The safety label market is gaining momentum, driven by regulatory compliance requirements, heightened awareness around workplace hazards, and evolving standards in industrial safety. Government mandates, including those issued by OSHA, REACH, and GHS, have intensified demand for durable and compliant labeling solutions across a range of industries.

Product recalls, litigation risks, and the rising importance of traceability have also pushed manufacturers to adopt high-visibility, tamper-evident, and long-lasting labeling formats. Print technology enhancements, such as UV-cured inks and thermal transfer printing, have expanded customization capabilities for safety-critical environments.

The growing diversity of hazardous materials in industrial supply chains and globalized manufacturing practices have necessitated consistent safety communication, further elevating the role of labels as integral components of risk mitigation strategies. With sectors such as chemicals, automotive, and pharmaceuticals maintaining high regulatory oversight, demand for safety labels is expected to grow steadily. Segmental expansion will continue to be LED by permanent product types, paper materials offering cost-efficiency, and end-use in the chemicals industry where labelling accuracy and resilience are critical.

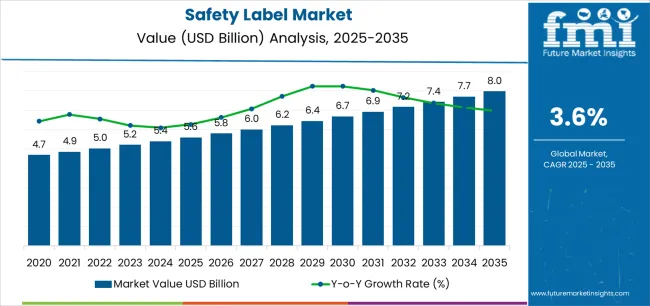

| Metric | Value |

|---|---|

| Safety Label Market Estimated Value in (2025E) | USD 5.6 billion |

| Safety Label Market Forecast Value in (2035F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

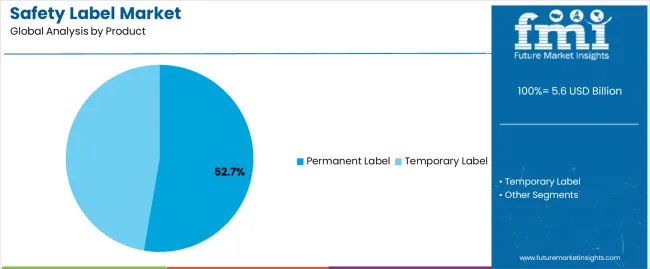

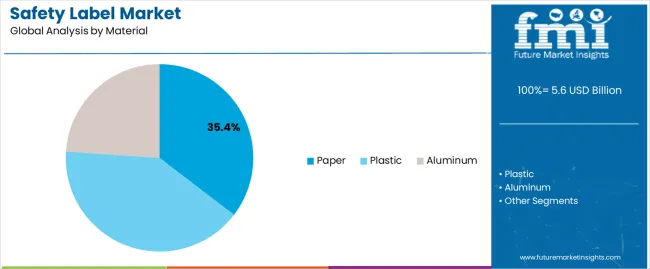

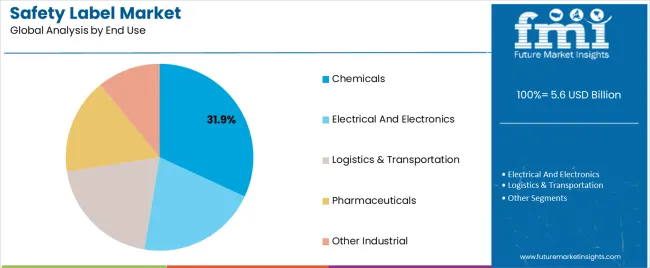

The market is segmented by Product, Material, and End Use and region. By Product, the market is divided into Permanent Label and Temporary Label. In terms of Material, the market is classified into Paper, Plastic, and Aluminum. Based on End Use, the market is segmented into Chemicals, Electrical And Electronics, Logistics & Transportation, Pharmaceuticals, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Permanent Label segment is projected to hold 52.7% of the safety label market revenue in 2025, maintaining its leading role due to its suitability in long-term hazard communication. This growth has been driven by the need for labels that remain intact and legible over extended operational periods, particularly in environments exposed to heat, chemicals, or moisture.

Manufacturing facilities and transportation units have increasingly opted for permanent adhesives that provide strong bonding to various surfaces, reducing the risk of label detachment and safety noncompliance. Additionally, regulatory bodies have specified permanent labeling for applications involving hazardous substances, reinforcing adoption in high-risk industries.

The use of tamper-evident and fade-resistant inks on permanent labels has further enhanced reliability and visual clarity in challenging conditions. As safety communication standards evolve and traceability expectations increase, the Permanent Label segment is expected to remain the default product type across industrial labeling applications.

The Paper segment is projected to contribute 35.4% of the safety label market revenue in 2025, reflecting its continued relevance in cost-sensitive applications where environmental exposure is limited. Paper labels have been favored in indoor settings or on packaging where short-term visibility and regulatory markings are sufficient.

The ease of printability and compatibility with a wide range of ink technologies have made paper an attractive option for manufacturers seeking economical compliance. Paper-based labels have also gained traction in environmentally conscious organizations due to recyclability and lower carbon footprints compared to synthetic alternatives.

Advancements in coated paper technologies have improved durability, water resistance, and ink adhesion, allowing paper labels to meet minimum safety standards in semi-controlled environments. As sustainability becomes a stronger purchasing criterion, the Paper segment is anticipated to hold its ground by offering eco-friendly, functional labeling solutions for general safety applications.

The Chemicals segment is projected to account for 31.9% of the safety label market revenue in 2025, establishing itself as the leading end-use category due to the sector’s stringent hazard communication requirements. Chemical manufacturers are required to comply with globally harmonized labeling systems that specify clear identification of hazards, precautionary statements, and standardized symbols.

Label durability in this segment has been critical, as products are frequently exposed to corrosive substances, temperature variations, and transportation handling. Safety labels serve not only regulatory compliance but also operational efficiency, helping avoid accidents, inform users, and support emergency response readiness.

Additionally, export documentation and cross-border regulatory frameworks have increased the need for multilingual, durable labeling in chemical logistics. With chemical supply chains growing more complex and subject to environmental and human safety scrutiny, the Chemicals segment is expected to remain the largest end-use vertical for safety labels, supported by regulatory oversight and continuous demand for precision in hazard communication.

The table shows how much the industry is expected to grow each year from 2025 to 2035. It predicts a 3.3% increase in the first half (H1) of the decade from 2025 to 2035 and a slightly higher growth of 3.8% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 3.3% (2025 to 2035) |

| H2 | 3.8% (2025 to 2035) |

| H1 | 3.7% (2025 to 2035) |

| H2 | 3.2% (2025 to 2035) |

In the next period, from H1 2025 to H2 2035, the growth rate is expected to drop slightly to 3.7% in the first half and decrease further to 3.2% in the second half. The BPS is expected to stay constant at 50 during both periods.

Consumer Awareness Creates a Favorable Environment for these Labels

Conditions of this industry are anticipated to improve due to the growing demand for these labels from the tobacco, food and beverage, and pharmaceutical sectors. Growing awareness about safety and product details, especially in Asia Pacific's food and beverage sector, is driving the need for security labels.

The food and beverage sector uses four out of every ten safety stickers sold worldwide, which makes it one of the biggest end-user industries for security labels globally. As consumers become more conscious about what they consume, the demand for clear and informative security labels continues to rise.

Safety Labels are Strengthening Security Protocols in Consumer Product Packaging

The surge in security label demand on boxes and cartons can be credited to the heightened safety protocols implemented by globally acclaimed producers of consumer products. The opportunistic safety label market is experiencing rapid growth due to increasing demand from the tobacco sector.

With these labels, the tobacco industry probably intends to enlarge on the negative psychological impacts of tobacco smoking and provide warnings in the form of textual notices and symbols. It's also possible that this aspect is likely to encourage industry expansion.

Printing Advancements Boost Security Label Effectiveness and Durability

The analysis of materials and printing technologies used in safety labels divulges significant advancements. These advancements improve security label efficacy, visibility, and durability. Durable adhesive safety signs and labels that function with common laser and inkjet printers that many facilities already own are examples of recent advancements.

Additional material alternatives, including metallic, vinyl, polyester, and retro-reflective films, have also been offered. The usefulness and attractiveness of security labeling solutions are increased by features like tamper-evident labels, QR codes for rapid information access, and sturdy weather-resistant materials.

The market size of safety labels was USD 4.7 billion in 2020 and USD 5.6 billion in 2025. Considering the CAGR of 2.8% from 2020 to 2025, it can be inferred that the safety label market investment and business potential are set to be sluggish.

Sales of these labels have slowed between 2020 and 2025 due to economic factors like changes in overall demand, fluctuations in raw material prices, or global supply chain disruptions. However, analysts suggest that the industry is set to rebound a little bit, which is apparent in its sales after a post-pandemic period. For this reason, the anticipated 3.6% CAGR for the ensuing ten years is reasonable.

Security labels are going to be in high demand as a result of strict laws and safety requirements in sectors including food, chemicals, and pharmaceuticals, with the intent to assure product compliance.

The growth of the pharmaceutical industry, especially in developing nations like China and India, makes significant use of security labels necessary for precise product specifications and transparency.

Security labels are necessary for efficient inventory management and traceability. This need arises from the ongoing expansion and improvement of the warehouse and logistics infrastructure, particularly in the United States and the United Kingdom.

Environmental sustainability considerations in the production of safety labels are becoming increasingly important in these countries. This is prompting manufacturers to adopt eco-friendly materials and processes.

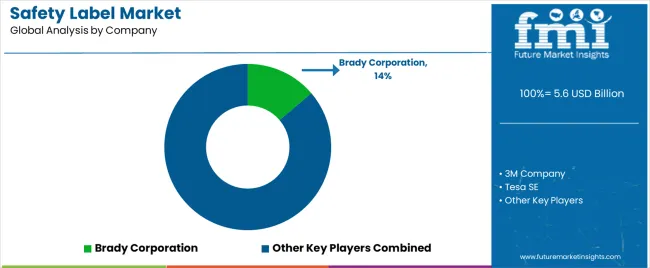

Tier 1 companies include top leaders in the industry. Large brands like Avery Dennison Corporation, 3M Company, Printpack, Inc., and Brady Corporation rule this sector with their extensive industry experience, cutting-edge technology, and a wide range of high-quality products.

Their dominance and strong brand recognition make them the go-to choice for many businesses seeking top-tier labeling solutions.

Tier 2 companies include Multi-Color Corporation, Tapp Label Company, LLC, Advanced Labels Limited, and Mercian Labels Ltd. Their strong reputation is a result of offering a high-quality product at a competitive cost.

Although they are not as prominent as Tier 1 firms, they are recognized for being credible and reasonably priced. Their attention to affordability and reliability makes them a preferred choice for businesses looking for value-driven options.

Prominent companies in Tier 3 include Clabro Label Inc. and Maverick Label, Inc. In comparison to Tier 1 and Tier 2 firms, they are smaller, but they have room for further growth. What sets them apart is their potential for growth and their ability to cater to niche markets with specialized labeling requirements.

Even though they're small, these companies come up with new ideas and give special attention to customers. This makes them attractive to businesses that want customized labels. If they keep growing and reaching more customers, they could become strong competitors in the industry.

The following section discusses the safety label market regional analysis. It includes information and data about influential nations in North America, Asia Pacific, Europe, and other regions. With a CAGR of 2.9% through 2035, the United States stays at the top in North America. In a similar vein, the United Kingdom is expected to lead Europe with a 2.7% CAGR up until 2035.

In the meanwhile, India is expected to develop at a CAGR of 5.9% in the South Asia and Pacific region up to 2035, somewhat faster than China's predicted CAGR of 5.2%. Nonetheless, Thailand is expected to have a progressive expansion in the industry, with a 4.8% CAGR through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.9% |

| China | 5.2% |

| United Kingdom | 2.7% |

| India | 5.9% |

| Thailand | 4.8% |

The existence of globally well-known pharmaceutical companies in the country, along with a successful packaged food & beverages industry, makes the United States an attractive market for security labels. Plus, the government's stringent regulations mandating that all firms offer accurate product labeling point to an increase in sales during the subsequent ten years.

Even though labels are widely used in industries like pharmaceuticals, chemicals, electronics, and food and beverage, the safety label market growth is slowing down. The anticipated 2.9% CAGR for the industry in the United States stems from market saturation.

It is one significant reason, as many companies in these industries already have established security labeling systems in place. Therefore, the demand for new labels slows down as well.

Despite these challenges, the broader United States economy continues to perform well. Even with fears around high inflation, slowing growth, and unsustainable consumer spending, the economy continues to deliver positive results month after month.

It seems policymakers are bringing inflation down without causing a recession. This economic strength might offer hope for future investments and innovations in the industry.

The United Kingdom Government's Health and Safety Executive has new rules for labeling things like cosmetics, electronics, and home appliances. All companies, whether they manufacture products in Europe or import it, must follow these rules. This means there's a higher need for security labels in the country.

The United Kingdom has the top security label industry in Europe. This is because it has many production facilities covering all end-user sectors. It also hosts leading global participants in the security label industry, offering traceable labels for large brand owners.

The United Kingdom economy bounced back quickly from a technical recession in the latter part of 2025. A growing economy means more production and consumption of goods. This leads to a higher demand for security labels in different end-use industries.

Companies are also likely to invest in new security labeling technologies to comply with regulations and safeguard brand reputation. Impact of regulatory compliance on the safety label market is undeniable. As a result, the industry is anticipated to experience a CAGR of 2.7%

The industry in India is forecasted to expand at a CAGR of 5.9%. Although industries in India use fewer labels per person compared to other places, the growth rate for labels in India is the highest globally. Sales of these labels are going up in India because they're used a lot in the food, pharmaceuticals, and durable goods industries.

For instance, the Food Safety Standard Authority of India made a rule to put security labels on food packages. This rule affects about 32% of the Indian food industry, which includes processed foods.

India has strict rules for security labels, so businesses buy more of them. India is increasing its label production faster than China. Hence, there are likely to be more labels available, prices might be lower, and new technology could be developed.

As India's industries grow, they are going to need more security labels, increasing sales. India might also export security labels to other countries, further boosting sales.

India is becoming a top choice for investors and stakeholders in the security label industry. The country has lots of factories and places that need security labels, so there's a big industry.

It follows global safety rules, so companies from other countries also invest here. India is growing in industries like renewable energy and electric vehicles, which need security labels, making it a hot spot for investors in this field.

This section of safety label market forecast analysis arranges for specifics about the industry's top segments. In terms of product type, the temporary labels segment is estimated to account for a share of 69.2% in 2025. By end use, the chemical industry category is projected to dominate by holding a share of 39.1% in 2025.

Temporary labels are often preferred over permanent ones since they are flexible and can be easily removed or replaced as required. This is extremely beneficial when the information or warning is only relevant for a short period. Temporary labels also minimize waste since they can be disposed of or recycled once they are no longer looked for.

| Segment | Temporary Safety Labels (Product Type) |

|---|---|

| Value Share (2025) | 69.2% |

Temporary labels are cost-effective as well since they do not require the same durability as permanent labels. Expenditures on adhesives drop as a result in this case. On top of that, temporary labels are ideal for changing environments, for example, construction sites, where hazards may vary day by day.

Temporary labels do not leave residue or damage surfaces when removed, maintaining the integrity of the equipment or area. Also, temporary labels can be customized quickly to address specific, short-term safety concerns. Market opportunities for customized and high-durability safety labels are going up as industries demand more personalized and resilient solutions for their specific needs.

In the chemical industry, safety is a top priority. Correct chemical labeling is important because it can help avoid accidents, among other reasons. These labels guarantee a successful reaction in the event that accidents do arise. Having instant access to the chemical's danger information can greatly reduce the potential harm in the case of a spill, fire, or personal exposure.

| Segment | Chemical Industry (End Use) |

|---|---|

| Value Share (2025) | 39.1% |

Companies understand that protecting stakeholders and following regulations is crucial. Accurate labeling is key for safe manufacturing. Security labels help track chemicals from start to finish, ensuring safety and compliance. They also aid in quality control, build brand identity, and enable clear communication.

For businesses in chemical manufacturing, proper security labels are a must. They convey vital details like chemical makeup, hazards, handling instructions, and disposal methods.

Having the right label on every container, whether raw materials or finished products, prevents mix-ups and safety risks. Hazard labels are especially important for dangerous substances like oxidizers or corrosives, indicating storage and shipping needs.

Safety label business opportunity analysis indicates that companies compete based on the quality and range of products they provide. The presence of multiple brands makes it very competitive.

Thereafter, they are using various strategies to stay ahead. In this situation, innovation is the sole method to drive the industry's expansion. Hence, they are creating labels with durable materials and advanced designs for better safety communication.

They are trying hard to stand out by coming up with new security label products to cater to different industries and needs. They are also deploying unique marketing strategies and brand differentiation. Some of these include highlighting product quality, compliance with safety standards, and customer satisfaction.

Competitive landscape of the safety label industry shows that leading companies are also looking into optimizing pricing strategies, with some companies offering competitive prices to attract customers. Some companies also provide additional services like customization and training to add value for customers.

Safety label market competition and industry analysis indicate that top companies also utilize the latest technology. They develop new products according to market trends in safety labels and customer preferences. A key battleground for competitors is integrating innovative technology.

Industry Update

In February 2025, Reliance Label Solutions, which specializes in producing labels for hazardous containers, launched the GHS L.A.B.E.L. Profile program. This new program is intended at assisting companies in refining and optimizing their chemical labeling processes.

The GHS L.A.B.E.L. Profile (Leading Assessment for Best Practices and Efficacy of Labels) service offers a technical inspection conducted by experts to ensure that companies handling and labeling hazardous chemicals adhere to compliance standards and best practices.

Based on cover type, the industry is categorized into chemical labels, hazardous labels, electrical labels, custom labels, and others.

In terms of product type, the industry is bifurcated permanent safety labels and temporary safety labels.

Depending on end use, the industry is branched into tobacco industry, electrical and electronics industry, chemical industry, food and beverage industry, and pharmaceutical industry.

Safety label market regional analysis is conducted across North America, Europe, the Middle East and Africa, East Asia, South Asia, Oceania, and Latin America.

The global safety label market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the safety label market is projected to reach USD 8.0 billion by 2035.

The safety label market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in safety label market are permanent label and temporary label.

In terms of material, paper segment to command 35.4% share in the safety label market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labels Market Forecast and Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Labelling Machine Market Growth & Industry Trends through 2035

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Safety Valve Market Size, Growth, and Forecast 2025 to 2035

Safety Relays Market Size, Share, and Forecast 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA