As cloud adoption continues to grow and cybersecurity threats evolve, the USA market for cloud data encryption solutions is expected to maintain steady growth.

The United Kingdom’s cloud data encryption solutions market is projected to grow at a CAGR of 5.4%. The UK’s strong digital infrastructure and increasing reliance on cloud computing across various industries, including finance, healthcare, and government, are driving the demand for data encryption solutions. With rising concerns about data privacy and compliance with regulations like GDPR, businesses in the UK are increasingly adopting cloud encryption technologies.

The UK’s focus on data protection and cybersecurity, along with its status as a key player in the European Union's digital landscape, ensures that the demand for cloud encryption solutions will continue to rise. The growing need for secure cloud services and the adoption of digital transformation initiatives across sectors are expected to support steady market growth.

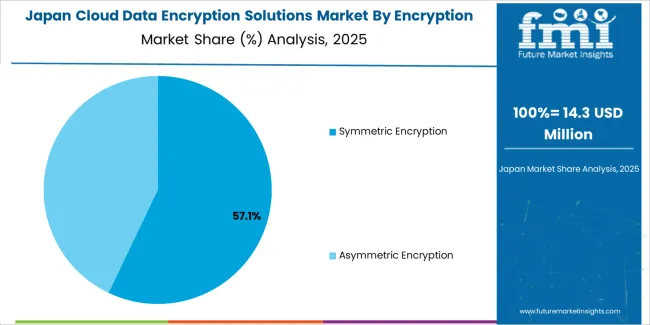

Japan’s cloud data encryption solutions market is expected to grow at a CAGR of 4.8%. Japan’s advanced digital infrastructure, increasing adoption of cloud services, and rising concerns over data security are key factors driving the demand for encryption solutions. As more businesses and government agencies move their operations to the cloud, the need for secure data storage and transmission is becoming critical.

Japan’s strict privacy regulations and the increasing prevalence of cyberattacks have made data encryption a priority for businesses. As the country’s digital transformation continues and the demand for secure cloud services grows, the market for cloud data encryption solutions is expected to expand at a moderate but steady pace. The growing adoption of cloud technologies across industries, combined with Japan’s focus on cybersecurity, will support market growth in the coming years.

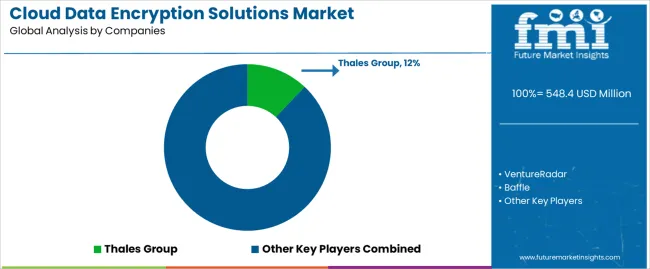

In the cloud data encryption solutions market, companies such as Thales Group (holding roughly 12 % share) compete alongside VentureRadar, Baffle, Cyberhaven, Intel Corporation, Tresorit, Nimbox, Google Cloud, Entrust Corporation, Veritas Technologies LLC, T Systems International GmbH, CrowdStrike Holdings, Inc., PKWARE Inc. and Trellix. Market growth is propelled by rising cyber threats against cloud hosted data, increasing regulatory pressures for data protection, and the expansion of cloud native services globally. For example, the cloud encryption market was valued at around USD 4.07 billion in 2024 and projections suggest a compound annual growth rate of nearly 30 % through 2032.

Strategic approaches across vendors vary. Some firms emphasise innovation in encryption algorithms, key management, and zero knowledge customer key control. Others prioritise partnerships and integrations with major cloud service platforms to embed encryption deeply into hybrid cloud and multi cloud deployments. For instance, firms align with global hyperscalers or security ecosystem partners to extend reach. Additional strategies include offering subscription based encryption services (encryption as a service) to reduce upfront cost and make adoption easier for mid size enterprises. Vendors that manage to combine high performance (low latency encryption/decryption), regulatory compliance (such as data residence, key custody) and broad cloud platform support are positioned to improve market standing.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Encryption Type | Symmetric Encryption, Asymmetric Encryption |

| Application | Financial, Healthcare, Manufacturing, Retail, Others |

| Key Companies Profiled | Thales Group, VentureRadar, Baffle, Cyberhaven, Intel, Tresorit, Nimbox, Google Cloud, Entrust, Veritas, T-Systems, CrowdStrike, PKWARE, Trellix, Fortanix |

| Additional Attributes | The market analysis includes dollar sales by encryption type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape focuses on key manufacturers in the cloud data encryption solutions sector, with innovations in both symmetric and asymmetric encryption technologies. Trends in the growing demand for data encryption in sectors such as financial, healthcare, and retail are explored, along with advancements in cloud security and data protection solutions. |

The global cloud data encryption solutions market is estimated to be valued at USD 548.4 million in 2025.

The market size for the cloud data encryption solutions market is projected to reach USD 1,019.8 million by 2035.

The cloud data encryption solutions market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in cloud data encryption solutions market are symmetric encryption and asymmetric encryption.

In terms of application, financial segment to command 30.0% share in the cloud data encryption solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA