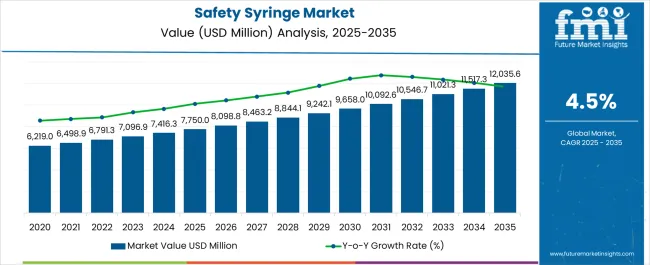

The Safety Syringe Market is estimated to be valued at USD 7750.0 million in 2025 and is projected to reach USD 12035.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Safety Syringe Market Estimated Value in (2025 E) | USD 7750.0 million |

| Safety Syringe Market Forecast Value in (2035 F) | USD 12035.6 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The safety syringe market is witnessing strong momentum, propelled by the global emphasis on infection prevention, rising vaccination initiatives, and stringent healthcare safety regulations. Increasing awareness about the risks of needlestick injuries has accelerated the adoption of safety syringes across hospitals, clinics, and homecare settings.

The market benefits from advancements in auto-disable and retractable technologies, which ensure single-use functionality and reduce the risk of reuse. Growing investments in immunization programs by governments and international health organizations further reinforce demand.

Additionally, the expansion of retail pharmacy channels and online platforms has increased accessibility, enhancing market penetration. Looking forward, consistent regulatory support and the ongoing integration of safety-focused innovations are expected to sustain market growth, with adoption further strengthened by the shift toward advanced drug delivery mechanisms.

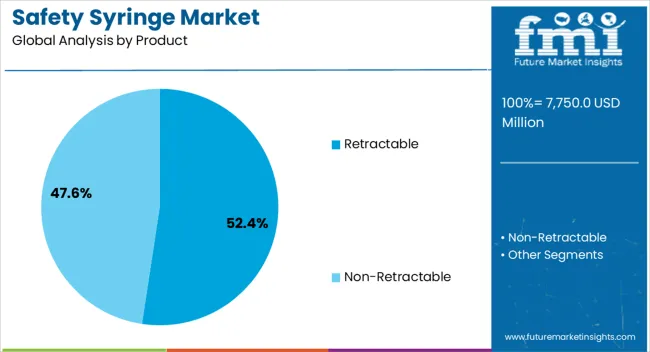

The retractable segment dominates the product category, holding approximately 52.40% share of the safety syringe market. This segment’s leadership is attributed to its ability to significantly reduce the risk of accidental needlestick injuries by retracting the needle into the barrel immediately after use.

Healthcare facilities favor retractable syringes for their enhanced safety profile, particularly in high-volume immunization and medication administration programs. Cost-effectiveness in large-scale procurement and the availability of multiple product variants have also reinforced adoption.

The segment benefits from supportive regulatory frameworks that mandate safety-engineered syringes, particularly in regions with strong occupational safety standards. With continued innovation in automatic retraction mechanisms and expanding adoption in both developed and developing healthcare systems, the retractable segment is positioned to retain its leading share during the forecast period.

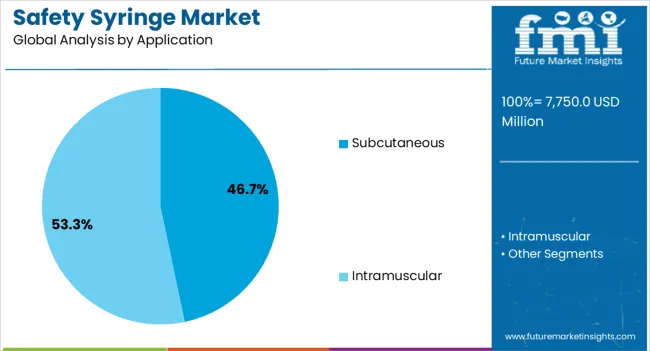

The subcutaneous segment leads the application category, accounting for approximately 46.70% share. This segment’s strength lies in its wide use for administering vaccines, insulin, and biologics, making it a cornerstone of safety syringe adoption.

The prevalence of chronic conditions such as diabetes has driven regular demand for subcutaneous injections, while mass immunization programs have further reinforced this segment’s significance. Safety syringes designed for subcutaneous use provide accurate dosing, minimal pain, and reduced risk of cross-contamination, which are key considerations in both hospital and homecare environments.

Technological advancements in needle design and barrel precision have enhanced patient compliance, further supporting demand. With the continued rise in injectable therapeutics and global immunization drives, the subcutaneous segment is expected to maintain a strong leadership position in the market.

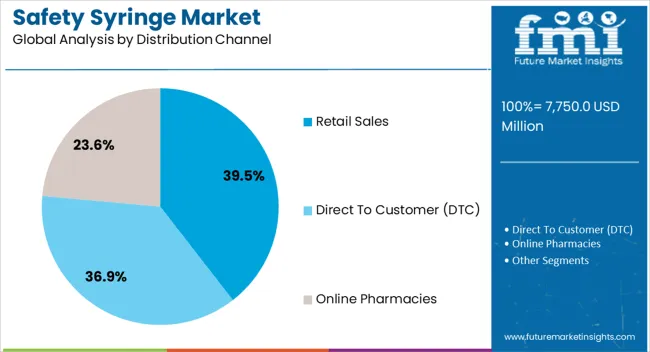

The retail sales segment dominates the distribution channel category with approximately 39.50% share, supported by the increasing accessibility of safety syringes through pharmacies, drug stores, and online channels. Consumer demand for convenient access to injectable devices for chronic disease management, particularly insulin administration, has reinforced this channel’s growth.

Retail outlets provide an essential bridge between manufacturers and end-users, ensuring wide distribution across urban and semi-urban markets. The segment has also been bolstered by government programs that leverage retail channels for immunization campaigns and public health initiatives.

With rising e-commerce penetration and the integration of direct-to-consumer supply chains, retail sales are expected to remain a critical driver of market accessibility and adoption.

The global market for systematic syringes grew at a CAGR of 4.3% from 2020 to 2025. Several factors, including a greater understanding of the importance of needle stick injury prevention and healthcare worker safety, can be responsible for the rising sales of safety syringes. Healthcare workers who suffer needlestick injuries have a serious risk of contracting bloodborne infections like HIV, hepatitis B, and hepatitis C.

Safety syringes have become an essential device due to the healthcare industry's active search for ways to improve safety precautions. The healthcare industry's growing emphasis on safety at work standards and regulations is one of the key factors driving sales growth.

The usage of safety syringes has also increased due to rising awareness of infectious diseases, specifically in global health emergencies. Notably, the COVID-19 pandemic has highlighted the need for infection control procedures, compelling healthcare professionals to invest in safer medical equipment, such as syringes with enhanced security features.

Technological developments have also resulted in innovative syringe safety features, like automatic safety shields and retractable needles. These characteristics increase the general effectiveness and accessibility of healthcare environments while reducing the probability of needlestick injuries.

Considering the increasing demand for minimally invasive surgeries, technological advancements, and increased awareness of infectious diseases, the growth of safety syringes is anticipated. The global safety syringe market is expected to propel at a CAGR of 4.5% over the forecast period.

Increasing the number of internet users and raising awareness regarding e-commerce for healthcare products are changing the scenario of distribution channels. Several manufacturers are selling their products through e-commerce websites at the country level.

A handful of e-commerce websites strongly focus on disposable products only. Due to the growing usage of online sales, the growth through online sales is increasing and creating opportunities for the market.

Asia Pacific, Latin America, and the Middle East are the emerging markets in the world. Insulin syringes present a higher opportunity for safe syringes for regions with the leading population and diabetic rate in the world.

The healthcare infrastructure is developing with increasing funding and investment in research & development and technology. Hence, the demand for precise and standardized medical equipment is increasing.

Systematic syringes, with their precision in medicine administration, play an essential role in ensuring effective medication delivery. Rising healthcare investments make modern medical tools more affordable, ultimately creating a favorable environment for the market growth of safe syringes.

The unauthorized use of safety syringes for illegal purposes is a severe problem when such products are misused. Safety syringe sales for their intended medical uses can drop as a result of unethical users using this product for non-medical purposes, such as the injection of illegal narcotics.

The improper use of safety syringes contradicts the intended usage of these instruments and puts the general public's health at risk. The possibility of needle sharing among drug addicts increases the likelihood of spreading bloodborne pathogens like hepatitis and HIV.

They would add to a more significant public health emergency. Incorrect application of safety syringes has two problems: it reduces the market for appropriate medical usage and makes infectious disease transmission in communities harder. Factors such as the availability of safe syringes in the illegal marketplace and unethical usage of safe syringes could be barriers to the growth of the safe syringe market.

The table below shows the estimated growth rates of the top five countries. India, China, and the United Kingdom are set to record higher CAGRs of 10.5%, 9.5%, and 2.2%, respectively, through 2035.

| Countries | Value CAGR |

|---|---|

| United States | 1.5% |

| China | 9.5% |

| Germany | 1.8% |

| United Kingdom | 2.2% |

| India | 10.5% |

The United States contributed as the profitable market, holding a global share of around 32.3% in 2025. The United States syringe market is expected to register a CAGR of 1.5% during the forecast period, owing to the rising number of minimally invasive procedures performed in the country.

There is an increasing need for precise and regulated drug administration as these procedures become increasingly common. Safety syringes are essential to the changing landscape of medical treatments in the United States because of the increased attention to patient safety and the efficacy of medication therapy.

China is projected to be the most attractive market globally in 2025, accounting for a market share of around 6.3%. Several factors, such as growing awareness of infectious disorders, a rise in healthcare spending, and the increasing prevalence of chronic disorders, are contributing to significant market growth. The need for safety syringes is further driven by the growing focus on preventative care and early intervention as China's healthcare system changes to meet the demands of an aging population.

Like several other nations, the United Kingdom has laws to encourage the use of safe syringes. Manufacturers and healthcare facilities must adhere to safety regulations and recommendations. There has probably been a rise in the use of safety syringes in the United Kingdom due to growing awareness of the dangers of needlestick injuries and the significance of safety for healthcare workers.

In the United Kingdom, healthcare practices are greatly influenced by the National Health Service (NHS). The NHS's deployment of safety syringes can significantly impact market dynamics. The nation's general attitude toward medical innovation is influencing the adoption of safe syringes with cutting-edge features and technologies.

The uptake of safety syringes is impacted by the condition of the healthcare system, including hospitals and clinics in India. Healthcare facilities with adequate equipment are more likely to incorporate safety syringes into their operations. Initiatives and public health campaigns geared toward lowering needlestick injuries and encouraging the use of safety syringes are fueling market expansion.

The COVID-19 pandemic has increased public knowledge of safe measures in healthcare. The pandemic's influence may have impacted the safety of syringe adoption on the order of importance for safety precautions. Government rules, including procurement procedures and reimbursement policies, are further influencing the safety syringe market in India.

Manufacturers of safe syringes and other medical devices must adhere to strict regulations in Japan. Adherence to safety standards and regulations is essential for market approval and entry. Safety syringe usage is rising in Japan due to increased knowledge about needlestick injury prevention, workplace safety, and healthcare safety.

Due to its aging population, Japan has a significant demand for healthcare services. Two primary drivers driving the market for safe syringes are the state of healthcare and the requirement for safe injection procedures.

The below section shows the retractable segment dominating by product type. It is expected to thrive at a 4.1% CAGR by 2035. Based on application, the subcutaneous segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 3.2% during the forecast period.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Subcutaneous (Application) | 3.2% |

| Retractable (Product) | 4.1% |

| Hospitals (End-user) | 2.8% |

| Retail Sales (Distribution Channel) | 3.5% |

The retractable segment accounted for a dominant share of 68.2% in 2025. Due to more safety measures than non-retractable safety syringes, retractable syringes usually have more significant sales.

The design of retractable syringes mechanically pulls the needle back into the barrel after use, lowering the possibility of needlestick injuries and stopping the transmission of diseases. Retractable syringes have become more prevalent in healthcare settings due to their safety benefit, which has expanded their adoption.

The subcutaneous segment is leading the market with a share of 65.7% in 2025. In general, subcutaneous injections are less effective and painful than intramuscular injections, which go deeper into the muscle tissue.

Subcutaneous injections involve injecting medications into the fatty tissue just beneath the skin. Because of their smaller size, patients find subcutaneous injections utilizing systematic syringes more manageable.

Several drugs are designed to be administered subcutaneously, which makes it the preferred approach for a handful of therapeutic applications. Subcutaneous application with systematic syringes is more common due to a mix of patient comfort, convenience of administration, and pharmaceutical requirements.

The hospital segment is a leading end-user of the syringe market, with a 29.8% value share in 2025. The hospital segment leads the periodic syringe sales as the end-user due to the high volume of medical testing.

Safety syringes are necessary in hospitals to ensure proper medicine delivery, patient safety, and therapeutic effectiveness. Hospitals have higher revenues in this market than other end-users, including clinics or research institutions, because of the vital importance of healthcare interventions in these locations.

Leading companies are strategically making acquisitions and developing new products to strengthen their positions. Through acquisitions, businesses can expand their skills, penetrate new markets, and diversify their portfolios.

Ongoing product innovations ensure both innovation and competitiveness at the same time. The dynamic market for safety syringes is promoting growth and sustainability through the ability of key players to meet consumer expectations, adjust to evolving industry trends, and maintain a competitive edge through strategic actions.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 7750.0 million |

| Forecast Market Size (2035) | USD 12035.6 million |

| Projected Growth Rate (2025 to 2035) | 4.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; South Asia and Pacific; East Asia; Western Europe; Eastern Europe; Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Chile, the Rest of Latin America, China, Japan, South Korea, India, the Association of Southeast Asian Nations, Australia and New Zealand, the Rest of South Asia and Pacific, Germany, Italy, France, United Kingdom, Spain BENELUX, Nordic Countries, Rest of Western Europe, Russia, Hungary, Poland, Rest of Eastern Europe, Saudi Arabia, Türkiye, South Africa, Other African Union, Rest of Middle East and Africa |

| Key Segments Covered | Product, Application, Distribution Channel, End-user, and Region |

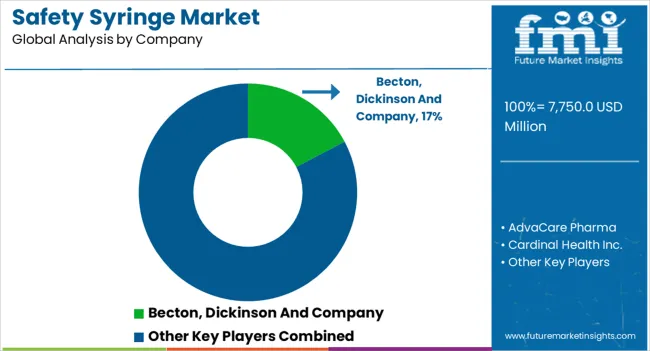

| Key Companies Profiled | Becton; Dickinson and Company; AdvaCare Pharma; Cardinal Health Inc.; DMC Medical Ltd.; Duopross Meditech Corp.; Haiou Medical; Kendall Healthcare; Lifelong Meditech (Group); Medicina (HMC Group); Medline Industries; Nipro Corporation; Numedico; Nemera; Retractable Technologies, Inc.; Revolutions Medical Corporation; Smith’s Medical, Inc. (ICU Medical, Inc.); Sol-Millennium Medical Group; Terumo Corporation; UltiMed, Inc. (Ulticare); Unilife Corporation; B. Braun Melsungen AG; Fresenius Kabi AG; West Pharmaceutical Services, Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, Drivers, Restraints, Opportunities, Trends, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global safety syringe market is estimated to be valued at USD 7,750.0 million in 2025.

The market size for the safety syringe market is projected to reach USD 12,035.6 million by 2035.

The safety syringe market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in safety syringe market are retractable, _manual retractable safety syringes, _automatic retractable safety syringes, non-retractable, _sliding needle cover syringes, _sheathing tube syringes and _hinged needle cover syringes.

In terms of application, subcutaneous segment to command 46.7% share in the safety syringe market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Industry Share Analysis for Safety Box for Syringe Companies

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Valve Market Size, Growth, and Forecast 2025 to 2035

Safety Relays Market Size, Share, and Forecast 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Safety Interlock Switches Market Analysis by Actuation Method, Application and End-use Industry and Region 2025 to 2035

Safety Light Curtains Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Safety Eyewear Sector

Safety Label Market Growth & Industry Demand 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA