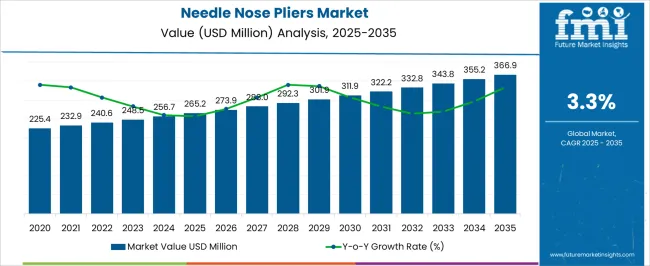

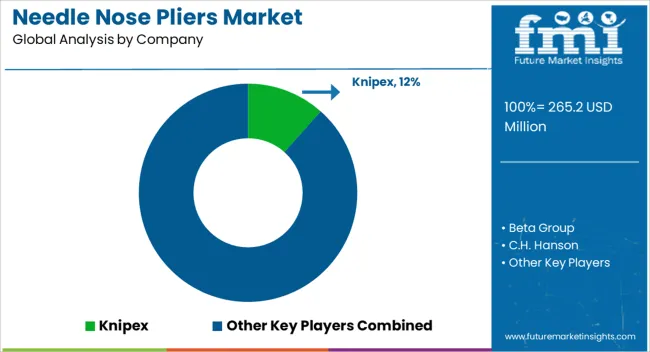

The needle nose pliers market is estimated to be valued at USD 265.2 million in 2025 and is projected to reach USD 366.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

This growth represents an absolute dollar opportunity of USD 101.7 million over the decade. Starting at USD 225.4 million in the early years, the market experiences steady expansion, reaching USD 311.9 million by 2030. For companies in hand tools and hardware sectors, this growth indicates consistent revenue potential. By aligning production, distribution, and sales strategies with market trends, businesses can capture incremental value and strengthen their position in the gradually expanding needle nose pliers market. The absolute dollar opportunity from 2025 to 2035 highlights consistent annual gains, with the market rising from USD 265.2 million to USD 366.9 million over the decade.

Incremental growth moves from USD 273.9 million in 2026 to USD 355.2 million in 2034, culminating at USD 366.9 million in 2035. This predictable expansion allows companies to plan capacity, partnerships, and marketing strategies effectively. Capturing market share during this period ensures meaningful revenue gains while reducing investment risk. Companies entering or scaling operations can maximize returns in the evolving needle nose pliers market.

| Metric | Value |

|---|---|

| Needle Nose Pliers Market Estimated Value in (2025 E) | USD 265.2 million |

| Needle Nose Pliers Market Forecast Value in (2035 F) | USD 366.9 million |

| Forecast CAGR (2025 to 2035) | 3.3% |

A breakpoint analysis of the needle nose pliers market highlights periods of steady and moderately accelerated growth. From 2025 to 2028, the market grows from USD 265.2 million to USD 283.0 million, with annual increments of around USD 6–7 million. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and evaluate demand trends. Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test marketing and distribution strategies, and build market presence. Early engagement during this period provides a foundation for capturing higher-value opportunities as the market continues to expand steadily in subsequent years.

The next breakpoint occurs between 2030 and 2035, as the market expands from USD 311.9 million to USD 366.9 million, reflecting larger annual increments averaging USD 10–12 million. This stage represents accelerated growth and meaningful absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture significant revenue gains while strengthening competitive positioning. Understanding these breakpoints helps stakeholders plan investments, production, and expansion strategies to maximize returns in the evolving needle nose pliers market.

The needle nose pliers market is experiencing steady expansion, fueled by growing demand across electrical, mechanical, and precision engineering applications. Industry updates and manufacturing sector reports have noted increased adoption in both professional and DIY toolkits due to their versatility in gripping, bending, and cutting tasks.

Product innovation, such as improved ergonomic handles and precision-machined jaws, has enhanced tool performance and user comfort, encouraging broader usage. Expansion of the electronics and automotive repair sectors has also boosted demand, as needle nose pliers are essential for accessing confined spaces and handling small components.

Furthermore, industrial output growth in emerging economies, coupled with rising home improvement activities, has strengthened the market base. Distribution through both online and offline channels has improved accessibility, while manufacturers are offering varied material and price options to cater to different user segments. Over the forecast period, product preferences are expected to center around straight nose designs, durable carbon steel construction, and medium-priced tools that balance quality with affordability.

The needle nose pliers market is segmented by product type, material, price, end user, distribution channel, and geographic regions. By product type, needle nose pliers market is divided into straight nose and bent nose. In terms of material, needle nose pliers market is classified into carbon steel, stainless steel, forged steel, and alloy steel. Based on price, needle nose pliers market is segmented into medium, low, and high. By end user, needle nose pliers market is segmented into industrial & manufacturing, automotive, home improvement, electronics & electrical, and others (woodworking, model making etc.). By distribution channel, needle nose pliers market is segmented into indirect sales and direct sales. Regionally, the needle nose pliers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

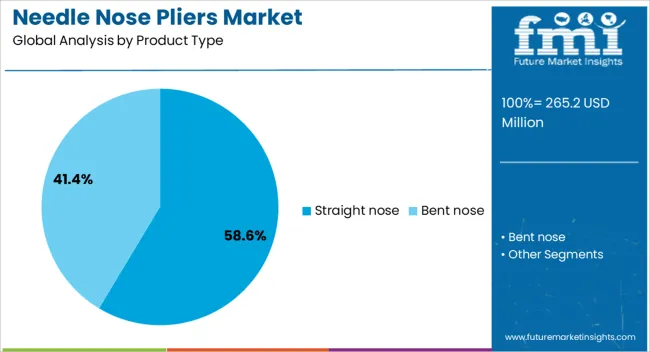

The straight nose segment is projected to hold 58.6% of the needle nose pliers market revenue in 2025, maintaining its leading position due to its widespread suitability for general-purpose applications. This dominance is supported by the segment’s versatility in handling tasks ranging from wire manipulation to component placement across electrical, automotive, and mechanical repair settings.

Manufacturing reports have indicated that straight nose pliers are preferred for their ease of alignment and consistent grip strength, enabling precise handling without damaging delicate workpieces. Additionally, their simpler jaw geometry compared to angled alternatives has made them a cost-effective option for both professional tradespeople and hobbyists.

Tool manufacturers have continued to refine straight nose designs with improved handle ergonomics, slip-resistant grips, and high-tolerance pivot joints, further reinforcing their market appeal. As demand grows for reliable, multi-purpose hand tools, the straight nose segment is expected to sustain its strong market share.

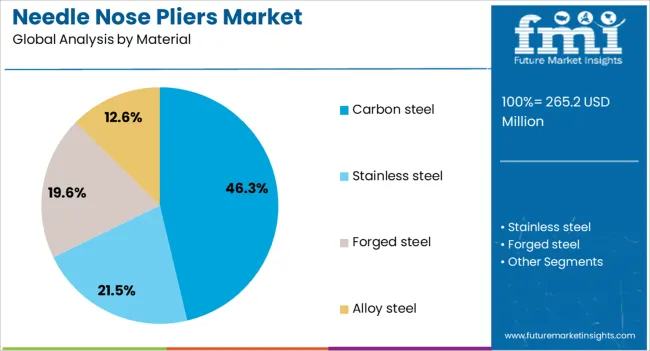

The carbon steel segment is projected to account for 46.3% of the needle nose pliers market revenue in 2025, reflecting its long-standing use in durable and cost-effective tool production. Carbon steel has been valued for its combination of strength, wear resistance, and ability to maintain jaw alignment under repeated use.

Manufacturing industry insights have shown that carbon steel pliers often undergo surface treatments such as nickel plating or black oxide coating to enhance corrosion resistance, extending their lifespan in both workshop and outdoor environments. The affordability of carbon steel compared to high-alloy or stainless steel options has also contributed to its popularity among both professional users and general consumers.

Its adaptability to mass production processes ensures consistent quality across various price points, making it a practical choice for large-scale tool manufacturing. With steady demand for dependable and budget-friendly tools, the carbon steel segment is positioned to retain a substantial share of the market.

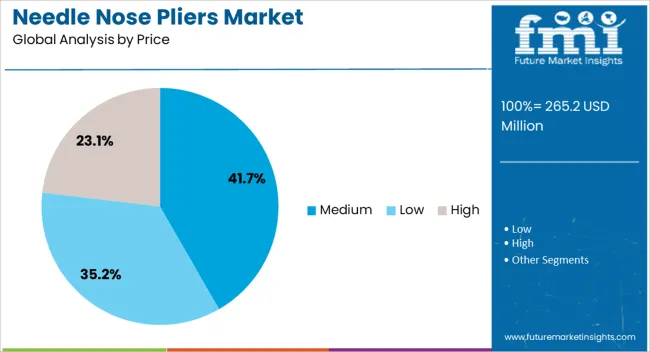

The medium price segment is projected to contribute 41.7% of the needle nose pliers market revenue in 2025, leading the price-based segmentation due to its balance between quality and affordability. Consumer purchasing trends have shown that users in this category expect durable construction, precision performance, and comfortable handling without paying premium prices.

Medium-priced needle nose pliers often incorporate professional-grade features such as cushioned grips, hardened cutting edges, and smooth pivot mechanisms, making them attractive to both tradespeople and serious DIY enthusiasts. Retail and e-commerce data have highlighted strong sales in this range, particularly for branded tools that offer warranties and quality assurances.

This segment’s appeal is further strengthened by its suitability for a broad range of applications, ensuring high utility for the investment. As price-conscious buyers continue to seek value-driven tools with professional capabilities, the medium price segment is expected to maintain its dominance in the market.

The needle nose pliers market is growing due to rising demand in electronics assembly, automotive repair, jewelry making, and industrial maintenance. North America and Europe lead in adoption of high-precision, insulated, and specialty pliers for professional applications, while Asia-Pacific shows rapid growth driven by manufacturing, DIY projects, and small-scale industrial usage. Key manufacturers differentiate through material quality, ergonomic design, and corrosion resistance. Market expansion is fueled by increased industrial automation, consumer DIY trends, and the need for durable hand tools across professional and hobbyist applications.

Needle nose pliers vary in steel grade, corrosion resistance, and finishing. Europe and North America favor high-carbon, chrome-vanadium steel pliers for industrial and professional applications, ensuring durability and long service life. In contrast, Asia-Pacific buyers often prioritize cost-effective steel options for general-purpose or small-scale usage. Differences in material quality affect gripping strength, longevity, and safety. Established global suppliers maintain consistent high-quality standards, whereas regional producers may exhibit variability in finish and hardness. These contrasts impact buyer trust, application suitability, and adoption in high-precision versus mass-market segments, influencing competitive positioning in the market.

Ergonomic handle design, grip material, and insulation influence usability and safety. European and North American markets demand ergonomic, insulated pliers for extended professional use, especially in electronics and electrical applications. Asia-Pacific markets prioritize affordability and basic comfort for industrial and DIY use. Differences in handle design impact user fatigue, safety compliance, and task efficiency. Leading manufacturers offer multi-material handles with anti-slip and insulating features, while regional producers often supply simple rubber-coated or plastic handles. Variations in handle design and ergonomics shape regional adoption patterns, professional acceptance, and market differentiation, particularly for high-end or precision tool applications.

Needle nose pliers production depends on steel sourcing, forging precision, and finishing processes. North America and Europe maintain established manufacturing facilities with quality control and consistent output, whereas Asia-Pacific relies on high-volume production with variable quality. Supply chain reliability, including raw material availability and logistics efficiency, affects delivery timelines and contract fulfillment. Manufacturers with integrated operations ensure steady supply for industrial customers, while smaller or regional producers may face delays during peak demand periods. These differences influence pricing, adoption, and long-term supplier relationships. Companies maintaining reliable production and supply gain competitive advantage, while less consistent suppliers may struggle in professional and industrial markets.

Demand for needle nose pliers differs by industry and region. Europe and North America focus on professional applications in electronics, automotive, and aerospace requiring precision, durability, and certified safety standards. Asia-Pacific growth is driven by general manufacturing, jewelry making, and DIY markets prioritizing cost-effective and versatile pliers. Differences in application requirements influence tool specifications, marketing strategies, and supplier selection. Global manufacturers provide specialized or high-precision pliers for professional sectors, whereas regional producers target bulk, general-purpose tools for industrial and consumer markets. Understanding these contrasts enables suppliers to align production, inventory, and sales strategies with regional end-use demand.

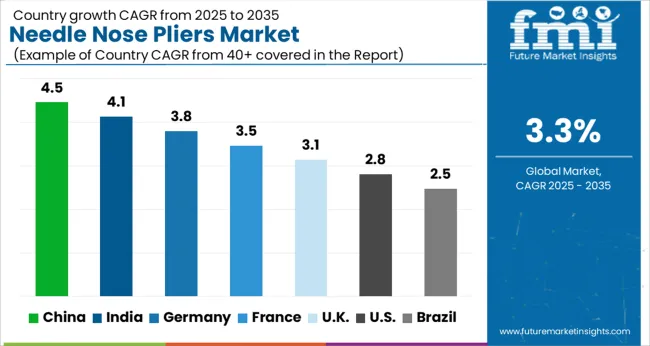

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The global needle nose pliers market was projected to grow at a 3.3% CAGR through 2035, driven by demand in electronics, electrical work, and general hardware applications. Among BRICS nations, China recorded 4.5% growth as large-scale manufacturing facilities were commissioned and compliance with quality and safety standards was enforced, while India at 4.1% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 3.8% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 3.1% relied on moderate-scale operations for electrical and hardware applications. The USA, expanding at 2.8%, remained a mature market with steady demand across industrial, residential, and professional sectors, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Needle nose pliers market in China is growing at a CAGR of 4.5%. Between 2020 and 2024, growth was driven by rising industrialization, expansion of electronics, automotive, and construction sectors, and increasing demand for precision hand tools. Domestic manufacturers focused on producing high quality, durable, and ergonomically designed pliers to meet industrial and consumer requirements. In the forecast period 2025 to 2035, growth is expected to accelerate with increasing adoption in electronics assembly, automotive maintenance, and DIY consumer markets. Technological innovation in tool design, improved materials, and ergonomic features will enhance efficiency and user comfort. China remains a leading market due to large manufacturing base, industrial demand, and growing consumer awareness of high quality tools.

Needle nose pliers market in India is growing at a CAGR of 4.1%. Historical period 2020 to 2024 saw growth supported by rising demand from electronics, automotive, and construction sectors. Manufacturers focused on providing durable, reliable, and cost effective tools. Expansion of industrial, maintenance, and DIY consumer markets created steady demand. In the forecast period 2025 to 2035, market growth is expected to continue with increased adoption in electronics assembly, electrical maintenance, and precision engineering applications. Technological improvements, material innovation, and ergonomic designs will support wider acceptance. India is projected to maintain strong growth due to expanding industrial activity and increasing awareness of high quality hand tools.

Needle nose pliers market in Germany is growing at a CAGR of 3.8%. Between 2020 and 2024, growth was supported by industrial precision requirements in automotive, electronics, and manufacturing sectors. Manufacturers focused on high quality materials, durability, and ergonomic tool design. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption in electronics assembly, industrial maintenance, and professional workshops. Technological innovation in tool coatings, precision engineering, and ergonomic designs will further support market expansion. Germany remains a key European market due to strong industrial base and focus on quality hand tools.

Needle nose pliers market in the United Kingdom is growing at a CAGR of 3.1%. During 2020 to 2024, adoption was driven by industrial maintenance, construction, and electronics sectors. Manufacturers focused on providing reliable, cost effective, and durable tools for professional and consumer use. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption in electrical maintenance, DIY projects, and precision applications. Ergonomic designs, material innovation, and increased awareness of high quality hand tools will further support market expansion. The United Kingdom market reflects stable growth with emphasis on quality, reliability, and versatility.

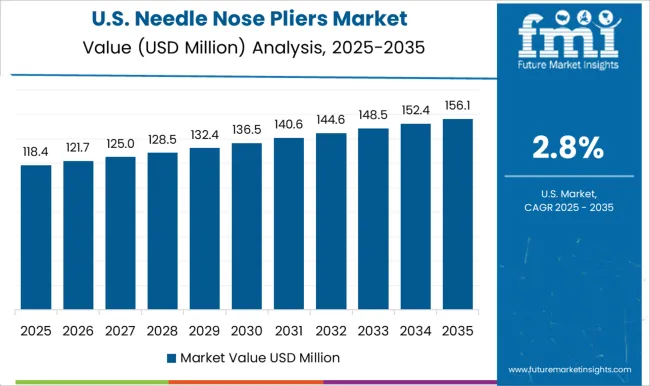

Needle nose pliers market in the United States is growing at a CAGR of 2.8%. Historical period 2020 to 2024 saw growth driven by demand from electronics, automotive maintenance, and professional workshops. Manufacturers focused on high quality, durable, and precise tools. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption in electrical work, precision assembly, and DIY consumer applications. Ergonomic designs, improved materials, and innovative tool coatings will support market expansion. The United States market demonstrates stable growth with emphasis on reliability, durability, and precision.

The needle nose pliers market is supplied by Knipex, Beta Group, C.H. Hanson, Crescent Tools, Grip-on, Klein Tools, Milwaukee Tool, Snap-On, Sonic Tools, Stanley Black & Decker, Tekton, Toptul, Vermont American, Wiha Tools, and Wurth, with competition shaped by jaw precision, handle ergonomics, and material hardness. Knipex and Klein Tools brochures highlight precision-machined jaws, high-grade steel construction, and insulated handles, specifying jaw length, tip width, and maximum grip force.

Snap-On and Milwaukee datasheets detail corrosion-resistant finishes, joint tolerance, and leverage ratios for professional-grade applications. Crescent Tools and Beta Group provide technical sheets including hardness ratings, wire-cutting capacity, and bending capability for fine electrical and mechanical work. Observed industry patterns indicate growing demand for lightweight, high-strength pliers suitable for electronics assembly, jewelry making, and detailed mechanical repairs. Market strategies focus on differentiation through material quality, ergonomic design, and specialized product lines.

Knipex and Snap-On invest in chrome vanadium steel pliers with precision-ground tips for durability and accuracy. Klein Tools, Milwaukee, and Crescent target electricians, mechanics, and industrial users with insulated grips and high-leverage designs. Observed trends show suppliers emphasizing modular packaging, tool sets, and value-added accessories to attract professional and hobbyist segments. Wiha Tools and Tekton focus on corrosion-resistant coatings, precision alignment, and extended warranty programs.

Grip-on, Toptul, and Vermont American provide compact models for confined spaces, while Wurth highlights tool kits with multiple tip variations and integrated wire-stripping capabilities. Sonic Tools emphasizes lightweight aluminum handles for repetitive use. Product brochures and technical datasheets communicate critical specifications including jaw length, tip thickness, handle material, cutting capacity, hardness, tensile strength, and insulation rating. Knipex and Klein Tools provide diagrams for tip alignment, spring tension, and load-bearing limits.

Snap-On and Milwaukee include recommended applications, maintenance guidelines, and corrosion prevention measures. Crescent, Tekton, and Wiha offer charts showing leverage, grip force, and bending tolerances. Clear technical documentation allows industrial engineers, electricians, and hobbyists to assess suitability, ensuring adoption based on verified durability, precision, and ergonomic compatibility across electronics, mechanical, and fine-detail applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 265.2 million |

| Product Type | Straight nose and Bent nose |

| Material | Carbon steel, Stainless steel, Forged steel, and Alloy steel |

| Price | Medium, Low, and High |

| End User | Industrial & manufacturing, Automotive, Home improvement, Electronics & electrical, and Others (woodworking, model making etc.) |

| Distribution Channel | Indirect sales and Direct sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Knipex, Beta Group, C.H. Hanson, Crescent Tools, Grip-on, Klein Tools, Milwaukee Tool, Snap-On, Sonic Tools, Stanley Black & Decker, Tekton, Toptul, Vermont American, Wiha Tools, and Wurth |

| Additional Attributes | Dollar sales vary by plier type, including insulated, non-insulated, and specialty needle nose pliers; by material, spanning stainless steel, carbon steel, and alloy steel; by application, such as electrical work, jewelry making, electronics assembly, and automotive repair; by end-use industry, covering construction, manufacturing, electronics, and DIY; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising industrial activities, precision work demand, and DIY trends. |

The global needle nose pliers market is estimated to be valued at USD 265.2 million in 2025.

The market size for the needle nose pliers market is projected to reach USD 366.9 million by 2035.

The needle nose pliers market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in needle nose pliers market are straight nose and bent nose.

In terms of material, carbon steel segment to command 46.3% share in the needle nose pliers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injection System Market Size and Share Forecast Outlook 2025 to 2035

Needle Coke Market Size and Share Forecast Outlook 2025 to 2035

Needleloom Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Needle Destroyer Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

Pen Needles Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Tattoo Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Global Suture Needles Market Analysis - Size, Share & Forecast 2024 to 2034

Steerable Needle Market Size and Share Forecast Outlook 2025 to 2035

High Flow Needle Sets Market

Disposable Needle Guides Market

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Retractable Needles Market

Vertebroplasty Needles Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Needle Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA