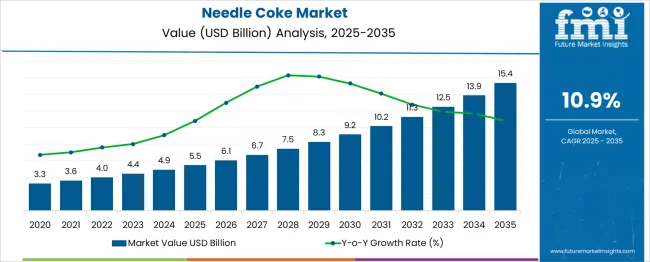

The global needle coke market is anticipated to reach from USD 5.4 billion in 2025 to approximately USD 15.39 billion by 2035, recording an absolute increase of USD 9.99 billion over the forecast period. This translates into a total growth of 185.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.9% between 2025 and 2035. The market size is expected to grow by nearly 2.85X during the same period, supported by the rising demand for electric arc furnace steel production and increasing adoption of graphite electrodes in the steel manufacturing industry.

Quick Stats for Needle Coke Market

Between 2025 and 2030, the needle coke market is projected to expand from USD 5.4 billion to USD 9.3 billion, resulting in a value increase of USD 3.9 billion, which represents 39.0% of the total forecast growth for the decade. This phase of growth will be shaped by increasing electric arc furnace steel production capacity, rising demand for ultra-high power graphite electrodes, and expanding aluminum smelting operations requiring high-quality carbon materials. Steel manufacturers are investing in advanced electrode technologies to improve energy efficiency and production quality in electric arc furnace operations.

From 2030 to 2035, the market is forecast to grow from USD 9.3 billion to USD 15.39 billion, adding another USD 6.09 billion, which constitutes 61.0% of the ten-year expansion. This period is expected to be characterized by technological advancement in needle coke production processes, the development of premium-grade materials for specialized applications, and increasing adoption in emerging economies. The growing demand for high-performance carbon materials in lithium-ion battery anodes and nuclear reactor components will drive market expansion beyond traditional steel industry applications.

Between 2020 and 2025, the needle coke market experienced substantial growth driven by global steel production recovery, increasing electric arc furnace adoption rates, and growing demand for specialty carbon materials in emerging applications. The market development was supported by capacity expansions from major producers and technological improvements in coking processes that enhanced product quality and production efficiency.

| Metric | Value |

| Needle Coke Market Value (2025) | USD 5.4 billion |

| Needle Coke Market Forecast Value (2035) | USD 15.39 billion |

| Needle Coke Market Forecast CAGR | 10.9% |

Market expansion is being supported by the increasing adoption of electric arc furnace technology in steel production and the corresponding demand for ultra-high power graphite electrodes requiring premium needle coke feedstock. Steel manufacturers are transitioning toward electric arc furnace production methods due to their environmental advantages and operational flexibility compared to traditional blast furnace operations. This technological shift requires high-quality needle coke materials that can withstand extreme temperatures and provide superior electrical conductivity for efficient steel production processes.

The growing emphasis on steel production methods and carbon emission reduction initiatives is driving demand for electric arc furnace technology and associated needle coke requirements. Electric arc furnaces produce steel using recycled scrap metal with significantly lower carbon emissions compared to integrated steel mills, creating strong demand for premium electrode materials. The expanding aluminum smelting operations and emerging applications in lithium-ion battery production are creating new market opportunities for specialized needle coke grades.

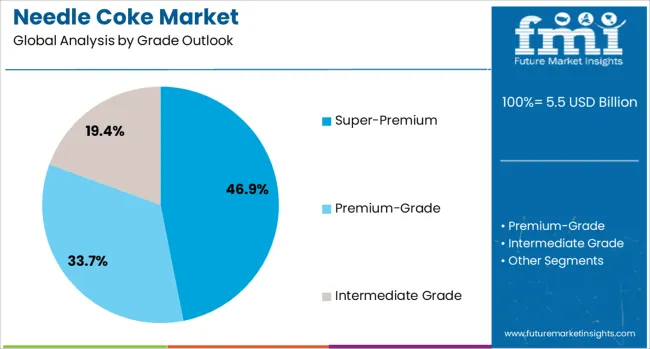

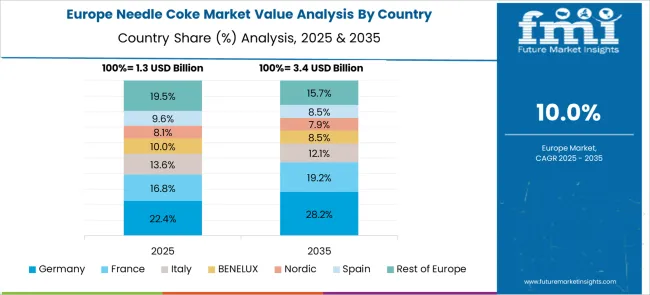

The market is segmented by grade, application, and region. By grade, the market is divided into super-premium, premium-grade, and intermediate grade. Based on application, the market is categorized into electrode, silicon metals & ferroalloys, carbon black, rubber compounds, and others. Regionally, the market is divided into China, India, Germany, France, UK, USA, and Brazil.

Super-Premium grade is projected to account for 46.9% of the needle coke market in 2025. This leading share is supported by the growing demand for ultra-high power graphite electrodes in electric arc furnace steel production and the superior performance characteristics of super-premium needle coke materials. Super-premium grade provides exceptional thermal conductivity, low thermal expansion, and superior structural integrity required for demanding steel production applications. The segment benefits from increasing steel manufacturer requirements for high-efficiency electrode materials that reduce production costs and improve operational performance.

Electrode applications are expected to represent 65.1% of needle coke demand in 2025. This dominant share reflects the critical role of needle coke in graphite electrode manufacturing for electric arc furnace steel production and the expanding adoption of electric arc furnace technology worldwide. Modern steel production increasingly relies on electric arc furnaces that require high-performance graphite electrodes manufactured from premium needle coke materials. The segment benefits from global steel industry growth, increasing electric arc furnace capacity, and technological advancement in electrode manufacturing processes.

The needle coke market is advancing steadily due to increasing electric arc furnace steel production and growing demand for high-performance carbon materials across various industrial applications. The market faces challenges including high production costs, limited manufacturing capacity, and complex quality control requirements for premium-grade materials. Environmental regulations and raw material supply constraints continue to influence production operations and market development patterns.

The growing implementation of advanced coking technologies is enabling improved product quality, enhanced production efficiency, and reduced environmental impact in needle coke manufacturing operations. Modern production facilities incorporate sophisticated temperature control systems, automated quality monitoring, and optimized feedstock processing that deliver consistent material properties and superior performance characteristics. These technological improvements support the development of specialized needle coke grades for emerging applications while maintaining cost-effectiveness and production scalability.

Global steel manufacturers are increasingly investing in electric arc furnace technology to reduce carbon emissions, improve production flexibility, and utilize recycled steel scrap materials more effectively. Electric arc furnace operations require ultra-high power graphite electrodes manufactured from premium needle coke, creating steady demand growth for high-quality carbon materials. This transition toward more steel production methods is driving long-term market expansion and supporting capacity investments from needle coke producers.

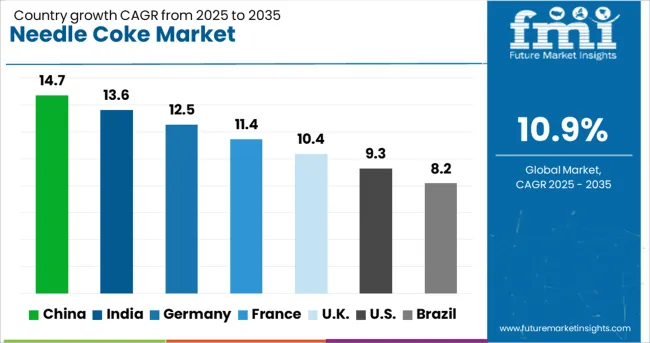

| Country | CAGR (2025-2035) |

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| France | 11.4% |

| UK | 10.3% |

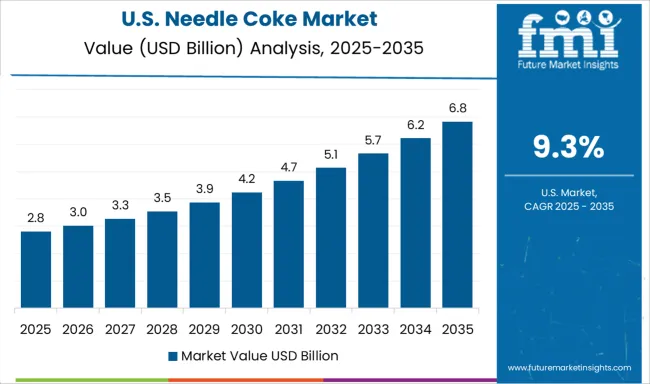

| USA | 9.3% |

| Brazil | 8.1% |

The needle coke market demonstrates varied growth patterns across key countries, with China leading at a 14.7% CAGR through 2035, driven by massive steel production capacity expansion, electric arc furnace technology adoption, and government initiatives supporting green manufacturing practices. India follows at 13.6%, supported by rapid industrialization, infrastructure development programs, and increasing steel consumption. Germany maintains strong growth at 12.5%, emphasizing high-quality specialty applications and advanced manufacturing technologies. France advances at 11.4%, focusing on premium-grade materials and innovative production processes. The UK grows at 10.3%, driven by steel industry modernization and environmental compliance requirements. The USA shows steady expansion at 9.2%, supported by infrastructure investment and manufacturing recovery programs. Brazil records solid growth at 8.1%, benefiting from regional steel industry development and increasing industrial activity.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from needle coke in China is projected to exhibit the highest growth rate with a CAGR of 14.7% through 2035, driven by massive expansion in electric arc furnace steel production capacity and aggressive adoption of green manufacturing technologies. The country's steel industry modernization programs prioritize energy efficiency and environmental compliance, creating substantial demand for premium needle coke materials. Major steel manufacturers are investing in ultra-high power graphite electrode technologies that require superior-grade needle coke feedstock, while government policies support the transition from traditional blast furnace operations to more environmentally friendly electric arc furnace production methods.

Revenue from needle coke in India is expanding at a CAGR of 13.6%, supported by rapid industrial development, infrastructure construction programs, and increasing steel consumption across automotive and construction sectors. The country's growing manufacturing base requires expanded steel production capacity, driving demand for electric arc furnace technology and associated needle coke requirements. Steel manufacturers are modernizing production facilities with advanced electrode systems that utilize premium needle coke materials to improve operational efficiency and reduce environmental impact.

Demand for needle coke in Germany is projected to grow at a CAGR of 12.5%, supported by the country's emphasis on precision manufacturing, advanced materials technology, and specialized industrial applications. German manufacturers focus on premium-grade needle coke materials for high-performance electrodes and specialty carbon products that serve demanding industrial applications. The market is characterized by technological innovation, stringent quality standards, and development of advanced needle coke processing capabilities.

Demand for needle coke in France is expanding at a CAGR of 11.4%, driven by increasing focus on premium-grade materials, manufacturing practices, and advanced industrial applications. French manufacturers emphasize high-quality needle coke production and specialized carbon materials that serve demanding automotive and aerospace applications. The market benefits from technological innovation, environmental compliance requirements, and growing demand for high-performance carbon materials.

Demand for needle coke in the UK is projected to grow at a CAGR of 10.3%, driven by steel industry modernization programs, environmental compliance requirements, and increasing adoption of electric arc furnace technology. British steel manufacturers are investing in advanced production capabilities that require premium needle coke materials for high-efficiency electrode applications. The market is supported by government initiatives promoting green manufacturing and industrial competitiveness.

Demand for needle coke in the USA is expanding at a CAGR of 9.3%, supported by infrastructure investment programs, manufacturing sector recovery, and increasing adoption of eco-friendly steel production methods. American steel manufacturers are modernizing production facilities with electric arc furnace technology that requires high-quality needle coke for electrode manufacturing. The market benefits from government support for domestic manufacturing and infrastructure development programs.

Demand for needle coke in Brazil is projected to grow at a CAGR of 8.1%, driven by regional steel industry development, increasing industrial activity, and expanding manufacturing base. Brazilian steel manufacturers are gradually adopting electric arc furnace technology and modern electrode systems that require premium needle coke materials. The market is supported by economic growth, infrastructure development, and increasing domestic demand for steel products.

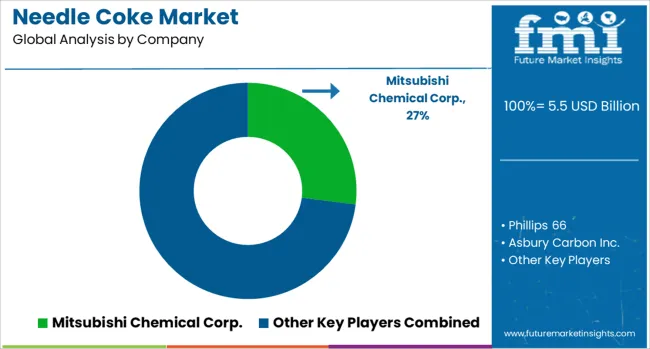

The needle coke market is defined by competition among specialized carbon materials producers, integrated oil and gas companies, and steel industry suppliers. Companies are investing in advanced production technologies, capacity expansion programs, quality improvement initiatives, and strategic partnerships to deliver high-performance needle coke materials that meet demanding industrial requirements. Technological innovation, production efficiency, and geographic expansion are central to strengthening market positions and supporting customer requirements.

Mitsubishi Chemical Corporation, Japan-based, offers high-quality needle coke materials with focus on precision manufacturing, advanced processing technologies, and comprehensive quality control systems. Phillips 66, USA, provides integrated needle coke production with emphasis on operational efficiency, supply chain optimization, and customer service excellence. Asbury Carbons, Inc., USA, delivers specialized carbon materials with advanced processing capabilities and customized solutions. Seadrift Coke L.P., USA, focuses on premium-grade needle coke production and consistent quality delivery. Sumitomo Chemical Company, Japan, emphasizes technological innovation and advanced materials development for demanding applications.

ENEOS Holdings, Inc., Japan, provides integrated production capabilities and comprehensive supply chain management. Indian Oil Corporation Limited, India, offers regional production capacity and domestic market expertise. GrafTech International, USA, delivers specialized electrode materials and technical support services. C-Chem Co., Ltd., Japan, focuses on trading and distribution capabilities. Baosteel Group provides regional production expertise and market development capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Grade Outlook | Super-Premium, Premium-Grade, Intermediate Grade |

| Application Outlook | Electrode, Silicon Metals & Ferroalloys, Carbon Black, Rubber Compounds, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Key Companies Profiled | Mitsubishi Chemical Corporation, Phillips 66, Asbury Carbons Inc, Seadrift Coke LP, Sumitomo Chemical Company, ENEOS Holdings Inc, Indian Oil Corporation Limited, GrafTech International, C-Chem Co Ltd, Baosteel Group |

| Additional Attributes | Dollar sales by grade and application, regional demand trends across key countries, competitive landscape with established producers and emerging market entrants, buyer preferences for premium versus standard grade materials, integration with steel production planning and electrode manufacturing processes, innovations in production technologies and quality control systems, and adoption of green manufacturing practices with enhanced environmental compliance and operational efficiency. |

Grade

Application

Region

The global needle coke market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the needle coke market is projected to reach USD 15.4 billion by 2035.

The needle coke market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in needle coke market are super-premium, premium-grade and intermediate grade.

In terms of application outlook , electrode segment to command 65.1% share in the needle coke market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Needle Gripper Market Size and Share Forecast Outlook 2025 to 2035

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injection System Market Size and Share Forecast Outlook 2025 to 2035

Needleloom Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Needle Nose Pliers Market Size and Share Forecast Outlook 2025 to 2035

Needle Destroyer Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

Jet Needle-free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Pen Needles Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Pitch Coke Market Size and Share Forecast Outlook 2025 to 2035

Suture Needles Market Size and Share Forecast Outlook 2025 to 2035

Tattoo Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Steerable Needle Market Size and Share Forecast Outlook 2025 to 2035

High Flow Needle Sets Market

Disposable Needle Guides Market

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA