The Retractable Needle Safety Syringes Market is anticipated to be valued at USD 6.3 billion in 2025 and is expected to reach USD 9.3 billion by 2035, registering a CAGR of 4%.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 6.3 billion |

| Market Value (2035F) | USD 9.3 billion |

| CAGR (2025 to 2035) | 4% |

This market is experiencing robust growth, driven by heightened awareness of needlestick injuries among healthcare professionals and stringent regulations mandating safer medical devices. The market's expansion is further fueled by the increasing prevalence of infectious diseases, necessitating safer injection practices.

Government initiatives promoting workplace safety and reducing healthcare-associated infections significantly impact market adoption. The hospital segment currently holds the largest market share due to high volumes of injections administered, followed by clinics. Auto-telescopic syringes, offering enhanced safety and ease of use compared to manual versions, are gaining significant traction and are expected to witness faster growth over the forecast period.

However, the relatively higher cost of retractable syringes compared to traditional ones poses a restraint to market penetration, particularly in developing economies. Nonetheless, the combination of increasing awareness, regulatory mandates, and technological advancements will contribute to continued and substantial market growth for retractable needle syringes over the next decade.

Prominent manufacturers in the Retractable Needle Safety Syringes Market include Becton, Dickinson and Company (BD), Terumo Corporation, Cardinal Health, Nipro Corporation, and Retractable Technologies, Inc. These companies are actively engaged in product innovation, strategic partnerships, and market expansion to gain a competitive edge.

For instance, BD has been focusing on developing advanced safety syringes that align with global safety standards thereby enhancing their product portfolio and market presence. Hindustan Syringes and Medical Devices (HMD) launched Dispojekt, an indigenous single-use safety syringe, to combat needle stick injuries and reduce blood-borne disease transmission among healthcare workers. HMD aims for 60-70% market share in India's disposable syringe segment, investing ₹70 crore to produce 200 million units annually, with plans for further expansion.

Sohail Nath, executive director of HMD said, “With Dispojekt safety syringes, HMD aims to reduce the prevalence of accidental NSI among health workers, reduction of infection control cost and that of disposal and training, offering a long-term positive financial impact on the healthcare sector”.

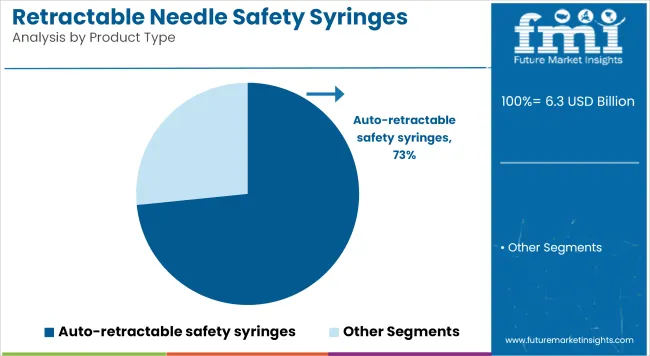

The auto-retractable safety syringe segment has emerged as the leading contributor in 2025, owing to its superior user protection and built-in passive safety features. A substantial share of 73.4% has been captured by this segment as healthcare institutions increasingly prioritize safety protocols aligned with WHO injection safety guidelines. Usage has been driven by the need to eliminate manual intervention in needle retraction, which significantly reduces needle-stick injuries (NSIs).

Compliance with regulatory mandates across North America and Europe has further favored auto-retractable variants. Moreover, rising adoption by procurement agencies and government healthcare bodies has been facilitated by their proven cost-benefit ratios in reducing infection transmission risks.

The product’s automatic retraction mechanism has ensured higher adoption in high-pressure clinical environments where error margins must be minimized. The segment’s dominance is expected to persist as global focus intensifies on safety, standardization, and reduction in healthcare-associated infections.

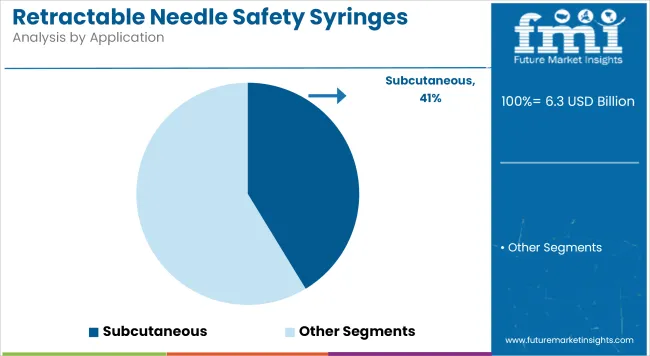

In 2025, subcutaneous injections have accounted for the largest application share at 41.3%, primarily due to their routine use in chronic disease management-especially insulin administration for diabetic patients. This segment has been bolstered by the increasing global burden of non-communicable diseases (NCDs), which has led to a surge in long-term injectable therapies.

Preference has been observed for retractable syringes in subcutaneous use due to their compatibility with low-volume, self-administered injections. Moreover, safety syringe adoption has been encouraged by patient-centric initiatives promoting home-based care and self-medication, supported by digital health platforms. Standardization in dosage and needle length for subcutaneous delivery has simplified production, allowing cost-efficient scalability. The reduced tissue trauma and infection risk further support its integration into chronic disease treatment pathways.

Hospitals have emerged as the primary distribution route, capturing 49.02% of the market in 2025. This dominance has been shaped by the high frequency of injection-based procedures performed in hospital settings, requiring stringent safety standards.

Retractable syringes have been extensively adopted to meet institutional guidelines related to needlestick injury prevention and infection control. Centralized procurement processes and regulatory obligations have facilitated bulk purchasing by hospital networks, especially in the USA, UK, and Japan. Implementation of safety policies under OSHA and EU directives has increased hospital reliance on auto-retractable systems.

Furthermore, large-scale public healthcare investments and pandemic-preparedness strategies have resulted in priority sourcing of safety syringes through hospital supply chains. Integration into surgical, emergency, and chronic disease units has further strengthened the channel’s growth potential.

The direct-to-customer (D2C) segment has secured 45.3% of the market share in 2025, driven by the increasing adoption of self-administration practices in chronic disease management and at-home care. Growth in this channel has been supported by the expansion of e-commerce platforms and telemedicine, which have improved accessibility to safety syringes for individual consumers.

The shift toward decentralization of healthcare, prompted by the pandemic and subsequent regulatory reforms, has encouraged patients to independently manage conditions like diabetes, hormone deficiencies, and rheumatoid arthritis. Retractable syringes have been favored in this segment for their user-friendly design and minimal post-use contamination risk.

Moreover, partnerships between manufacturers and retail logistics networks have facilitated last-mile delivery models, ensuring reliable supply even in remote areas. Patient education campaigns and mobile health monitoring have played a vital role in promoting D2C safety device usage, making this segment a pivotal component of market growth.

High Production Costs and Limited Adoption in Low-Income Regions

A big challenge in retractable needle safety syringes market is high cost due to advanced safety elements. Retractable technology increases complexity, causing higher costs than normal syringes. This price gap limits use, mainly in areas delicate about costs.

In poor and developing lands, money troubles stop wide use. Small healthcare funds and need for basic medical supplies over advanced safety syringes limit market reach. Also, lack of knowing about needlestick injuries and related health risks lowers demand. Many health places in these areas still use regular syringes, despite risks of infections.

To fix these issues, we need affordable production ideas, government help programs, and global awareness drives to show the importance of safety syringes, making them more available and follow infection control rules everywhere.

Increasing Government Regulations and Technological Innovations

The market has big chances to grow. Governments around the world now have tougher rules to keep healthcare workers safe. Lots of places demand the use of special syringes that are safer, and this means more people need them.

Smart inventors keep creating better syringes that work well and are easy to use. These new designs, like auto-retraction and simple handling, make them popular with healthcare workers. More vaccines are being used to fight diseases, which also helps this market get bigger.

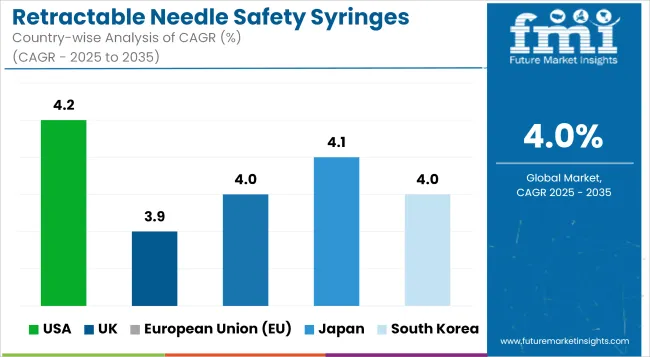

The market for retractable needle safety syringes in the USA is growing. There are more worries about injuries from needles. Tough rules on safety for medical tools and more use of safe syringes in hospitals help the market grow. The FDA and OSHA manage syringe safety standards and laws against needlestick injuries.

Big trends include more need for prefilled safety syringes, higher use of retractable syringes in shots, and more knowledge about how to keep healthcare workers safe. Government efforts to promote needlestick-prevention tools also make the market grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The retractable needle safety syringes market in the UK is growing. This growth is due to strict health rules. Hospitals and clinics use more safety syringes. Concerns about blood infections are increasing. Two groups, MHRA and HSE, watch over medical device safety and ensure laws about needlestick injuries are followed.

Trends in the market show a higher need for automated retractable syringes. More disposable safety syringes are being used. There's also a big focus on making syringes in a way that is good for the environment.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The retractable needle safety syringes market in the EU is expanding rapidly. This is due to European Union regulations, preventing injuries from sharp objects, an increased demand for safety syringes in hospitals and nursing homes, and a growing number of people being aware of the dangers of needle injuries.

The EMA guides safety; the EC, the rules of medical devices. The top three countries are Germany, France and Italy. They have better health-care systems, smear new syringe safety tech, and have greater vaccination drives. Additionally, increased self-injecting tools and syringes for home utilization to bolster market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

Japan’s retractable needle safety syringes market is growing. This is due to stricter healthcare rules, more people using needlestick prevention devices, and higher demand for disposable syringes in hospitals. The Ministry of Health and the Pharmaceuticals and Medical Devices Agency set syringe safety rules and approve medical devices.

Important trends are more use of retractable syringes for diabetes care, more prefilled safety syringes, and new self-injection tech. Also, Japan’s growing elderly population needs safer injections in elderly care.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The retractable needle safety syringes market in South Korea is growing. This is because of more focus on preventing infections and more government actions to stop injuries from needle sticks. Hospitals are using more safety syringes with automatic features. The Korea Food and Drug Administration and the Ministry of Health and Welfare set rules for the safety of these medical devices.

Trends in the market show a need for cheaper safety syringes. There is also more money being put into better syringe technology. Vaccination programs are using more retractable syringes. Home healthcare and telemedicine services are growing too. This makes people need devices they can use to give their own shots.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The rise in demand for the prevention of needlestick injuries, increasing awareness regarding healthcare workers safety, supportive government regulations, and increased incidence of chronic and infectious diseases are contributing to the growth of the retractable needle safety syringes market.

Growth of the market is attributed to avenue of syringe automation, self-retracting needle technologies, and ensure compliance with infection control standards. To further capitalize the market, enterprises are concentrating on unique safety devices, economical production and a wider distribution network. This market is implemented by prominent medical device manufacturers, syringe technology companies, and healthcare solution providers implementing an innovation in needle safety.

the market is segmented into Manual Retractable Safety Syringe and Auto-Retractable Safety Syringe.

the market is segmented into Subcutaneous, Intramuscular, and Intravenous.

the market is segmented into Hospitals, Clinics, Ambulatory Surgical Centers, and Others.

the market is segmented into Direct to Customer, Retail, and Online Pharmacies.

The Retractable Needle Safety Syringes Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East & Africa.

The overall market size for the retractable needle safety syringes market was USD 6.3 billion in 2025.

The retractable needle safety syringes market is expected to reach USD 9.3 billion in 2035.

Increasing focus on needlestick injury prevention, rising demand for safety syringes in healthcare settings, growing awareness of infection control, and stricter government regulations on syringe safety will drive market growth.

The USA, Germany, China, Japan, and France are key contributors.

The automatic retractable needle safety syringes segment is expected to lead due to their enhanced safety features, ease of use, and growing adoption in hospitals and clinics.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retractable Lift Market

Retractable Needles Market

Needle Coke Market Size and Share Forecast Outlook 2025 to 2035

Needleloom Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Needle Nose Pliers Market Size and Share Forecast Outlook 2025 to 2035

Needle Destroyer Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

Global Needle-Free Injection System Market Insights – Trends & Forecast 2024-2034

Pen Needles Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Tattoo Needles Market Size and Share Forecast Outlook 2025 to 2035

Global Suture Needles Market Analysis - Size, Share & Forecast 2024 to 2034

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Steerable Needle Market Size and Share Forecast Outlook 2025 to 2035

High Flow Needle Sets Market

Disposable Needle Guides Market

Vertebroplasty Needles Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Needle Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA