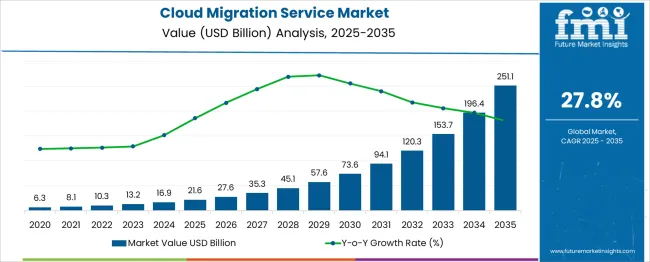

The global cloud migration service market is anticipated to grow from USD 21.6 billion in 2025 to approximately USD 251.1 billion by 2035, recording an absolute increase of USD 29.43 billion over the forecast period. This translates into a total growth of 136.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 27.8% between 2025 and 2035. The overall market size is expected to grow by nearly 2.36X during the same period, supported by the accelerating digital transformation initiatives across enterprises and increasing demand for cloud-native architectures to enhance operational efficiency and scalability.

Between 2025 and 2030, the cloud migration service market is projected to expand from USD 21.6 billion to USD 32.45 billion, resulting in a value increase of USD 10.83 billion, which represents 36.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising enterprise adoption of hybrid cloud strategies, increasing complexity of legacy system modernization, and growing regulatory compliance requirements driving secure migration practices. Service providers are expanding their automated migration tools and developing industry-specific migration frameworks to address diverse enterprise requirements.

From 2030 to 2035, the market is forecast to grow from USD 32.45 billion to USD 51.05 billion, adding another USD 18.60 billion, which constitutes 63.2% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of multi-cloud architectures, integration of artificial intelligence in migration processes, and development of advanced containerization and microservices migration capabilities. The growing emphasis on edge computing integration and real-time data migration will drive demand for more sophisticated migration services and specialized technical expertise.

Between 2020 and 2025, the Cloud Migration Service market experienced significant acceleration, driven by the global pandemic pushing enterprises toward rapid digital transformation and remote work capabilities. The market developed as organizations recognized the need for scalable, secure, and cost-effective cloud infrastructure to support business continuity and operational resilience. Cloud service providers and system integrators expanded their migration capabilities and developed comprehensive assessment tools to facilitate smooth transitions from on-premises to cloud environments.

| Metric | Value |

|---|---|

| Cloud Migration Service Market Value (2025) | USD 21.6 billion |

| Cloud Migration Service Market Forecast Value (2035) | USD 251.1 billion |

| Cloud Migration Service Market Forecast CAGR | 27.8% |

Market expansion is being supported by the increasing enterprise recognition of cloud computing benefits including cost optimization, operational flexibility, and improved disaster recovery capabilities. Organizations across industries are migrating their IT infrastructure, applications, and data to cloud platforms to achieve better resource utilization, enhanced security features, and access to advanced technologies such as machine learning and analytics. The growing volume of data generation and the need for real-time processing capabilities are compelling businesses to adopt cloud-native solutions.

The rising complexity of enterprise IT environments and the shortage of internal cloud expertise are driving demand for professional migration services from certified providers with proven methodologies and experience. Regulatory compliance requirements and data governance standards are establishing structured migration approaches that require specialized tools and trained professionals. The increasing adoption of DevOps practices and continuous integration workflows is creating demand for seamless migration services that maintain operational continuity during transitions.

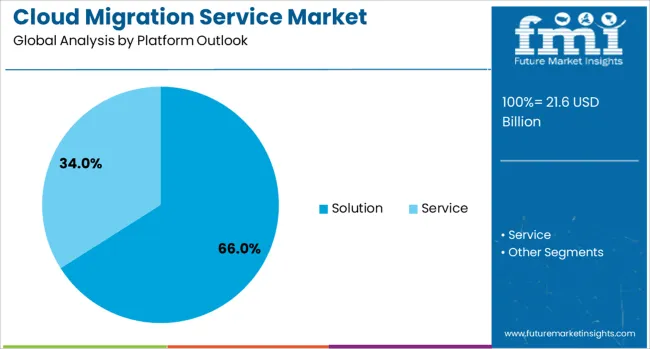

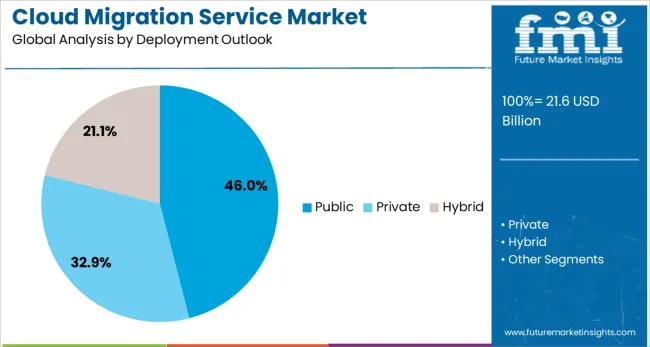

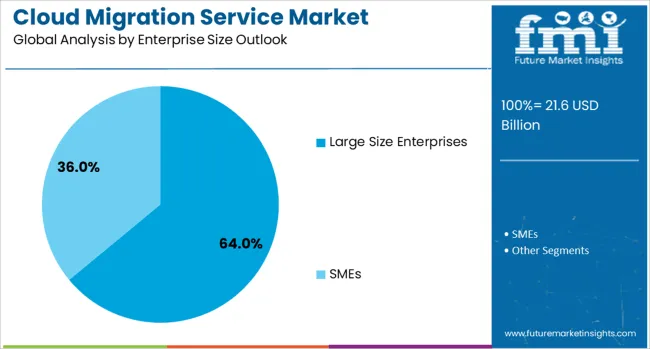

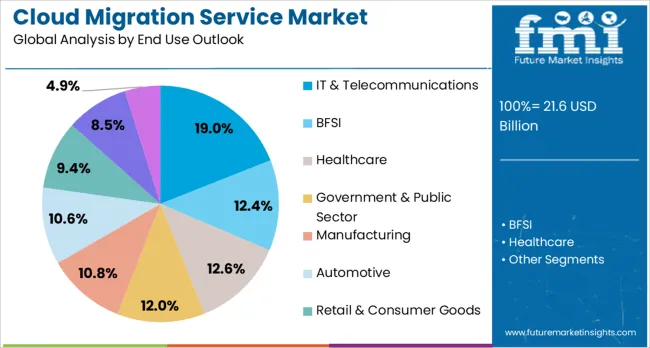

The market is segmented by platform outlook, deployment outlook, enterprise size outlook, end use outlook, and region. By platform outlook, the market is divided into solution and service categories. Solution includes infrastructure migration, platform migration, database migration, application migration, and storage migration. Service encompasses professional services and managed services. Based on deployment outlook, the market is categorized into public, private, and hybrid cloud deployments. In terms of enterprise size outlook, the market is segmented into large size enterprises and SMEs. By end use outlook, the market is classified into IT & telecommunications, BFSI, healthcare, government & public sector, manufacturing, automotive, retail & consumer goods, media & entertainment, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Solution segment is projected to account for 66% of the cloud migration service market in 2025. This leading share is supported by the comprehensive nature of migration solutions that include infrastructure, platform, database, application, and storage migration capabilities. Solution offerings provide end-to-end migration frameworks that enable organizations to transition entire IT ecosystems to cloud environments. The segment benefits from increasing demand for integrated migration tools that reduce complexity and ensure data integrity during transitions.

Public cloud deployment is expected to represent 46% of cloud migration service demand in 2025. This dominant share reflects the widespread adoption of public cloud platforms due to their cost-effectiveness, scalability, and comprehensive service offerings. Organizations are increasingly migrating to public cloud environments to access advanced technologies and reduce infrastructure management overhead. The segment benefits from continuous innovation by major cloud providers and expanding global infrastructure coverage.

Large size enterprises are projected to contribute 64% of the market in 2025, representing organizations with complex IT infrastructures and substantial migration requirements. These enterprises typically require comprehensive migration strategies that address multiple applications, databases, and legacy systems. Large enterprises benefit from dedicated migration teams and customized service delivery models that ensure minimal business disruption. The segment is supported by increasing digital transformation budgets and strategic cloud adoption initiatives.

IT & telecommunications sector is estimated to hold 19% of the market share in 2025. This significant share reflects the technology-forward nature of these industries and their early adoption of cloud technologies. IT and telecommunications companies are migrating infrastructure to improve service delivery, enhance customer experiences, and support next-generation applications. The segment provides leadership in cloud migration practices and serves as a reference for other industries.

The cloud migration service market is advancing rapidly due to accelerating digital transformation initiatives and growing recognition of cloud computing benefits. However, the market faces challenges including data security concerns, application compatibility issues, and the complexity of migrating legacy systems. Regulatory compliance requirements and vendor lock-in considerations continue to influence migration strategies and service provider selection patterns.

The growing deployment of automated migration tools powered by artificial intelligence is enabling faster, more accurate, and less disruptive cloud transitions. AI-driven assessment tools analyze existing infrastructure, identify migration dependencies, and recommend optimal migration strategies. These technologies reduce manual effort, minimize human error, and accelerate migration timelines while ensuring comprehensive documentation and compliance verification.

Service providers are developing specialized migration frameworks tailored to specific industry requirements, regulatory standards, and operational characteristics. Healthcare migration frameworks address HIPAA compliance and patient data protection, while financial services frameworks focus on regulatory compliance and risk management. Industry-specific approaches enable more effective migration planning and ensure adherence to sector-specific requirements and best practices.

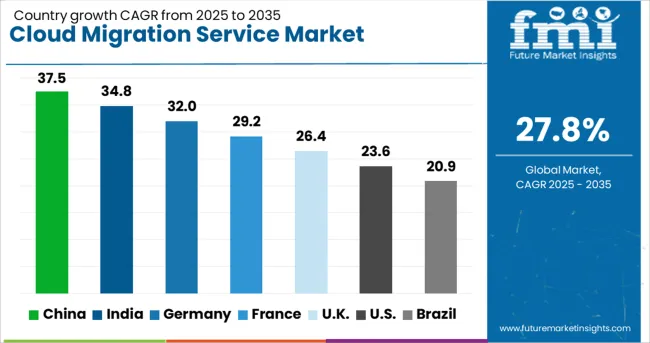

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 37.5% |

| India | 34.8% |

| Germany | 32% |

| France | 29.2% |

| UK | 26.4% |

| USA | 23.6% |

| Brazil | 20.9% |

The cloud migration service market is experiencing exceptional growth globally, with China leading at a remarkable 37.5% CAGR through 2035, driven by massive digital infrastructure investments, government cloud-first policies, and rapid enterprise modernization initiatives. India follows closely at 34.8%, supported by expanding IT services sector, increasing foreign investment in technology, and growing adoption of cloud-native solutions. Germany records strong growth at 32%, emphasizing industrial digitization and advanced manufacturing migration. France advances at 29.2%, focusing on digital sovereignty and public sector modernization. The UK shows solid growth at 26.4%, driven by post-Brexit technology independence initiatives. The USA maintains steady expansion at 23.6%, supported by mature cloud adoption and advanced migration practices. The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from cloud migration services in China is projected to exhibit the highest growth rate with a CAGR of 37.5% through 2035, driven by unprecedented government investment in digital infrastructure development and national cloud computing strategies. The country's commitment to technological self-reliance and digital transformation across industries is creating massive demand for comprehensive migration services. State-owned enterprises and private companies are rapidly modernizing legacy systems to support smart city initiatives, advanced manufacturing, and digital government services. Government policies promoting domestic cloud platforms and data localization requirements are driving structured migration approaches that prioritize security and compliance. The expanding technology sector and growing venture capital investment in cloud-native startups are fostering innovation in migration tools and methodologies that support complex enterprise transitions.

Revenue from cloud migration services in India is expanding at a CAGR of 34.8%, supported by the country's position as a global IT services hub and increasing adoption of cloud technologies across domestic enterprises. The growing sophistication of Indian technology companies and their expanding global client base are driving demand for advanced migration capabilities and specialized expertise. Multinational corporations establishing operations in India require comprehensive migration services to integrate with global cloud infrastructures while meeting local regulatory requirements. Digital India initiatives and government modernization programs are creating opportunities for large-scale public sector migrations that require proven methodologies and security frameworks. The expanding startup ecosystem and increasing venture funding are accelerating cloud-native development practices that require specialized migration services for legacy system integration.

Demand for cloud migration services in Germany is projected to grow at a CAGR of 32%, supported by the country's leadership in industrial automation and commitment to Industry 4.0 implementation. German manufacturing companies are investing heavily in smart factory technologies that require comprehensive migration of operational systems to cloud platforms. The emphasis on data sovereignty and European cloud solutions is driving demand for migration services that ensure compliance with strict data protection requirements. Automotive industry transformation toward electric and autonomous vehicles is creating complex migration requirements for legacy systems integration with modern cloud architectures. The strong focus on engineering excellence and precision manufacturing is establishing German companies as leaders in sophisticated migration practices that maintain operational continuity while enabling digital transformation.

Demand for cloud migration services in France is expanding at a CAGR of 29.2%, driven by national digital sovereignty initiatives and comprehensive public sector modernization programs. The government's commitment to reducing dependence on foreign technology providers is creating demand for migration services that prioritize European cloud platforms and domestic expertise. Large-scale public sector digital transformation projects require specialized migration approaches that address complex regulatory requirements and citizen data protection standards. French multinational corporations are implementing global cloud strategies that require sophisticated migration planning to coordinate transitions across multiple jurisdictions. The growing emphasis on sustainable technology practices is driving migration projects that prioritize energy-efficient cloud architectures and environmental compliance.

Demand for cloud migration services in the UK is projected to grow at a CAGR of 26.4%, supported by post-Brexit technology independence initiatives and continued leadership in financial services innovation. The financial sector's commitment to digital transformation and regulatory technology adoption is driving sophisticated migration projects that address complex compliance requirements. Government initiatives promoting domestic technology capabilities are creating opportunities for migration service providers with proven expertise in regulated industries. The emphasis on cybersecurity and data protection is establishing advanced migration practices that prioritize security frameworks and risk management. Growing investment in fintech and digital banking is driving migration projects that integrate legacy financial systems with modern cloud-native applications.

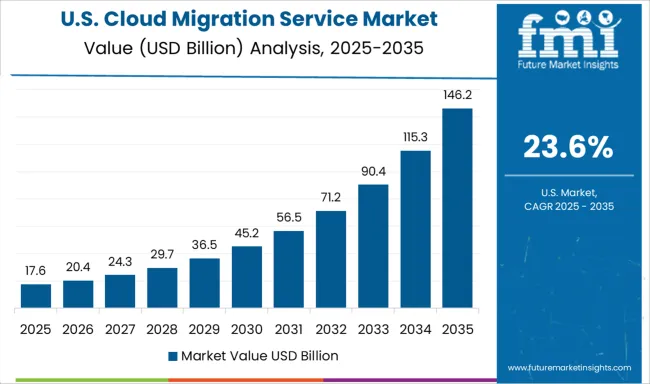

Demand for cloud migration services in the USA is expanding at a CAGR of 23.6%, driven by mature cloud adoption practices and continuous innovation in migration technologies. Large enterprises are implementing multi-cloud strategies that require sophisticated migration planning and ongoing optimization services. The emphasis on cybersecurity and zero-trust architectures is driving migration projects that prioritize security integration and threat protection. Healthcare industry digitization and electronic health record modernization are creating specialized migration requirements that address patient privacy and regulatory compliance. The growing adoption of edge computing and IoT technologies is driving complex migration projects that integrate distributed systems with centralized cloud platforms.

Demand for cloud migration services in Brazil is expanding at a CAGR of 20.9%, driven by comprehensive digital economy initiatives and increasing enterprise recognition of cloud computing benefits for competitive advantage. The government's commitment to digital transformation across public sectors and regulatory modernization is creating substantial demand for secure, compliant migration services that address local data protection requirements. Brazilian multinational corporations in banking, telecommunications, and manufacturing are implementing cloud strategies to improve operational efficiency and support expansion into regional markets. The growing fintech sector and digital banking innovations are driving sophisticated migration projects that integrate legacy financial systems with modern cloud-native platforms. Small and medium enterprises are increasingly adopting cloud technologies to access advanced capabilities previously available only to large corporations, creating demand for cost-effective migration services that minimize business disruption.

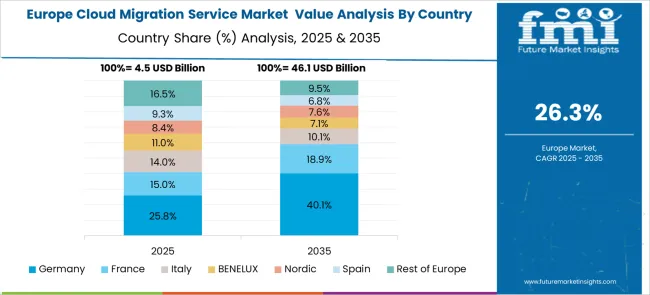

BFSI sector leads the European cloud migration market with 22% share in 2025, driven by digital banking initiatives and regulatory technology requirements. Government & public sector accounts for 18%, supported by national digitization programs and public cloud adoption mandates. Manufacturing represents 16% of demand, reflecting Industry 4.0 implementation and smart factory development. Healthcare sector holds 14% share, driven by electronic health record modernization and telemedicine infrastructure requirements. IT & telecommunications maintains 12% share, focusing on service provider infrastructure modernization and 5G network support capabilities.

The cloud migration service market is characterized by intense competition among global technology giants, specialized cloud service providers, and system integrators. Companies are investing in automated migration tools, artificial intelligence-powered assessment capabilities, industry-specific frameworks, and comprehensive professional services to deliver efficient, secure, and cost-effective migration solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening service portfolios and market presence.

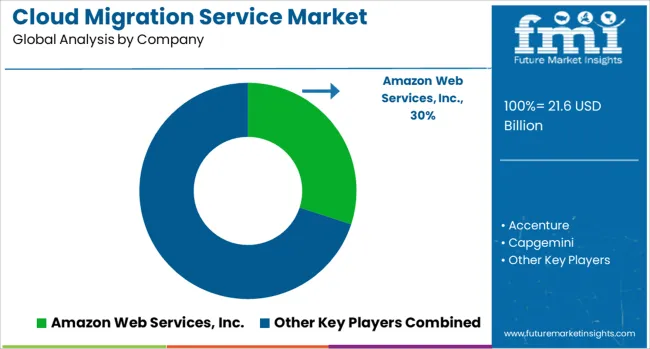

Amazon Web Services Inc., USA-based, offers comprehensive migration services with advanced automation tools, proven methodologies, and extensive partner ecosystem support. Accenture, operating globally, provides end-to-end migration consulting with industry expertise and change management capabilities. Capgemini delivers specialized migration services with focus on European markets and regulatory compliance. Google LLC emphasizes AI-powered migration tools and data analytics capabilities. Hewlett Packard Enterprise Development LP offers hybrid cloud migration services with edge computing integration.

IBM Corporation provides comprehensive migration services with focus on enterprise applications and mainframe modernization. Kyndryl Inc. delivers infrastructure migration services with extensive managed services capabilities. Microsoft offers integrated migration tools through Azure platform with comprehensive professional services support. NTT DATA Americas Inc. provides global migration services with focus on telecommunications and financial services. SAP SE offers enterprise application migration with specialized ERP modernization expertise. TATA Consultancy Services Limited delivers cost-effective migration services with global delivery capabilities. Veritis Group Inc., VMware Inc., Vodafone Limited, and Wipro offer specialized migration expertise across various industry segments and geographic markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 21.6 billion |

| Platform Outlook | Solution (Infrastructure Migration, Platform Migration, Database Migration, Application Migration, Storage Migration), Service (Professional Services, Managed Services) |

| Deployment Outlook | Public, Private, Hybrid |

| Enterprise Size Outlook | Large Size Enterprises, SMEs |

| End Use Outlook | IT & Telecommunications, BFSI, Healthcare, Government & Public Sector, Manufacturing, Automotive, Retail & Consumer Goods, Media & Entertainment, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Amazon Web Services Inc., Accenture, Capgemini, Google LLC, Hewlett Packard Enterprise Development LP, IBM Corporation, Kyndryl Inc., Microsoft, NTT DATA Americas Inc., SAP SE, TATA Consultancy Services Limited, Veritis Group Inc., VMware Inc., Vodafone Limited, Wipro |

| Additional Attributes | Dollar sales by platform outlook, deployment model, and enterprise size, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established cloud providers and specialized system integrators, customer preferences for public versus hybrid deployment models, integration with DevOps practices and continuous integration workflows, innovations in automated migration tools and AI-powered assessment capabilities, and adoption of industry-specific migration frameworks with embedded compliance and security requirements for enhanced service reliability. |

The global cloud migration service market is estimated to be valued at USD 21.6 billion in 2025.

The market size for the cloud migration service market is projected to reach USD 251.1 billion by 2035.

The cloud migration service market is expected to grow at a 27.8% CAGR between 2025 and 2035.

The key product types in cloud migration service market are solution, infrastructure migration, platform migration, database migration, application migration, storage migration, service, professional services and managed services.

In terms of deployment outlook, public segment to command 46.0% share in the cloud migration service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Cloud API And Management Platforms And Middleware Market Size and Share Forecast Outlook 2025 to 2035

Cloud Encryption Market Size and Share Forecast Outlook 2025 to 2035

Cloud-RAN (Radio Access Network) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Firewalls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA