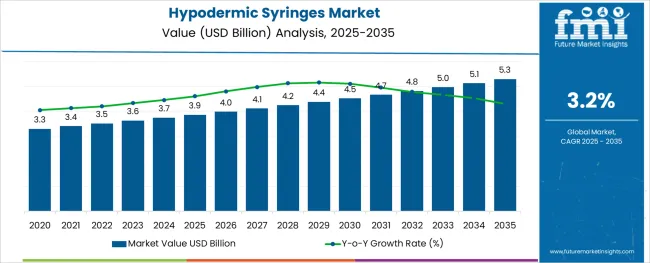

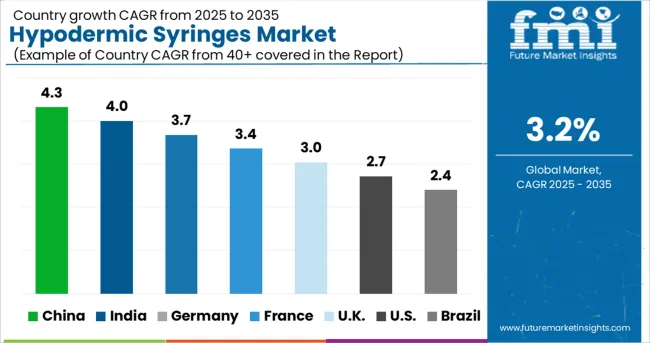

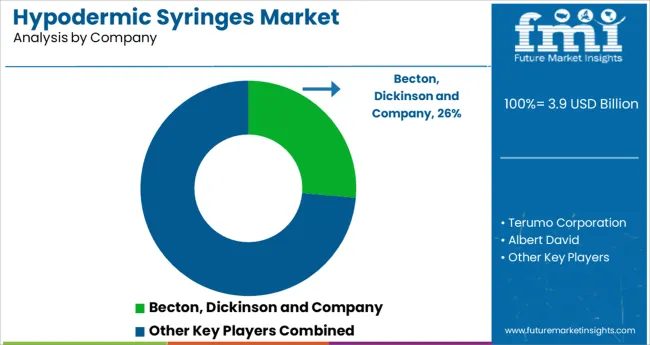

The Hypodermic Syringes Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The hypodermic syringes market continues to progress steadily as healthcare providers seek efficient drug delivery solutions for a wide range of treatments. Increased global vaccination programs, chronic disease management, and emergency care needs have expanded the use of hypodermic syringes in clinical and non-clinical settings. Industry publications and public health reports have emphasized the demand for safer and more durable syringe materials, with manufacturers enhancing product designs for better patient comfort and healthcare worker safety.

Additionally, advancements in needle technology and the growing preference for disposable syringes have contributed to the market’s momentum. Improvements in hospital infrastructure and ongoing expansion of medical services across emerging economies have further supported this growth.

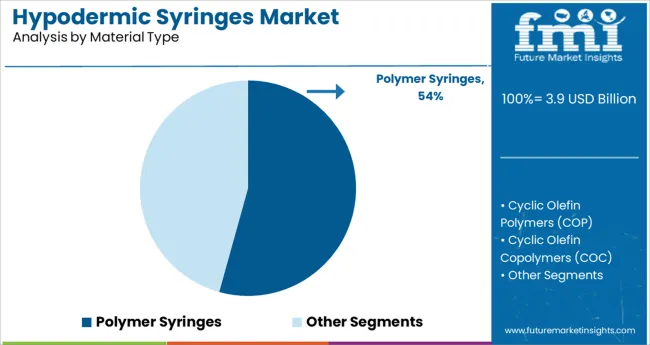

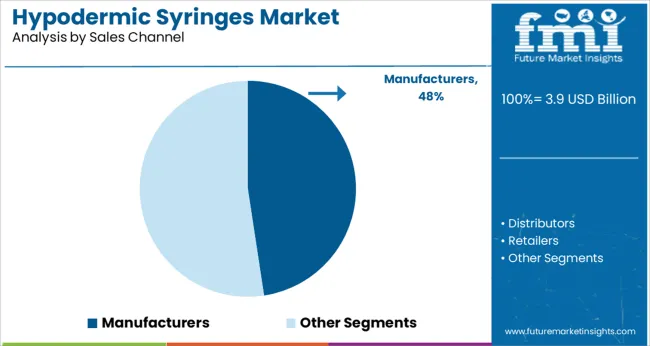

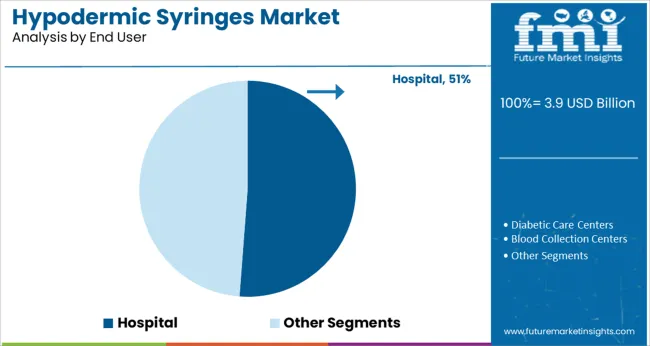

Looking forward, demand is expected to remain strong as healthcare systems focus on infection prevention, single-use product adoption, and streamlined manufacturing processes. Polymer syringes are anticipated to lead material preferences, manufacturers are projected to remain the primary sales channel, and hospitals are expected to hold the largest end-user share in the market.

The market is segmented by Material Type, Sales Channel, and End User and region. By Material Type, the market is divided into Polymer Syringes, Cyclic Olefin Polymers (COP), Cyclic Olefin Copolymers (COC), Polypropylene and Other Polymers, and Glass Syringes. In terms of Sales Channel, the market is classified into Manufacturers, Distributors, and Retailers. Based on End User, the market is segmented into Hospital, Diabetic Care Centers, Blood Collection Centers, Veterinary Care Centers, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Material Type, Sales Channel, and End User and region. By Material Type, the market is divided into Polymer Syringes, Cyclic Olefin Polymers (COP), Cyclic Olefin Copolymers (COC), Polypropylene and Other Polymers, and Glass Syringes. In terms of Sales Channel, the market is classified into Manufacturers, Distributors, and Retailers. Based on End User, the market is segmented into Hospital, Diabetic Care Centers, Blood Collection Centers, Veterinary Care Centers, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polymer Syringes segment is projected to contribute 54.3% of the hypodermic syringes market revenue in 2025, sustaining its lead among material types. Growth in this segment is attributed to the widespread shift towards lighter, more durable, and cost-effective syringe components. Healthcare facilities have preferred polymer syringes for their break-resistant nature and compatibility with a variety of medications and biological fluids.

The ease of large-scale manufacturing and flexibility in design have enabled the production of syringes in various sizes and configurations. Furthermore, polymer syringes have demonstrated consistent quality under sterile conditions, making them suitable for both high-volume vaccination campaigns and routine clinical use.

As global health priorities continue to emphasize safety, efficiency, and environmental considerations, the Polymer Syringes segment is expected to remain at the forefront of material adoption in hypodermic syringes.

The Manufacturers segment is projected to account for 47.6% of the hypodermic syringes market revenue in 2025, affirming its role as the leading sales channel. This dominance is driven by the direct supply relationships established between syringe producers and healthcare providers, allowing for streamlined procurement processes and bulk purchasing efficiencies.

Hospitals, clinics, and vaccination centers have increasingly preferred to engage directly with manufacturers to secure reliable product quality and timely deliveries. Additionally, global health initiatives and national stockpiling programs have favored direct partnerships with syringe manufacturers to meet large-scale demand without intermediary delays.

Manufacturers have also introduced product customization services, offering tailored solutions for specific therapeutic applications. With the growing focus on supply chain resilience and cost management, the Manufacturers segment is expected to sustain its prominence in sales distribution for hypodermic syringes.

The Hospital segment is projected to hold 51.2% of the hypodermic syringes market revenue in 2025, making it the largest end-user segment. Hospitals have remained the central hubs for administering injections, vaccinations, and blood draws, accounting for the majority of syringe utilization worldwide.

The need for efficient drug delivery in emergency care, surgery, chronic disease management, and immunization programs has reinforced the segment’s demand. Hospitals have adopted a wide range of hypodermic syringes that meet strict regulatory and sterility standards, ensuring patient safety and clinical efficiency.

Bulk procurement capabilities and structured inventory management have also positioned hospitals as key buyers in the market. As healthcare systems expand and modernize hospital services, the segment is expected to maintain its leadership role in driving syringe demand across both public and private healthcare networks.

The global hypodermic syringes market is expected to flourish under the backdrop of the global pharmaceutical industry during the forecast period. Hypodermic syringes are preferred over after-filled syringes as they offer fixed dosages of the drug and ease in usability.

Prefill ability helps in reducing the overall cost by reducing the drug overfill. Single-dose vials or multi-dose vials have a drug overfill of almost 20-25% so that the administrator has enough to fill the correct dose and to compensate for human errors, flourishing the demand for hypodermic syringes.

However, prefilled hypodermic syringes eradicate the source of inefficiency in the manufacturing process by eliminating drug overfills. This is particularly advantageous for companies dealing with costly biopharmaceuticals. The growth of the biologics market is likely to boost the hypodermic syringes market.

The conventional syringes were made of glass barrels and glass rods, which were comparatively expensive to manufacture when compared to plastic-based hypodermic syringes, pushing the sales of hypodermic syringes globally.

Healthcare workers benefit from accurate and pre-measured doses. Demand for hypodermic syringes is also fueled by reduced dosing, medication errors, and decreased microbial contamination risk.

Along with this, an increasing trend of people getting vaccinated outside hospitals such as in schools, community centers, pharmacies, and airport booths is likely to contribute to the growth of the hypodermic syringes market.

Geographically, the global hypodermic syringes market has been divided into seven key regions: North America, Latin America, East Asia, South Asia, Europe, the Middle East & Africa (MEA), and Oceania.

Europe is expected to hold maximum market share in the hypodermic syringes market owing to the well-established healthcare industry in the region.

The healthcare sector in India is diversified and offers enormous opportunities in every segment, which includes payers, providers, and medical technology. Increasing competition pushing businesses to explore and adapt according to the latest trends and dynamics is expected to impact the hypodermic syringes market in the country positively.

The key players in the hypodermic syringes market are focusing on mergers and collaborations that are fueling the sales of Hypodermic syringes including Terumo Corporation, Albert David Ltd., Becton, Dickinson and Company, Nipro Corporation, Smiths Medical, Hindustan Syringes & Medical Devices Limited etc.

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.2% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Material type, Sales Channel, End-user, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Terumo Corporation; Albert David Ltd.; Becton; Dickinson and Company; Nipro Corporation; Smiths Medical; Hindustan Syringes & Medical Devices Limited etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global hypodermic syringes market is estimated to be valued at USD 3.9 billion in 2025.

It is projected to reach USD 5.3 billion by 2035.

The market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types are polymer syringes, cyclic olefin polymers (cop), cyclic olefin copolymers (coc), polypropylene and other polymers and glass syringes.

manufacturers segment is expected to dominate with a 47.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Hypodermic Syringes Market Share & Industry Leaders

Latin America Hypodermic Syringes and Needles Market Analysis & Forecast by Type, End Users, and Region Through 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

MENA Syringes & Cannula Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Syringes Market

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA