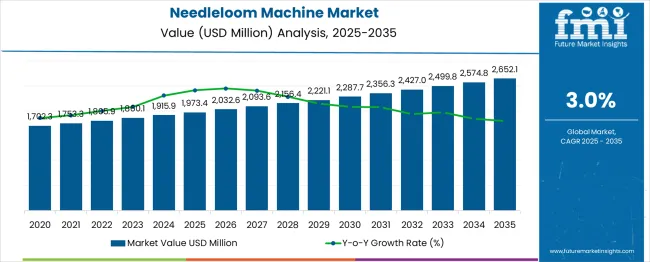

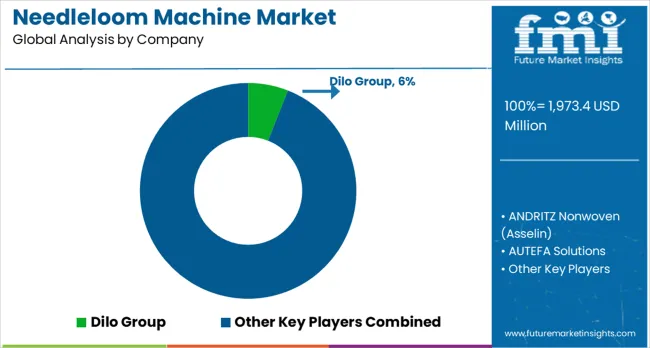

The global needleloom machine market is projected to grow from USD 1,973.4 million in 2025 to approximately USD 2,652.1 million by 2035, recording an absolute increase of USD 678.8 million over the forecast period. This translates into a total growth of 34.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.34X during the same period, supported by the rising demand for nonwoven textiles and increasing applications across automotive, filtration, and geotextile sectors.

Between 2025 and 2030, the needleloom machine market is projected to expand from USD 1,973.4 million to USD 2,287.8 million, resulting in a value increase of USD 314.4 million, which represents 46.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for technical textiles in automotive applications, increasing adoption of geotextiles for infrastructure projects, and growing awareness of sustainable filtration solutions. Manufacturers are expanding their production capabilities to address the growing complexity of modern nonwoven applications and specialized textile requirements.

From 2030 to 2035, the market is forecast to grow from USD 2,287.8 million to USD 2,652.1 million, adding another USD 364.4 million, which constitutes 53.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of high-speed automation technologies, integration of advanced servo systems, and development of specialized needleloom configurations for emerging applications. The growing adoption of technical textiles in construction and automotive industries will drive demand for more sophisticated needleloom machines with enhanced precision and productivity.

Between 2020 and 2025, the needleloom machine market experienced steady expansion from USD 1,756.1 million to USD 1,973.4 million, driven by increasing demand for nonwoven textiles and growing applications in automotive interiors and filtration media. The market developed as textile manufacturers recognized the need for specialized needlepunching equipment to meet quality standards in technical textile applications. Automotive industry requirements and infrastructure development projects began emphasizing advanced nonwoven materials, driving adoption of modern needleloom technologies.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,973.4 million |

| Forecast Value in (2035F) | USD 2,652.1 million |

| Forecast CAGR (2025 to 2035) | 3.0% |

Market expansion is being supported by the rapid increase in demand for nonwoven textiles across multiple industries and the corresponding need for advanced needlepunching technologies. Modern manufacturing processes rely on precise fiber entanglement and controlled density distribution to ensure optimal product performance in applications including automotive interiors, geotextiles, and filtration media. Even minor improvements in needleloom technology can significantly enhance product quality and manufacturing efficiency.

The growing complexity of nonwoven applications and increasing quality requirements are driving demand for advanced needleloom machines from certified manufacturers with appropriate technology and expertise. Automotive manufacturers are increasingly requiring specific textile properties and performance standards that necessitate precise needlepunching processes. Regulatory requirements and industry specifications are establishing standardized production procedures that require specialized equipment and trained operators.

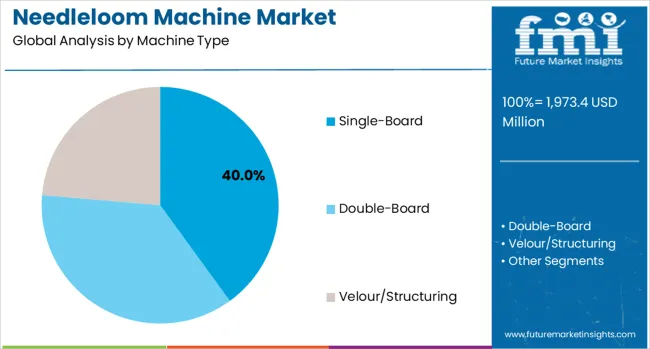

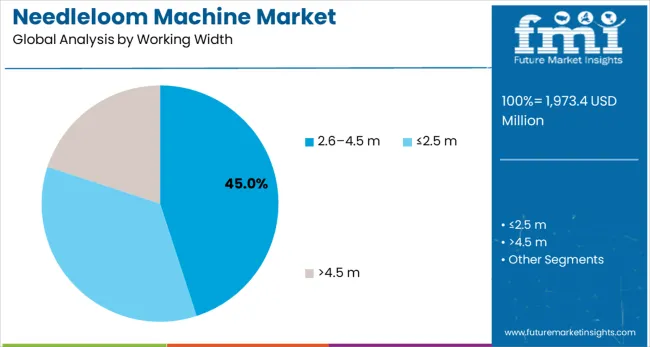

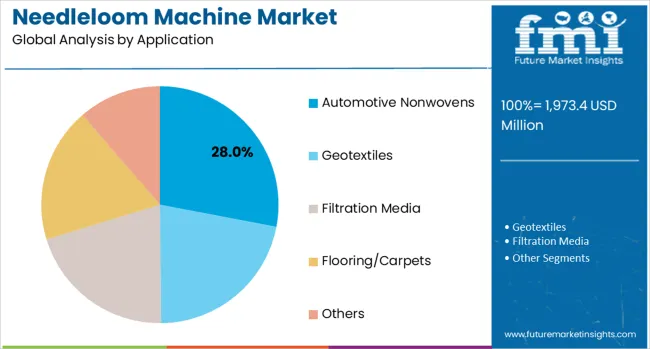

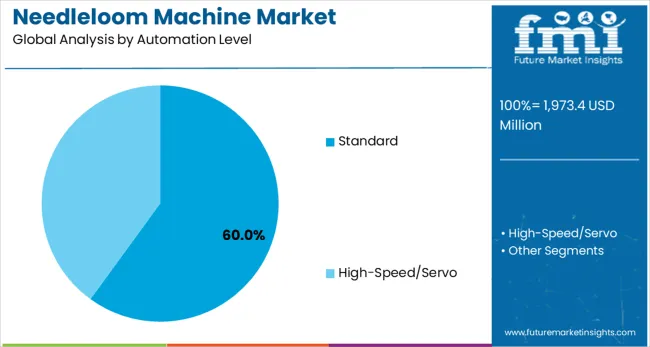

The market is segmented by machine type, working width, application, automation level, and region. By machine type, the market is divided into single-board, double-board, and velour/structuring machines. Based on working width, the market is categorized into ≤2.5 m, 2.6-4.5 m, and >4.5 m segments. In terms of application, the market is segmented into automotive nonwovens, geotextiles, filtration media, flooring/carpets, and others. By automation level, the market is classified into standard and high-speed/servo systems. Regionally, the market is analyzed across major manufacturing and consumption centers globally.

The single-board machine segment is projected to account for 40% of the global needleloom market in 2025, making it the leading configuration type. Single-board systems are widely adopted for standard nonwoven production, especially in medium-density applications where cost efficiency and operational reliability are key. They provide effective fiber entanglement while maintaining moderate energy consumption, making them particularly well-suited for applications in automotive interiors and general-purpose filtration media.

This segment benefits from established manufacturing processes and widespread supplier availability, which reduce procurement costs and ensure consistent performance. For many manufacturers, single-board machines strike the right balance between productivity and affordability, making them the default choice for high-volume production environments. Their broad compatibility with different fiber types and process requirements further reinforces their dominance in the global needleloom machine market.

The 2.6-4.5 m working width segment is expected to represent 45% of needleloom machine demand in 2025, reflecting its suitability as the most versatile size class. Machines in this width range offer an optimal compromise between throughput capacity and material flexibility, enabling manufacturers to address diverse end-use markets with standardized setups. This makes them highly attractive for applications in automotive, geotextiles, and filtration industries.

These widths align with common roll sizes, ensuring efficient material utilization while minimizing waste. Manufacturers benefit from the ability to balance high production efficiency with manageable capital costs, making this range the most practical for large-scale adoption. With growing demand for flexible equipment that can handle multiple nonwoven product formats, the 2.6–4.5 m working width machines remain the market’s dominant segment.

The automotive nonwovens segment is projected to contribute 28% of the global needleloom machine market in 2025, establishing itself as the largest application area. Needlepunched fabrics are critical in vehicle interiors, including carpet systems, trunk liners, underbody protection, and acoustic insulation components. The process delivers precise fiber distribution and controlled density profiles, which are essential for meeting automotive performance requirements.

This segment is supported by rising global vehicle production and increasing consumer expectations for interior comfort, noise reduction, and durability. Automakers also favor lightweight nonwoven materials for their role in improving fuel efficiency and supporting electric vehicle designs. These drivers ensure that the automotive sector remains the most significant contributor to demand for needleloom machinery worldwide.

The standard automation level is estimated to hold 60% of the global needleloom machine market in 2025, making it the dominant segment. Conventional needleloom systems offer proven reliability and cost-effectiveness, providing adequate precision and productivity for most nonwoven applications. This makes them highly attractive to manufacturers producing for automotive, geotextile, and filtration markets.

These systems are valued for their operational simplicity, ease of maintenance, and accessible investment levels compared to advanced automation solutions. Standard machines allow manufacturers to maintain consistent quality while minimizing both capital and operating expenses. With demand for nonwovens continuing to rise globally, particularly in emerging markets, the accessibility and dependability of standard automation systems ensure their continued dominance in the industry.

The needleloom machine market is advancing steadily due to increasing demand for technical textiles and growing recognition of nonwoven material advantages. However, the market faces challenges including high capital investment requirements, need for specialized technical expertise, and varying quality standards across different application segments. Standardization efforts and automation developments continue to influence equipment capabilities and market development patterns.

The growing deployment of high-speed servo systems is enabling enhanced production rates and improved quality consistency in needlepunching operations. Advanced automation technologies provide precise needle depth control and variable penetration patterns that optimize fiber entanglement for specific applications. These systems are particularly valuable for automotive and filtration applications that require consistent quality standards and high production volumes with minimal operator intervention.

Modern needleloom manufacturers are incorporating advanced process monitoring and quality control systems that improve production efficiency and reduce material waste. Integration of real-time density monitoring and automated parameter adjustment enables more precise control over product characteristics and comprehensive production documentation. Advanced control systems also support production of specialized nonwovens including multi-layer structures and gradient density materials.

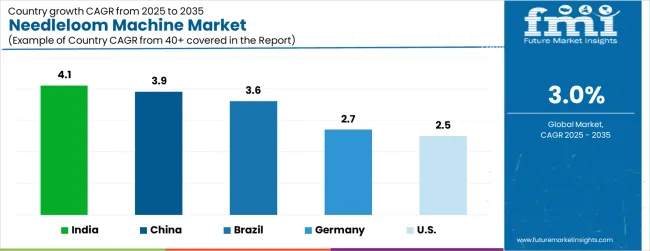

| Countries | CAGR (2025-2035) |

|---|---|

| India | 4.1% |

| China | 3.9% |

| Brazil | 3.6% |

| Germany | 2.7% |

| United States | 2.5% |

The needleloom machine market is growing rapidly, with India leading at a 4.1% CAGR through 2035, driven by expanding textile manufacturing, infrastructure development projects, and growing automotive production. China follows at 3.9%, supported by large-scale nonwoven production and increasing technical textile applications. Brazil grows steadily at 3.6%, integrating advanced needleloom technologies into its established textile industry. Germany records 2.7%, emphasizing precision engineering, quality standards, and advanced automation technologies. The USA shows growth at 2.5%, focusing on technical textile applications, automotive nonwovens, and filtration media production. Overall, India and China emerge as the leading drivers of global needleloom machine market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from needleloom machines in India is projected to exhibit the highest growth rate with a CAGR of 4.1% through 2035, driven by rapid expansion of textile manufacturing and increasing demand for technical textiles in automotive and infrastructure applications. The country's growing nonwoven industry and expanding automotive production are creating significant demand for advanced needlepunching equipment. Major textile manufacturers and automotive suppliers are establishing comprehensive production capabilities to serve domestic and export markets.

Revenue from needleloom machines in China is expanding at a CAGR of 3.9%, supported by large-scale nonwoven production and increasing integration of technical textiles in construction and automotive applications. The country's established textile manufacturing base and growing emphasis on quality improvement are driving demand for advanced needlepunching technologies. Manufacturers are gradually upgrading production capabilities to serve domestic and international markets with higher-quality nonwoven products.

Revenue from needleloom machines in Brazil is growing at a CAGR of 3.6%, driven by expanding automotive production and increasing adoption of geotextiles in infrastructure projects. The country's established textile industry is gradually integrating advanced needlepunching technologies to serve modern application requirements. Manufacturers are investing in equipment upgrades and technical capabilities to address growing domestic and regional market demand.

Demand for needleloom machines in Germany is projected to grow at a CAGR of 2.7%, supported by the country's emphasis on precision engineering and advanced automation technologies. German textile manufacturers are implementing comprehensive needlepunching capabilities that meet stringent quality standards and technical specifications. The market is characterized by focus on technological innovation, advanced equipment integration, and compliance with comprehensive quality and environmental standards.

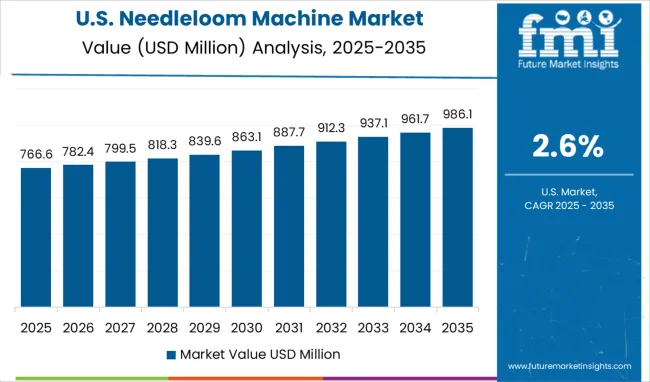

Demand for needleloom machines in the USA is expanding at a CAGR of 2.6%, driven by increasing technical textile applications and growing emphasis on quality standardization across automotive and filtration sectors. Large manufacturers and specialized producers are establishing comprehensive needlepunching capabilities to serve diverse application requirements. The market benefits from automotive industry quality requirements and environmental regulations that drive demand for advanced nonwoven materials.

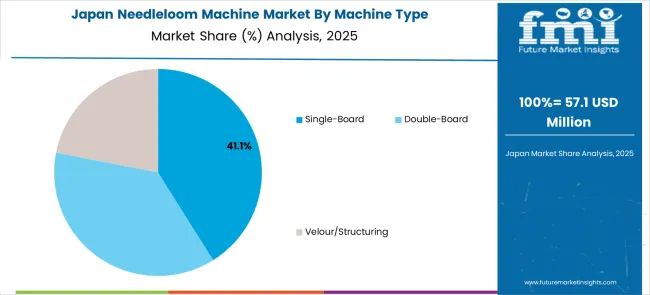

The global needleloom machine market is witnessing notable segmentation by machine type, with the single-board segment leading at 41.1% of total market share, equivalent to nearly USD 789 million out of the overall USD 1,973.4 million valuation. Double-board and velour/structuring machines follow as key categories, together comprising the remaining 60% of the market. The dominance of single-board machines highlights their widespread adoption due to cost efficiency and operational simplicity, while demand for double-board and structuring machines continues to rise in applications requiring enhanced fabric texture and durability.

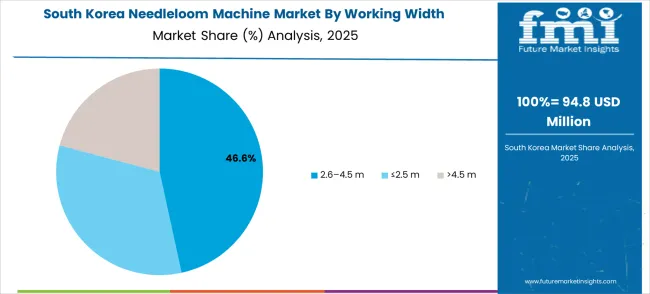

In South Korea, the market is characterized by diverse working width requirements, with ≤2.5 m machines holding a 46.6% share in 2025, primarily serving specialized automotive and electronics applications. The 2.6-4.5 m segment accounts for 35%, supporting standard geotextile and construction applications. Machines >4.5 m contribute 15%, focused on large-scale industrial and infrastructure projects that require wide-width nonwoven production.

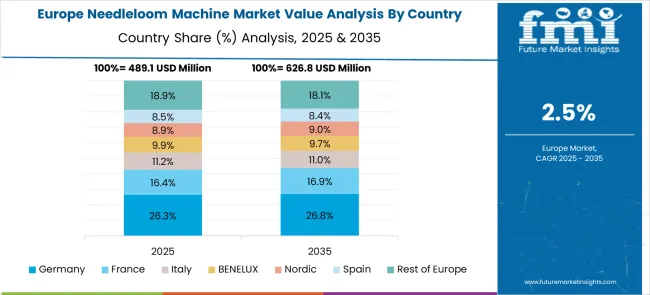

The European needleloom machine market demonstrates sophisticated development across major economies with Germany leading through its advanced textile machinery manufacturing capabilities and engineering expertise, supported by companies like Trützschler Nonwovens and Dilo Group pioneering innovative needlepunching technologies for diverse nonwoven applications. Austria shows significant strength through ANDRITZ Nonwoven (Asselin) and Fehrer (ANDRITZ), leveraging extensive experience in nonwoven machinery and process optimization solutions. France contributes through NSC Groupe (Thibeau), while Italy exhibits excellence through Ramina S.p.A. in specialized textile machinery manufacturing.

Spain and other European regions show expanding adoption in automotive and technical textile applications, driven by industry growth and quality improvement requirements. The market benefits from strict quality standards, advanced automation integration, and the region's leadership in textile machinery technology, positioning Europe as a key innovation center for next-generation needleloom solutions across automotive textiles, geotextiles, and technical applications requiring advanced fiber entanglement, precision control, and high-performance nonwoven production capabilities supporting diverse industrial and consumer applications worldwide.

The needleloom machine market is defined by competition among specialized equipment manufacturers, technology providers, and engineering companies. Companies are investing in advanced needlepunching technologies, automation systems, process optimization, and technical support services to deliver precise, reliable, and cost-effective needleloom solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

ANDRITZ Nonwoven (Asselin), Austria-based, offers comprehensive needleloom solutions with focus on precision, reliability, and technical expertise. AUTEFA Solutions, Germany, provides advanced needlepunching technologies integrated with process optimization and automation systems. Dilo Group, Germany, delivers technologically sophisticated needleloom equipment with standardized procedures and digital integration. Fehrer (ANDRITZ), Austria, emphasizes specialized needlepunching solutions and comprehensive technical support.

Trützschler Nonwovens, Germany, offers advanced needleloom systems with focus on automation and process control. Changshu Feilong Nonwoven and Jiangsu Yingyang Nonwoven, China, provide cost-effective solutions with growing technical capabilities. NSC Groupe (Thibeau), France, delivers specialized European engineering with comprehensive service support. Qingdao Hongda, China, and Ramina S.p.A., Italy, offer regional expertise and specialized needleloom configurations for specific applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,973.4 million |

| Machine Type | Single-Board, Double-Board, Velour/Structuring |

| Working Width | ≤2.5 m, 2.6–4.5 m, >4.5 m |

| Application | Automotive Nonwovens, Geotextiles, Filtration Media, Flooring/Carpets, Others |

| Automation Level | Standard, High-Speed/Servo |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, India, Australia and 40+ countries |

| Key Companies Profiled | ANDRITZ Nonwoven (Asselin), AUTEFA Solutions, Changshu Feilong Nonwoven, Dilo Group, Fehrer (ANDRITZ), Jiangsu Yingyang Nonwoven, NSC Groupe (Thibeau), Qingdao Hongda, Ramina S.p.A., and Trützschler Nonwovens |

| Additional Attributes | Dollar sales by machine width and needle density, regional demand trends, competitive landscape, buyer preferences for standard versus custom configurations, integration with automated textile production, innovations in high-speed needling, energy efficiency, and durable component design |

The global needleloom machine market is estimated to be valued at USD 1,973.4 million in 2025.

The market size for the needleloom machine market is projected to reach USD 2,652.1 million by 2035.

The needleloom machine market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in needleloom machine market are single-board, double-board and velour/structuring.

In terms of working width, 2.6–4.5 m segment to command 45.0% share in the needleloom machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Machine Learning As A Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA