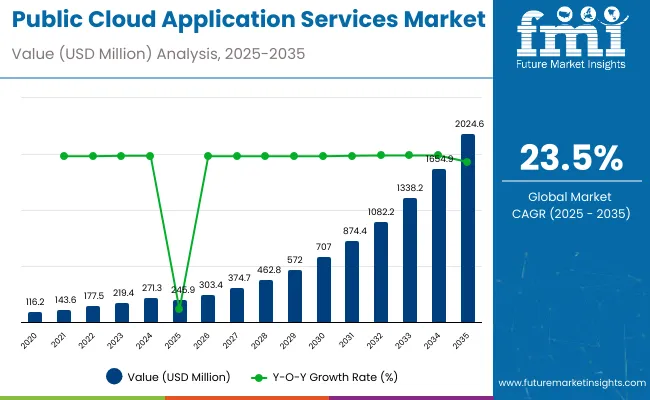

The public cloud application services market is estimated to be valued at USD 245.9 million in 2025 and is projected to reach USD 2,024.6 million by 2035, registering a compound annual growth rate (CAGR) of 23.5%.

The market is expected to add an absolute dollar opportunity of USD 1,778.7 million during this period. This reflects an 8.23 times growth at a compound annual growth rate of 23.5%.The market evolution is expected to be shaped by enterprises strong preference for scalable infrastructure, accelerated digital transformation, and the rapid adoption of evolving cloud technologies across diverse industries.

By 2030, the market is likely to reach USD 779.9 million, accounting for USD 534.0 million in incremental valueover the first half of the decade.The remaining USD 1,244.7 million is expected during the second half, suggesting an accelerated growth pattern driven by large-scale workload migration, advanced cloud-native innovations, and increasing reliance on flexible, on-demand cloud services worldwide.

Companies such as Amazon Web Services (AWS) are advancing their competitive positions through continuous innovation in cloud infrastructure and service offerings. Investments in scalable public cloud platforms and enhanced cloud-native application services support rapid enterprise adoption. Innovation-led service models, including AI integration and advanced analytics, are driving expansion across industry verticals such as government, BFSI, and healthcare. Market performance will remain anchored in data security, regulatory compliance, and service reliability. These factors are critical for sustaining enterprise trust and supporting large-scale cloud deployments.

| Metric | Value |

|---|---|

| Estimated Market Value (2025E) | USD 245.9 million |

| Forecast Market Value (2035F) | USD 2,024.6 million |

| Forecast CAGR (2025 to 2035) | 23.5% |

The market holds a strong position within the broader enterprise IT and cloud services landscape, reflecting its scalability, flexibility, and cost-efficiency. Within enterprise IT spending, public cloud represents about 45% of total cloud-related expenditures, underscoring its critical role in digital transformation strategies. In vertical adoption, it accounts for nearly 30% in BFSI, supported by its application in secure transactions, compliance, and customer-facing platforms.

The healthcare sector contributes 18%, leveraging public cloud for patient data management, telehealth, and advanced analytics. In the retail sector, its share is around 22%, driven by e-commerce growth, omnichannel experiences, and real-time insights. Across digital ecosystems, public cloud enables over 50% of AI, business intelligence, and CRM workloads, highlighting its central role in next-gen enterprise innovation.

The market is experiencing transformational growth driven by increasing cloud adoption, enhanced service offerings, and expanding geographic penetration. Innovations in cloud-native technologies, containerization, and AI integration have increased platform efficiency and service personalization.

Cloud providers are continuously evolving security, compliance, and data governance practices to meet stringent enterprise requirements. Strategic partnerships and industry collaborations are accelerating enterprise migration to public cloud platforms. Regulatory adherence and service-level agreements support the trusted positioning of public cloud services among large-scale businesses and government agencies.

The market is expanding rapidly due to the increasing demand for scalable, flexible, and cost-effective infrastructure solutions across industries. Organizations are prioritizing digital transformation, agility, and operational efficiency. Public cloud platforms support these priorities through on-demand resources and seamless integration. Growing adoption of cloud-native applications, big data analytics, artificial intelligence, and Internet of Things (IoT) technologies further fuels market growth.

Additionally, enterprises are shifting from traditional on-premises systems to cloud services to reduce capital expenditure and improve scalability. Innovations in cloud security, compliance, and hybrid cloud deployment options enhance trust and broaden adoption. As businesses continue to embrace digital innovation and require flexible IT infrastructure, the public cloud application services market is poised for sustained, robust growth.

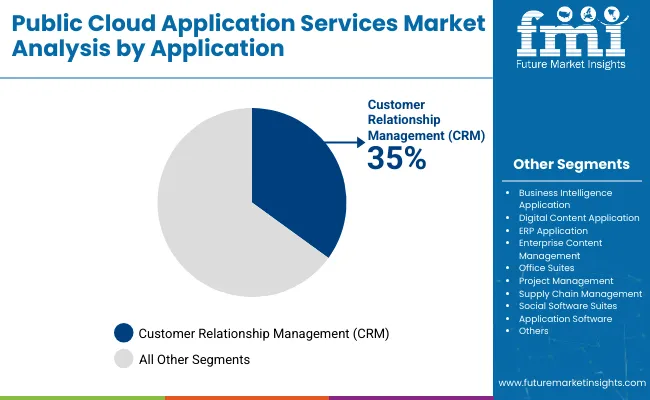

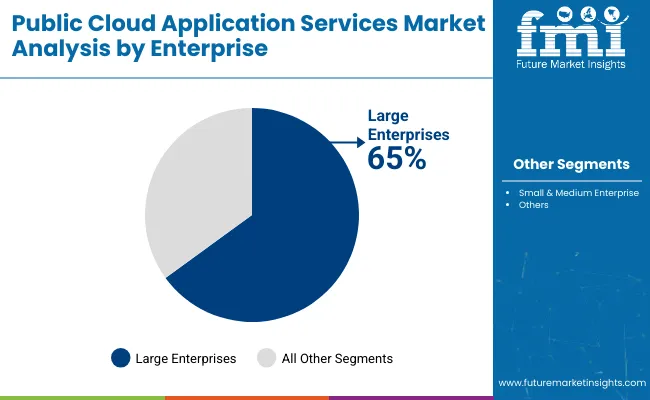

The market is segmented by application, enterprise, vertical, and region. By application, the market is categorized into business intelligence application, customer relationship management, digital content application, ERP application, enterprise content management, office suites, project management, supply chain management, social software suites, and application software. Based on enterprise size, the market is bifurcated into large enterprise and small & medium enterprise.

In terms of vertical, the market is segmented into BFSI, healthcare, telecommunication, media & entertainment, energy & utilities, retail/wholesale, manufacturing, transportation, and others (education, government, and hospitality). Regionally, the market spans across North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East and Africa (MEA).

The most lucrative segment in the market is customer relationship management (CRM), with a market share of 35% in 2025. This segment commands a substantial share due to the critical role CRM software plays in managing customer interactions, sales, and marketing functions. Its importance continues to grow as businesses seek to improve customer engagement, personalize marketing campaigns, and streamline sales processes. The shift to cloud-based CRM solutions enables organizations to access real-time data, collaborate across remote teams, and leverage AI-driven insights for better decision-making.

Large enterprises contribute the majority of revenue, but adoption among small and medium enterprises (SMEs) is rapidly increasing as cloud CRM platforms become more affordable and scalable. Major vendors like Salesforce, Microsoft, and Oracle lead the market, continuously innovating with new features and integrations. Overall, CRM is expected to remain the largest and most strategically important segment in the public cloud application services landscape for the foreseeable future.

Large enterprises are the leading segment in the market, accounting for 65% of the market share in 2025. These organizations have substantial IT budgets and complex infrastructure needs, driving extensive adoption of public cloud services. Large enterprises leverage cloud platforms to support digital transformation initiatives, enhance scalability, improve security, and enable global operations.

Their focus on mission-critical applications and the need for advanced collaboration tools further boosts cloud service adoption. Additionally, large enterprises benefit from the ability to customize and integrate cloud solutions with existing systems, making them the primary drivers of revenue and innovation in the public cloud application services market. With increasing digitalization across industries, their investment in cloud technologies is expected to accelerate, reinforcing their dominant position in the market.

From 2025 to 2035, enterprises across industries are accelerating their digital transformation initiatives to enhance agility, scalability, and operational efficiency. This shift drives widespread adoption of public cloud application services as organizations seek flexible, on-demand infrastructure and software solutions that support remote work, data analytics, and AI integration.

Cloud Security and Compliance Innovations Enhance Market Expansion Opportunities

In recent years, advancements in cloud security protocols, compliance frameworks, and data privacy measures have significantly boosted enterprise confidence in public cloud adoption. Integration of AI-powered threat detection and automated compliance tools ensures robust protection of sensitive information, addressing regulatory requirements across sectors.

This ongoing innovation enables organizations to safely migrate critical workloads and scale cloud deployments, thereby expanding the public cloud application services market. Providers offering secure, compliant, and integrated cloud solutions are well-positioned to capture growing demand and solidify market leadership.

Emergence of Industry-Specific Cloud Solutions Drives Market Diversification

The increasing demand for tailored cloud application services is driving the development of industry-specific solutions across sectors such as healthcare, finance, retail, and manufacturing. These specialized cloud offerings address unique compliance, data management, and operational needs, enabling businesses to optimize workflows and enhance customer experiences. As organizations prioritize digital innovation in competitive markets, the growth of customized public cloud applications creates new opportunities for service providers to differentiate themselves.

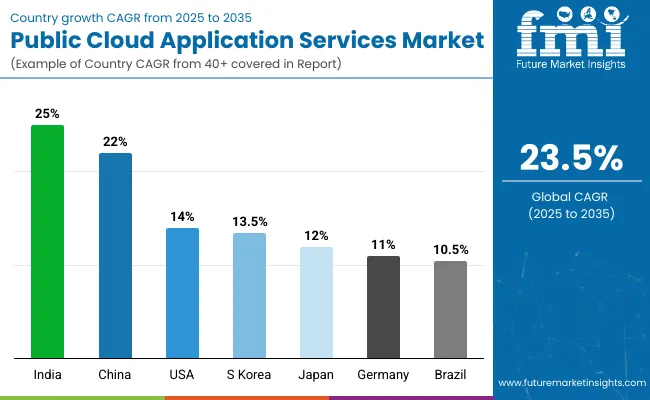

| Countries | CAGR (%) |

|---|---|

| India | 25 |

| China | 22 |

| United States | 14 |

| South Korea | 13.5 |

| Japan | 12 |

| Germany | 11 |

| Brazil | 10.5 |

The market shows significant variation in growth rates across leading countries, reflecting differences in digital maturity and cloud adoption. India leads with the highest CAGR of 25%, driven by rapid digital transformation, strong government support, and a vibrant startup ecosystem. China follows closely with a 22% CAGR, fueled by large-scale enterprise cloud migrations and government-backed smart city initiatives. The United States, with a mature cloud infrastructure, shows a solid CAGR of 14%, supported by advanced cloud innovations and widespread enterprise adoption.

South Korea and Japan display steady growth with CAGRs of 13.5% and 12%, respectively, leveraging 5G rollout and AI integration in cloud services. Germany’s market grows at around 11%, propelled by industry 4.0 and data privacy compliance, while Brazil’s growth stands at 10.5%, supported by rapid digital adoption and expanding cloud infrastructure. Overall, emerging economies like India and China outpace developed markets, driven by aggressive cloud deployment and digitalization initiatives.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

The public cloud application services market in India is projected to expand at a CAGR of 25% from 2025 to 2035, driven by increased cloud adoption among SMEs and large enterprises seeking scalable and cost-efficient IT solutions. The expansion of data center infrastructure and supportive government policies promoting cloud-first strategies are key catalysts.

Additionally, the thriving startup ecosystem in India is leveraging cloud technologies extensively for innovation and growth. The demand for AI, machine learning, and analytics within cloud platforms is rising sharply, boosting the overall market expansion. Major global and local cloud providers are investing heavily in the country to capitalize on this growth opportunity.

Revenue from public cloud application services in China is expected to grow at a CAGR of 22% from 2025 to 2035, fueled by its vast digital economy and intense focus on technological innovation. Enterprises across industries are rapidly migrating traditional IT workloads to the cloud to improve agility and operational efficiency. Government-backed smart city projects and digital infrastructure initiatives accelerate cloud adoption further.

The integration of AI, IoT, and big data into cloud platforms supports new applications and services, driving demand. Additionally, hybrid and multi-cloud models are gaining traction in China, with local cloud providers like Alibaba Cloud and Tencent Cloud competing strongly alongside global players.

Sales of public cloud application services in the USA are expected to expand at a CAGR of 14% from 2025 to 2035, driven by the country’s mature cloud infrastructure and technological leadership. Large enterprises lead adoption due to their extensive IT needs and focus on digital innovation, leveraging cloud platforms for mission-critical applications.

The growth is bolstered by advancements in SaaS, PaaS, and IaaS offerings. Increasing emphasis on cloud security, compliance, and hybrid cloud deployment supports further uptake. SMBs are also rapidly adopting cloud solutions as affordability and flexibility improve. Leading providers such as AWS, Microsoft Azure, and Google Cloud innovate continuously to maintain competitive advantage in this dynamic market.

Revenue from public cloud application services in South Korea is projected to grow at a CAGR of 13.5% from 2025 to 2035, driven by its advanced industrial base and government initiatives promoting cloud adoption. The nation’s aggressive rollout of 5G technology enhances cloud capabilities, leading to increased demand for cloud-hosted IoT and real-time analytics solutions.

Manufacturing, finance, and telecommunications sectors are the leading adopters, leveraging cloud platforms for operational efficiency and innovation. The government’s cloud-first policies encourage digital transformation across public and private domains. Collaboration between cloud providers and local enterprises fosters customized cloud solutions, supporting sustained market growth.

Demand for public cloud application services in Japan is expected to grow at a CAGR of 12% from 2025 to 2035, propelled by steady digital modernization in enterprise and government sectors. There is significant investment in AI and machine learning applications integrated into cloud platforms to enhance business intelligence and automation.

Hybridity in cloud deployment, combining on-premises and public cloud resources, remains popular due to stringent security and compliance requirements. Japan’s enterprises also prioritize improving cloud security frameworks to safeguard sensitive data. Partnerships between global cloud providers and Japanese companies enable advanced, localized cloud solutions, supporting market expansion and innovation in this mature but evolving landscape.

Revenue from public cloud application services in Germany is projected to expand at a CAGR of 11% from 2025 to 2035, driven by the country’s strong industrial base and commitment to digital innovation. Enterprises across manufacturing, automotive, and finance sectors are accelerating cloud adoption to enhance operational efficiency and support Industry 4.0 initiatives.

The government’s emphasis on data privacy and compliance shapes cloud strategies, with hybrid cloud solutions gaining prevalence. German organizations increasingly adopt cloud services to improve scalability, reduce costs, and foster agile business models. Additionally, investments in cloud security and IT infrastructure enable companies to transition confidently to cloud environments, contributing to steady market growth.

Demand for public cloud application services in Brazil is expected to grow at a CAGR of 10.5% from 2025 to 2035, supported by rapid digital adoption and expansion of internet connectivity. Brazilian enterprises, especially in retail, financial services, and government sectors, are migrating to the cloud to improve service delivery and increase operational flexibility. The country benefits from growing investments in data center infrastructure and cloud ecosystems, alongside supportive regulatory reforms aimed at boosting digital economy growth. Cloud adoption in Brazil is driven by demand for scalable, cost-efficient IT resources, enabling organizations to innovate and adapt swiftly to evolving market demands.

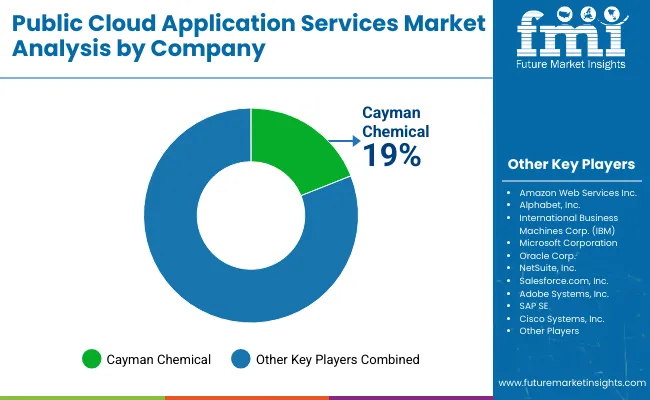

The market is moderately consolidated, featuring leading cloud providers with varying strengths in infrastructure, service offerings, and industry specialization. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominate the market, leveraging their vast global infrastructure, advanced AI and analytics capabilities, and broad enterprise service portfolios. Their competitive edge lies in innovation, scalability, regulatory compliance, and integrated security features.

Other key players like IBM Cloud and Oracle Cloud differentiate through hybrid cloud solutions, catering to industries with strict data residency and compliance needs. Regional providers such as Alibaba Cloud and Tencent Cloud focus on local market expertise, tailoring services to domestic enterprise demands and regulatory environments, especially in Asia-Pacific regions. Smaller specialized cloud vendors carve niches by providing customized cloud applications and vertical-specific solutions.

Entry barriers in this market are significant due to the high capital investment in data centers, technology innovation, and stringent security and compliance standards. Market competitiveness increasingly hinges on global network reach, service reliability, customer support, and continuous technological advancements to meet evolving enterprise requirements.

Key Developments in the Public Cloud Application Services Market

In April 2025, TCS launched three India-focused offerings, TCS SovereignSecure™ Cloud, TCS DigiBOLT™, and TCS Cyber Defense Suite, at its “Accelerating India” event in New Delhi, reinforcing its commitment to secure, sovereign, and sustainable digital growth for India’s AI-driven future.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 245.9 million |

| Application | Business Intelligence Application, Customer Relationship Management, Digital Content Application, ERP Application, Enterprise Content Management, Office Suites, Project Management, Supply Chain Management, Social Software Suites, and Application Software |

| Enterprise | Large Enterprises and Small & Medium Enterprises (SMEs) |

| Vertical | BFSI, Healthcare, Telecommunication, Media & Entertainment, Energy & Utilities, Retail/Wholesale, Manufacturing, Transportation, and Others (including Education, Government, and Hospitality) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia and 40+ countries |

| Key Companies Profiled | Amazon Web Services Inc., Alphabet, Inc., International Business Machines Corp. (IBM), Microsoft Corporation, Oracle Corp., NetSuite, Inc., Salesforce.com, Inc., Adobe Systems, Inc., SAP SE, and Cisco Systems, Inc. |

| Additional Attributes | Dollar sales by application and enterprise , regional demand trends, competitive landscape, enterprise adoption drivers for cloud migration, integration with compliance and security frameworks, innovations in AI/ML, serverless and edge technologies, standardization of performance and service quality across diverse industry verticals |

The public cloud application services market is predicted to grow at 23.5% CAGR through 2032.

North America public cloud application services market holds the highest revenue potential.

The public cloud application services market is expected to surpass USD 1,073 Billion by 2032.

The public cloud application services market size is anticipated to be over USD 130 Billion in 2022.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Public Cloud Application Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Public Announcement System Market Size and Share Forecast Outlook 2025 to 2035

Public Safety & Security Market Size and Share Forecast Outlook 2025 to 2035

Public Key Infrastructure (PKI) Market Analysis - Growth & Forecast through 2034

Public Safety In-Building Wireless DAS System Market

Public Cloud Storage Market

AI for Public Security and Safety Market

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

IoT for Public Safety Market

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

AI In Government And Public Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA