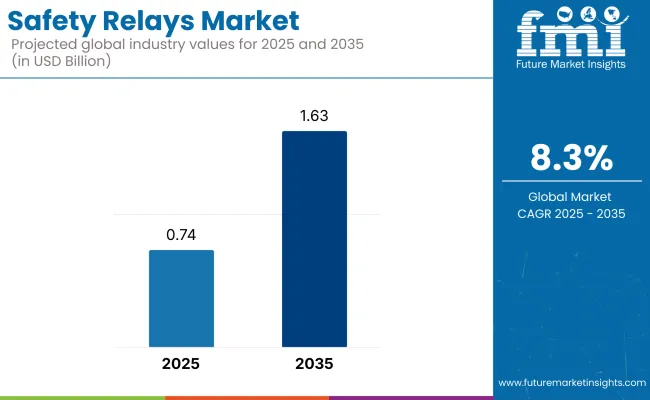

The global safety relays market is estimated to be valued at USD 0.74 billion in 2025 and is projected to grow at a CAGR of 8.3% to reach USD 1.63 billion by 2035. This growth is primarily driven by heightened regulatory enforcement, including ISO 13849-1 and IEC 62061 standards, across manufacturing, power generation, and process industries.

North America and Western Europe lead in terms of compliance-driven adoption, while Asia Pacific-especially India, China, and South Korea-is witnessing rapid uptake due to rising automation and industrial safety mandates.

The demand surge is rooted in the need for emergency shutdown, machine control redundancy, and personnel safety across complex, high-risk operations. Solid-state safety relays are gaining prominence for their energy efficiency, long lifecycle, and ability to support Industry 4.0 protocols such as PLC integration, cloud connectivity, and predictive diagnostics. However, electromagnetic relays continue to hold value in legacy systems due to cost efficiency and power surge tolerance.

Looking forward, AI-based safety relays and wireless modules will reshape industrial safety architectures. Smart factories in the automotive and electronics sectors are increasingly deploying diagnostic-enabled relays for real-time risk mitigation. The pharmaceutical sector is also accelerating adoption owing to GMP compliance.

Meanwhile, emerging markets like India and Southeast Asia are expected to be the next hotspots due to Make-in-India initiatives and stricter enforcement of workplace safety standards. Regulatory divergence across regions-from OSHA in the US to KOSHA in South Korea-will necessitate localized strategies by global relay providers. As a result, modular, scalable, and sustainable relay systems are expected to dominate procurement choices over the next decade.

Furthermore, the market is undergoing a structural transformation as manufacturers shift from fixed, one-size-fits-all safety solutions to modular relay platforms that offer plug-and-play capabilities, especially for retrofitting legacy systems. The convergence of cybersecurity protocols with safety logic is gaining traction, with newer relays offering encryption, self-diagnosis, and fault prediction capabilities.

With semiconductor shortages impacting availability in recent years, many vendors have localized production and diversified their supply chains to ensure business continuity. These shifts-coupled with rising demand for energy-efficient and recyclable relay enclosures-indicate that future procurement will increasingly be driven not just by safety compliance but also by sustainability, serviceability, and smart factory compatibility.

The safety relays market is bifurcated into Electromagnetic Safety Relays and Solid-state Safety Relays. While electromagnetic relays continue to dominate legacy infrastructure due to their cost-effectiveness, mechanical durability, and resistance to electrical surges, their dominance is gradually waning.

Solid-state safety relays are witnessing rapid adoption across smart factories and automation-heavy environments due to their extended operational lifespan, faster switching speed, and compatibility with PLCs, robotics, and AI-enabled safety architectures. These relays are also preferred in environments that require silent operation and low power consumption. Europe and North America lead the shift toward solid-state systems, though Asia-Pacific is expected to catch up quickly with rising automation standards.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| Solid-state Safety Relays | 9.1% |

In application terms, the market is divided into Emergency Stop (E-stop), Safety Gate, Two-hand Control, and Light Curtain Safety Relays. E-stop relays hold the highest market share, being essential for immediate shutdowns in hazardous conditions. However, light curtain relays are poised to grow the fastest, driven by the proliferation of sensor-based safety in automated assembly lines, robotics, and pharmaceutical manufacturing.

These systems provide real-time machine shutdown on detecting human entry into risk zones, thereby enhancing operational safety. Industries in Japan, Germany, and the U.S. are leading adopters, with light curtain solutions aligning closely with precision manufacturing norms and collaborative robotics.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Light Curtain Safety Relays | 9.4% |

The end-user landscape includes Manufacturing, Oil & Gas, Pharmaceuticals, Power Generation, and Mining. Manufacturing dominates the global demand owing to wide-scale deployment across assembly lines, conveyor systems, and robotic cells.

However, pharmaceuticals are expected to be the fastest-growing sector, as compliance with Good Manufacturing Practices (GMP) and automation in cleanroom environments demand advanced, self-diagnostic safety relays. Power generation-especially nuclear and renewable-also shows steady growth as safety relays ensure fail-safe operations in high-risk environments. Additionally, mining and oil & gas sectors continue to rely on explosion-proof and rugged relay systems for subterranean and offshore safety applications.

| End-user Segment | CAGR (2025 to 2035) |

|---|---|

| Pharmaceuticals | 9.7% |

Regional Difference

Adoption of Advanced Technologies

ROI Perception

Polycarbonate Enclosures: Chosen by 62% because of their strength and insulation against electricity.

Regional Variance

Price Sensitivity

Regional Differences

Manufacturers

Distributors

Industrial Operators

72% of manufacturers will invest in IoT-enabled safety relays.

Regional Focus Areas

Regulatory Influence

Consensus

Safety compliance and reliability cost challenges transcend borders.

Regional Differences

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | OSHA (Occupational Safety and Health Administration) Standard: Require the use of a safety relay in a hazardous working environment. NFPA 79 (Electrical Standard for Industrial Machinery): Standard for machine safety. UL 508 Certification-Required for Industrial Control Equipment. |

| United Kingdom | After Brexit, manufacturing electrical devices that conform to UK standards requires a UKCA (UK Conformity Assessed) Mark. HSE, the Health and Safety Executive, regulates workplace safety laws. BS EN ISO 13849-1 applies to safety-related control systems for machinery. |

| France | INRS (French National Research and Safety Institute) requires compliance with safety relays for industrial automation. CE Marking (EU-wide) is necessary for access to the market. Electrical installation and machine safety are regulated by NF C 15-100. |

| Germany | The DGUV (German Social Accident Insurance) strictly enforces workplace safety. Electrical safety for accident prevention for machinery according to DIN EN 60204-1 CE Marking under the European Machinery Directive. |

| Italy | INAIL guarantees the compliance with safety standards. CE marking is required for industrial safety relays-Functional safety norms are covered by ISO 12100 & IEC 61508. |

| South Korea | KOSHA (Korea Occupational Safety and Health Agency), industrial safety regulations. KC (Korea Certification) Mark is required for electrical safety products. KCS 13 subtitle (emergency stop and control devices) |

| Japan | Japanese Industrial Standards: safety relay specifications. PSE certification for the electrical control device (Product Safety Electrical Appliance & Material) The automation industry emphasizes compliance with ISO 13849-1. |

| China | CCC (China Compulsory Certification) is required for the industry use of safety relays. There are GB Standards for electrical safety and automation systems. SAMR [State Administration for Market Regulation] is the compliance authority. |

| Australia-NZ | AS/NZS 4024.1, like ISO 13849, relates to machine safety requirements. RCM is mandatory for electrical products. Safe Work Australia is responsible for maintaining industrial safety standards. |

| India | Industrial control safety IEC 60947 (BIS (Bureau of Indian Standards) IS 13947) The Factory Act, 1948, mandates compliance with safety standards in the workplace. Please note that safety relays for import must have CE & ISO 13849-1 as additional certification. |

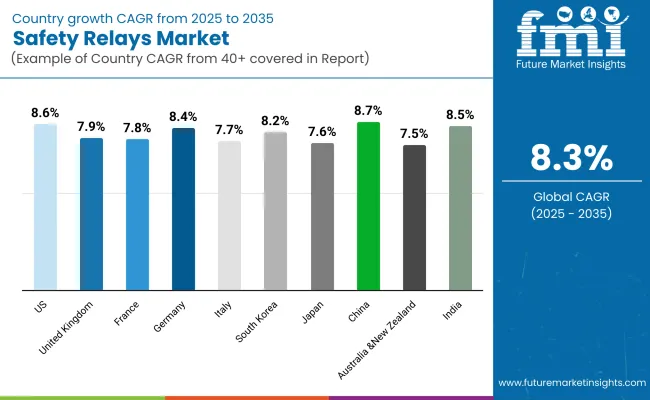

The North America safety relays market is anticipated to showcase a growth rate of 8.6% through 2023 because of the stringent OSHA and NFPA regulations & codes that mandate print safety mechanisms to ensure safety in industries.

Growing adoption of Industrial IoT (IIoT) and smart factories is further pushing demand for networked safety relays offering predictive maintenance. Heavy investments in automated manufacturing in the automotive and aerospace industries will drive adoption. Cybersecure relay systems are also targeting industrial networks to prevent the spread of attacks. The Inflation Reduction Act and investments in domestic semiconductor manufacturing will keep supply chain dislocations in check, allowing steady market growth.

The UKe UK safety relays market grew at a CAGR of 7.9% and will keep flourishing due to the UKCA compliance requirements in a post-Brexit setting. Workplace safety regulations have also been getting stricter, driven by the Health and Safety Executive (HSE), resulting in an increased demand for certified safety relays in industrial environments.

Policies that prioritise energy saving and low power, such as carbon neutrality, are driving the demand for low power and energy-saving safety relays. The increased movement towards smart manufacturing and AI-based automation in core industries such as pharma and food processing will further drive growth. However, the complexities of Brexit-related supply chains can create headaches for manufacturers that import safety relay elements.

The growth of the French safety relays market is primarily attributable to INRS safety requirements and compliance with the EU Machinery Directive (CE Marking), which is expected to reach a CAGR of 7.8%. France: The country's relatively robust industrial sector contributes to the growing demand for high-reliability safety relays.

France is also leaning towards sustainable production, thus forcing corporates to invest in recyclable and sustainable safety relay materials. Ultimately, the government’s industrial plan for France 2030 will drive smart automation, forcing companies to invest in IoT-enabled safety relays to monitor locations and mitigate risk in realtime.

Germany is expected to grow at a CAGR of 8.4% driven by safety regulations (DGUV, CE Marking) and a hydra-a-automated industrial base. AI-capable safety relays are experiencing increased uptake for proactive failure detection as part of Industry 4.0 applications.

The need for performance in automotive and heavy machinery industries coupled with redundant safety relay systems, such as for the elevator and the manufacturing process,, will help escalate the market demand in the country. The EUe EU Green Deal and the shift toward sustainability of the production are driving the increasing use of energy-efficient & low-power safety relays. Having leading robotics and industrial automation companies located in Germany, the country is expected to remain a significant growth hub for high-tech safety relays.

It is also expected that the Italian safety relay market will grow at a CAGR of 7.7% thanks to INAIL workplace standards and the EU Machinery Directive. The country's automotive, food processing, and textile industries have high safety standards that are met by modern, fail-safe safety relay systems.

It is very common to add IoT-enabled safety relays to existing industrial installations. To meet EU sustainability rules, Italy's National Recovery and Resilience Plan (NRRP) also encourages manufacturers to use low-energy, recycled safety relays in their systems.

The South Korean safety relay industry is anticipated to grow at 8.2% throughout the forecast period, owing to KOSHA's (Korea Occupational Safety and Health Agency) regulatory norms compelling stringent workplace safety. The demand for high-speed and compact safety relays is also on the rise as industrial automation, especially semiconductors, shipbuilding, and automobiles, becomes more complex.

Smart factory initiatives led by the government are increasingly pushing companies towards AI-based and cloud-sourced safety relay systems. Secondly, KC (Korea Certification) compliance is a giant barrier for foreign producers to enter the domestic market, while it's a sign of safe and quality products for the consumer.

Japan's market for safety relays is projected to have a CAGR of 7.6% and growth due to JIS (Japanese Industrial Standards) and PSE (Product Safety Electrical Appliance) regulations. The country's high-automation environment uses advanced safety relays for risk prevention, primarily in robotics and electronics.

However, cost-conscious manufacturers stubbornly resist adopting IoT-based safety relays and continue using the Stone Age electromechanical version. The ageing industrial base in Japan presents us with an opportunity to retrofit factories with AI-powered, predictive maintenance safety relays. With government incentives encouraging Industry 5.0 innovations, the market will witness further growth.

Increasing stringency in norms as mandated by GB Standards and CCC (China Compulsory Certification) for safety relays in China will make the country one of the most lucrative places in the world over the forecasted period, with an anticipated growth of 8.7% CAGR by volume. The country's burgeoning industrial automation development in the manufacturing, electronics, and mining sectors is driving the need for safety relays with high performance and safety.

Regulatory influences, like workplace safety improvement initiatives (often called Made in China 2025), drive the adoption of fail-safe and networked relay technology. Still, low-cost domestic competition represents a risk for foreign makers. Furthermore, the increasing investment in 5G-based industrial automation will progressively increase the need for IoT-capable safety relays.

In Australia and New Zealand, the safety relay market is expected to rise at a 7.5% CAGR, driven by the requirements of Safe Work Australia standards and AS/NZS 4024.1 safety. Mining, oil & gas, and heavy industries are the largest buyers in terms of compliance with hazardous environments, with safety relays being the largest consumption segment.

The move towards sustainable, solar-powered automation is driving the adoption of energy-efficient safety relays. There are also opportunities in wireless safety relay systems at remote industrial locations within mining areas for enhanced reliability. Import dependence on European and USA safety relay brands is a concern that needs to be addressed through local production at the domestic level as a future growth driver.

Further, the USA safety relays market will develop with an 8.5% CAGR in the Indian market, supported by initiatives like Make in India promotion and compliance with BIS (Bureau of Indian Standards) IS 13947. The Smart Safety Relay Market in the Automotive, Power, and Heavy Engineering Industries The automotive, power, and heavy engineering industries are primarily high-quality users of smart safety relays.

Growing awareness concerning safety at work according to the Factories Act, 1948, as well as increased promotion for industrial automation, is driving market growth. The manufacturing industry is making a vastly growing contribution to India's generating economy and FDI inflows in industrial automation sectors; it is expected that India will be one of the fastest-growing safety relay markets in Asia.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market grew steadily due to increasing workplace safety regulations and automation in industries. | Industry 4.0, including AI-based safety systems and IoT-enabled safety relays, will significantly boost the market. |

| COVID-19 had an impact on supply chains, resulting in longer lead times on semiconductors and components for safety relay manufacturing. | Diversification of supply and regional manufacturing clusters will create stability in component supply and lead times. |

| Electromagnetic safety relays remained leading on the basis of cost-effectiveness and reliability in traditional industries. | Solid-state safety relays will become more widespread due to their years of service, energy-saving features, and plug-and-play capability on smart factory networks. |

| Due to the strict necessity to comply with safety regulations, the manufacturing, oil and gas, and mining sectors are witnessing strong demand. | Automation and regulatory compliance make pharmaceuticals and power generation high-growth markets. |

| The regions of Europe and North America led the safety relay market and accounted for a greater share due to strict safety regulations and advanced manufacturing facilities. | Asia-Pacific will account for the largest share of the most growth, driven by industrial growth, better regulations, and take-up of smart factories. |

| Safety was basic compliance with ISO and OSHA in all industries. | Stricter workplace safety regulations and enhanced training requirements from governments will compel firms to adopt innovative safety relay solutions. |

The safety relay market is part of the industrial automation and safety equipment segment of the industrial control systems (ICS) and workplace safety solutions industry. Manufacturing automation, regulatory compliance, and occupational safety regulations for the automotive, pharmaceutical, energy, and mining industries primarily drive the market.

That sector is the Advanced High Strength (AHSS) market. Macro-Economic Trends: Between 2025 and 2035, the market will steadily expand due to industrial digitization, increased safety standards, and more capital investments in factory automation. Industry 4.0, IoT-based safety devices, and AI-based risk assessment tools will drive adoption.

Emerging economies, particularly across the Asia-Pacific region, will experience rapid growth with a surge of industrialization and workplace safety programs promoted by governments. Applications are becoming more demanding, with the increasing need for energy efficiency, cybersecurity and sustainable solutions for safety relays being there in the long term, even though, in the short term, what also challenges the industry are supply chain limitations, chip shortages, and rising prices of raw materials.

Dominant players in the safety relays market contend over price policies, technological advancements, strategic alliances, and geographic development. Cost-effective brands target price-sensitive sectors, while premium players focus on additional offerings such as IoT capabilities, AI-powered fault detection, and predictive maintenance.

Leading manufacturers are developing solid-state and wireless safety relays for Industry 4.0 needs through R&D. Partnerships with automation companies and regulatory agencies drive compliance-focused sales. Firms are also entering emerging markets with local manufacturing and distributor networks to reduce import dependency and lead times. Mergers and acquisitions also enhance market positioning and technological strengths.

New exploration in 2024 The safety relay market witnessed a significant enhancement with technological advancement and strategic ventures by circumferential players. Siemens AG has introduced a new range of safety relays that incorporate embedded IoT capabilities, thereby facilitating real-time monitoring and predictive maintenance. The innovation is expected to improve operational efficiency and reduce downtime for industrial customers.

Rockwell Automation, Inc., increased its market reach with the acquisition of a small competitor that specialises in developing safety solutions for the renewable energy market. Announced March 2024, it strengthens Rockwell's offering and also supports its strategy to take advantage of the growing need for safety solutions for sustainable energy projects. (SOURCE: Rockwell Automation Press Release: March 2024.

ABB Ltd. launched a new generation of safety relays featuring enhanced cybersecurity capabilities due to growing cyberthreat concerns in industrial automation. This product positions ABB to be a leader in safe safety solutions across the critical infrastructure sectors.

Another example is OMRON, which collaborated with a pioneering robotics firm in the development of safety relays specially designed for cobots. This new partnership tackles the distinct safety needs of cobots, which are currently seeing widespread deployment in manufacturing and logistics.

Schneider Electric SE started focusing on sustainable safety relays made up of recycled materials, and this was the start of their sustainable era. This move aligns with the company’s subsequent focus on reducing its carbon footprint and meeting rising demand for sustainable products.

Eaton Corporation invested in R&D to manufacture safety relays embedded with advanced diagnostics and self-testing capabilities. Such technology contributes to higher reliability and reduced maintenance expenses, and therefore, Eaton's products become relatively attractive to price-sensitive customers.

Phoenix Contact GmbH & Co. KG expanded its sales network into emerging economies, particularly Asian and African countries, to take advantage of the growing demand for industrial automation solutions. The acquisition will help bolster the company's market presence in these markets.

The fastest growing is in AI-enabled safety relays for predictive maintenance and real-time hazard detection, which limit downtime for manufacturing and power plants. Most of these efforts seem to be aimed at automotive, pharmaceutical, and renewable energy verticals, leading OEMs to work towards supporting solid-state safety relays along with intelligent diagnostics and cloud connectivity.

India and Southeast Asian emerging markets present excellent expansion opportunities through productivity, industrialization, and stricter safety regulations requiring local manufacture and collaborations to reach the market. High-end safety relay leasing and subscription options would also help gain penetration in price-sensitive territories like Japan and South Korea.

Manufacturers would need to collaborate with regulators to stay ahead of future proposed safety standards and pre-emptively align. Distributors must strengthen supply chains, pairing with domestic spice vendors to diffuse component shortages. Especially when retrofitting legacy industrial facilities with next-generation automation and IoT functions is between these two parameters, modular safety relay systems must focus end users on the fact that those features can continue to be scaled in the future.

The industry is segmented into Electromagnetic Safety Relays and Solid-state Safety Relays

It is fragmented into Emergency Stop (E-stop) Safety Relays, Safety Gate Safety Relays, Two-hand Control Safety Relays and Light Curtain Safety Relays

It is segmented among Manufacturing, Oil & Gas, Pharmaceuticals, Power Generation and Mining

The industry is fragmented among North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East & Africa

Safety relays provide emergency shutdown, avoid accidents, and meet workplace safety standards.

AI facilitates predictive maintenance, and IoT enables real-time monitoring and remote diagnostics.

Pharmaceutical, automotive, and renewable energy industries are experiencing high adoption rates because of automation and safety compliance.

Legacy system integration, high upfront costs, and semiconductor supply chain limitations are the main challenges.

Intelligent factories are primarily using wireless alternatives, while conventional models continue to dominate in mission-critical applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safety Label Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Safety Valve Market Size, Growth, and Forecast 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Safety Interlock Switches Market Analysis by Actuation Method, Application and End-use Industry and Region 2025 to 2035

Safety Light Curtains Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Safety Eyewear Sector

Industry Share Analysis for Safety Box for Syringe Companies

Safety and Process Filter Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA