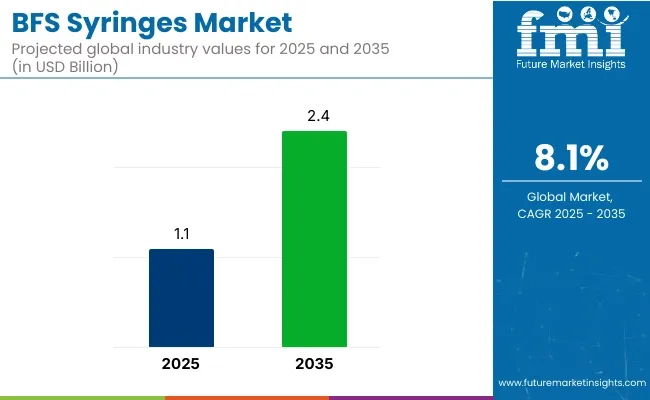

The BFS syringes market is projected to grow from USD 1.1 billion in 2025 to USD 2.4 billion by 2035, registering a CAGR of 8.1% during the forecast period. Sales in 2024 reached USD 900 million. This expansion has been driven by rising demand for unit-dose packaging, increased adoption of aseptic delivery in biopharmaceuticals, and reduced risk of contamination.

BFS technology has been favored for its single-step process, integrating blow molding, filling, and sealing. Enhanced product integrity and reduced dependency on glass have made BFS syringes suitable for vaccines and biologics. Technological innovations in nozzle designs and mold control systems have improved precision.

Market Value (2025): USD 1.1 billion

In June 2024, The Ritedose Corporation, the leading contract development and manufacturing organization (CDMO) specializing in sterile Blow Fill Seal (BFS) production, announces a significant expansion of its production capabilities to meet the demand for ophthalmic and respiratory medications. “This expansion marks a pivotal moment in our company’s history,” said CEO of Ritedose Jody Chastain.

“We’re passionately dedicated to advancing the health and well-being of patients across the United States it’s why we come to work every single day. We are perfectly positioned to support our partners and deliver quality medications, and both they and our patients count on us to be steps ahead in capacity, capabilities and without a doubt, quality. It’s our forward-looking strategy and commitment that has allowed us to maintain a 100% customer retention rate over the past 25 years.”

Sustainability and innovation have become critical factors in shaping the BFS syringes market. Manufacturers have been focusing on developing recyclable polymer-based BFS syringes with reduced carbon footprints. Automation technologies, including robotic filling systems and AI-driven quality checks, have been integrated to boost production throughput and consistency.

Regulatory compliance with USP for container closure integrity has driven innovation in testing protocols and BFS unit validation. Emphasis has also been placed on the minimization of waste during production and the optimization of energy-efficient sterilization techniques.

Robust growth for BFS syringes is anticipated across biopharmaceuticals, ophthalmology, and respiratory segments. Stringent regulations from the FDA and EMA have been influencing market entry and setting high standards for sterility and quality assurance.

Competitive advantage is expected to be gained by firms offering integrated BFS platforms with modular scalability and digital traceability. Rapid expansion of drug delivery infrastructure in emerging economies has opened new market opportunities, especially for contract manufacturing organizations. Rising preference for single-use, prefilled units in post-pandemic healthcare settings is also contributing to this shift.

The market is segmented based on capacity, material type, end use, and region. By capacity, the market is categorized into 0.5-1 ml, 1-3 ml, and above 3 ml. In terms of material type, the market is divided into polypropylene (PP), polyvinyl chloride (PVC), and others, including polyethylene. Based on end use, the market is segmented into pharmaceuticals and healthcare, personal care and cosmetics, and others. Regionally, the BFS syringes market is analyzed across North America, Latin America, Europe, East Asia, South Asia, and the Middle East and Africa.

Polypropylene (PP) has been projected to account for 51.4% of the global BFS syringes market by 2025, owing to its excellent thermal and chemical resistance, which has enabled safe sterilization and compatibility with pharmaceutical substances. This material has been commonly selected in BFS processes for its ability to maintain dimensional integrity during aseptic blow-fill-seal operations.

Its low moisture transmission rate has helped prevent degradation of sensitive drug formulations. Its recyclability and cost-efficiency have made it favorable for single-use medical packaging, particularly in mass immunization and ophthalmic therapy applications.

PP has been widely used in BFS syringes because it can easily be molded into complex geometries while maintaining a smooth internal surface, thereby preventing drug interaction. Furthermore, PP syringes have demonstrated robust performance in low-temperature storage, essential for biologics and vaccines.

Drug developers have continued to specify polypropylene for BFS syringe production due to its inert nature and compatibility with both aqueous and lipid-based formulations. Migration testing and stability studies have consistently validated its safe use in injectable drug delivery systems.

Lightweight construction and breakage resistance have also contributed to its extensive deployment in hospital and clinical settings. As global demand for prefilled syringes increases and stricter sterility norms are enforced, the use of polypropylene in BFS syringe production is expected to grow steadily. Its dominance has been reinforced by the expanding role of biologics, combination therapies, and government-led vaccination programs, which have required reliable and sterile primary packaging materials.

The pharmaceuticals segment is projected to hold 67.9% of the BFS syringes market by 2025, primarily due to the growing reliance on sterile, unit-dose packaging formats in hospitals, clinics, and immunization programs. BFS syringes have been extensively used for ophthalmic drops, inhalable formulations, biologicals, and vaccines that demand precise dosing and contamination-free filling. Injectable drug delivery trends have further accelerated the segment’s expansion.

Hospitals and ambulatory surgical centers have adopted BFS syringes to reduce medication errors, improve patient safety, and streamline aseptic administration workflows. These syringes have been favored for their tamper-evident designs and prefilled convenience, reducing the need for on-site compounding or vial reconstitution. Compliance with global regulatory standards such as FDA 21 CFR and EU GMP has been achieved through BFS technology’s closed-system capabilities.

Major pharmaceutical manufacturers have collaborated with contract packaging organizations (CPOs) to increase capacity for BFS syringe production. Innovations in 2-chamber and multi-dose BFS syringe systems have allowed broader drug compatibility and enhanced patient compliance.

Drug stability and long shelf life have been ensured through the use of protective PP or PVC materials in tandem with BFS filling. The pharmaceuticals and healthcare segment is expected to continue leading the market, as injectable therapies become more prevalent and global health agencies emphasize mass drug administration programs.

Regulatory Compliance and Quality Assurance

Stringent regulatory requirements and quality assurance pose challenges for the BFS Syringes Market. Manufacturers must meet different international standards when packaging pharmaceuticals and delivering sterile drugs, which can hamper production in addition to contributing to higher costs.

High Initial Investment and Production Costs

For Blow-Fill-Seal (BFS) technology, there would be a need to invest in machinery, infrastructure and skilled workforce. Small and mid-sized manufacturers are further deterred by the high cost of establishing BFS syringe production facilities.

Rising Demand for Prefilled and Single-Dose Syringes

This has led to an increase in adoption of prefilled syringes and single-dose drug administration which fuels the demand for BFS syringes. BFS technology is booming due to its expanding application in the production of vaccines, biologics and emergency medications, creating major growth opportunities.

Expansion in Emerging Markets and Sustainable Packaging

Increasing urbanization across emerging economies is generating demand for BFS syringes as healthcare infrastructure and vaccine delivery are being implemented. Moreover, the trend of sustainability and adopting eco-friendly packaging solutions could be a promising approach for innovation within BFS syringe manufacturing process.

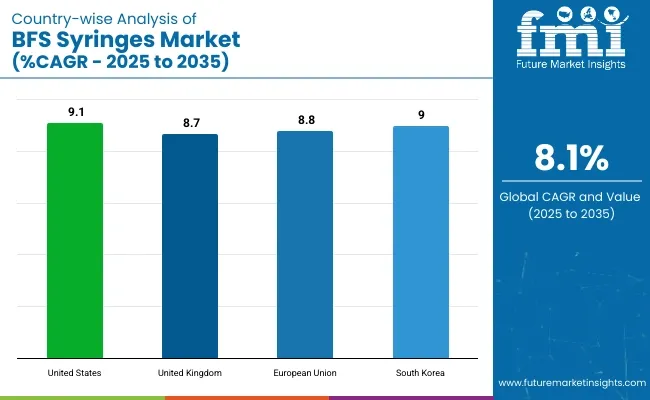

Increased adoption of BFS (Blow-Fill-Seal) syringes in pharmaceutical packaging, as well as a rise in demand for prefilled syringes and stringent regulations to guarantee drug safety and sterility, is fuelling growth in the USA market for BFS. Increased automation and aseptic filling technology also fuel the expansion of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 9.1% |

The UK market is anticipated to grow steadily, owing to strong pharmaceutical infrasuture, surging investments in BFS technology, and growing preference of single dose administration of drug. Growing demand for eco-friendly and contamination-free packaging solutions also promotes the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.7% |

According to the Global BFS Syringe Market Report, the European Union holds the largest market share owing to the strict pharmaceutical safety regulations, increased focus on reduction in medical waste, and technological progression in drug delivery mechanisms. The market is benefitted by the presence of prominent BFS manufacturers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.8% |

The BFS syringes market in South Korea is growing quickly owing to recent government initiatives that encourage innovation in the healthcare sector, increased pharmaceutical exports, and a growing demand for advanced drug packaging technologies. In addition, the expanding biotech sector also drives growth in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.0% |

The Blow-Fill-Seal (BFS) syringes market is witnessing steady growth due to rising demand for prefilled syringes, advancements in pharmaceutical packaging, and increasing regulatory emphasis on sterile drug delivery systems. Key drivers include the adoption of BFS technology for aseptic manufacturing, growing preference for single-dose drug administration, and the expansion of biologics and vaccine applications.

The overall market size for BFS Syringes Market was USD 1.1 Billion in 2025.

The BFS Syringes Market is expected to reach USD 2.4 Billion in 2035.

The BFS Syringes Market will grow due to increasing pharmaceutical demand, eco-friendly materials, and rising personal care applications across capacity segments.

The top 5 countries which drives the development of BFS Syringes Market are USA, European Union, Japan, South Korea and UK.

0.5-1 ml and 1-3 ml Syringes demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BFSI Security Market – Cyber Threats & Digital Banking

AI-Driven BFSI Staffing – Optimizing Hiring & Workforce Growth

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

MENA Syringes & Cannula Market Growth - Trends & Forecast 2024 to 2034

Hypodermic Syringes Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Hypodermic Syringes Market Share & Industry Leaders

Veterinary Syringes Market

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Latin America Hypodermic Syringes and Needles Market Analysis & Forecast by Type, End Users, and Region Through 2035

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA