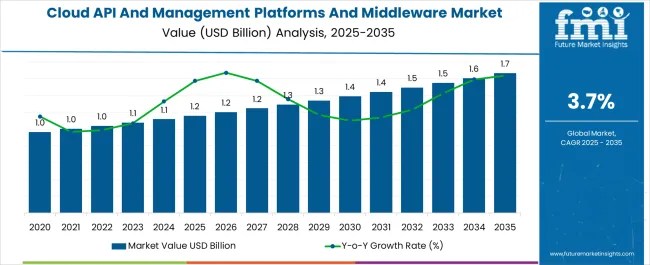

The Cloud API And Management Platforms And Middleware Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Cloud API And Management Platforms And Middleware Market Estimated Value in (2025 E) | USD 1.2 billion |

| Cloud API And Management Platforms And Middleware Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The cloud API and management platforms and middleware market is gaining momentum as enterprises increasingly migrate workloads to cloud-based environments and prioritize application integration. Industry publications and corporate disclosures have emphasized that APIs serve as the backbone of digital transformation strategies, enabling enterprises to connect diverse applications, enhance interoperability, and streamline service delivery.

Middleware platforms are being deployed to support hybrid and multi-cloud environments, allowing businesses to achieve scalability, flexibility, and cost efficiency. Investor briefings and analyst presentations have noted substantial investments in API security, monitoring, and lifecycle management, reflecting the need for robust governance frameworks in enterprise cloud adoption.

Additionally, growing demand for automation, microservices, and container orchestration has accelerated the use of management platforms that simplify complex cloud infrastructures. With ongoing expansion of digital ecosystems across industries, market growth is expected to be driven by large-scale enterprise adoption and the BFSI sector, which is heavily investing in API-driven innovation to improve customer engagement and operational efficiency.

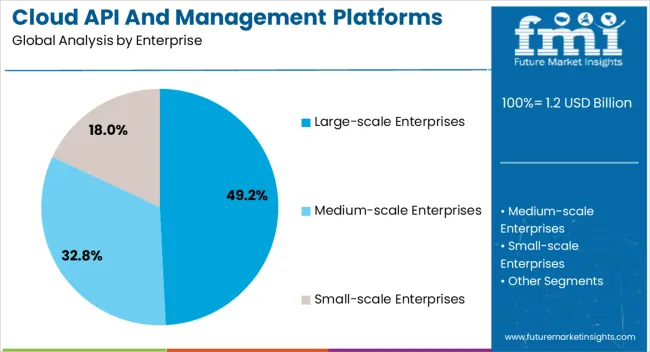

The Large-scale Enterprises segment is projected to account for 49.2% of the cloud API and management platforms and middleware market revenue in 2025, sustaining its leadership due to higher IT budgets and complex infrastructure requirements. Growth in this segment has been driven by the rapid adoption of hybrid and multi-cloud environments, where large enterprises rely on APIs and middleware platforms to unify diverse applications and ensure seamless operations.

Company annual reports have emphasized that large-scale enterprises are allocating significant resources to API security, monitoring, and compliance tools, given their heightened regulatory obligations. Furthermore, the scale of operations in these organizations necessitates middleware solutions capable of handling high transaction volumes and ensuring real-time data integration.

Strategic partnerships with cloud service providers have also strengthened enterprise adoption of advanced API management frameworks. As digital transformation remains a top priority, large-scale enterprises are expected to continue leading market demand for cloud API and management solutions.

The BFSI segment is projected to contribute 24.3% of the cloud API and management platforms and middleware market revenue in 2025, establishing itself as the leading industry vertical. This growth has been driven by the sector’s accelerated digitization initiatives, particularly in areas such as open banking, digital payments, and customer identity management.

Regulatory frameworks mandating secure data exchange have further reinforced the need for robust API management solutions in BFSI. Financial institutions have increasingly deployed middleware platforms to enable real-time transaction processing, fraud detection, and seamless integration of third-party fintech services.

Investor communications from major banks and fintech firms have highlighted increased spending on API-driven platforms to enhance customer experience, improve agility, and strengthen security. Additionally, the rising adoption of cloud-native technologies in BFSI has fueled demand for API lifecycle management and monitoring solutions that ensure compliance and data protection. With financial services undergoing rapid digital transformation, the BFSI segment is expected to remain at the forefront of industry adoption.

Cloud API and management platforms and the middleware market are fast picking up due to the wide adoption of mobile and cloud applications for back-end services and the wide adoption of microservices-based architectures by enterprises.

These applications comprise small, independent processes that communicate via API, creating demand for cloud API and management platforms and middleware.

The challenge faced by the market is that many large-scale enterprises have applications with point-to-point integration, which is not well documented, thereby making integrating these applications with modern apps. Hence, if there is a restriction on the company's IT budget (spending), the companies tend to side-line services comprising cloud APIs.

Apart from this, the cloud API management solutions also offer additional services such as security, analytics, and platform add-ons such as bot prevention by stopping bad bot traffic, internet of thing APIs by building apps that connect to multiple devices, and monetization by offering flexible rate plans.

Cloud API and management platforms and middleware market share are currently dominated by the North American region and account for over 50% in 2025 on account of the increase in the use of cloud-based services. Due to the presence of advanced IT infrastructure, several significant players are operating in this area, shaping the market trends.

Additionally, during the projected period, North American nations' high IT expenditure capacity significantly contributes to the expansion of cloud API and management platforms and the middleware market in this region.

By 2025, Europe is anticipated to get hold of cloud API and management platforms and a middleware market share of 25.5% in 2025 as healthcare and government sectors are shifting towards the usage of cloud-based services.

The European Union (EU) Information and Communication Technology (ICT) sector contributed USD 1 billion to the market for cloud API and management platforms and middleware in 2020, indicating that it is experiencing a period of sustained expansion.

Business models vary throughout time, sometimes due to market shifts and other times due to technological advancements, which leads to the birth of exciting new trends.

Such cloud API and management platforms and middleware market trends are brought about by numerous start-ups that are emerging in the market lately.

Upbound is a cloud-native computing firm offering businesses a multi-cloud platform to combine various cloud environments into a single cloud environment.

Users can use multiple private and public cloud environments to run, scale, and optimize their services. It offers a platform for automation that enables businesses to create scalable cloud services. Cost optimization, capacity overflow, failover, policy enforcement, and portability between clouds are among the features.

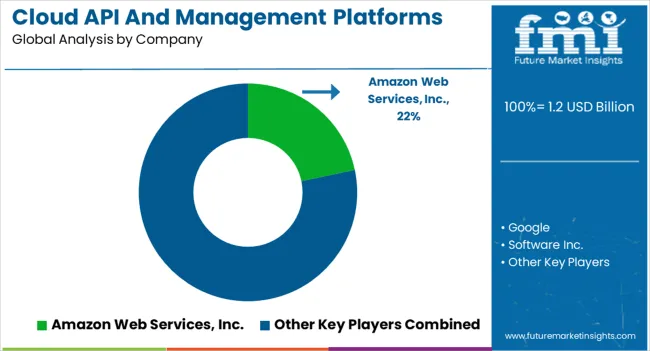

Top companies in the cloud API and management platforms and middleware market are involved in various organic and inorganic strategies, including mergers and acquisitions, partnerships, and collaborations, thereby augmenting the market share.

A few of the recent developments in cloud API and management platforms and the middleware market are listed below:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Enterprises, Industry, Region |

| Regions Covered | North America; Latin America; Asia Pacific; The Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Google; Software Inc.; IBM; Microsoft; TIBCO; Amazon Web Services, Inc.; Broadcom; Dell Inc.; Oracle; Salesforce; Axway; SAP SE; VMware, Inc.; Red Hat, Inc.; TWILIO INC.; UpCloud Ltd.; RACKSPACE US, INC.; Mulesoft, LLC; Informatica; Celigo, Inc.; Boomi, Inc. |

The global cloud API and management platforms and middleware market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the cloud API and management platforms and middleware market is projected to reach USD 1.7 billion by 2035.

The cloud API and management platforms and middleware market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in cloud API and management platforms and middleware market are large-scale enterprises, medium-scale enterprises and small-scale enterprises.

In terms of industry, bfsi segment to command 24.3% share in the cloud API and management platforms and middleware market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA