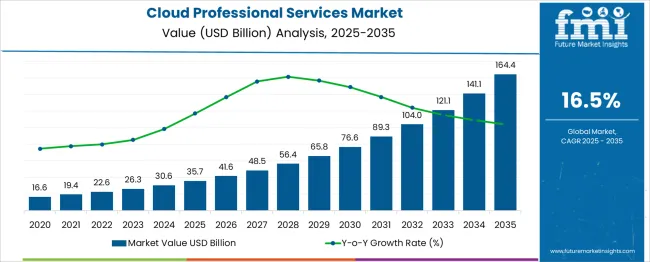

The global cloud professional services market is expected to reach USD 35.7 billion in 2025 and is anticipated to expand to USD 164.4 billion by 2035, representing a CAGR of 16.5% and an absolute increase of USD 128.7 billion over the forecast period. The year-on-year (YoY) growth highlights a strong upward trajectory, beginning with USD 16.6 billion in 2020, USD 19.4 billion in 2021, USD 22.6 billion in 2022, USD 26.3 billion in 2023, USD 30.6 billion in 2024, and reaching USD 35.7 billion in 2025. Post-2025, the market is projected to expand further to USD 41.6 billion in 2026, USD 48.5 billion in 2027, USD 56.4 billion in 2028, USD 65.8 billion in 2029, and USD 76.6 billion in 2030, as enterprise adoption of cloud technologies and outsourcing of cloud implementation, migration, and managed services.

| Item | Value |

|---|---|

| Market Value (2025) | USD 35.7 billion |

| Forecast Value (2035) | USD 164.4 billion |

| Forecast CAGR | 16.5% |

The cloud professional services market is shaped by five interconnected parent markets that collectively define its growth trajectory and adoption across industries. The consulting segment contributes the largest share at 32%, driven by organizations seeking expert guidance to manage multi-cloud and hybrid environments, optimize cost structures, and ensure regulatory compliance. The SaaS (software as a service) segment follows closely with 25%, as enterprises increasingly adopt cloud-based applications to gain scalability, rapid deployment, and automatic updates without significant infrastructure investment. The public cloud segment holds 20%, propelled by its flexibility, cost-efficiency, and ease of provisioning, making it a preferred choice for startups, SMEs, and large enterprises looking for scalable solutions. The large enterprise segment accounts for 15%, leveraging cloud professional services to integrate global operations, implement governance frameworks, and maintain consistent performance across multiple regions. The managed services and support segment adds 8%, enabling organizations to efficiently handle maintenance, monitoring, and optimization of cloud infrastructure.

Market expansion is being supported by the accelerating digital transformation initiatives across industries and the corresponding need for specialized expertise to implement comprehensive cloud strategies. Organizations across sectors require professional guidance to navigate complex cloud architectures while optimizing performance, security, and cost-effectiveness throughout their digital transformation journeys.

The growing complexity of multi-cloud and hybrid cloud environments and increasing demand for cloud-native applications are driving need for advanced professional services that can manage diverse cloud platforms and integration requirements. Enterprises are investing in specialized cloud services to accelerate innovation, improve operational agility, and maintain competitive advantages through strategic cloud adoption and optimization initiatives.

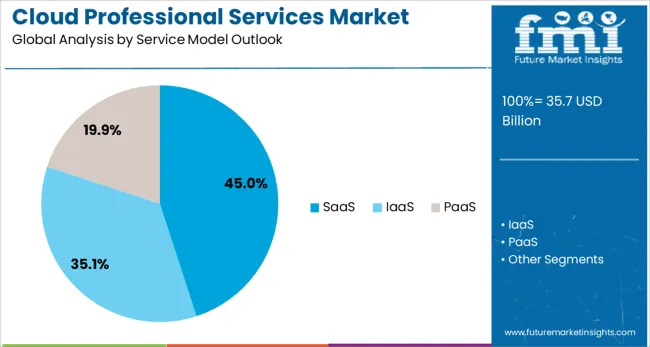

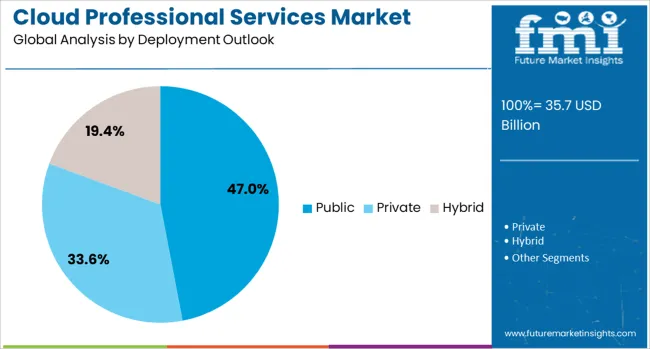

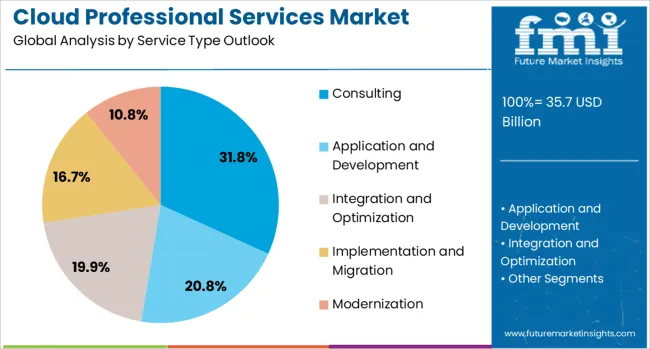

The market is segmented by service type outlook, service model outlook, deployment outlook, enterprise size outlook, end-use outlook, and region. By service type outlook, the market is divided into consulting, application and development, integration and optimization, implementation and migration, and modernization. Based on service model outlook, the market is categorized into SaaS, IaaS, and PaaS. In terms of deployment outlook, the market is segmented into public, private, and hybrid. By enterprise size outlook, the market is classified into large enterprises and SMEs. Based on end-use outlook, the market is divided into BFSI, IT and telecom, government, healthcare, manufacturing, retail and e-commerce, energy and utility, and others. Regionally, the market is divided into China, India, Germany, France, UK, US, and Brazil.

SaaS services are projected to account for 45% of the Cloud Professional Services market in 2025. This leading share is supported by the widespread adoption of software-as-a-service solutions across enterprises seeking scalable, cost-effective applications without infrastructure management requirements. SaaS implementations require specialized professional services for customization, integration, and optimization to align with specific business processes and requirements. The segment benefits from established service frameworks and comprehensive support ecosystems from multiple providers.

Public cloud deployment is expected to represent 47% of cloud professional services demand in 2025. This dominant share reflects the widespread preference for public cloud platforms due to their scalability, cost-effectiveness, and comprehensive service offerings from major cloud providers. Public cloud implementations require specialized expertise for architecture design, security configuration, and performance optimization. The segment benefits from mature public cloud ecosystems and extensive professional service capabilities across multiple cloud platforms.

Consulting services are projected to contribute 32% of the market in 2025, representing strategic advisory services that guide organizations through cloud adoption and optimization decisions. This segment includes cloud strategy development, technology assessment, and digital transformation planning services essential for successful cloud initiatives. Consulting provides foundational expertise that enables informed decision-making regarding cloud architecture, vendor selection, and implementation approaches. The segment benefits from growing demand for strategic guidance in complex cloud transformation projects.

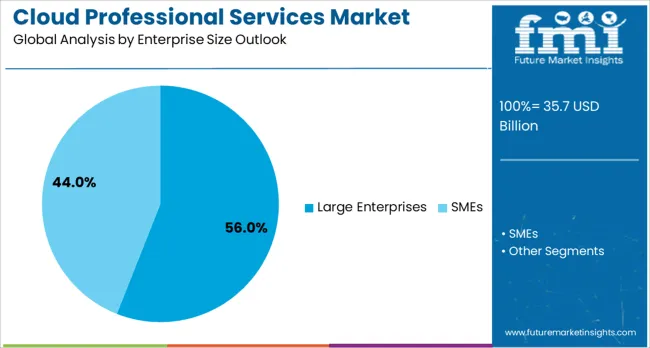

Large enterprises are estimated to hold 56% of the enterprise size market share in 2025. This dominance reflects the substantial cloud professional service requirements of large organizations undertaking comprehensive digital transformation initiatives. Large enterprises require sophisticated cloud architectures, extensive integration capabilities, and specialized expertise to manage complex multi-cloud environments. The segment provides significant opportunities for comprehensive service engagements including strategy, implementation, and ongoing optimization services.

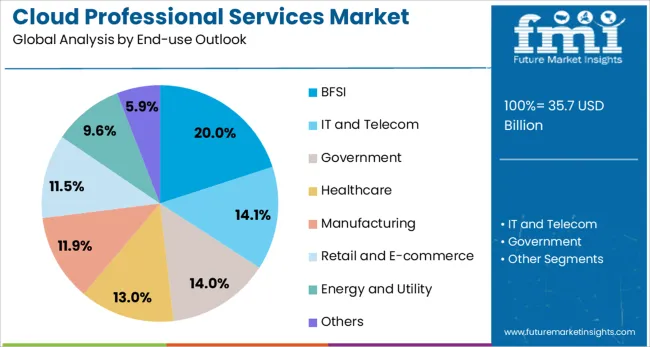

Banking, Financial Services, and Insurance (BFSI) sector is expected to represent 20% of end-use demand in 2025. This significant share reflects the financial industry's increasing adoption of cloud technologies for digital banking, regulatory compliance, and customer experience enhancement. BFSI organizations require specialized cloud services that address stringent security, compliance, and performance requirements. The segment benefits from growing demand for cloud-based financial services and regulatory technology solutions.

The cloud professional services market is expanding due to widespread adoption of cloud-based platforms, which enable enterprises to migrate workloads, applications, and data to public, private, and hybrid clouds. These services enhance operational efficiency, scalability, and collaboration while reducing costs. Service providers deliver consulting, implementation, migration, and managed solutions to ensure seamless integration with existing IT infrastructure. The rise of multi-cloud and hybrid deployment models further drives market growth by preventing vendor lock-in, optimizing performance, and supporting complex IT environments. Providers offer architecture design, data migration, automation, and monitoring solutions, enabling organizations to manage diverse cloud ecosystems efficiently and confidently.

Rising Adoption Of Cloud-Based Solutions The cloud professional services market is witnessing significant growth due to increasing adoption of cloud-based platforms across enterprises. Organizations are migrating workloads, applications, and data to public, private, and hybrid clouds to improve operational efficiency, scalability, and agility. Cloud professional service providers offer consulting, implementation, migration, and managed services to support seamless transition and integration with existing IT infrastructure. Businesses across sectors such as banking, healthcare, retail, and manufacturing are leveraging these services to optimize costs, streamline operations, and enhance collaboration.

Emergence Of Multi-Cloud And Hybrid Deployment Models The adoption of multi-cloud and hybrid deployment models is transforming the cloud professional services market. Organizations increasingly leverage multiple cloud platforms to prevent vendor lock-in, improve performance, and optimize costs. Service providers support architecture design, application integration, data migration, and ongoing management across diverse cloud environments. Hybrid models combining on-premises infrastructure with cloud platforms are also gaining traction to address data sensitivity, latency, and legacy system integration challenges. Providers offer automation, monitoring, and orchestration solutions to manage complex environments effectively.

| Countries | CAGR (2025–2035) |

|---|---|

| China | 22.3% |

| India | 20.6% |

| Germany | 19% |

| France | 17.3% |

| United Kingdom | 15.7% |

| United States | 14% |

| Brazil | 12.4% |

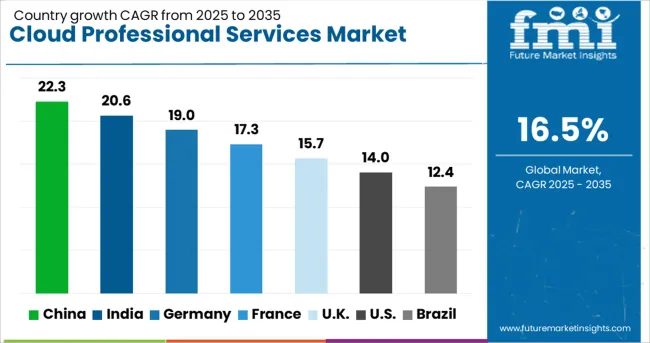

The global cloud professional services market is projected to grow at a CAGR of 17.0% between 2025 and 2035. China leads this expansion with a 22.3% CAGR, driven by rapid digital transformation, adoption of hybrid cloud solutions, and increasing enterprise investments in IT services. India follows at 20.6%, supported by growing IT outsourcing, strong demand for cloud migration, and rising SME adoption of professional services. Germany shows growth at 19.0%, emphasizing enterprise modernization and consulting-led cloud integration. France records 17.3%, fueled by demand for managed cloud solutions and digital service innovation. The UK grows at 15.7%, focusing on hybrid cloud consulting and enterprise-grade cloud deployments. The USA stands at 14.0%, expanding demand for advanced cloud architectures and service orchestration, while Brazil follows at 12.4%, influenced by emerging enterprise cloud adoption and local market digitalization initiatives.

China is projected to witness a CAGR of 22.3% in the cloud professional services market from 2025 to 2035, driven by rapid enterprise adoption of digital technologies and government-backed cloud initiatives. The market growth is supported by AI, IoT, and big data integration across finance, healthcare, and manufacturing sectors. Local and international providers are delivering cloud migration, managed services, and hybrid cloud solutions tailored for enterprise needs. Technology hubs in Beijing, Shanghai, and Shenzhen drive innovation, while cybersecurity and regulatory compliance enhance enterprise confidence. Rising adoption of cloud-native platforms and scalable IT infrastructure accelerates growth, and cross-border partnerships strengthen the ecosystem. Competition among providers focuses on technology differentiation, security, and industry-specific solutions. Large enterprises increasingly implement multi-cloud strategies to optimize costs and agility.

India is expected to grow at a CAGR of 20.6% in the cloud professional services market from 2025 to 2035, fueled by digital transformation across enterprises and expanding IT ecosystems. BFSI, IT, retail, and healthcare sectors are adopting cloud consulting, migration, and managed services to enhance operational efficiency and scalability. Hybrid cloud models and AI-enabled analytics are increasingly integrated into enterprise systems. Cities like Bengaluru, Hyderabad, and Pune are driving adoption through innovation centers and technology hubs. Government initiatives on digital infrastructure and data localization support cloud penetration. SMEs and startups are embracing scalable, cost-efficient cloud solutions. Competition among domestic and international providers emphasizes cybersecurity, service customization, and advanced managed offerings. Workforce training programs enhance readiness for cloud adoption, supporting long-term market growth.

Germany is projected to experience a CAGR of 19% in cloud professional services from 2025 to 2035, supported by enterprise demand for secure, compliant, and high-performance solutions. Automotive, manufacturing, healthcare, and finance sectors increasingly adopt cloud consulting, migration, and managed services for operational efficiency and digital transformation. Regulatory frameworks such as GDPR influence service delivery and provider selection. AI, analytics, and automation integration enhance productivity and decision-making. Workforce development and cloud-native skill programs support enterprise readiness. Providers differentiate through hybrid and multi-cloud solutions, performance optimization, and tailored consulting. Large organizations implement cloud solutions to reduce IT costs and support digital business models. Germany benefits from strong infrastructure and enterprise awareness, maintaining leadership in European cloud professional services.

France is expected to grow at a CAGR of 17.3% in cloud professional services from 2025 to 2035, driven by enterprise digital transformation and hybrid cloud adoption. Finance, retail, and healthcare sectors are adopting cloud consulting, migration, and managed services to reduce costs, improve scalability, and enhance operational agility. GDPR compliance, data security, and local data residency influence provider selection. AI-enabled analytics and tailored industry services enhance enterprise insights and efficiency. SMEs and large enterprises are increasingly adopting cloud services, partnering with local and global providers for secure and scalable solutions. Urban enterprise investment and cloud-native platform adoption accelerate growth. Providers differentiate through advanced managed services, cybersecurity offerings, and performance optimization.

The United Kingdom is projected to grow at a CAGR of 15.7% in cloud professional services from 2025 to 2035, driven by hybrid cloud adoption and digital-first strategies among enterprises. Financial institutions, healthcare organizations, and government agencies are increasingly leveraging cloud consulting, migration, and managed services to improve operational efficiency and scalability. AI-driven analytics, cloud-native platforms, and cybersecurity services enhance enterprise performance. Providers compete on flexible delivery models, industry-specific consulting, and managed services tailored to regulatory and operational needs. Digital skills programs and workforce training support cloud adoption. Telemedicine, fintech, and e-commerce sectors increasingly utilize cloud services, contributing to growth. The UK market combines technological innovation, regulatory compliance, and enterprise readiness, positioning it as a strategic hub for cloud services.

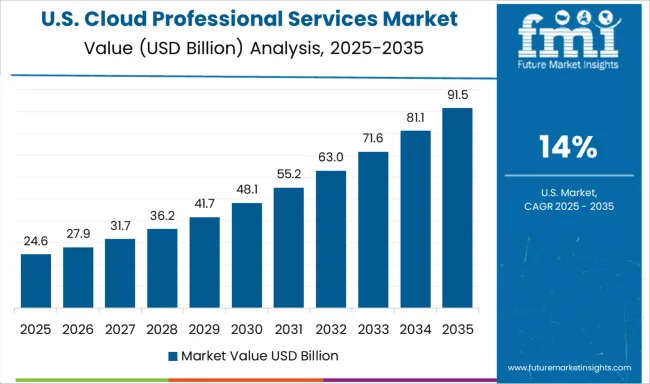

The United States is projected to grow at a CAGR of 14.0% in cloud professional services from 2025 to 2035, supported by enterprise digital transformation and adoption of cloud-native infrastructure. Finance, IT, healthcare, and retail sectors are leveraging cloud consulting, migration, and managed services for scalability, operational efficiency, and cost reduction. AI, machine learning, and analytics integration improve decision-making and real-time insights. Hybrid and cloud-native solutions differentiate providers in a competitive market. Workforce training, cybersecurity, and compliance initiatives strengthen enterprise confidence. SMEs and large organizations adopt cloud solutions to accelerate innovation and business growth. The USA remains a global leader in cloud professional services, driving technological advancements and high-value digital transformation initiatives.

Brazil is projected to grow at a CAGR of 12.4% in cloud professional services from 2025 to 2035, driven by digital transformation initiatives and enterprise modernization. Finance, retail, and manufacturing sectors are increasingly leveraging cloud consulting, migration, and managed services to optimize operations and reduce costs. AI-enabled analytics, automation, and cybersecurity solutions improve operational efficiency and decision-making. Government programs supporting digital infrastructure and IT adoption enhance market penetration. Domestic and international providers compete through customized solutions, flexible pricing, and industry-focused offerings. SMEs and urban enterprises are adopting cloud solutions to scale efficiently and improve IT performance. Hybrid cloud integration and cloud-native platform adoption contribute to long-term growth across the market.

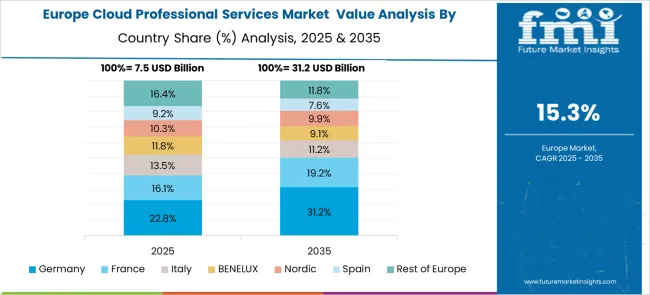

Europe cloud professional services market is led by Germany’s advanced digitization initiatives, strong enterprise cloud adoption, and a focus on hybrid/multi-cloud and regulatory compliance. France stands out for rapid digital transformation across public and private sectors, with organizations seeking scalable, secure cloud solutions and industry-specific expertise. The UK thrives on innovation, with financial and public sectors investing in customized multi-cloud strategies and regulatory alignment. Southern and Eastern European regions are experiencing rapid uptake fueled by modernization and greater digital maturity, while Nordics and BENELUX highlight stability and security-driven investments in cloud consulting and managed services.

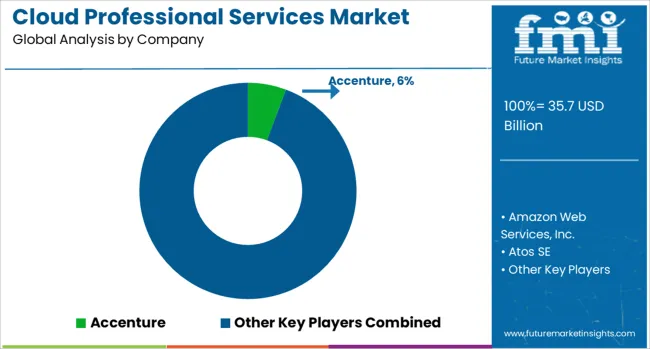

The Cloud Professional Services market is defined by competition among comprehensive technology consulting firms, specialized cloud service providers, and major cloud platform companies. Companies are investing in advanced cloud technologies, specialized industry expertise, comprehensive service capabilities, and strategic partnerships to deliver innovative, reliable, and cost-effective cloud transformation solutions. Technological innovation, industry specialization, and global service delivery capabilities are central to strengthening service portfolios and market presence.

Accenture offers comprehensive cloud consulting and implementation services with a focus on digital transformation, industry expertise, and strategic technology adoption. AWS (Amazon Web Services) provides extensive cloud platform services and professional consulting capabilities for enterprise cloud adoption. Atos SE, operating globally, delivers specialized cloud integration and optimization services with a focus on security and regulatory compliance. Capgemini focuses on comprehensive digital transformation and cloud migration services across multiple industries.

Cognizant provides cloud application development and modernization services with a focus on business process optimization. Fujitsu offers advanced cloud infrastructure and professional services with a focus on enterprise integration capabilities. Google Cloud delivers cloud platform services and specialized professional consulting for cloud-native application development. HCL Technologies Limited provides comprehensive cloud services and digital transformation expertise. IBM Corporation offers enterprise cloud solutions and strategic consulting services for complex business requirements. Infosys Limited delivers cloud implementation and optimization services with a focus on operational efficiency. Microsoft provides comprehensive cloud platform services and professional consulting capabilities. NTT DATA offers global cloud infrastructure and professional services. Oracle delivers enterprise cloud applications and specialized implementation services. SAP SE provides enterprise cloud solutions and business transformation services. TATA Consultancy Services Limited offers comprehensive cloud consulting and implementation expertise across multiple industry sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.7 billion |

| Service Type Outlook | Consulting, Application and Development, Integration and Optimization, Implementation and Migration, Modernization |

| Service Model Outlook | SaaS, IaaS, PaaS |

| Deployment Outlook | Public, Private, Hybrid |

| Enterprise Size Outlook | Large Enterprises, SMEs |

| End-use Outlook | BFSI, IT and Telecom, Government, Healthcare, Manufacturing, Retail and E-commerce, Energy and Utility, Others |

| Regions Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Country Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Key Companies Profiled | Accenture, AWS (Amazon Web Services), Atos SE, Capgemini, Cognizant, Fujitsu, Google Cloud, HCL Technologies Limited, IBM Corporation, Infosys Limited, Microsoft, NTT DATA, Oracle, SAP SE, TATA Consultancy Services Limited |

| Additional Attributes | Dollar sales by service type outlook, service model outlook, deployment outlook, enterprise size outlook, and end-use outlook, regional demand trends across major technology markets, competitive landscape with established consulting firms and specialized cloud service providers, integration with artificial intelligence and machine learning capabilities, innovations in industry-specific cloud solutions and multi-cloud architecture services, and adoption of comprehensive digital transformation programs with integrated cloud migration and optimization services |

The global cloud professional services market is estimated to be valued at USD 35.7 billion in 2025.

The market size for the cloud professional services market is projected to reach USD 164.4 billion by 2035.

The cloud professional services market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in cloud professional services market are consulting, application and development, integration and optimization, implementation and migration and modernization.

In terms of service model outlook, saas segment to command 45.0% share in the cloud professional services market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA