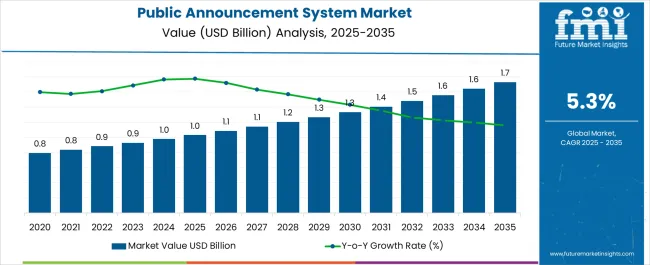

The Public Announcement System Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Public Announcement System Market Estimated Value in (2025 E) | USD 1.0 billion |

| Public Announcement System Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The public announcement system market is experiencing strong growth. Increasing demand for effective communication in commercial, industrial, and institutional environments is driving market expansion. Current dynamics are influenced by technological advancements, rising adoption of wireless and IP-based systems, and growing emphasis on safety and emergency management protocols.

The future outlook is supported by urbanization, infrastructure development, and industrial automation, which are boosting demand for scalable and reliable announcement solutions. Regulatory focus on workplace safety and compliance standards is further encouraging the deployment of advanced systems.

Growth rationale is anchored on the need for seamless communication across large facilities, integration with modern security and building management systems, and continuous innovation in system efficiency and coverage Strategic investments in product development and distribution networks are expected to enhance market penetration, providing sustainable growth opportunities and broader adoption across industrial and commercial end-use sectors.

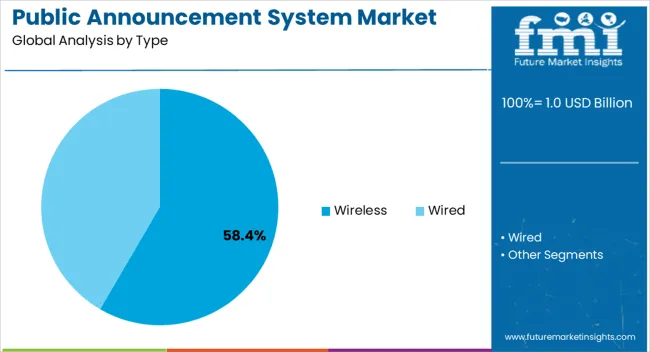

The wireless segment, holding 58.40% of the type category, has maintained its leading position due to its flexibility, ease of installation, and adaptability in diverse environments. Adoption has been driven by the need for scalable and rapidly deployable systems that reduce cabling costs and installation time.

System reliability, supported by improved connectivity and battery management, has reinforced preference among facility managers and integrators. Technological enhancements, including integration with cloud management and mobile platforms, have expanded functionality and operational efficiency.

Wireless systems are increasingly preferred in retrofit and expansion projects where traditional wired infrastructure is impractical Continuous innovation and reliability improvements are expected to sustain the segment’s market share and support long-term adoption in commercial, institutional, and industrial environments.

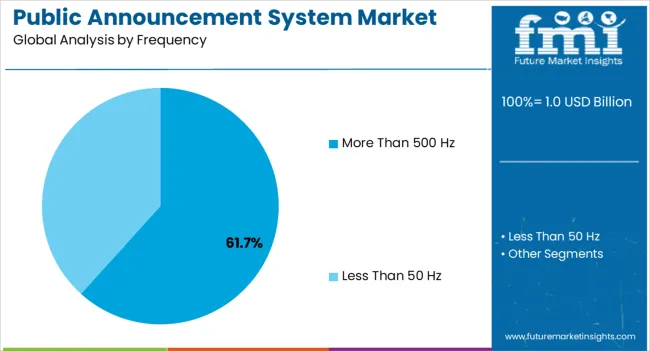

The more than 500 Hz frequency segment, representing 61.70% of the frequency category, has emerged as the leading choice due to its superior sound clarity and effective voice transmission over long distances. Adoption has been facilitated by the segment’s ability to meet performance standards for public address and emergency announcement applications.

High-frequency systems ensure audibility in noisy industrial and manufacturing settings, enhancing operational safety and communication reliability. Equipment design improvements and regulatory compliance have further strengthened adoption.

Growth is expected to continue as industries prioritize audio intelligibility and system performance, maintaining the segment’s market leadership within the public announcement system landscape.

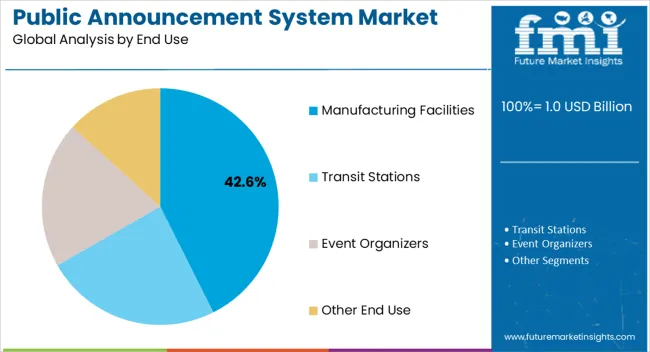

The manufacturing facilities segment, accounting for 42.60% of the end-use category, has emerged as the leading sector due to the critical requirement for clear communication and safety announcements in large-scale operations. Adoption has been driven by regulatory compliance, operational efficiency, and workforce safety considerations.

Integration of public announcement systems with production monitoring and emergency alert mechanisms has enhanced utility. Demand stability is supported by the ongoing expansion and modernization of manufacturing units across developed and emerging regions.

Continued focus on safety standards, process optimization, and facility management is expected to sustain the segment’s market share and drive adoption growth over the forecast horizon.

| Historical Value in 2020 | USD 737 million |

|---|---|

| Historical Value in 2025 | USD 923.5 million |

| Market Estimated Size in 2025 | USD 976 million |

| Projected Market Value in 2035 | USD 1,715.10 million |

Between 2020 and 2025, the public announcement system market experienced a significant evolutionary phase marked by technological advancements and shifting demands. This period saw a surge in smart technology integration, with IoT and AI revolutionizing public announcement system capabilities, enhancing communication, and amplifying functionality.

Safety and security concerns, propelled by global events, drove a heightened emphasis on remote working solutions and safety measures, influencing public announcement system adoption in various sectors. Infrastructure expansions and urbanization further fueled market growth, especially in transportation hubs and emerging economies, while customizable, user centric public announcement system solutions gained traction.

Looking ahead from 2025 to 2035, market forecasts project a continued trajectory of innovation and expansion. While smart technology integration remains crucial, the focus extends beyond to include sustainability as a driving force.

Public announcement system solutions are anticipated to prioritize eco friendly designs and energy efficient components, aligning with global sustainability initiatives. Enhanced user experiences through interactive features and customizable, adaptable systems will define market trends.

Collaboration between public announcement system providers and IoT device manufacturers is expected to deepen, fostering seamless integration and unlocking new functionalities. The market anticipates an exponential surge in educational institution deployments, propelled by safety concerns and communication needs.

These forecasts indicate a transformative decade for the public announcement system, where sustainability, adaptability, and user centric design will shape its evolution.

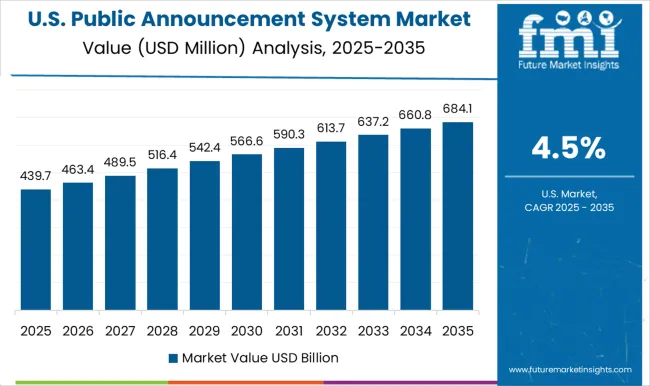

In the dynamic landscape of the public announcement system market, India leads with a remarkable 6.30% growth rate, driven by rapid urbanization and technological advancements. Following closely, China and Australia exhibit robust growth at 6.10% and 5.30%, respectively, propelled by infrastructural developments and increasing safety concerns.

The United States and Germany maintain strong positions, forecasting 5.20% and 5.00% growth rates, respectively, attributed to technological innovation and stringent quality standards. These global leaders reflect diverse market dynamics, showcasing sustained expansion and a commitment to fostering cutting edge public announcement system solutions, influencing market advancements on a global scale.

Forecast CAGRs from 2025 to 2035

| India | 6.30% |

|---|---|

| China | 6.10% |

| Australia | 5.30% |

| The United States | 5.20% |

| Germany | 5.00% |

India emerges as a frontrunner in the public announcement system market, projected to drive a remarkable 6.30% CAGR until 2035. Its rapid urbanization, infrastructural developments, and government initiatives propel the demand for advanced public announcement system solutions.

Increased public announcement system deployments across diverse sectors, including transportation, education, and healthcare, accentuate its pivotal position in the market. Leveraging technological advancements and a burgeoning economy, India sets the pace for public announcement system innovation and adoption, solidifying its leadership role and contributing significantly to the global public announcement system market landscape.

China leads the charge in the public announcement system market, poised for a remarkable 6.10% projected CAGR until 2035. This surge in public announcement system adoption stems from infrastructural expansions, rapid urbanization, and a burgeoning need for effective communication systems in diverse sectors.

Innovations in smart technology integration, coupled with stringent safety standards and government initiatives, fuel its dominance. Leveraging advanced manufacturing capabilities and a vast consumer base, China sets the pace for public announcement system advancements, emphasizing scalability, reliability, and cutting edge solutions, propelling the country as a frontrunner in shaping the future of public announcement system technologies and applications.

Australia emerges as a trailblazer in the public announcement system market, spearheading with a projected 5.30% CAGR until 2035. The country showcases immense opportunities driven by infrastructure development, urban expansion, and a strong emphasis on safety protocols.

Innovations in public announcement system technologies and increasing investments in transport hubs, educational institutions, and public spaces present a fertile ground for market expansion.

Australia has a proactive approach towards implementing advanced public announcement system solutions, ensuring efficient communication and safety across diverse sectors, positions it at the forefront of public announcement system market growth, offering promising prospects for the market evolution.

The United States emerges as a vanguard, propelling the public announcement system market with a projected 5.20% CAGR until 2035. Bolstered by infrastructural developments and a burgeoning demand for smart communication systems, this landscape offers substantial growth prospects.

The surge in smart city initiatives, coupled with stringent safety regulations, fuels the adoption of advanced public announcement system solutions across various sectors. Opportunities abound for public announcement system providers to innovate and cater to evolving needs in transportation, healthcare, and entertainment domains.

With its technological prowess and demand dynamics, the United States stands as a prime arena for public announcement system expansion, paving the way for transformative opportunities in the market.

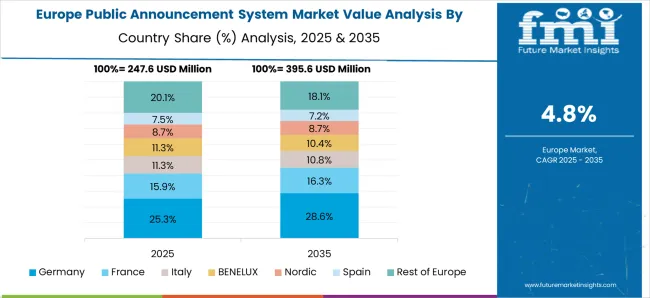

Germany emerges as a frontrunner propelling the public announcement system market, projecting an impressive 5.00% CAGR until 2035. This momentum is fueled by its commitment to technological innovation, stringent safety standards, and a burgeoning need for efficient communication infrastructure.

Leveraging advanced manufacturing techniques, Germany pioneers eco-friendly and high performance public announcement system solutions, influencing market trends across Europe. Its proactive approach in adopting smart technologies, coupled with a robust emphasis on quality and compliance, solidifies its pivotal role in shaping the future trajectory of the public announcement system market, fostering innovation and sustainable growth.

The transit stations segment is poised to uphold a sturdy 25.00% market share until 2025. With surging urbanization and increasing commuter footfall, this category remains pivotal in implementing public announcement system for efficient communication, ensuring passenger safety, and disseminating real time updates.

FMI forecasts an exponential rise for the outdoor segment, expected to attain a dominant 29.00% market share by 2025. Driven by the growing demand for robust public announcement system in open spaces like parks, stadiums, and urban areas, this category highlights the necessity for weather resistant, high performance systems to cater to diverse outdoor communication needs.

| Category | Market Share in 2025 |

|---|---|

| Transit Stations | 25.00% |

| Outdoor | 29.00% |

The transit stations segment is poised to maintain its substantial 25.00% market share in the public announcement system market until 2025 due to escalating demand for efficient communication infrastructure. With expanding urbanization and increasing commuter traffic, transit hubs prioritize public announcement system for seamless information dissemination and safety protocols.

Its sustained dominance is attributed to continual infrastructure upgrades, addressing passenger needs for real time updates, emergency notifications, and streamlined public announcements. The pivotal role of public announcement system in ensuring passenger safety, navigation, and operational efficiency solidifies the transit stations category as a key driver in the public announcement system market.

The outdoor category is projected to maintain a commanding 29.00% market share in the public announcement system market until 2025, driven by increasing demand for communication solutions in open spaces. Outdoor settings necessitate robust public announcement system for effective messaging, emergency alerts, and public safety announcements.

As cities expand and outdoor events thrive, the requirement for weather resistant, high decibel systems persists. Public announcement system installations in parks, stadiums, and urban areas continue to surge, reinforcing its dominance. The versatility and adaptability of public announcement system in outdoor environments reaffirm its pivotal role in enhancing communication accessibility and safety, contributing significantly to the public announcement system market landscape.

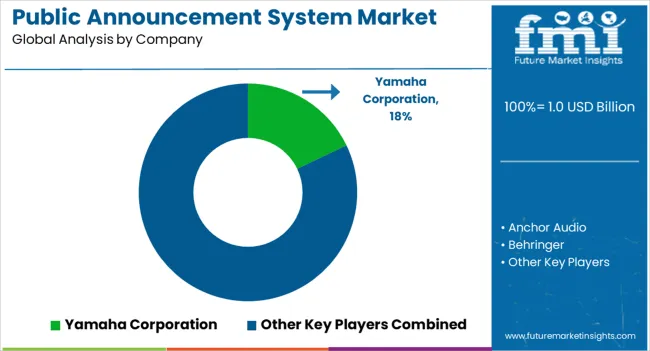

The competitive landscape within the public announcement system market is a dynamic arena characterized by a blend of established players and emerging innovators. Prominent market contenders continually innovate, offering comprehensive public announcement system solutions integrated with innovative technologies and tailored functionalities. These include established names renowned for their extensive product portfolios and market presence.

Smaller, agile companies contribute by focusing on niche segments or disruptive technologies, challenging established norms. Partnerships between public announcement system providers and tech giants amplify the competitive edge, fostering novel integrations and expanding market reach. The public announcement system market thrives on this vibrant competition, pushing boundaries and evolving to meet the ever changing needs of diverse industries and consumers.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.0 billion |

| Projected Market Valuation in 2035 | USD 1.7 billion |

| Value-based CAGR 2025 to 2035 | 5.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Type, Frequency, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Anchor Audio; Behringer; Bose Corporation; FISHMAN TRANSDUCERS INC.; Peavey Electronics; PowerWerks; Pyle Audio; QFX, Inc; Rockville; Yamaha Corporation |

The global public announcement system market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the public announcement system market is projected to reach USD 1.7 billion by 2035.

The public announcement system market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in public announcement system market are wireless and wired.

In terms of frequency, more than 500 hz segment to command 61.7% share in the public announcement system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Public Cloud Application Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Public Safety & Security Market Size and Share Forecast Outlook 2025 to 2035

Public Cloud Application Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Public Key Infrastructure (PKI) Market Analysis - Growth & Forecast through 2034

Public Cloud Storage Market

Public Safety In-Building Wireless DAS System Market

AI for Public Security and Safety Market

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

IoT for Public Safety Market

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

AI In Government And Public Services Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA