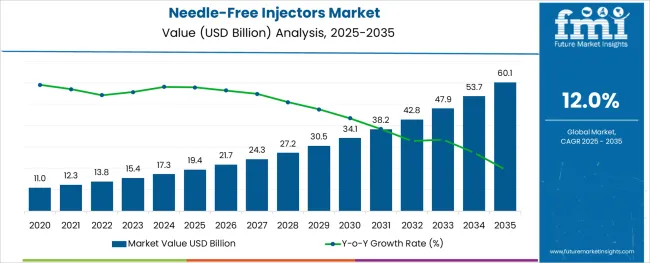

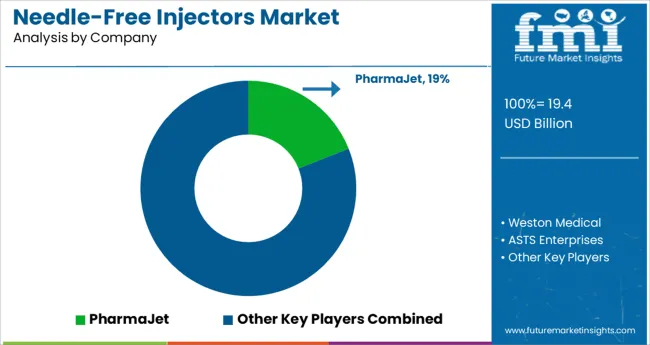

The Needle-Free Injectors Market is estimated to be valued at USD 19.4 billion in 2025 and is projected to reach USD 60.1 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

The needle-free injectors market is witnessing accelerating growth, supported by increasing demand for pain-free, safe, and efficient drug delivery methods. Rising vaccine administration rates, growing needle-phobia cases, and cross-contamination concerns are compelling healthcare providers to shift toward needle-free solutions.

Technological advancements in jet propulsion, device miniaturization, and precise dose control have further enhanced adoption across clinical and homecare settings. Additionally, the regulatory push toward improving patient compliance and safety in chronic disease management is favoring non-invasive delivery alternatives.

Public immunization campaigns, especially in pediatrics and geriatrics, are catalyzing deployment in both developed and emerging healthcare ecosystems. With ongoing innovation in biologics and biosimilars, needle-free delivery systems are increasingly being positioned as essential tools for efficient and user-friendly administration, particularly in decentralized healthcare delivery models.

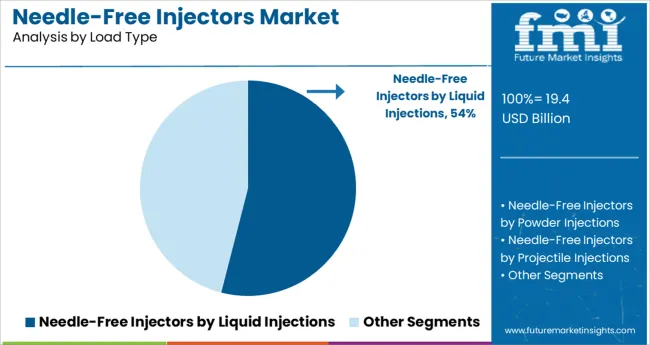

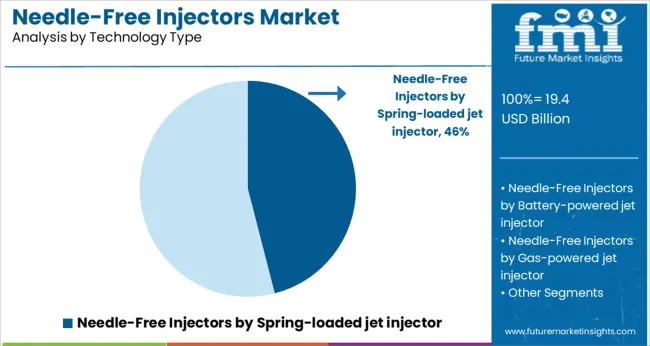

The market is segmented by Load Type, Technology Type, Delivery Site Type, and Application Type and region. By Load Type, the market is divided into Needle-Free Injectors by Liquid Injections, Needle-Free Injectors by Powder Injections, and Needle-Free Injectors by Projectile Injections. In terms of Technology Type, the market is classified into Needle-Free Injectors by Spring-loaded jet injector, Needle-Free Injectors by Battery-powered jet injector, and Needle-Free Injectors by Gas-powered jet injector.

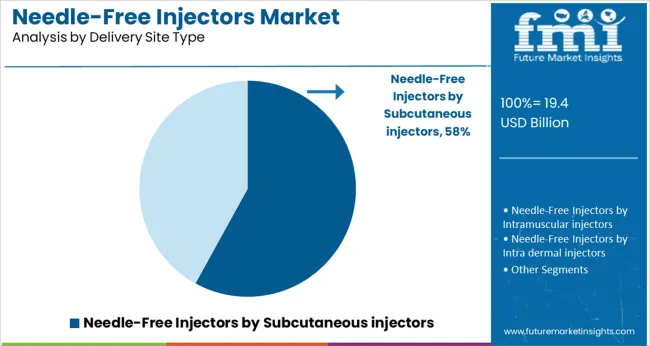

Based on Delivery Site Type, the market is segmented into Needle-Free Injectors by Subcutaneous injectors, Needle-Free Injectors by Intramuscular injectors, and Needle-Free Injectors by Intra dermal injectors. By Application Type, the market is divided into Needle-Free Injectors by Vaccines, Needle-Free Injectors by Drug Delivery, Needle-Free Injectors by Cosmetic, and Needle-Free Injectors by Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid injections segment is projected to contribute 54.0% of the total market revenue by 2025, making it the dominant load type. This leadership is being driven by the segment's compatibility with a broad spectrum of drugs and vaccines, along with its high absorption efficiency.

Liquid-based injectors offer rapid dispersion and are particularly suited for mass immunization and chronic disease treatment programs. The ability to precisely calibrate dosage, along with reduced preparation time compared to powder-based or reconstituted formulations, has made liquid injections preferable for healthcare providers.

Moreover, advancements in drug stabilization have allowed a wider range of liquid formulations to be stored and delivered effectively through needle-free systems. These attributes have enhanced operational efficiency, patient comfort, and delivery consistency, thereby reinforcing the segment’s market strength.

Spring-loaded jet injectors are expected to hold 46.0% of the revenue share in 2025, positioning them as the leading technology type within the needle-free injectors market. Their dominance is underpinned by mechanical simplicity, portability, and cost-effectiveness.

Spring-based systems utilize compressed energy to propel medication into subdermal layers, eliminating the need for electrical components or batteries. This makes them ideal for low-resource settings and rapid deployment in public health scenarios.

Additionally, user training requirements are minimized due to the intuitive design, improving adoption among frontline healthcare workers. As regulatory agencies encourage broader immunization access and patient-friendly technologies, spring-loaded jet injectors have gained traction as scalable, reusable, and maintenance-light solutions aligned with cost-control and sustainability goals.

Subcutaneous injectors are projected to contribute 58.0% of the overall market share by 2025, establishing them as the leading delivery site category. This dominance is attributed to the segment’s widespread use in administering biologics, vaccines, and insulin-therapies that demand consistent, patient-compliant delivery.

Subcutaneous delivery enables slower, controlled absorption of medications, which is particularly critical in chronic care treatments. Needle-free devices optimized for subcutaneous administration offer improved user comfort and reduced risk of infection or injury, enhancing adherence.

Additionally, subcutaneous injectors are well-suited for home-use settings, supporting trends in self-care and remote healthcare delivery. As the biopharmaceutical landscape continues to expand with high-value therapies, the subcutaneous segment is expected to sustain its lead due to its compatibility with large molecule drugs and broad disease applications.

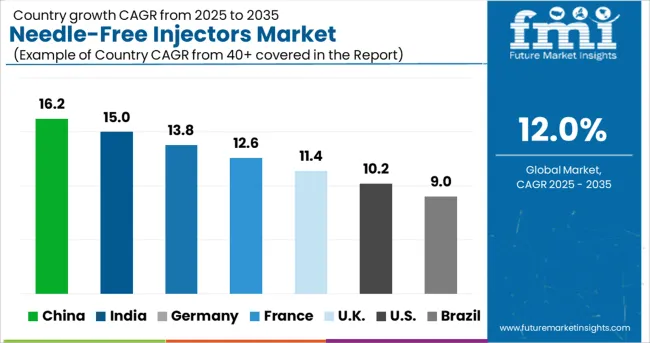

The Asia Pacific is anticipated to yield significant growth opportunities, backed by robust healthcare infrastructure and favorable government regulations. By 2035-end, the annual growth rate is projected to encircle 12%, affected by several aspects.

Within the Asia Pacific, the rapidly developing healthcare industry in China, is attributed to the increasing geriatric population and rising life expectancy.

Thereby, several pharma companies in China are making hefty investments in the development of innovative treatments for chronic diseases like cancer, diabetes, etc.

These approaches are supporting the expansion of private-sector hospitals & clinics which sets a strong base for the development of needle-free injectors.

Likewise, India is expected to offer numerous growth opportunities for pharma companies, due to increasing emphasis on better healthcare treatment and promising growth in the healthcare sector in the country.

In terms of market bifurcation, needle-free injectors have experienced the highest traction in the cosmetic surgeries segment. Based on the growing trends, this segment is estimated to register a CAGR of 12.1% over the years to come.

Given the technological advancements in recent years, a significant shift in the adoption of cosmetic surgeries for skin whitening, and body marks removal has been observed. Earlier, the high cost of surgeries impeded market growth. However, the introduction of innovative tools like needle-free injectors has supported global acceptance.

Needle-free injection technology (NFIT) is an exceptionally broad concept that includes an extensive array of drug delivery systems that drive drugs through the skin.

This technology is not only touted to be valuable for the pharma industry but the developing world to find it highly useful in mass immunization programs, avoiding the chances of needle stick injuries and ducking other complications including those arising due to multiple uses of a single needle.

Growth of the needle-free injectors market can be attributed to faster drug delivery and increasing demand of the same from the healthcare sector. The market for needle-free injectors registered a CAGR of 8% in the historical period 2020 to 2024.

The global demand for electric guitars is projected to increase at a CAGR of 12% during the forecast period between 2025 and 2035, reaching a total of USD 60.1 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 8%.

Sales of needle-free injectors market increased considerably increased over the last few years due to factors such as the growing incidence of needle stick injuries and rise in the number of parenteral drugs approvals. People working with hypodermic syringes and other needle equipment are at a greater risk of needle stick injuries.

These injuries can mainly occur when people use or dispose needles. Hence, demand for needle-free injectors increased as they are the best alternative for patients and healthcare workers to prevent themselves from needle stick injuries.

Also, needle-free injectors offer faster drug delivery which enhances bioavailability as compared to invasive drug delivery systems. This is resulting in the increasing adoption of needle-free injectors.

Pharmaceutical industries propelling growth of needle-free injectors

Pharmaceutical industries are increasing the adoption of needle-free injectors as need for drug delivery or vaccinations is increasing. Needle-free injectors are preferred over invasive drug delivery systems as they don’t cause side-effects such as pain, swelling, or wounds.

Additionally, needle-free injectors are cost-effective, sanitary, fast, and nearly painless. Hence, key players are capitalizing on these benefits to increase their sales in countries with the weaker economic system.

Need for needle-free insulin delivery as a primary treatment option has surged due to the rising prevalence of diabetes and insulin across the globe.

Growth of plastic surgeries increasing dependency on needle-free injectors

Alongside this, application of needle-free injectors in cosmetic industry is accelerating at a mounting pace. As per FMI, the cosmetics segment is projected to report maximum growth at a CAGR of 12.6% during the forecast period.

According to the American Society of Plastic Surgeons, 15.6 Billion cosmetic procedures took place in the world, among which 2.3 Billion are cosmetic surgical procedures and 13.2 Billion are cosmetic minimally-invasive procedures.

Hence, the demand for minimally invasive procedures is more as compared to invasive procedures. Driven by this, needle-free injectors manufacturers are increasing the adoption, generating ample of growth opportunities within cosmetic industry.

High Operating Cost of Needle-Free Injectors to Act as a Barrier for Key Players

Key players are facing difficulties in needle-free injectors manufacturing due to high cost and requirement of complex equipment. Difficulty in procuring certification for needle free injectors and need for sterilization before each batch of production also are proving to be challenges for market players.

Key players often have to spend on high operating costs to meet the aforementioned requirements for manufacturing of needle-free injectors, which also is expected to act as a challenge to growth. Besides this, the easy availability of needle-free injectors alternatives is restraining the market growth during the forecast period.

Key players expanding presence by increasing production units

According to the study, Germany is expected to dominate the Europe, holding 29.4% Europe’s market share through 2035. Increasing expenditure in healthcare due to rising awareness among consumers has encouraged them to spend on quality wellness products.

This has led to the surge in needle-free injectors’ adoption due to their ability of faster drug delivery and minimal invasion. Germany is considered to have the highest expenditure on its healthcare system, contributing approximately 11% of the GDP in 2020, according to Eurostat.

Alongside this, the presence of key players in the country and development of their product portfolio is also aiding the market growth. For instance, Gerresheimer Regensburg announced the expansion of its production unit for small batch production of plastics in Wackersdorf, Bavaria, Germany in November 2024.

Minimally invasive diagnostic care favoring growth of needle-free injectors

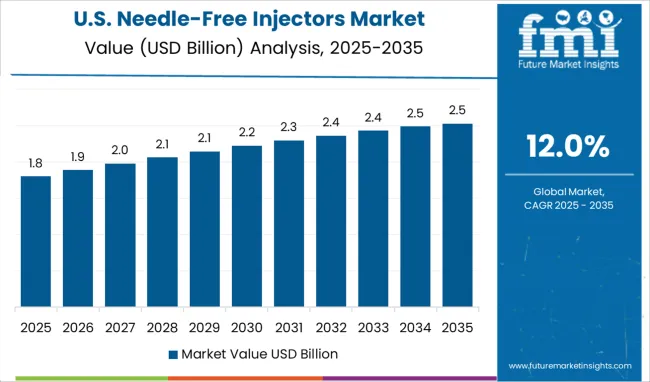

As per Future Market Insights, the USA is expected to be a leading market across North America, accounting for over 94.0% of the market in 2025. It is expected to continue exhibiting high demand for needle-free injectors through the course of the report’s assessment period.

Growth in the market is primarily driven by the rising prevalence of chronic diseases such as diabetes, cancer, and others. With goring preference for non-invasive and minimally-invasive diagnostic care, the adoption of needle-free injectors have increased, especially among home-care patient.

According to Centers for Disease Control and Prevention (CDC), in 2020, approximately 34.2 Billion cases of diabetes were found with the USA With the rising prevalence of diabetes, demand for needle-free injectors will accelerate, especially within geriatric population.

Technological advancements supporting the use of needle-free injectors in the country

Japan is projected to hold over 34% share in the East Asia market, exhibiting growth at a CAGR of 11.7% during the forecast period. This is predominantly due to the rising cosmetic procedures in the country and technological advancements in healthcare and cosmetic industry.

For instance, according to International Survey on Aesthetic/Cosmetic Procedures Performed in 2020, there were total 224,293 surgical procedures took place in Japan that fuel the market of needle-free injectors.

Growth hormones for children accelerating growth of needle-free injectors

In 2024, China led the East Asia market with more than 46.8% share and is projected to expand at a CAGR of 12.0% through 2035. This is mainly due to the need of daily dosage of hormones administration in children and easy regulations by government for approving innovative products.

For instance, the National Medical Products Administration approved needle-free injectors for sale on the domestic market in August, 2020 in China. Also, more than 7 Billion Chinese children need daily doses of growth hormone who suffer from dwarfism in China which also going to benefits the market.

Reduction in production cycles elevating growth

In terms of load type, the projectile injections segment is expected to expand at a CAGR of 13.9% during the forecast period.

The segment is expected to gain popularity due to the ability for prevention of material clusters that reduces cycle times and as it supports the production of parts with variable and uneven diameters.

Painless and minimally invasive cosmetic surgeries contributing to spring-loaded jet injector growth

Growth in this segment attributed due to its nature to penetrate the skin for delivering a drug or vaccine into subcutaneous, intradermal or intramuscular tissues by creating a narrow stream under high pressure.

Moreover, the increasing dependency on needle-free injectors in the cosmetic industry is contributing to the growth of spring-loaded injectors. Thus, based on technology type, the spring-loaded jet injector segment will dominate the market, holding 47.1% of the revenue share in 2025.

Healthcare industry supporting growth of drug delivery

Rising prevalence of chronic diseases is expected to aid the segment growth. This also has created demand for needle-free injectors in the homecare setting. Increasing expenditure by the healthcare industry along with technological advancements is fueling the growth of needle-free injectors.

In terms of application, drug delivery is expected to hold the leading share in the market, accounting for 65.0% of the revenue share in 2025.

Multiple drug delivery making reusable needle-free injectors popular

With 79.5% of the revenue share, reusable needle-free injectors are expected to dominate the market in 2025. Reusable needle-free injectors are gaining popularity because they can be reused multiple times for drug delivery to a single patient with maximum ease of use.

For example, insulin delivery to the diabetic patient can be done through reusable needle-free injectors for multiple times. This method is cost effective also which plays a prime role in driving its demand in the future.

Prevalence of chronic diseases increasing dependency on needle-free injectors

This has led to an increasing demand for needle-free injectors. Based on the end-user, hospitals are expected to be the primary end-user, accounting for over 33.4% market share during the forecast period.

Few key players in the needle-free injectors market are Portal Instruments and NovaXS Biotech.

Key players in the needle-free injectors market are Gerresheimer AG, Pfizer Inc., Halozyme, CSL Limited (Seqirus UK Limited), Crossject, Portal Instruments, Ferring Pharmaceuticals, PharmaJet Inc., PenJet Corporation

Key players are focusing on the expansion of their brands in emerging regions and manufacturing the newly revised product. Manufacturers are also adopting a slew of expansion strategies such as acquisition, new product launches and approvals, agreements, partnerships, and collaborations to strengthen their market presence.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 13.78 Billion |

| Market Value in 2035 | USD 42.79 Billion |

| Growth Rate | CAGR of 12% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Load, Technology, Delivery Site, Application, End User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Gerresheimer AG; Pfizer Inc.; Halozyme; CSL Limited (Seqirus UK Limited); Crossject; Portal Instruments; Ferring Pharmaceuticals; PharmaJet Inc.; PenJet Corporation |

| Customization | Available Upon Request |

The global needle-free injectors market is estimated to be valued at USD 19.4 billion in 2025.

It is projected to reach USD 60.1 billion by 2035.

The market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types are needle-free injectors by liquid injections, needle-free injectors by powder injections and needle-free injectors by projectile injections.

needle-free injectors by spring-loaded jet injector segment is expected to dominate with a 46.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

Auto-Injectors Market Analysis - Size, Share & Forecast 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Contrast Media Injectors Market Analysis - Size, Share, and Forecast 2025 to 2035

Odor-Neutralizer Injectors Market Size and Share Forecast Outlook 2025 to 2035

Epinephrine Auto-Injectors Market Insights - Growth & Forecast 2024 to 2034

Patient-Controlled Injectors Market

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA