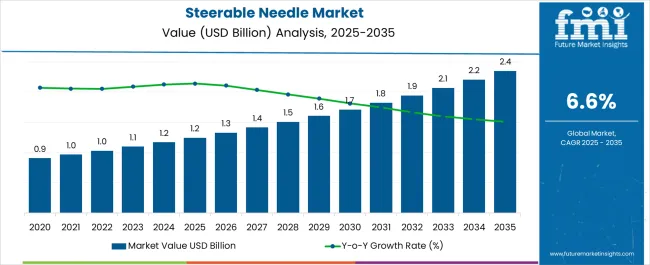

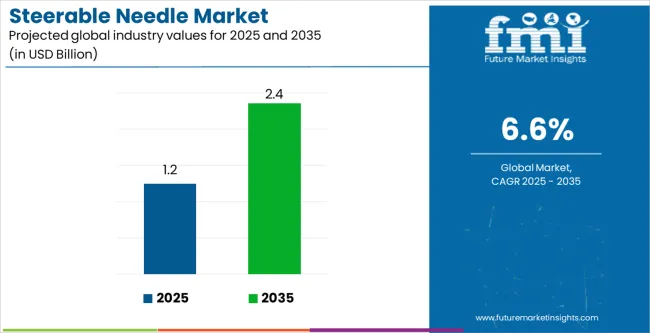

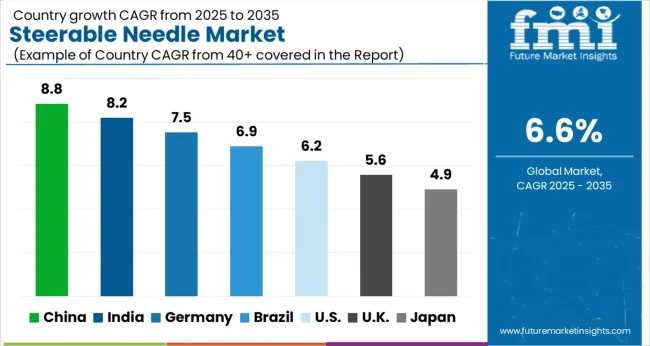

The Steerable Needle Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Steerable Needle Market Estimated Value in (2025 E) | USD 1.2 billion |

| Steerable Needle Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The steerable needle market is expanding steadily, supported by increasing demand for precision in minimally invasive procedures and the growing incidence of chronic diseases requiring targeted interventions. Advances in imaging technologies and real time navigation systems have enhanced the accuracy and safety of steerable needle applications, driving their adoption in diagnostic and therapeutic procedures.

Rising investments in robotic assisted surgery and image guided interventions are further shaping the market landscape. Additionally, the emphasis on reducing patient recovery time and minimizing surgical complications has positioned steerable needles as a valuable tool in modern healthcare.

The outlook remains strong as healthcare providers continue to prioritize technologies that combine safety, efficiency, and improved patient outcomes, particularly in complex diagnostic and interventional practices.

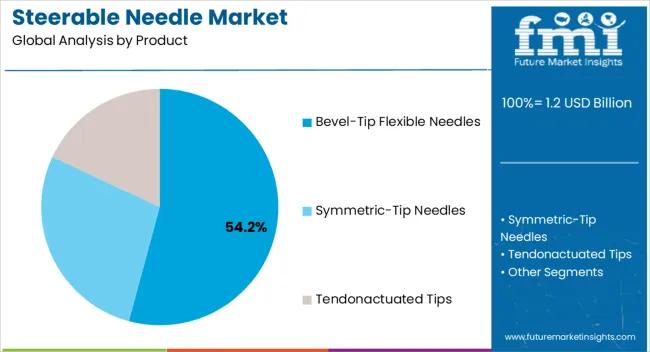

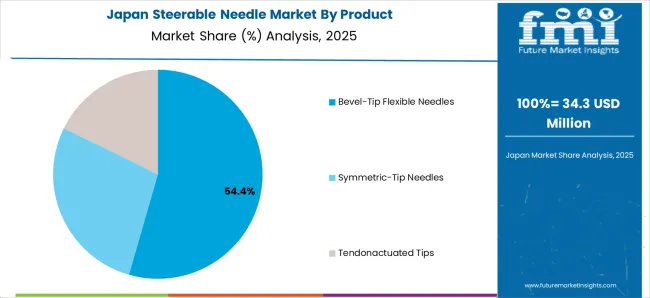

The bevel tip flexible needles segment is projected to account for 54.20% of total market revenue by 2025 within the product category, positioning it as the leading segment. This growth is being driven by their high flexibility, enhanced maneuverability, and ability to reach targeted tissue sites with greater precision.

Their compatibility with advanced imaging systems and suitability for minimally invasive procedures have accelerated their adoption.

The increasing focus on personalized and targeted interventions has further supported demand for bevel tip flexible needles, establishing them as the dominant product type.

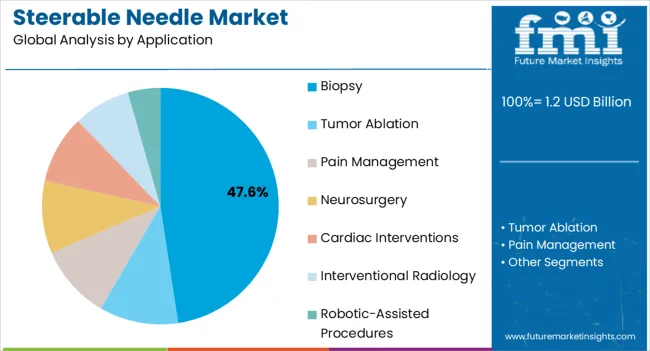

The biopsy segment is expected to capture 47.60% of total market revenue by 2025 within the application category, making it the most prominent segment. This dominance is attributed to the rising prevalence of cancer and other chronic conditions requiring early and accurate tissue diagnosis.

Steerable needles enable precise targeting of small or difficult to reach lesions, improving diagnostic accuracy and reducing patient risk.

Growing reliance on image guided biopsies and the rising need for minimally invasive diagnostic techniques have reinforced the leadership of this segment.

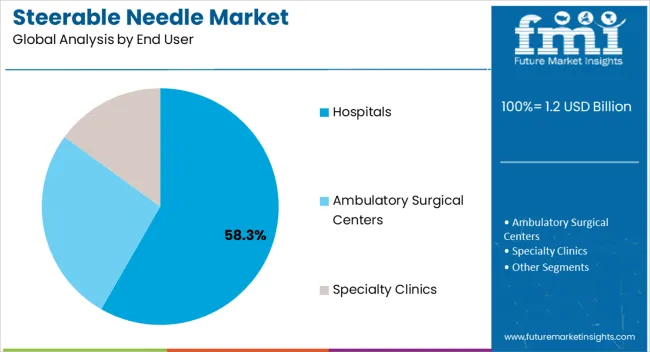

The hospitals segment is projected to contribute 58.30% of overall market revenue by 2025 within the end user category, positioning it as the largest segment. This is driven by the concentration of advanced diagnostic and therapeutic infrastructure in hospitals and the availability of skilled healthcare professionals to perform complex procedures.

The growing number of hospital based minimally invasive interventions and investments in robotic and image guided systems have further supported adoption.

Hospitals continue to be the primary setting for deploying steerable needles, ensuring patient access to advanced diagnostic and therapeutic care.

From 2020 to 2025, the global steerable needle market experienced a CAGR of 5.7%, reaching a market size of USD 1.2 billion in 2025.

Worldwide, there is a significant shift toward minimally invasive procedures. Steerable needles allow practitioners to perform precise and targeted interventions while causing minimum tissue damage, reducing patient discomfort, and allowing for shorter recovery times. As a result, demand for steerable needles is projected to rise as medical professionals seek to provide patients with minimally invasive alternatives.

Personalized medicine, in which therapies are tailored to specific patients, is gaining popularity. Steerable needles enable targeted drug delivery and precise interventions based on individual patient characteristics. The demand for steerable needles is projected to rise as personalized treatment becomes more common.

Future Forecast for Steerable Needle Industry:

Looking ahead, the global steerable needle market is expected to rise at a CAGR of 6.9% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 2.4 billion by 2035.

The steerable needle market is seeing growth opportunities in developing regions such as Asia-Pacific and Latin America. These regions are undergoing tremendous economic development, as well as improvements in healthcare infrastructure and increased investments in healthcare technologies. Steerable needles are predicted to become more popular in these markets as access to modern medical technologies improves.

Steerable needles are in demand due to technological improvements such as robotic-assisted steering mechanisms, real-time imaging guiding, and sensor-enabled navigation systems. These developments improve the precision, accuracy, and safety of needle-based operations, resulting in increased utilization by healthcare practitioners.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 2.4.0 million |

| CAGR % 2025 to End of Forecast (2035) | 7.0% |

The steerable needle market in the United States is expected to reach a market size of USD 2.4.0 million by 2035, expanding at a CAGR of 7.0%. In the USA, the market expansion is fueled by factors such as the increasing adoption of minimally invasive procedures, a rising incidence of chronic diseases, advancements in needle technology, and a growing emphasis on personalized medicine. Also, the aging population and investments in healthcare infrastructure contribute to the market's growth.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 116.3 million |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The steerable needle market in the United Kingdom is expected to reach a market value of USD 116.3 million, expanding at a CAGR of 7.2% during the forecast period. The market in the UK is expected to witness significant growth in the coming years. The UK's focus on healthcare advancements, investments in research and development, and the availability of advanced healthcare infrastructure contribute to the market's expansion. The market is poised to benefit from the increasing demand for precise and targeted interventions, driving the growth of the steerable needle market in the UK.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 147.8 million |

| CAGR % 2025 to End of Forecast (2035) | 7.6% |

The steerable needle market in China is anticipated to reach a market size of USD 147.8 million by the end of 2035, growing at a CAGR of 7.6% throughout the forecast period. With rising income levels and increased awareness of advanced healthcare technologies, the demand for precise and targeted interventions is growing in China. Patients are seeking high-quality medical treatments, leading to increased adoption of steerable needles by healthcare providers to meet the rising demand.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 107.6 million |

| CAGR % 2025 to End of Forecast (2035) | 7.5% |

The steerable needle market in Japan is estimated to reach a market size of USD 107.6 million by 2035, expected to thrive at a CAGR of 7.5%. Japan boasts a robust healthcare infrastructure, with well-equipped hospitals, research institutes, and skilled healthcare professionals. The presence of advanced healthcare facilities and a highly trained medical workforce supports the adoption of advanced medical devices like steerable needles. The strong healthcare infrastructure acts as a catalyst for market growth.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 121.9 million |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The steerable needle market in South Korea is expected to reach a market size of USD 121.9 million, expanding at a CAGR of 7.2% during the forecast period. South Korea has witnessed an increasing preference for minimally invasive procedures across various medical specialties. Steerable needles are essential tools in performing precise and targeted interventions with minimal tissue disruption, reduced patient discomfort, and faster recovery times. The rising demand for minimally invasive procedures has led to an increased adoption of steerable needles in the country.

Based on products, bevel-tip flexible needles dominated the category withholding the significant share of the market at around 38.9% at the end of 2025. Bevel-tip flexible needles are designed with a flexible shaft that allows for greater maneuverability and navigation through complex anatomical structures.

Over time, surgeons have become accustomed to using bevel-tip flexible needles due to their widespread availability and advantages. Familiarity and positive experiences with these needles lead to their continued adoption in the field.

Based on application, biopsy segment has led the category withholding about 24.5% of the total market share. Steerable needles enable a minimally invasive approach to biopsies. Compared to traditional open surgical procedures, steerable needles can be inserted through small incisions or even percutaneously, resulting in less tissue trauma, reduced scarring, shorter recovery times, and lower risks of complications.

The hospitals have led the steerable needle market as the leading end user with the market share of 59.4% in 2025. Hospitals are full-service medical facilities that offer a wide range of medical services, including diagnostic tests. They have the infrastructure, technology, and competence to provide a wide range of diagnostic tests, treatments and services, which demands the need for needles, including steerable needles.

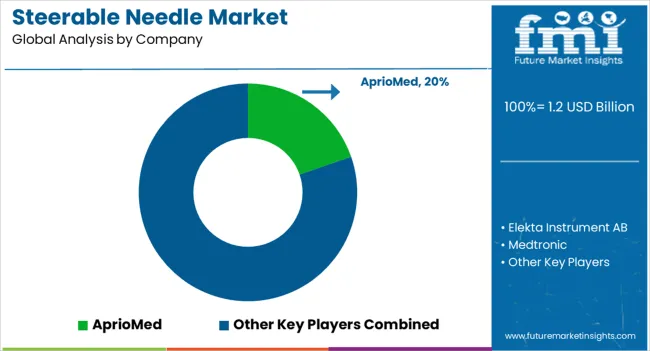

The steerable needle market has undergone market consolidation, with key players establishing and vying to maintain their competitive edge. Key players in the steerable needle industry are using certain strategies to stay competitive, such as differentiating their offerings, and adapting to evolving market dynamics. Continuous innovation, strong partnerships, regulatory compliance, and strategic market expansion.

Key Strategies Used by the Participants

Product Innovation

Key players continuously invest in research and development to introduce innovative products. They strive to develop assays with improved sensitivity, specificity, accuracy, and ease of use.

Strategic Partnerships and Collaborations

Key players often form strategic partnerships and collaborations with other companies, research institutions, and healthcare organizations. These partnerships can lead to knowledge sharing, joint product development, and expanded market reach.

Expansion into Emerging Markets

Expanding into emerging markets with growing healthcare infrastructure and rising demand for steerable needles allows companies to tap into new opportunities and gain a competitive edge.

Mergers and Acquisitions

Companies in the market may engage in mergers or acquisitions to streamline their product portfolio, obtain new technologies, enter new market niches, and gain access to novel products or intellectual property.

Key Developments in the Steerable Needle Market

The global steerable needle market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the steerable needle market is projected to reach USD 2.4 billion by 2035.

The steerable needle market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in steerable needle market are bevel-tip flexible needles, symmetric-tip needles and tendonactuated tips.

In terms of application, biopsy segment to command 47.6% share in the steerable needle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rotary Steerable System Market

Needle Gripper Market Size and Share Forecast Outlook 2025 to 2035

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injection System Market Size and Share Forecast Outlook 2025 to 2035

Needle Coke Market Size and Share Forecast Outlook 2025 to 2035

Needleloom Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Needle Nose Pliers Market Size and Share Forecast Outlook 2025 to 2035

Needle Destroyer Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

Pen Needles Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Suture Needles Market Size and Share Forecast Outlook 2025 to 2035

Tattoo Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

High Flow Needle Sets Market

Disposable Needle Guides Market

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Retractable Needles Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA