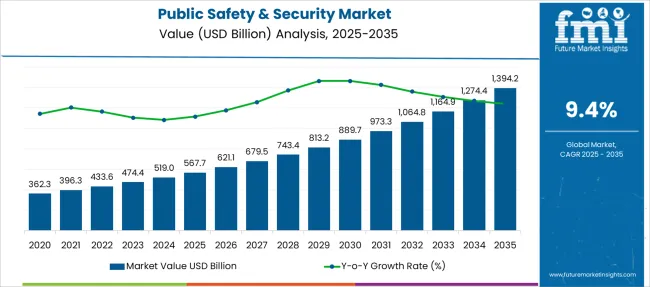

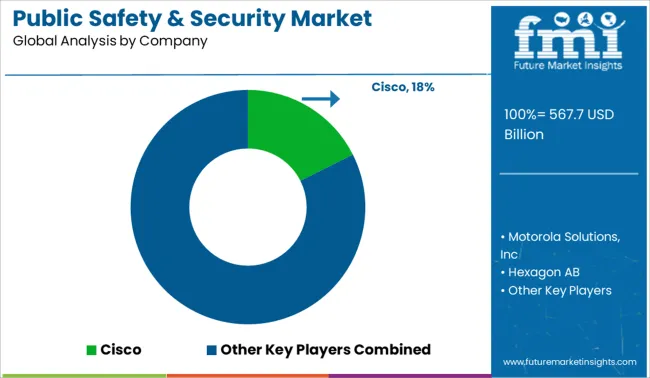

The Public Safety & Security Market is estimated to be valued at USD 567.7 billion in 2025 and is projected to reach USD 1394.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

| Metric | Value |

|---|---|

| Public Safety & Security Market Estimated Value in (2025 E) | USD 567.7 billion |

| Public Safety & Security Market Forecast Value in (2035 F) | USD 1394.2 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The public safety and security market is undergoing strategic expansion, fueled by heightened global threats, digital transformation in emergency response systems, and rising public-private partnerships in critical infrastructure protection. Increasing urbanization and geopolitical tensions have necessitated modernization of safety protocols across transportation, border control, and civil governance systems.

Governments are prioritizing multi-agency collaboration, real-time intelligence sharing, and technology-driven incident management, leading to stronger investments in integrated solutions. The convergence of IoT, AI-powered surveillance, and cloud-native platforms is redefining the way public safety agencies monitor, respond, and mitigate risk.

Emphasis on resilient communication infrastructure and continuous service delivery has also accelerated adoption of managed platforms. Over the coming years, demand will be driven by investments in predictive analytics, cybersecurity frameworks, and scalable command and control solutions across high-density and mission-critical zones.

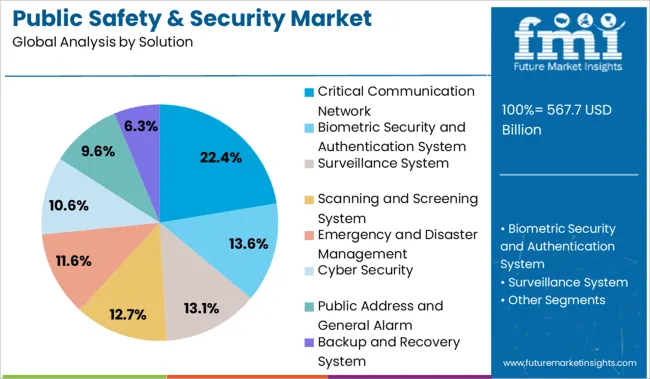

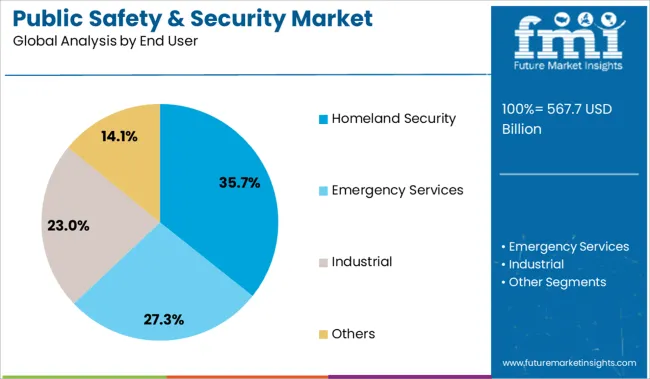

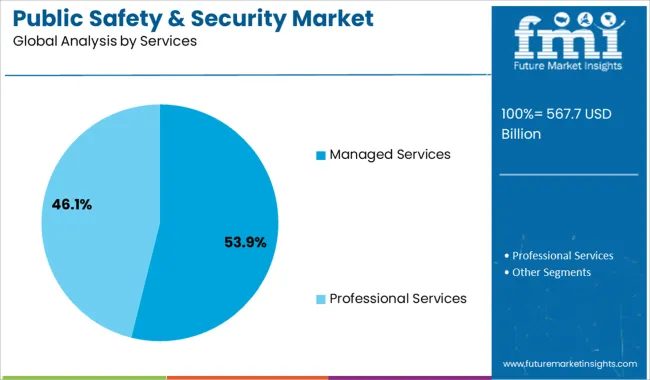

The market is segmented by Solution, End User, and Services and region. By Solution, the market is divided into Critical Communication Network, Biometric Security and Authentication System, Surveillance System, Scanning and Screening System, Emergency and Disaster Management, Cyber Security, Public Address and General Alarm, and Backup and Recovery System. In terms of End User, the market is classified into Homeland Security, Emergency Services, Industrial, and Others. Based on Services, the market is segmented into Managed Services and Professional Services. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Critical communication networks are expected to account for 22.4% of total revenue in the public safety and security market by 2025, making them the dominant solution segment. This segment’s growth has been fueled by the urgent need for uninterrupted, secure, and real-time communication among law enforcement, emergency medical services, and disaster management teams.

Public safety operations increasingly rely on LTE, satellite, and private broadband networks to coordinate field activities and deliver high-availability services. Emphasis on encrypted, mission-critical push-to-talk (MCPTT) functionalities and multi-network interoperability has further elevated the strategic value of these networks.

Supportive government funding and long-term technology contracts have reinforced deployments, especially in regions vulnerable to natural or human-made disruptions.

Homeland security agencies are projected to hold 35.7% of the total market share in 2025, establishing this as the leading end user category. The dominance of this segment is being reinforced by the expanding scope of national threat mitigation, including cyber espionage, border infiltration, and biological risk containment.

Integrated surveillance systems, biometric authentication platforms, and command-and-control centers have become critical tools in intelligence gathering and response operations. Rising incidents of organized crime and terrorism have accelerated cross-border technology integration, including drone-based perimeter monitoring and AI-driven pattern recognition tools.

As governments scale up preparedness frameworks, homeland security continues to lead investments in adaptive and proactive safety systems.

Managed services are anticipated to contribute 53.9% of total market revenue in 2025, making this the largest segment within services. This trend is being supported by the growing complexity of multi-layered security environments, which require continuous monitoring, system optimization, and incident response capabilities.

Outsourcing to specialized providers ensures round-the-clock support, cost control, and rapid adoption of emerging technologies without burdening public sector resources. Managed threat detection, data analysis, and equipment lifecycle management have become core to modern safety operations, especially in smart city ecosystems.

Additionally, government emphasis on risk resilience, uptime guarantees, and vendor accountability has driven greater trust in managed service partnerships as a long-term model.

With the emergence of protection thwarting concerns, individuals are shifting toward embracing safety and security measures, and given this pattern, the market is estimated to demonstrate a healthy CAGR over the coming years.

Social media analytics, the configuration of thermal sensor cameras, the implementation of cameras on traffic signals and in critical points for monitoring the process, the transformation of security systems in banking institutions and ATMs, and the deployment of digital RFID door lock mechanisms are just a few illustrations of the equipment and technology that have advanced public safety and security. In addition, constant innovations and scientific research are intensifying, which can add value to public safety and security.

Public safety and security is a commitment that can't be overlooked, and it has developed in every aspect over time. This is the sole factor that there is minimal to no restraint on the expansion of the public safety and security market unless humans cease to exist on Earth.

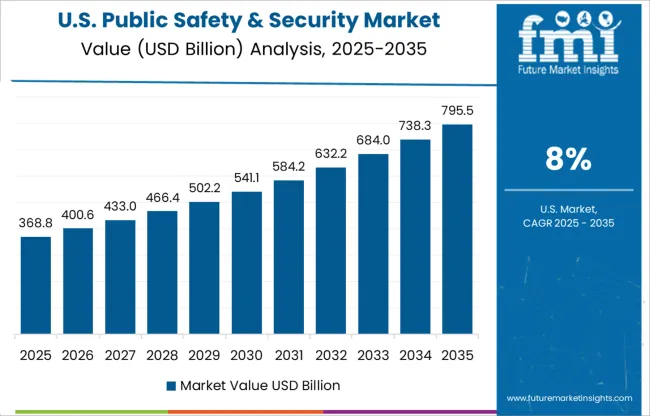

North America dominates the global public safety and security market, as it has the most public safety and security manufacturers. The region, which comprises the USA and Canada, possesses the most efficient framework and a high level of acceptance of cyber technology.

Other considerations expected to spur the expansion of this market in North America include the prevalent use of smartphones, the burgeoning e-commerce industry, and the friction related to technological advancements among competing nations in various regions.

The widening need to safeguard critical infrastructure and sensitive information has enhanced government interference in recent decades. North America is accounting for a market share of 35.1% of the global Public Safety & Security market.

The Canadian government instituted the Canadian Cyber Incident Response Center to supervise and strategize for cyber threats in the country.

With terrorist organizations increasingly relying on online platforms for sponsorships and propaganda purposes, the Canadian government is conducting public awareness and outreach campaigns to training to allow about the inherent risks of cyberspace. The governments of the USA and Canada are constantly collaborating with agencies of law enforcement to thwart violent extremism and counterterrorism-related operations.

Because of the ever-changing threat landscape, Asia Pacific countries are extremely concerned about raising security spending. To negotiate with incredibly sophisticated threats, India, Japan, and Singapore have upgraded or introduced various national cybersecurity guidelines. Large sums of money are anticipated to be spent by organizations in the Asia Pacific region to cope with cybersecurity breaches.

Terrorist attacks and cyber threats in the region have resulted in substantial damage, spurring India, China, Australia, Japan, Malaysia, and Singapore to enforce world-class public safety and security systems. The Australian Government has appointed a National Counterterrorism Coordinator to

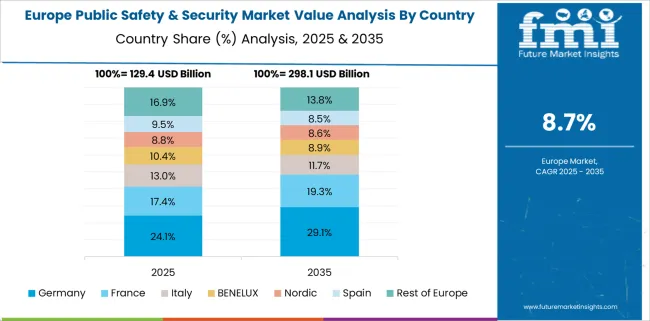

Europe has a substantial market share owing to increased capital investment in improving cooperation and monitoring systems for safety and security. The European Union has imposed several stringent rules and regulations that security solution suppliers must obey before installation. As a result of these rules, the reliability of the solutions has improved.

The innumerable cybersecurity and embedded border management approach that has been conducted over into the emerging markets of the United Kingdom, France, Italy, Spain, Italy, and the rest of the nations of the region commonly referred to as the Rest of Europe segment have contributed to the industry's growth in the European region. Europe is accounting for a market share of 23.6% of the global Public Safety & Security market.

With a significant revenue of 35.1%, North America is the largest public safety & security market. This is attributed to the recurring government investments to improve the existing security infrastructure to tackle illegal immigration and terrorism. Moreover, several safety & security solution providers, such as Cisco Systems Inc. and General Dynamics, find homes in the USA and Canada.

The USA Department of Homeland Security initiates a set of missions to prevent terrorism and enhance security. In addition, it further secures and manages America’s borders, enforces and administers immigration laws, safeguards and secures cyberspace, and strengthens preparedness and resilience. These measures are likely to propel the global public safety & security market growth.

Mental health emergency hotlines provide clinical support and connection to services. These hotlines appear to be more effective at reaching some populations than others, indicating that more intensive outreach efforts may be necessary to engage underrepresented high-risk populations.

For instance, approximately half of the included studies focused on the descriptive information of callers, most of whom were females, younger adults, and veteran hotlines that typically reach older men.

Security in colleges and universities is committed to providing a safe learning and working environment for every member of the community due to violence that may occur from extreme racism, bullying, hazing, etc.

For instance, the security team of St. John’s College in Santa Fe, New Mexico, prioritizes the safety and well-being of the students, with a dedicated and experienced staff to assist the community 24 hrs a day, 7 days a week. These factors contribute to the rising demand for public safety & security in the USA

Europe is the second largest public safety & security market, with a revenue of 23.6%. This is owing to the improving cooperation and monitoring systems and increased capital investment.

Numerous reports of hacking attacks on businesses and the public sector in Germany have demonstrated the importance of IT security in an age of advancing digitizing in all areas of industry. Moreover, effective IT security is indispensable given the networking of trades (IoT), the strong growth in the importance of AI, and the outsourcing of important functions and databases in the cloud. These factors are estimated to support the expansion of the public safety & security market size.

The German civil security model has a legal framework with room for the entrepreneurial spirit to flourish within it. Beyond the government security services that are extended to the people, there is also scope for new businesses to offer security services. This combination of private and state provision of protection is expected to pave the way for a healthy get of the public safety & security market share.

Terrorist attacks in other countries of Europe are compelling Germany to rethink its liberal attitude towards aggressive security and surveillance policies. Moreover, the German market related to products for safety and security is sophisticated and well-served. Foreign products can usually strongly compete on the basis of price and performance, even with a preference for locally manufactured products.

The France Homeland Security is in transition. The government is fully aware of the fact that France is facing problems with a far greater reach than its economic ones, such as ISIS terror threats, coupled with the surge in the arrival of millions of immigrants to Europe that shows no signs of declining, as stated by the French president.

Up to 1,600 French nationals travel to fight in Syria and Iraq, and approximately 2,000 French citizens are involved in extremist Islamic cells in France. Moreover, France may be in a predicament with inadequate counter-terror funding and a homeland security budget. These factors are expected to skyrocket the adoption of public safety & security.

Asia Pacific countries are extremely concerned about raising security spending with the ever-changing threat landscape. Countries such as Japan, India, and Singapore have upgraded or introduced various national cybersecurity guidelines.

The demand for public safety & security has recently increased in Japan owing to the need for security technologies and equipment because of several factors such as international events, mitigation and monitoring measures related to the ongoing Covid-19 pandemic, etc. For instance, an Internet Protocol (IP) camera is a digital video camera that receives control data and sends image data via an IP network and is commonly used for surveillance.

Japanese real estate facilities, such as retail stores and commercial buildings, widely install access control systems. These include CCTV cameras, face recognition access control systems, touchless operation systems, etc.

Moreover, Japan ranked 8th in a 2024 poll that surveyed people’s sense of security and confidence in local law enforcement among 115 countries and regions. Hence, the growing safety measures are making people feel safe to travel to and live in Japan, which bolsters the demand for public safety & security.

The South Korean public safety & security market is categorized into three main sectors, which are disaster prevention/management, fire safety, and industrial/public safety. Moreover, the Korean government’s desire to buy from local suppliers and the drive to develop indigenous technology satisfies a majority of the market segments.

South Korean authorities sometimes hold civil emergency exercises where sirens are sounded, transport stopped, and some people are even asked to take shelter indoors, including in designated metro stations or basements. In addition, the government has developed a smartphone application with civil emergency advice, including shelter locations, different types of alarms, medical facilities, and emergency services.

In November 2014, a new Ministry of Public Safety & Security (MOPSS) was initiated by the Korean government and housed in the office of the Prime Minister, due to the growing concerns of Koreans over the fast-growing, fast-moving, highly industrialized country, with a population of over 50 Million.

Furthermore, the need for security systems for regular government facilities and commercial buildings has been supplied, while the demand for anti-terrorism and illegal product detection systems is expected to sustain growth in the public safety & security market share.

During the forecast period, the emergency and disaster management segment is predicted to expand the most. As organic or man-made disasters including earthquakes, hurricanes, cyclones, typhoons, or tsunamis are becoming more prevalent, safety agencies are progressively deploying emergency and catastrophe management solutions. It provides access to vital documentation such as risk assessments, protocols, guidebooks, and emergency contacts.

Because of the constant effort of each nation's government to strengthen domestic safety and security, the homeland security segment possesses the largest public safety and security share of the market. In the USA, for example, the National Infrastructure Protection Plan (NIPP) is based on National Strategy for Homeland Security protocols for the physical protection of key infrastructure, as well as safeguarding cyberspace and key assets.

product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a larger customer base. For instance,

Some of the leading Public Safety & Security manufacturers include

These key Public Safety & Security providers are adopting various strategies such as new product launches and approvals, partnerships, collaborations, acquisitions, mergers, etc. to increase their sales and gain a competitive edge in the global Public Safety & Security market. For instance,

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.4% from 2025 to 2035 |

| Market Value in 2025 | USD 567.7 billion |

| Market Value in 2035 | USD 1394.2 billion |

| Base Year for Estimates | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Solution, End User, Service, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Cisco; Motorola Solutions, Inc.; Hexagon AB; Paessler AG; NORTHROP GRUMMAN CORPORATION; Kroll; Honeywell |

| Report Customization & Pricing | Available upon Request |

The global public safety & security market is estimated to be valued at USD 567.7 billion in 2025.

The market size for the public safety & security market is projected to reach USD 1,394.2 billion by 2035.

The public safety & security market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in public safety & security market are critical communication network, biometric security and authentication system, surveillance system, scanning and screening system, emergency and disaster management, cyber security, public address and general alarm and backup and recovery system.

In terms of end user, homeland security segment to command 35.7% share in the public safety & security market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI for Public Security and Safety Market

Public Safety In-Building Wireless DAS System Market

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

IoT for Public Safety Market

Smart Personal Safety & Security Device Market Analysis - Trends & Growth through 2035

Public Transportation Full Payment Platform Market Size and Share Forecast Outlook 2025 to 2035

Safety Label Market Size and Share Forecast Outlook 2025 to 2035

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Public Announcement System Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA